Gary Schall

More posts from Gary Schall

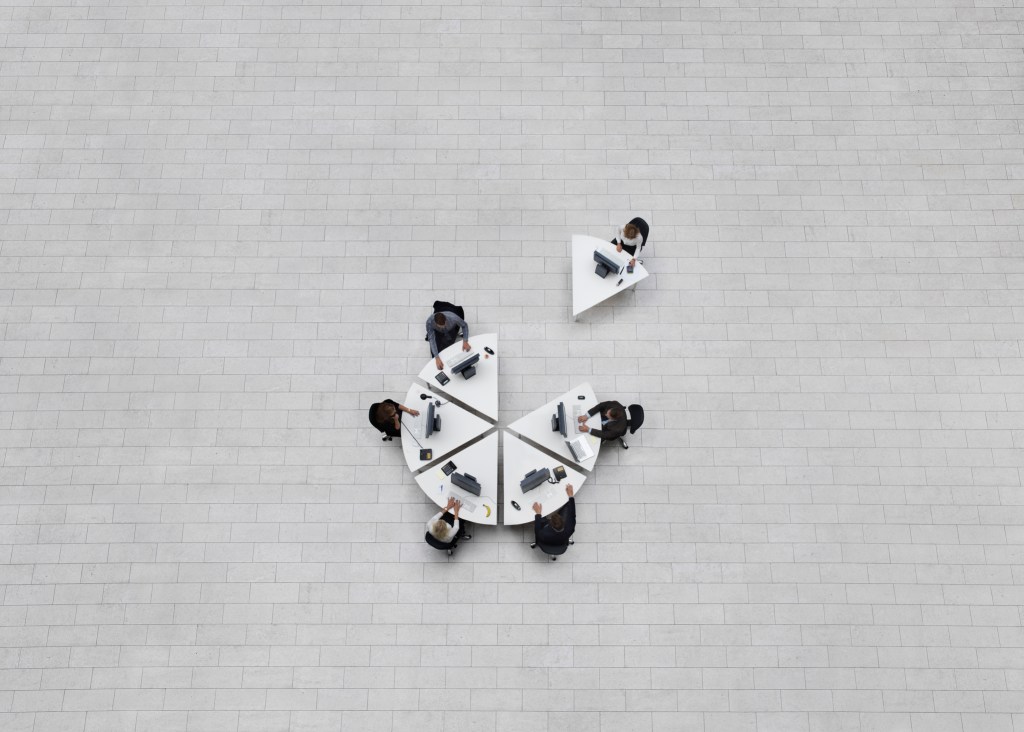

Sometimes I think about replacing the table in my office with a sofa and a box of tissues. I’m a lawyer, but sometimes I feel like a therapist. When startup founders sit down with me to hash out equity splits and trust and commitment issues, their tempers sometimes flare. Uncomfortable silences ensue. Feelings get hurt, and tears sometimes fall.

This is an awkward and uncomfortable step in the process of forming new ventures, and there’s no question that many founders would rather bypass all this potentially messy stuff. In fact, many do. They form their companies, assure one another they’re all in this together and, as a gesture of good will, divide their equity equally.

While a split of 50-50 or 25-25-25-25 might appear to be the fairest arrangement, in most cases, it’s a recipe for disaster. This seemingly innocuous decision can set a startup on the course for failure. Investors don’t like it because it positions founders to become deadlocked when tough decisions need to be made, and it may not reflect the contributions and commitments needed to rapidly grow the startup. Even-equity splits can also be the source of headaches and additional legal fees down the line.

A red flag for investors

Prospective investors will want to know how your startup has divvied up ownership, so be prepared to explain your reasoning. If you’ve opted for an even-steven split, funders anticipate two complications: The founders unwisely assume they’re all going to be equally committed to the venture and making equal contributions. They’re clueless about the varying level of responsibility and long-term commitment each will make. Or, they’re just not savvy enough to ask these tough questions.

Investors scrutinize the equity split to determine the founders’ level of contributions and commitment. They want to make sure the management team is incented appropriately. And on the flip side, they want to see that people who aren’t engaged in the startup’s success can’t exert a disproportionate influence.

That was the problem facing a Boston startup with three founders. Two were working full-time on the venture, dedicated to making it a success. The third, the brains behind the technology, was part-time. However, their ownership split didn’t reflect their commitment. The two guys who had staked their futures on this venture each held a 25 percent stake, and the other founder held the rest. The technology was critical, but the two full-time founders were doing the heavy lifting to build the startup. Five percent would have been a more appropriate allocation for the tech guy.

When a founder who is not involved in day-to-day operations holds outsized voting power, the potential for decision logjam looms large. That’s a red flag for investors. This startup was very lucky; the founders managed to convince an angel to take 15 percent of the company, effectively diluting the 50 percent owner’s holding to below a majority.

That critical first year

You’ll want to use equity allocations to incentivize your founders to stick it out and grow the business. I strongly recommend that founders institute a one-year vesting cliff, earning 25 percent of their stock after they’ve completed their first year of service with the company. The balance vests equally over the next three years of service, rewarding those who are loyal through those difficult early times.

A vesting plan can help forestall a situation I’ve seen too many times to count: A founder with a 20 or 30 percent stake loses enthusiasm and moves on after six or eight or 10 months, necessitating the buyback of their shares and/or their transfer to other founders. Those transactions cost time and money, and founders usually don’t have much of either to spare.

So think hard — and get some counsel — on who gets what. Ask yourself whether the allocations you’re considering now will be fair in six months or a year. It may appear wise to be more generous with options for your tech people than your sales team because without that genius, there wouldn’t be anything to sell. Remember, though, that if your company is going to thrive, it must shift to sales. An incentivized sales team is a motivated sales team.

Doing it anyway

Although I regularly warn my clients about the perils of equity splits, now and then some founders prove me wrong (or maybe just defy the odds). I recently advised two college juniors whose hardware startup had tremendous potential. They wanted to form a company and split the equity equally.

One was going to take a leave of absence from school to devote his energies to the startup. The other was determined to first earn his diploma. They hesitated when I suggested that their levels of commitment be reflected in the allocation of shares.

They spent weeks talking over various scenarios. They researched how a 50-50 split might play out with prospective investors. They met with a respected advisor at their college. They sat down with me for a few counseling sessions. After extensive analysis and candid discussions, both remained thoroughly committed to the half and half split.

This could have been a winning recipe for early failure. But the founders’ willingness to devote the time to thoughtfully reach consensus and together defy conventional wisdom presaged a huge success: Their startup was accepted into a premier accelerator program and is thriving. At least in this case, I was happy to eat my words.

Comment