African startup funding has seen a significant decline of more than 50% over the past three quarters compared to the previous year, as reported by The Big Deal. To date, startups on the continent have secured funding in the range of $2.5 billion to $3.4 billion, based on data from The Big Deal and Briter Bridges. With one quarter remaining, it appears unlikely that this figure will reach the levels seen in 2021 and 2022, when venture capital peaked at $5 to $6 billion, encompassing equity and debt deals.

It’s essential to note that this decline isn’t exclusive to Africa. Venture capital worldwide has retraced to pre-COVID levels. However, Africa’s diminishing numbers are particularly concerning given its reliance on external funding, especially compared to other emerging tech ecosystems such as India and Latin America.

According to a report from the African Private Equity and Venture Capital Association (AVCA), 77% of the venture capitalists who funded African startups last year were outside the continent. However, as global investors retract their commitments this year, this percentage may change significantly by the end of the year. While we await those figures, it’s worth highlighting a crucial discovery from the report that sheds light on where African founders are looking for their next source of capital.

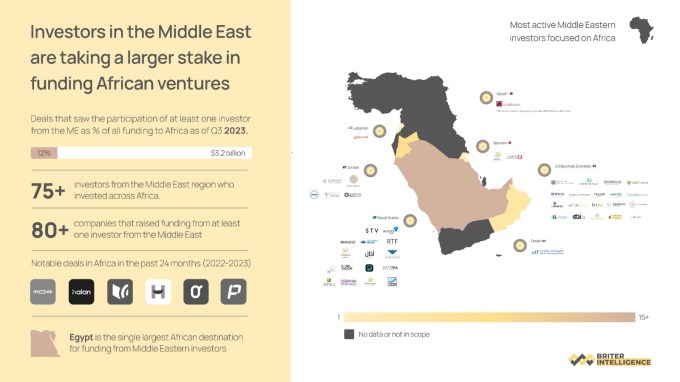

The U.S. and the U.K. collectively accounted for 50% of foreign venture capitalists investing in Africa. Remarkably, the UAE represented the third-largest source of foreign capital for African startups in 2022, contributing 4%, outpacing countries like France and China. Data from Briter Bridges indicates that over 80 Middle Eastern investors have participated in African transactions since they began monitoring this area. In 2019, 16 Middle Eastern investors supported African ventures, a number that grew to 50 last year.

This growing connection between African startups and VCs and investors and LPs from or based in the Middle East was prominently displayed last week at GITEX, a global tech show organized by and held in the UAE. The event attracted over 170,000 attendees, with 33% from the Middle East, 21% from Africa, 20% from Asia, 18% from Europe, and 8% from the Americas.

Only 22% of the 950 investors hailed from the Middle East at the event. However, I spoke with several African founders, primarily in the early stages of building their businesses who attended the event intending to forge relationships with investors in the UAE and neighboring GCC countries. Traditionally, they had sought funding from Western investors, and GITEX offered them the opportunity to explore new and diversified options, considering the current challenges in raising venture capital. While ongoing conversations with both sets of investors are taking place, whether these will lead to investments remains uncertain.

On the sidelines of the event, executives from some of the most valuable African technology companies, including MNT Halan, Fawry, Andela, and Interswitch, participated and engaged with government officials, customers, and investors in the region.

Meanwhile, investors focused on Africa had varying experiences. Some attended the event to connect with their existing limited partners (LPs) in the Middle East and expand their network to include a broader spectrum of institutional investors, not restricted to the region. Additionally, a couple of venture capitalists noted that while the Middle East is a place to establish valuable connections, building trust is essential before they can secure institutional capital. As a result, the region remains a long-term strategic focus for their funds.

In contrast, certain early-stage venture capitalists were explicitly seeking institutional investors from the Middle East. One investor mentioned that during some of the conversations, they sensed a competition between African and U.K. investors vying for the attention of Middle East limited partners (LPs), particularly government-backed funds and family offices.

Over the past year, investors have been increasingly drawn to the Middle East, seeking to establish enduring relationships with sovereign wealth funds. Venture capital firms are facing one of the most significant funding shortages in nearly a decade. Notably, prominent venture capital firms like Tiger Global and a16z were reportedly exploring opportunities in Saudi Arabia, the UAE, and Qatar earlier this year. They sought institutional investors interested in diversifying their portfolios away from oil and into technology sectors like artificial intelligence and robotics, two of the most prominent tech themes at GITEX.

For a long time, the Middle East and GCC have been perceived as sources of readily available funding. However, the landscape of regional investment has become more sophisticated, involving more comprehensive due diligence and selectivity than in the past. Now, startup founders and venture capitalists from outside the region must meet specific criteria to gain support. In a conversation with an African investor outside GITEX, I learned that some institutional investors based in Dubai and Riyadh required him to have previously supported regional startups before they would consider committing. Fortunately, he was able to connect with more accommodating partners.

Philip Bahoshy, the founder of MAGNITT, a Dubai-based data, analytics, and insights platform, who was present at GITEX, shared insights with TechCrunch. He noted that there has been a growing perception in recent months that sovereign entities and venture capital firms in the Middle East have been more active than elsewhere in the global venture markets. With the return of events in Q4, it was expected that more startups and VCs would visit the region to raise funds, he noted.

“While it is true that there are more sovereign entities like Dubai Future District Fund in Dubai, Saudi Venture Capital and Jada in Saudi Arabia, the deployment of the capital has been selective and mainly focused on those looking to build and deploy locally,” said Bahoshy. “So, where a VC is looking for LP funding or a startup is looking to raise funds, it is crucial to work out how you plan to deploy that for expansion into the GCC or MENA region.”

Octavius Phukubye, an investor from the pan-African early-stage fund Microtraction who was also at GITEX, pointed out that Middle East limited partners are eager to support African general partners (GPs). However, he observed that these investors frequently inquire about the GPs’ investment plans in the MENA region. This inquiry stems from the pressure on institutional investors to demonstrate their role in catalyzing the region through tech investments.

“Dubai is positioning itself as the mecca to produce 40 unicorns in 2030. But there’s a mismatch. LPs from the Middle East have funds but don’t have many local VC funds led by experienced GPs, and the ecosystem is too nascent to factory-produce stellar founders,” said Phukubye. “There were talks of GPs currently raising to split their funds to include MENA focus or set up new funds to be domiciled in Dubai. And overseas GPs to migrate their portfolio companies to set up in Dubai so that Middle Eastern LPs or GPs could back those portcos to scale in the MENA and larger GCC region.”

Moove takes in $76M equity, debt from Mubadala and BlackRock at a $550M valuation

A rare illustration of how this approach could work for a sub-Saharan founded startup is Moove, the mobility fintech company headquartered in Lagos and Amsterdam. Despite its launch from Lagos in 2019, Moove has significantly expanded its reach, with a presence in 13 cities worldwide, including Dubai. In Dubai, the company boasts over 300 employees and maintains highly active operations. Moove has positioned itself as Uber’s primary vehicle supply partner in the EMEA region. It operates the largest electric vehicle fleet, measured in supply hours, on the Uber platform in the UAE. In August, Moove secured $76 million in funding, with the equity portion led by Abu Dhabi-based Mubadala Investment Company – marking Mubadala’s first investment in an African startup.

African startups aren’t just eyeing the UAE for capital; Dubai’s appeal lies in its efficient startup incorporation and tax system and its facilitation of residence permits and visas for entrepreneurs. In Africa, Egyptian startups have been the primary beneficiaries of venture capital from GCC-based investors, including firms like BECO Capital, Saudi Technology Ventures, Middle East Venture Partners (MEVP), and Global Ventures. Notably, while some of the most well-funded companies, like Swvl and Vezeeta, have relocated their headquarters from Cairo to Dubai to attract more investment and enhance their global positioning, early-stage startups are increasingly making this move to escape the current economic challenges in Egypt.

Comment