India’s UPI is “fantastic at many levels” but remains an “incredibly painful experience” for ecosystem participants, Mastercard’s CFO said at a recent conference, underscoring tensions around the mobile payments rail that facilitates over 10 billion transactions monthly in the nation with low card penetration.

When questioned about Mastercard’s prospects in emerging markets such as India, CFO Sachin Mehra praised UPI for helping with digitization but voiced reservations about its commercial sustainability.

“It is an incredibly painful experience for ecosystem participants who all end up losing money as part of that proposition,” he said at the UBS conference.

While card giants such as Mastercard and Visa charge merchants a fee for consumer transactions, UPI — established seven years ago by a consortium of banks and supervised by the Reserve Bank of India’s special unit, NPCI — largely functions at no cost to the merchants.

The reduced cost, coupled with support from the Indian government and regulatory bodies, has fueled a surge in the adoption of mobile digital payments in the world’s most populous country.

To be sure, this isn’t the first time Mastercard has expressed reservations about UPI’s economic model.

“The banks who actually enable those payments tend to lose money on those transactions. So it’s a proposition which we are asking the question is this long-term sustainable or not. And who knows? We’ll see where it goes. But in the meantime, debit continues to flourish in that market, as does credit,” Mehra said in May this year.

Mastercard is also not alone with this view, though few have publicly critiqued UPI’s economic framework in recent times. Several fintech executives have appealed to the government over the years to impose a fee on merchants.

But what’s interesting is that many firms in India have innovated and built businesses around UPI in recent years.

Take Paytm’s soundbox, which offers real-time auditory notification when a transaction has completed, as an example. Paytm’s soundbox processes UPI transactions at no cost to merchants, but charges them a monthly subscription fee or a one-time payment of as low as 999 Indian rupees ($12) for using the device.

The soundbox business is growing fast for Paytm and is increasingly contributing to its bottom line. (Mastercard, Visa and AmEx, on a side note, recently partnered with Paytm to accept cards payment on the soundbox in an attempt to expand their reach among merchants in the country.)

Furthermore, the soundbox has paved the way for businesses to access a wealth of cash flow data from merchants. Previously, many of these merchants solely accepted cash and evaded tax.

Having access to this cash flow data, businesses are now developing modern underwriting capabilities and extending credit to previously underserved merchants who were dependent on predatory lenders.

(Additionally, the Reserve Bank of India this month acknowledged the potential of the soundbox and added its deployment to the Payments Infrastructure Development Fund, an initiative that aims to subsidize the rollout of payment acceptance tools in India’s smaller cities.)

Moreover, nearly all stakeholders have benefited from the shift from cash to cashless transactions, and AllianceBernstein analysts argued this month that these benefits outweigh the costs involved in facilitating UPI transactions.

“Banks have benefited from a sharp decline in (expensive) ATM transactions (ATM transactions per capita has fallen from ~7 to ~5 in the last 4 years). The cost savings from this decline itself equals ~20 bps of the current UPI (P2M) transactions. Banks could also reap benefits from an eventual decline in the cash to deposits ratio and the lending opportunities linked to the increasing cashless payments,” AllianceBernstein wrote in a report last week.

The report adds: “The government has benefited from lower currency printing costs (costs as % of private consumption have declined from ~5 bps pre-FY18 to ~2.8 bps now). The cost savings from this decline itself equals ~12 bps of the current UPI (P2M) transactions. The bigger benefit for the government is the increased tax collection efficiency. Consumers and merchants potentially earned greater interest income from a decline in the holding of physical currency, but the direct gains are less apparent as the costs of alternatives (cash and eventually CBDC) is zero.”

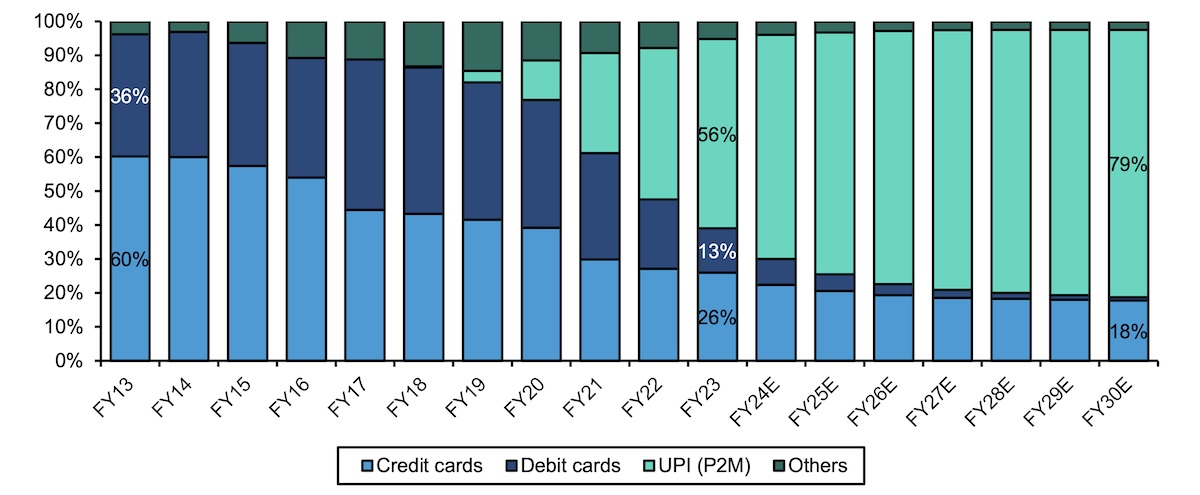

For Mastercard and Visa, both of whom identify India as a key overseas market, the path ahead in the country appears fraught with more obstacles. New Delhi is increasingly promoting the homegrown RuPay card network, which is beginning to see fast-adoption thanks to some unique features such as credit linkage with UPI.

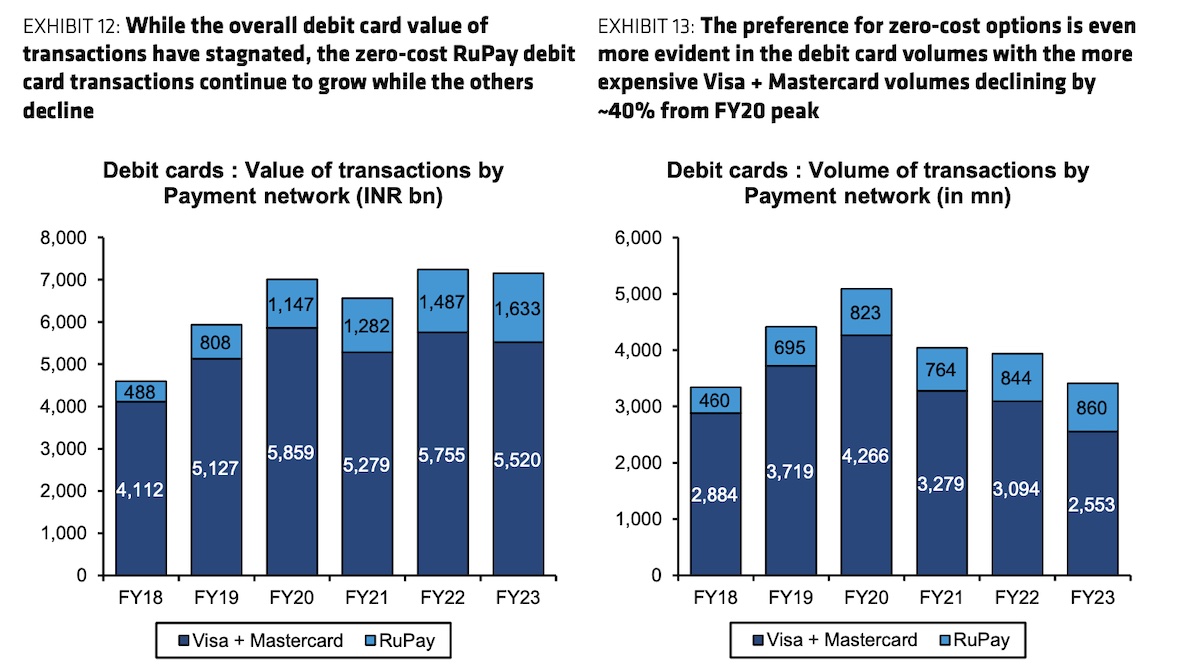

“The MDR (merchant discount rate) on RuPay debit card transactions is zero and not surprisingly, 100% of the volume growth in the last 5 years and ~50% of value growth has been led by RuPay cards with the volume of transactions through debit cards linked to other networks declining by ~40% over the last 5 years,” AllianceBernstein analysts added.

Comment