I recently wrote about DeckMatch’s $1 million seed round. Given that the tool evaluates pitch decks, it’s only fair that I offered to evaluate its pitch deck, too. The founders saw the irony in that and offered its pitch deck as a sacrifice to the teardown gods.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

The deck is lightly redacted. A section on upcoming hires and an appendix on how the company is training its model have been removed.

That aside, DeckMatch raised with a tight 14-slide deck:

- Cover slide

- Problem slide

- “Generative AI is part of the problem” slide

- “Who experiences this problem” slide

- Problem impact slide

- Solution slide

- Demo slide

- Market opportunity slide

- Go to market slide

- The Moat slide

- Goals/milestones slide

- Team slide

- The Ask slide

- Closing slide

Three things to love

Because this product directly targets VCs and even tries to evaluate decks, you’d better believe I’m going to look particularly close at this deck. Even with that in mind, the startup tells a very compelling story.

Turning the problem into the solution

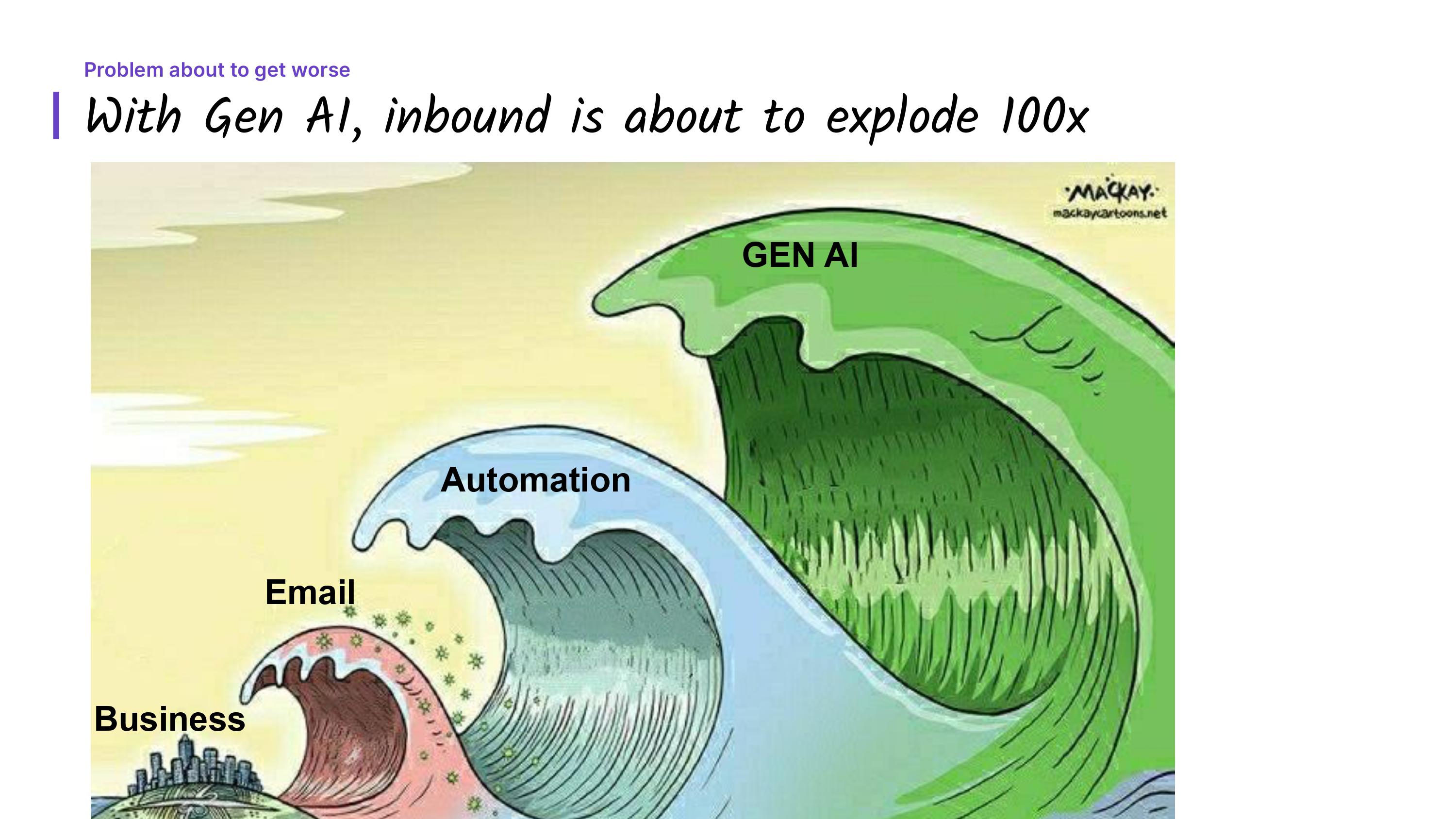

It’s clever that the problem statement shows that the problem is the solution. The ease with which businesses can send vast amount of high-quality outbound requests is an advantage for companies, but not if you’re on the other end. I’m already seeing a huge uptick in SEO spam, for example. High-profile VCs get thousands upon thousands of inbound pitch decks.

Turning the problem on itself, then, is a good solution: If your inbox is filling up with customized, automated emails due to generative AI, why not use AI to evaluate and deal with it all? This slide makes it very easy to understand, it’s funny, and it’s a great visual representation of the problem at hand.

Bonus points: Read the slide carefully, and you see that it doesn’t say pitch decks or VCs anywhere. It says “inbound,” which hints at what the rest of the deck entails. But that also means that the company’s name, DeckMatch, is perhaps overly specific, considering that the market opportunity is enormous.

A great team

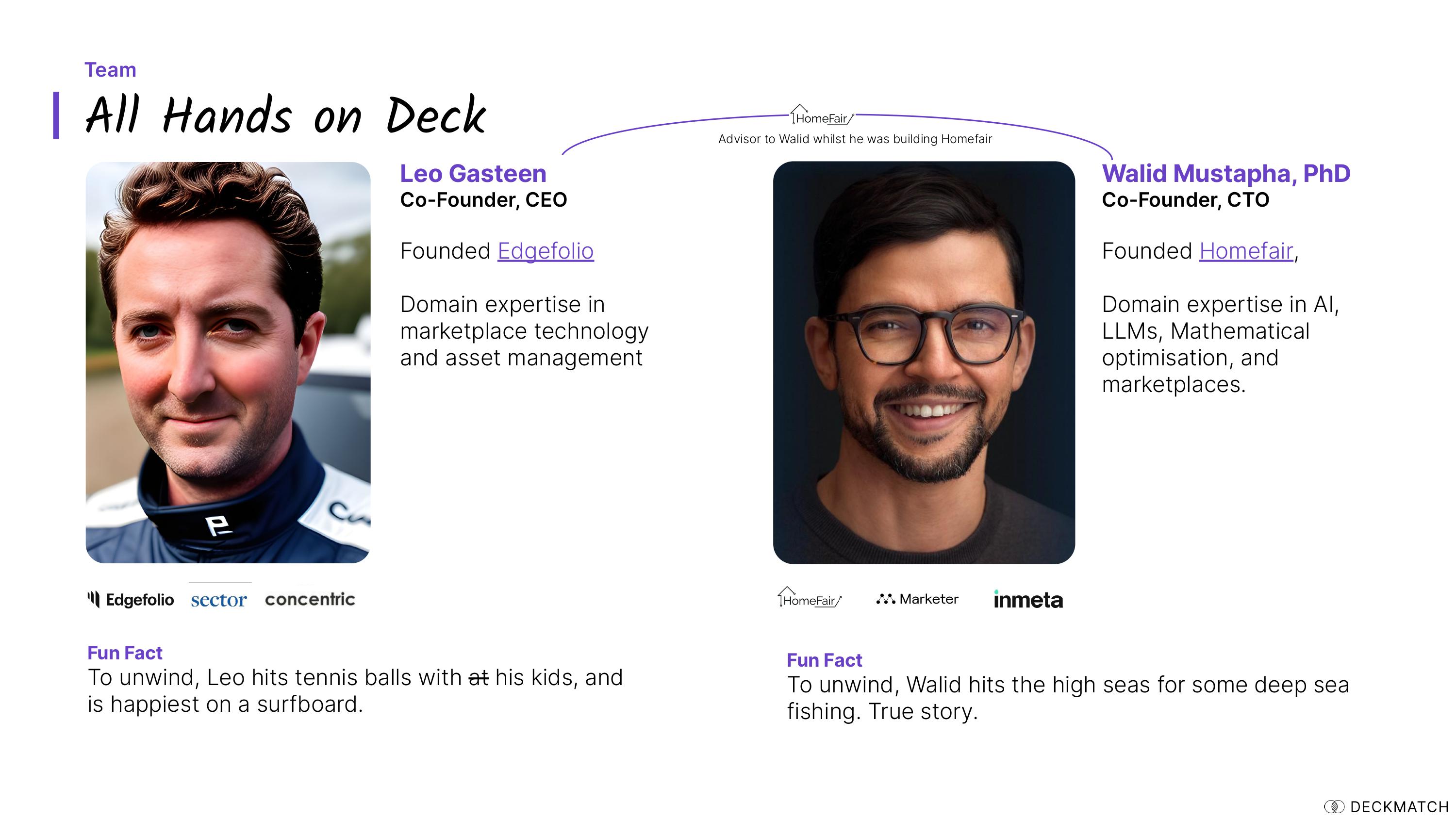

This is not necessarily the best team slide, but it somehow works to show off the quality of the team despite the slide.

Experienced founders tackling a problem that makes sense makes me perk up right away. Founding Edgefolio means that Leo Gasteen has experience with the financial industry, and while Homefair doesn’t immediately seem all that relevant (and perhaps the team could have done a better job at explaining why it’s relevant), Walid Mustapha has deep AI and marketplace experience (I learned this during my interview with him). On the surface, this seems like a solid team.

If you have a great team, I usually recommend leading with the team slide. As a rule of thumb, if the team slide is near the end of the deck, that typically means the founders are trying to bury it. But DeckMatch is doing the opposite: By sticking the slide at the end of the deck, they hope that the conversation will end on a high note. It’s a high-risk approach, but I think it worked well in this circumstance, in a humble-brag kind of way.

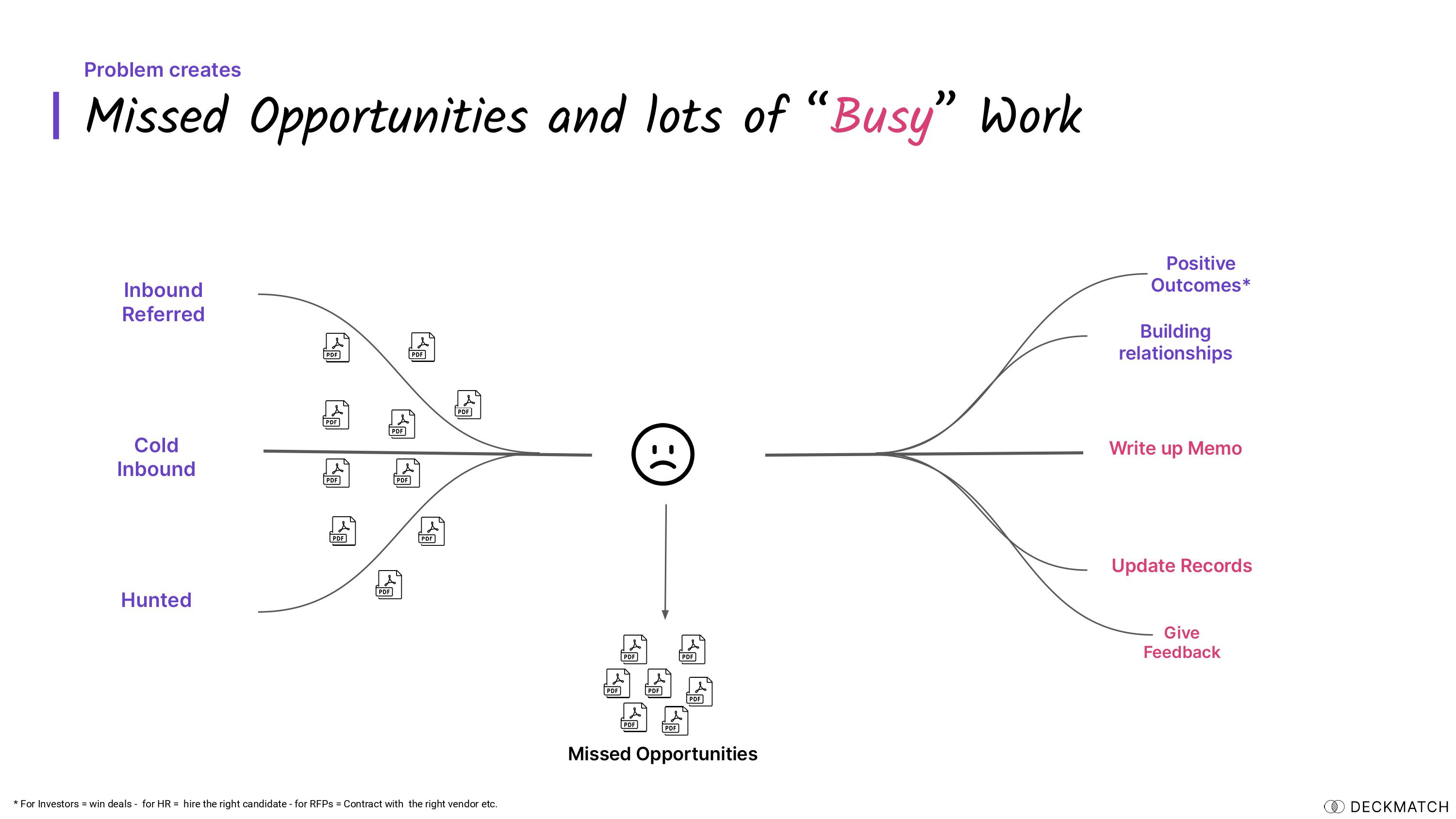

Problem impact slide

I rarely love decks that have three different problem slides, but DeckMatch is doing a really clever thing here, breaking the story into four different steps:

- Slide 2: What is the problem? Too much data.

- Slide 3: How is the problem evolving? It’s about to get a lot worse.

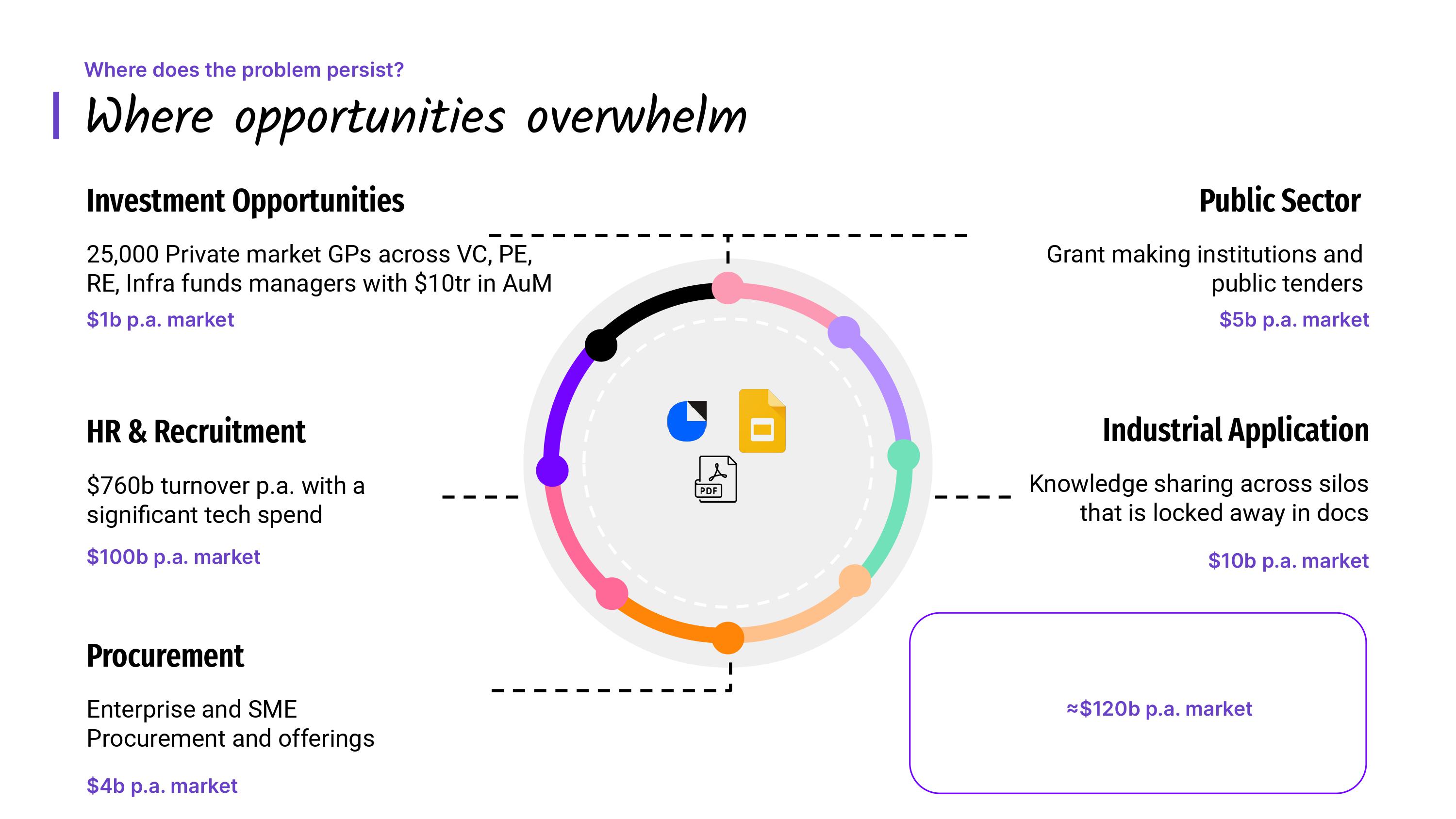

- Slide 4: Who experiences this problem? Investors, HR, procurement, grant-making institutions and industry.

- Slide 5: What’s the impact of this problem? Missed opportunities and wasted effort.

DeckMatch does a great job spinning a narrative around a complex, almost universal problem. It’s a great technique for helping investors understand what the opportunity is.

In the rest of this teardown, I’ll take a look at three things DeckMatch could have improved or done differently, along with its full pitch deck!

Three things that could be improved

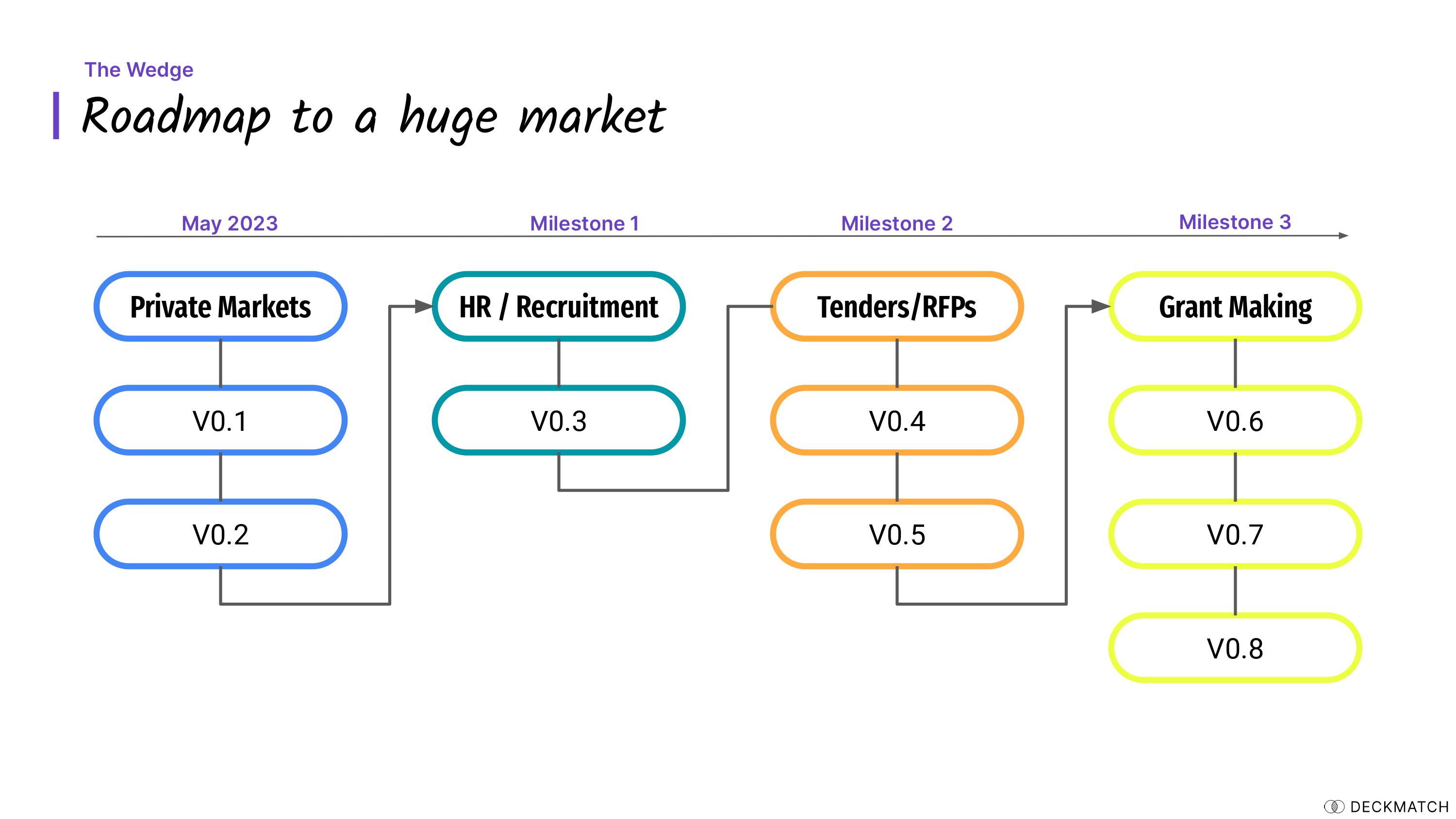

This deck is a little chaotic. It reads as if the company first tried to raise money just for its first version of the product (a tool for helping VCs sift through vast amounts of inbound pitches), but then it shoehorned in a much bigger market.

Wait, what now?

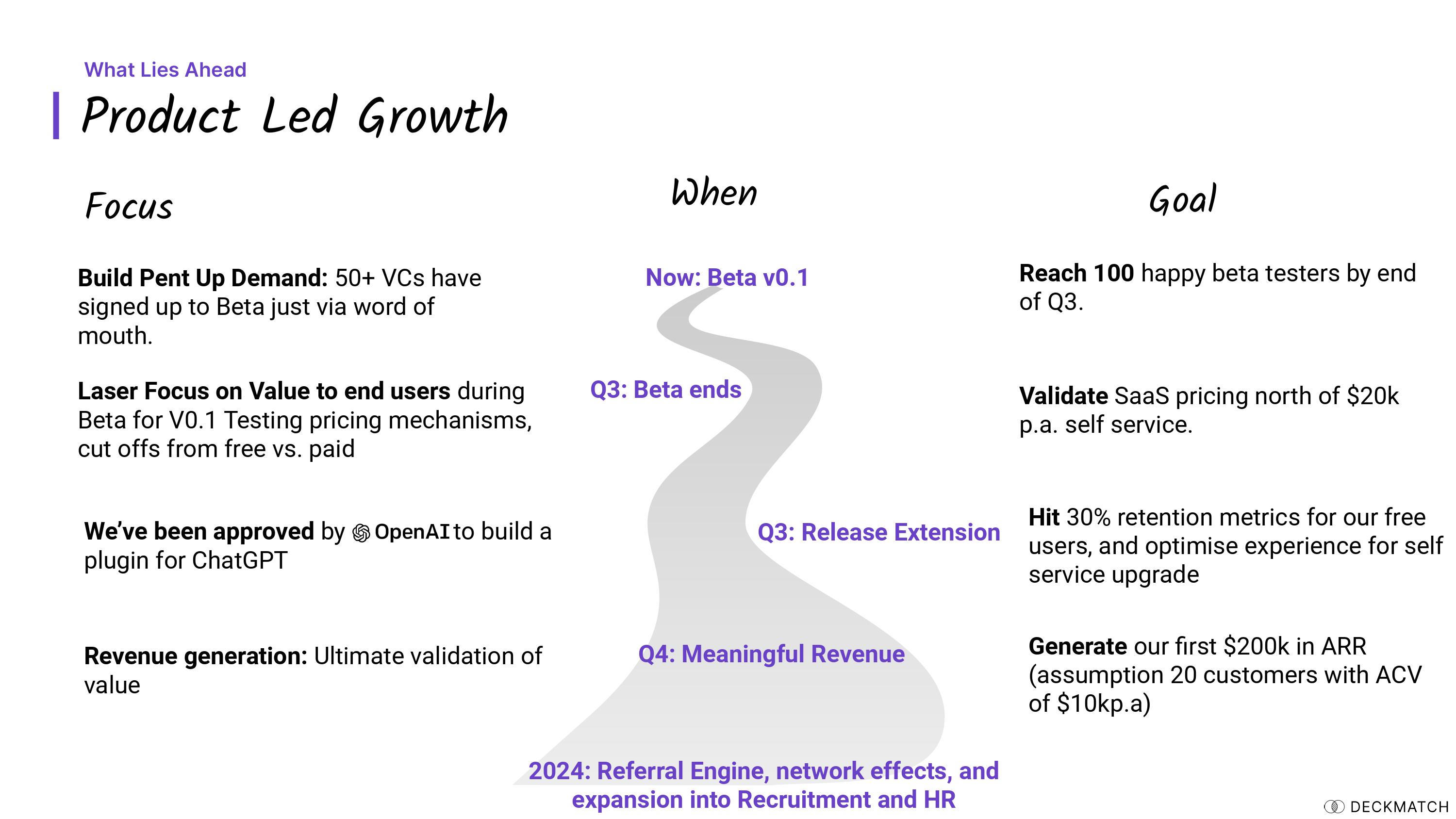

Why is this slide called a “roadmap”? “Milestone 1” and “Milestone 2” could mean anything. What’s the difference between V0.2 and V0.5? There’s no timeline showing when each milestone should happen. This slide is utterly useless in every possible way, which is frustrating, because I can see what the founders were thinking here; they just didn’t execute very well at all.

To make this slide work, the founders could have indicated the milestones (in terms of time, market launches or feature sets). They could have changed the V0.2 labels for named releases or perhaps broken them out as a proper tech roadmap. But right now, this slide says practically nothing.

How is this helpful?

DeckMatch can build a powerful set of tools that help investors and perhaps others, like people in HR and recruitment, because they all share similar problems: a constant deluge of information in their inboxes. The problem is that there are a lot of HR tools out there, and the company says very little about that aspect of the business. I can imagine a world where the tool it builds can be useful to recruiters, sure. But a quick Google search for “AI resume screening tool” shows that there are tons of companies already trying to solve this problem.

DeckMatch’s deck doesn’t have a competitor section, which might be fine, considering how niche the company is; it might not have any competition for pitch deck analyzing. But on this slide, it claims it is planning to go after five different markets, without a particular go-to-market plan in place for any of them. It also doesn’t mention that these additional markets are out of scope for the current round of funding.

It’s likely impossible to go after all of these markets with $1 million. Each market will have a different sales channel, a different top of funnel, and slightly different needs from the product. I have to conclude that it is planning to be more focused with Phase 1 of the product (perhaps that’s the milestones it mentions on Slide 9?), but I’d rather not have to assume.

There’s nothing wrong with saying, “Ultimately we are going after these $120 billion markets, but we’re going to start with this $1 billion market first and expand from there” — and I think that is, in fact, what DeckMatch plans to do. The problem is that this deck doesn’t say that.

Wait, what?

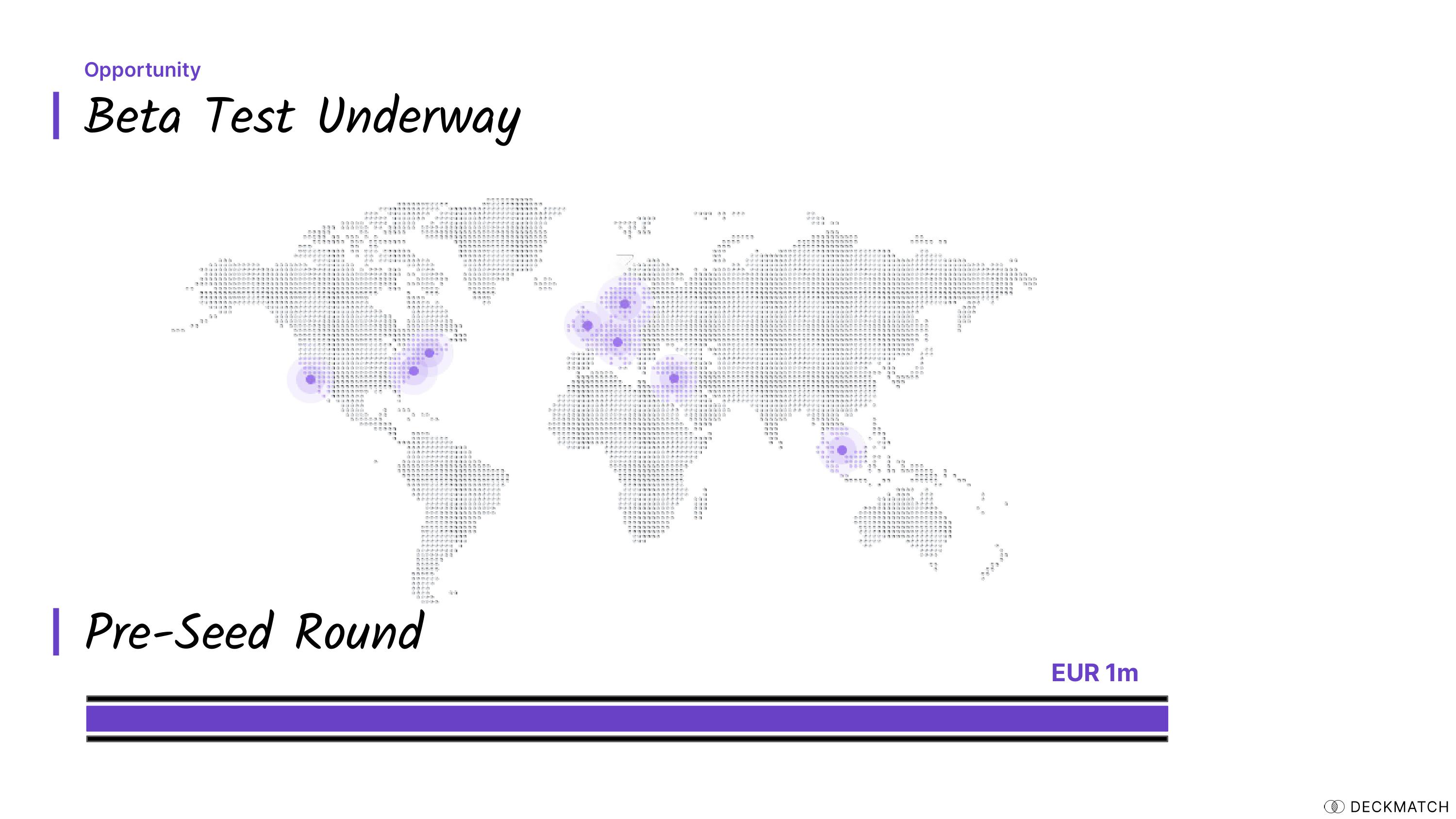

Neither the ask slide nor the use of funds slide in this deck works at all.

The ask slide:

This slide could have been summarized in three words:

Ask: EUR 1m.

But somehow, the most important part of this slide (how much the company is raising) is tucked away at the bottom right. It could have very easily been added to the use of funds slide instead, with the heading “We are raising EUR 1M to . . .”

But the use of funds slide doesn’t do that:

This slide doesn’t draw a direct line between the $1 million the company raised and the goals it is trying to hit. I always ask myself: If this company were to deliver on all of its stated goals, would it be able to raise its next round of funding? And this slide doesn’t properly answer that question. This slide offers many theses but no concrete steps for how funds will be used. Will VCs convert to beta customers? Will they then convert to paying customers?

“Revenue generation: Ultimate validation of value” is pointless; it basically says that DeckMatch is building a business. Who is the audience for this message? The VCs? Because, believe me, they are acutely aware.

The goals are super fuzzy, too. A hundred happy beta testers by the end of Q3 is cool, but it seems like, from the data on the left, the company has only 50 VCs on the waitlist. And what’s more, all of those learned about DeckMatch by word of mouth, which is notoriously hard to scale.

The numbers don’t really make sense, either. The top of funnel is 50 VCs; the company wants 100 customers, but then it says it is hoping to generate $200,000 annual recurring revenue (ARR) — which is pretty low — from 20 customers. Does that mean it is expecting an 80% attrition from its customers? If so, how “happy” were these customers in the first place?

Without a clear plan for what it’s trying to do, I’m surprised the company was able to raise at all. Maybe slapping an AI label on a deck and mentioning possible markets to go into is all it takes to raise money, regardless of whether or not the deck does a good job showing how you plan to succeed.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment