For our 60th (yes, there’s 60 of them now!) Pitch Deck Teardown, we’re taking a closer look at a $1.5 million pre-seed round and the deck that helped raise it. Tulsa-based startup SquadTrip tells me it raised its first institutional funding from Atento Capital, Forum Ventures and others at a pre-money valuation of $6 million.

The company is building a new way for people to do group travel. Let’s take a look at how it positioned itself!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

SquadTrip tells me the deck is unredacted, and they even included their appendix slides. Here’s how it breaks down:

- Cover slide

- “Where it all started” slide

- Problem impact slide

- Problem details slide

- Solution slide

- Market size and target audience slide

- Go-to-market slide

- Traction slide

- Business and pricing model slide

- Competition slide

- Team slide

- Ask and use of funds slide

- Summary slide

- Appendix cover slide

- Appendix I: Hiring roadmap slide

- Appendix II: Product roadmap slide

- Appendix III: Sales and marketing roadmap slide

- Appendix IV: Revenue projections slide

Three things to love

This is a good-looking deck that goes a long way toward showing the business need for a tool like SquadTrip.

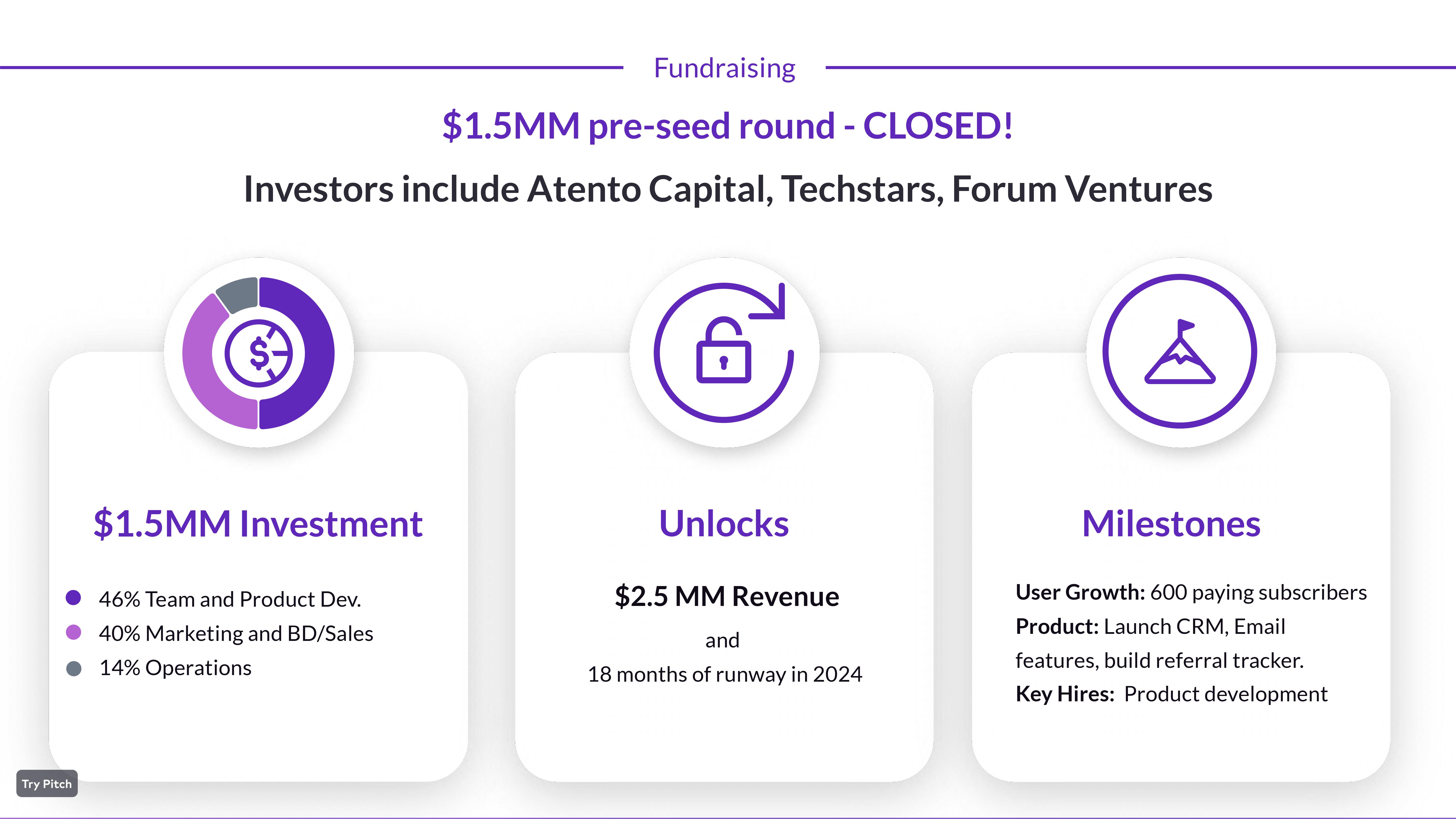

Clear ask and use of funds

It’s obvious that this slide was being updated during the fundraise — it’s a good idea to do so if you have a lead investor and a term sheet while your fundraise is still ongoing.

The slide deck doesn’t show off an operating plan, so I’m curious what the path to attaining revenue of $2.5 million looks like. While I don’t love that it lists how much runway they have — it’s all about milestones, baby — on the whole, this is a good, clean slide. In addition to the runway, it shows what the company is planning to work toward over the next 18 months: 600 paid customers, specific product features, and the key hires needed to get there.

The percentage breakdown is a little fuzzy, but overall, if all of my pitch coaching clients started with an ask and use of funds slide that’s put together as well as this one, I wouldn’t have to send this link to almost everyone I speak to about pitch decks.

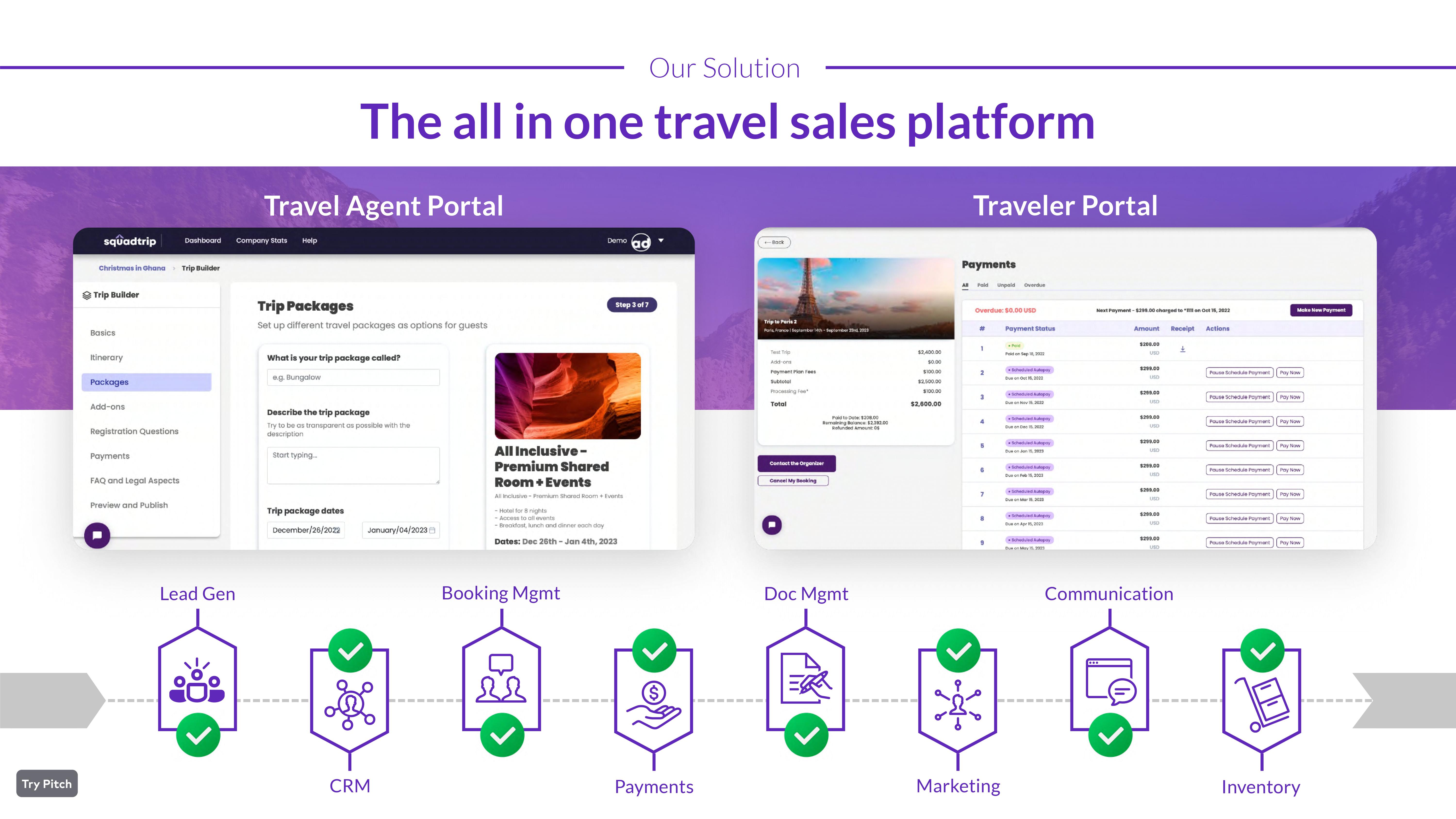

Clean solution slide

This is a great way to tell the story: Show what the travel agents and travelers see, and list the features underneath.

I’d have loved to also see the benefits to both the travelers and the agents, but this is a great start.

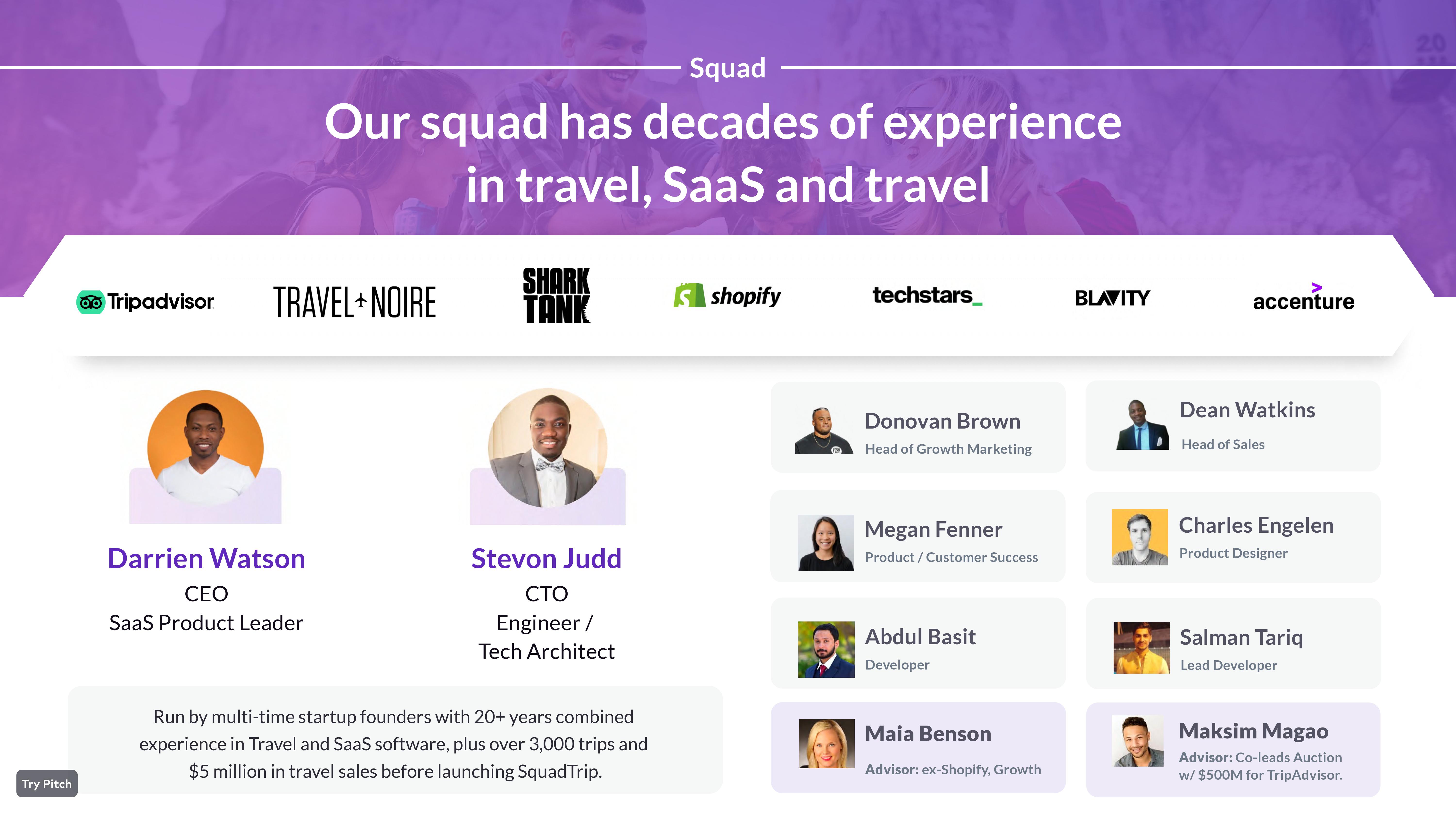

“Teaming” with talent

Can I be honest for a moment? I was genuinely confused why this company was able to raise money. Suffice it to say that there’s a lot of words behind the paywall this week in the “Three things could be improved” section.

But. This team makes up for my doubts and misgivings. Sure, the slide could be cleaner (I don’t know who the logos at the top represent, who most of the people on the right are, or why I should care), but reading the text on the bottom helped me realize that this makes sense.

Twenty years of experience in the travel space, $5 million of sales, and a bunch of travel-booking experience all point to one thing: This is a founding team that really understands its customers’ challenges. If they can tell a coherent story about how they’ll innovate in this industry, they may be a shrewd investment.

In the rest of this teardown, we’ll look at three things SquadTrip could have improved or done differently, along with its full pitch deck!

Three things that could be improved

The deck leaves me with a few questions and curiosities. Let’s start with the first impressions.

First impressions matter

It’s pretty rare for a good deck to begin with a couple of slides that start off on the wrong foot, and to my surprise, that’s what happened in this case. The cover slide begins with:

I like the “Group trips made easy” tagline, but I was confused right away. My first impression was that this was an app for creating group trips for me and my friends.

The second line, however, reads, “Sell more and save time running your travel business.” That was in conflict with my first impression until I figured out that this is a platform for travel agents.

The final quirk on this slide is the word “your.” This is a pitch deck being sent to institutional investors, so it seems the targeting isn’t on the bull’s-eye here. One of the first rules of communication is to keep your audience in mind, and in two short sentences, SquadTrip has gotten that wrong a few times.

So, not a great first impression. Does slide 2 do a better job?

Not really:

This one had me confused on many levels. Why are we talking about a store? Is this startup going to open a bunch of travel agencies, starting with one store? Also, “CDE” doesn’t mean anything to me, and isn’t Antigua a Caribbean island? How does that fit? And when it says, “It all started with our first travel company,” does that mean a travel company owned by the founders? Or was it their first customer?

Overall, slide 2 continues the whiplash of information that started on slide 1. I can make an educated guess about what the company meant to say, but that’s not how communication is supposed to work: If I have to guess, we’ve taken a wrong turn somewhere.

Finally, and this is unpleasant but necessary: It’s really hard to raise money if you’re headquartered outside the core startup hubs (i.e., the San Francisco Bay Area, Boston or New York), and it gets harder if you are based overseas. And if you are from a country that investors can’t immediately recognize, that gets exponentially harder again. I would hazard that just having the word “Antigua” on slide 2 would bias some investors against this startup. Is it fair? Hell no.

Yet, as a pitch coach, I’m all about storytelling. In this case, I would advise founders to tell the story in a way that gets potential investors excited. Share the more challenging parts of the narrative after you have them leaning forward and seeing dollar signs.

In this case, the company is based in the U.S., so there’s no need to lead with the part of the story that takes place elsewhere. I would probably just lose slide 2 or move it farther back in the deck. But if challenged to improve it, I’d go with the following:

Slide 1

- We make group trips easy for travel agents.

- Raising $1.5 million to give travel agents a competitive edge.

Slide 2

- We built a tool to optimize group travel, making 3,000 bookings since 2017.

- Then we opened the tool to other travel agents.

- Now 200 companies rely on our software.

Fuzzy go-to-market

Before I start harping on SquadTrip too hard, I have to admit I don’t know the travel industry very well. Perhaps this slide makes sense to folks who are in the industry. On the other hand, maybe the company wants to raise from people who aren’t from the industry, in which case it could’ve sharpened the story a bit more.

Slide 7 is paired with the “Sales and marketing road map” appendix slide (slide 17), but neither of them really explain how the company is going to find and convert its customers. “Inbound content marketing” doesn’t mean a lot to me. On slide 17, the company says it is going to be producing webinars for “3,000 qualified leads,” but in both cases, I’m confused where those leads will come from. Also: What happens when those 3,000 leads are exhausted?

Partnerships are a powerful way to do sales, but I don’t really know what “travel consortia” are. I don’t recognize the logos, so I can’t google them. And Journeybee’s website doesn’t do much to help me understand how signing up there can help convert to leads.

Finally, the company says that its customer acquisition cost (CAC) is $100,000 per month. Unless you are in the business of selling jumbo jets to airlines, $100,000 per customer is not a reasonable CAC, so I suspect the company means something else here. I think this is a mistake, but I can’t figure out what it’s supposed to mean.

It may have been easier to understand a more operationalized, tactical go-to-market plan that explains the CAC and lifetime value (LTV) of customers.

Inconsistent data

I think SquadTrip is trying to hone in on the serviceable, obtainable market (SOM) here, but this slide makes very little sense. I don’t understand how large-scale festivals fit in. I don’t understand how the SAM (serviceable available market) is $3.8 billion. On the left, the company is talking about 10,000 travel agencies, but on slide 3, the company says “85,000 travel agencies are losing out on $26 billion revenue every year.”

Flipping through the slides, I’m finding it hard to reconcile which numbers apply where, how the company is trying to segment its audience, and how it views its TAM/SAM/SOM breakdown.

On the traction slide (slide 8), SquadTrip refers to its traction as $2.4 million GMV, which confuses things even further. Gross merchandise value is, as far as I’m aware, usually reserved for retailers selling physical goods. Travel agencies don’t really sell merchandise, they sell services. In either case, that’s not a particularly helpful number.

All of the above makes me a little worried about how experienced SquadTrip’s founders really are. Yes, it’s important to tell your story with numbers, but the numbers do have to make sense. With this deck, I’m struggling on that front.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment