A megabucks enterprise acquisition that closed six months ago could lead to thousands of patents landing on the open market.

Last August, Canadian enterprise technology giant OpenText announced plans to acquire U.K.-based IT software vendor and consultancy Micro Focus for a chunky $6 billion, a deal that closed on January 31. In our coverage at the time, TechCrunch considered various takes on what it might mean for their respective customers, and the motivations behind the deal.

Chief among them, Micro Focus’s assets would help OpenText diversify its product suite and become a stickier proposition. But there are fears that OpenText also could capitalize on something else: a windfall of thousands of patents amassed by Micro Focus.

Now, with Micro Focus set to end its membership of anti-patent troll organization LOT Network next week, the big question will be: What will OpenText do next?

PAE off

Over a period of nearly 50 years, Micro Focus racked up a catalog of thousands of patents both through internal R&D — it started as an early pioneer in COBOL — and acquisitions. Its procurement history included legacy software companies such as Borland, Novell (via its 2014 Attachmate acquisition), Serena Software and certain software assets of HPE.

Even as recently as the months before, during and after OpenText’s approach in August 2022, Micro Focus had dozens of patents granted through applications it had made years earlier, spanning everything from machine learning-based network device profiling and stateless password management to blockchain-based transaction methods.

Back in 2021, however, Micro Focus had joined LOT Network, a nonprofit outfit that promises to protect its members through an agreement that automatically cross-licenses patents that fall into the hands of patent assertion entities (PAEs). Such PAEs — also called non-practicing entities (NPEs) or more commonly “patent trolls” — are organizations that make most of their revenue through patent enforcement, shell companies set up to assert those rights with no tangible products or R&D associated with the patents.

The LOT Network counts thousands of members: Google, Amazon, Uber, Salesforce, Facebook, Microsoft, eBay, Netflix, Airbnb, ByteDance and IBM, though there are plenty of smaller companies in there too, from fledgling startups to pre-IPO scale-ups. The idea is that when a company joins LOT, it commits to ensuring that none of its patents end up in the hands of a PAE. If the patents do end up there, then all LOT members are automatically granted a license to the patents, making them immune to future litigation in perpetuity for as long as they remain members of LOT — even if the patent holder itself leaves LOT.

This arrangement isn’t designed to deter patent enforcement in general — there are many legitimate scenarios that may require member companies to assert their IP rights. In fact, there are examples of LOT Network members suing one another for patent infringement, for example Google’s sibling Waymo’s suing Uber for trade secret theft, and IBM pursuing Airbnb for patent infringements for some six years, eventually settling the case in 2020.

These kinds of patent assertions are fine under LOT’s terms. This is because the companies involved aren’t PAEs, which it defines as any company that derives more than half of its revenues from patent enforcement (litigation or licensing).

In other words, LOT is essentially a deterrent mechanism more than anything else, discouraging would-be trolls from snapping up patents for the express purpose of litigation or licensing. Companies are free to end their LOT membership at any point, with the understanding that they will no longer be protected from PAE patent litigation.

But on the flip-side, this also frees them to do whatever they want with their patents, including selling them to the highest bidder — whoever that may be.

Patent boost

All this leads us back to OpenText, which now owns thousands of granted and pending patents, aggregating its own holdings with those of its recent acquisition.

Notably, Micro Focus officially handed in its resignation notice to LOT Network in March, though in reality the resignation was somewhat moot as LOT’s T&Cs state that when a member is acquired, the acquiring company has to join the organization to remain covered. If this doesn’t happen, the membership is automatically cancelled six months from the acquisition date — which, in this case, is July 31. (OpenText has never been a member of the LOT Network.)

What this means is that Micro Focus (and thus its patents) will no longer be subject to the LOT Network agreement, and OpenText will be free to use them however it wants. LOT members who joined before Micro Focus’s exit date (July 31) will continue to be protected regardless. But from August 1 onwards, any other company could be a potential litigation or licensing target should the patents end up in the hands of a PAE.

While LOT Network membership would be irrelevant if OpenText were to decide to assert these patents itself — remember, it’s a legitimate operating company — there is always a danger that these patents could be sold on to another entity, including a patent troll.

“We think there’s a possibility that in the future, one way OpenText might choose to deal with these patents would be to sell them to a PAE,” LOT Network’s VP of partnerships and thought leadership Sam Wiley said in an interview with TechCrunch.

Wiley isn’t alone in voicing concerns. IP attorney Patrick McBride, who most recently headed up IP programs at Red Hat, said that while it’s impossible to know how these patents might be leveraged, OpenText likely has something specific in mind for them.

“One would assume that the reason they are removing those assets from the LOT Network is to do something with them, as they would be free to use them for their own operating company purposes while staying in the network,” McBride said. “You have to conclude that they have some purpose in mind for them by withdrawing them.”

TechCrunch reached out to OpenText for comment, but was told that it doesn’t comment on business decisions such as this.

PAE concerns aside, though, recent behavior indicates that OpenText might in fact be open to asserting these patents itself, with litigation one possible outcome.

Legacy software

OpenText makes most of its annual revenue through its business, which involves helping companies manage their content and data. Over the past decade, its market cap has roughly tripled to more than $11 billion. A chunk of this growth has been off the back of buying legacy software companies, securing countless patents along the way. But some of its actions in recent times have led to accusations that it’s behaving like a patent troll itself.

Back in 2019, OpenText acquired Carbonite, a data security firm that itself had acquired a 25-year-old endpoint security company called Webroot earlier that same year. Fast-forward to March 2022, and Webroot (backed by its parent OpenText) initiated patent litigation proceedings against CrowdStrike, Kaspersky, Sophos and Trend Micro, with claims that its cybsersecurity rivals were using malware detection techniques protected by patents owned by Webroot.

A CrowdStrike spokesperson said at the time that this is something it would “expect from a patent troll” rather than a cybersecurity company. “Legitimate licensing discussions start with a phone call, not a lawsuit,” they said.

Trend Micro COO Kevin Simzer echoed this sentiment, saying that “desperate times call for desperate measures” from OpenText.

“Perhaps OpenText is struggling with the less-than-successful assets they have acquired over the years, so they need to transform into a patent troll type of company,” he said. “We will vigorously defend ourselves.”

Going further back, OpenText has something of a history of patent litigation, settling with rival Alfresco back in 2014 before going after cloud storage company Box and its government procurement partner Carahsoft in 2015. It also currently has litigation against Alfresco’s parent Hyland Software over patents covering remote data-storage technology.

“OpenText is definitely not a PAE — it makes most of its money from technology,” Wiley said. “But compared to its peers, especially on the cybersecurity side, they’re pretty aggressive with patent licensing.”

Data from Clarivate’s Darts IP database, cited by LOT Network, indicates that OpenText has asserted in the region of 40 patents, spanning 19 separate patent litigations, in the past decade.

While the main motive behind buying Micro Focus might well be its ability to generate more direct revenue for its new parent, it’s clear from OpenText’s recent past that patent litigation is on its agenda. And Micro Focus adds significant ammunition to its arsenal, with LOT Network estimating that Micro Focus essentially doubles OpenText’s patent trove. This trove isn’t cheap to administer, either.

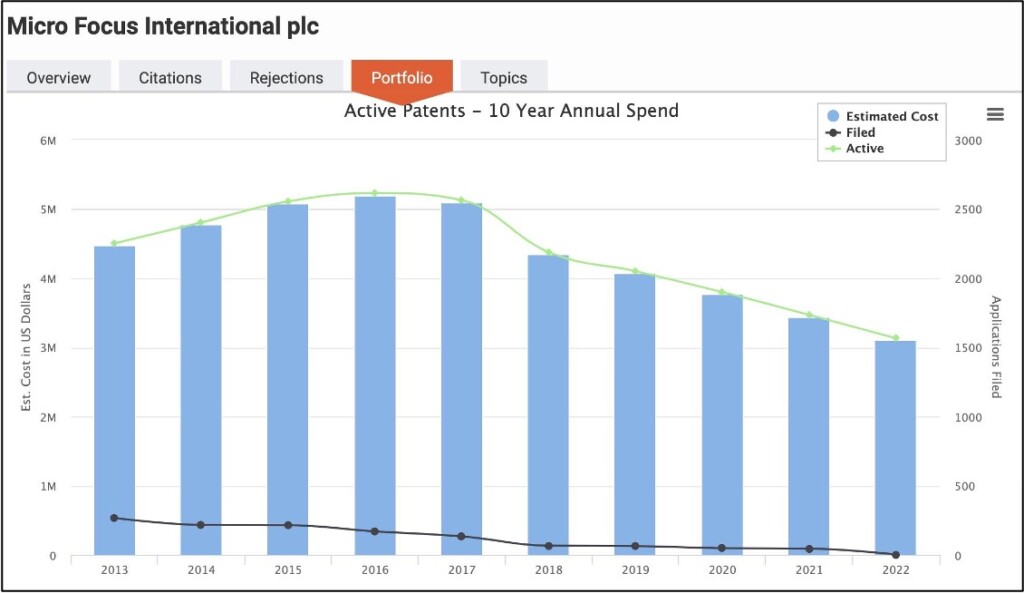

Figures derived from Clarivate’s Innography suggests that Micro Focus has been paying as much as $3 million each year to manage its patent portfolio, which may include registering or renewing patents, monitoring their use (or misuse) across hundreds or thousands of markets. So one way to reduce these overheads, while simultaneously making money, would be to sell some of these patents to a third-party, such as a PAE.

“If you look at OpenText’s patent portfolio, it’s probably much larger than it needs to be,” Wiley added. “Those portfolios are very expensive to maintain, you have to pay maintenance to all the different patent offices. And so one possibility would be that OpenText says, ‘Hey, the best way to get a return on these patents is to sell to a PAE.’”

This may also tie in with other cost-cutting measures OpenText announced post-acquisition, which effectively translated into an 8% workforce reduction to save $400 million in outgoings.

If patent litigation is on the agenda, OpenText might pursue its own route, but there are inherent risks associated with that. An operating company might not want to get too litigious, given the inherent costs, uncertainties and reputational risks associated with that. In which case, selling at least some to a PAE might be a better option in the long run.

Either way, though, when you consider that OpenText has proactively removed Micro Focus from LOT, and has been actively engaging in litigation to loud cries of “patent trolls,” this could spell trouble for some companies out there.

Comment