They grow up so fast. Babies, toddlers and kids will grow out of literally everything you get for them, probably well before it wears out. And then what do you do with the cots, car seats, strollers and toys?

That’s where GoodBuy Gear comes in: It’s like eBay, except for the little ones’ used stuff.

“Parents in the United States spend $87 billion on baby and kid gear every year, and most of those products are hardly used. In fact, 83% of the inventory on our marketplace is never or barely used before it’s listed for resale — that’s the massive opportunity GoodBuy Gear was founded to solve,” the company’s CEO and co-founder, Kristin Langenfeld, said in a press release.

The company raised a $6 million Series A in October 2020 and added a $11 million Series A-1 this May. The company also raised a $3 million line of debt, which puts the total funding secured at around $22.75 million.

For this Pitch Deck Teardown, we are looking at the deck the company used to raise its $11 million Series A-1.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

GoodBuy Gear raised the extension round with a 14-slide deck. The version we have has a lightly redacted slide outlining its unit economics (AOV, revenue, margins, etc.). Here are the slides:

- Cover slide

- Problem slide

- Problem slide 2

- Market interstitial slide

- Market slide

- Market differentiation slide

- Solution slide

- Traction slide

- Value proposition slide

- Market dynamic slide

- How it works slide

- Growth metrics slide

- Use of funds slide

- Closing + Mission slide

Three things to love

GoodBuy Gear’s deck is not without its challenges, but there’s a lot to love, including some unusual choices that really worked out for the team.

Closing on a high note

I’ve often argued that last impressions matter, and GoodBuy Gear’s closing slide does an elegant job:

A lot of pitch decks start with the mission, but GoodBuy Gear crashes straight into the story with its problem slide. I ain’t mad, because it works well.

I don’t think I’ve ever seen a pitch deck that ends with the mission, though. Anyway, it does a great job here, pulling the narrative together with a strong, “Hey, this is why we are here.”

Very cool, and well done.

Why not just use eBay?

When I first heard about this company, I was wondering why there was a market for this stuff at all. Clearly, I don’t have kids, because I should have seen this one coming. GoodBuy Gear tackles the question tastefully without even mentioning its competitors:

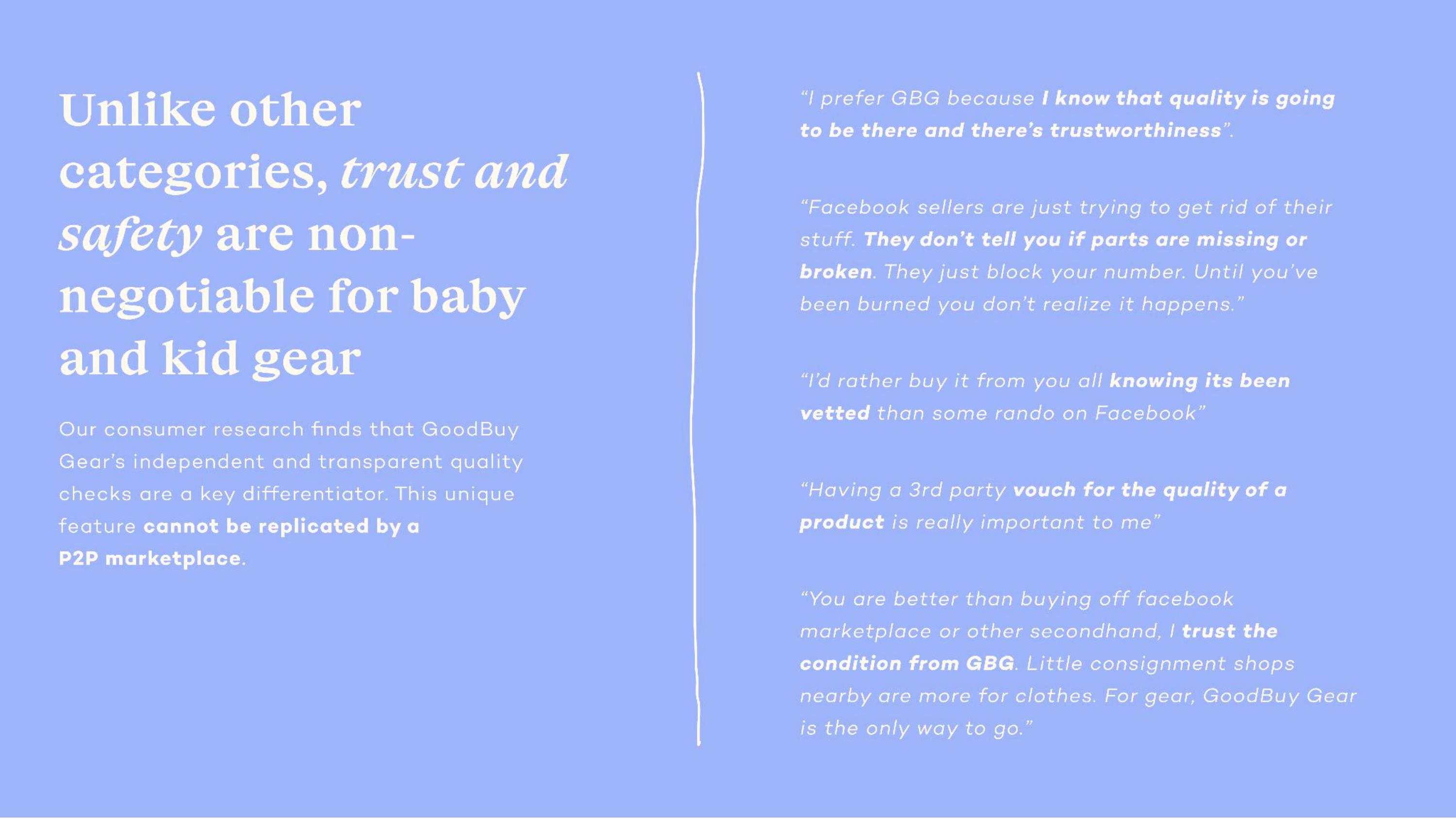

GoodBuy Gear’s business model is different from its peers: It vets the quality of the products and ensures that they are clean and of high quality. Busy parents don’t have time to deal with going to the post office, dealing with returns, so this service eradicates a lot of the hassle. Telling this part of the story through customer testimonials is smart. While I hate this white-on-light-blue wall of text, it does get the “why” of the message across.

The deck doesn’t go far into the “how,” which I think would have been beneficial for getting people fully onboard, but the company’s “How it works” page has a pretty decent explanation:

Up and to the right

I usually don’t include redacted slides, but storytelling is storytelling, and GoodBuy Gear does a mighty fine job of explaining why it is doing well:

The company paints a pretty rosy picture here: It’s trending toward $100 million revenue in five years and has clear growth trajectories, a healthy marketplace dynamic and exponential revenue growth.

It feels a little strange to show the 2023 figures, though. The company raised this extension round in May, which means it only had data for 40% of the year at most. It’s just good practice to show projected numbers in a different color than actual figures to highlight the difference.

Still, if the company can deliver on its projections, it’s on to something, and the investors agreed to the tune of a $11 million round.

In the rest of this teardown, we’ll look at three things GoodBuy Gear could have improved or done differently, along with its full pitch deck.

Three things that could be improved

The No. 1 thing that frustrates me about this deck isn’t what’s there — most of that is pretty good. It’s everything that’s been left out. Some of the omissions are straight-up suspicious and they’ll set off some pretty major alarm bells if you’re an investor.

The problem here is: The company raised a Series A in 2020 and has returned three years later to raise another series A, this time labeled as a Series A-1. As an investor, the first question out of my mouth would be, “So, what happened?” followed by, “How is it going to be different this time?”

Okay, I wouldn’t phrase it quite that rudely, but you’d better believe that investors are going to be curious.

Glaring in their absence

The deck is missing some pretty major elements that I expect to see in a pitch deck, and those parts will almost certainly come up in due diligence.

First off, there is no team slide in the deck that was submitted to TechCrunch (ED: the team later noted that there was a team slide in the original deck, but that it was deleted from the version that was submitted to TechCrunch. It is unclear what about the team slide was confidential). In any case, the team slide is arguably one of the most important slides for an early-stage company. There’s no competition slide either (again, very important), and, curiously, the company doesn’t include an operating plan or anything about how much it is raising.

Of those missing slides, the team slide is downright unforgivable. I need to know why the leadership is the right team to build this company for two reasons: If you need to come back to raise a Series A extension instead of a beefy Series B, there’s probably something amiss. There are a lot of companies in this space (Kidizen, Thredup, Mommy & Me Resale, Once Upon a Child, Children’s Orchard, to name a few), so an investor needs to know that they’re backing the right horse.

Market size and go-to-market are hand-wavy

I’m a little torn here. On the one hand, of course secondhand children’s and baby gear is a huge market.

On the other hand, this slide doesn’t explain the market segmentation. The $87 billion is not GoodBuy Gear’s TAM (total addressable market); it’s the annual spending on all kid and baby gear, excluding clothing and shoes. But that’s not really the market this company is going after, because even if it were to become very successful, many parents will still buy new. Also, I suspect a lot of demand for baby stuff comes from people buying gifts for baby showers, and I don’t know what the appetite is for secondhand gear in that context.

The smaller number is also suspect: This isn’t the SAM (serviceable available market) or the SOM (serviceable obtainable market); it’s the resale value of unused baby and children’s items. Retail value is iffy for exactly the reasons I describe in my article about SOMs. Unless you are an equipment manufacturer, your SOM is the markup — the revenue you can make here — and not the retail value.

This slide leaves me confused: Are the founders unaware that neither of these numbers represents their market size? That would be bad, because the founding team has been building in this space since 2016 and should be domain experts. The other alternative is that they are aware and are trying to use numbers that inflate the obtainable market it is going after.

Whatever the reason, this slide could do with some work.

It’s made worse by the fact that the company doesn’t have a clear go-to-market slide. That is a problem, because an investor will be in the dark about the size of the obtainable market or how the company plans to capture it. On Slide 12 (referenced above), the company says it has “efficient customer acquisition.” That’s awesome, but I want numbers. What’s the customer acquisition cost? Which channels are working? If you had $10 million to invest in marketing, could you grow dramatically?

Fuzzy “use of funds”

By coming back to investors for a bridge round, the company needs to show that it has a clear idea of how it will get to a position where it can raise a Series B.

Look, I get it. It really sucks to be on the VC treadmill, where the chorus is “grow or die.” You have to play to win and show that you’re aware of what’s needed in this round in order to raise the next round. That’s not what’s going on here:

“It is our category to win,” the company claims, and I would love to be convinced that’s true. The problem is, this “use of funds” slide doesn’t actually say how the company is going to use the money to position itself for the next round of funding.

Here’s a look at the claims:

- The only scaled player: Awesome, but you don’t have a competition slide. I found 20-plus competitors with just one Google search. If nothing else, Craigslist and eBay are competitors operating at enormous scale, so I’m skeptical.

- Clear path to positive cash flow: That would be huge, so why doesn’t your deck show that?

- Scale new retailer and brand partnerships: “Scale” is not a great goal. One new partnership is enough to meet that goal, but that wouldn’t position you to raise a Series B. As an investor, I want to see that founders understand what it will take to raise more funds. How many retailers do you need? How many brand partnerships? Those would be good “use of funds” goals.

- Open additional markets: Great! How many? Which ones? How much revenue will that generate? I would expect an appendix slide here showing the playbook and what it will take to launch in those markets.

- Capitalize on accelerating tailwinds: Those are all macroeconomic factors. It’s great that you have them, but there’s nothing here about how this fundraise will help you grow the business and get ready for a Series B.

This slide has almost no real information on it. There’s no go-to market, there’s no playbook, and there is no financial information on where the money will be spent. Will it be spent 90% on marketing to attract new customers? Are you investing in tech? Are you increasing your headcount?

As a startup founder, your takeaway from this slide should be: You need to focus on having a clear ask for a fundraise. It helps you come across as an experienced and believable founder.

UPDATE: An earlier version of this article stated that the round covered by the pitch deck was a $5 million series A extension round. It turns out that the founders prefer to have this referred to as a Series A-1 round, and – the information in the press release the company sent out notwithstanding – that the round was, in fact, for $11 million. The article has been updated to reflect this above. UPDATE 2: The team also informed TechCrunch that there was a team slide in the original slide deck. The article has been updated to reflect that.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment