In a world where people working from home still need access to networks and a ton of other use cases, Netmaker lets users create and manage VPN connections without the learning curve, as Romain wrote last year when the company announced its seed round.

Netmaker submitted its pitch deck to TechCrunch+, and today we’re taking a close look at the deck the company used to raise its $2.3 million round.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Netmaker has a tight, 14-slide deck. The company tells me it redacted certain sensitive data (such as financial information), but those parts have been marked clearly so the deck still makes sense in context.

- Cover slide

- Problem slide

- Vision slide

- Solution slide

- Market-size slide

- Product slide

- How it works slide

- Traction slide (“In active use on over 10,000 devices”)

- Product evolution slide

- Go-to-market slide

- Road map slide

- Competition slide

- Team slide

- Closing slide

Three things to love

Netmaker is sharing a lot of information in just a handful of slides about what could be perceived to be a pretty complex, technical space. The company has done an incredible job of keeping things accessible.

Traction is king

Having powerful traction is great for any startup, as rapid growth implies a company has found something important in the market and can attract new customers.

That said, some of these stats seem like vanity metrics to me. For example, why is it important to have 5,500 stars on GitHub? Does that translate into customers? Why is the 1,000 community members number important? Netmaker could have tried to connect the dots: Why are these metrics important to the company and how do they show rapid growth?

I did find myself stumbling on the claim of “50% MoM growth for 6 months.” It’s hard to overstate how impressive that is, and as an investor, I’m finding myself itching to learn what the growth engine is here. How much did the company have to spend to acquire those customers? How can it continue along this trajectory?

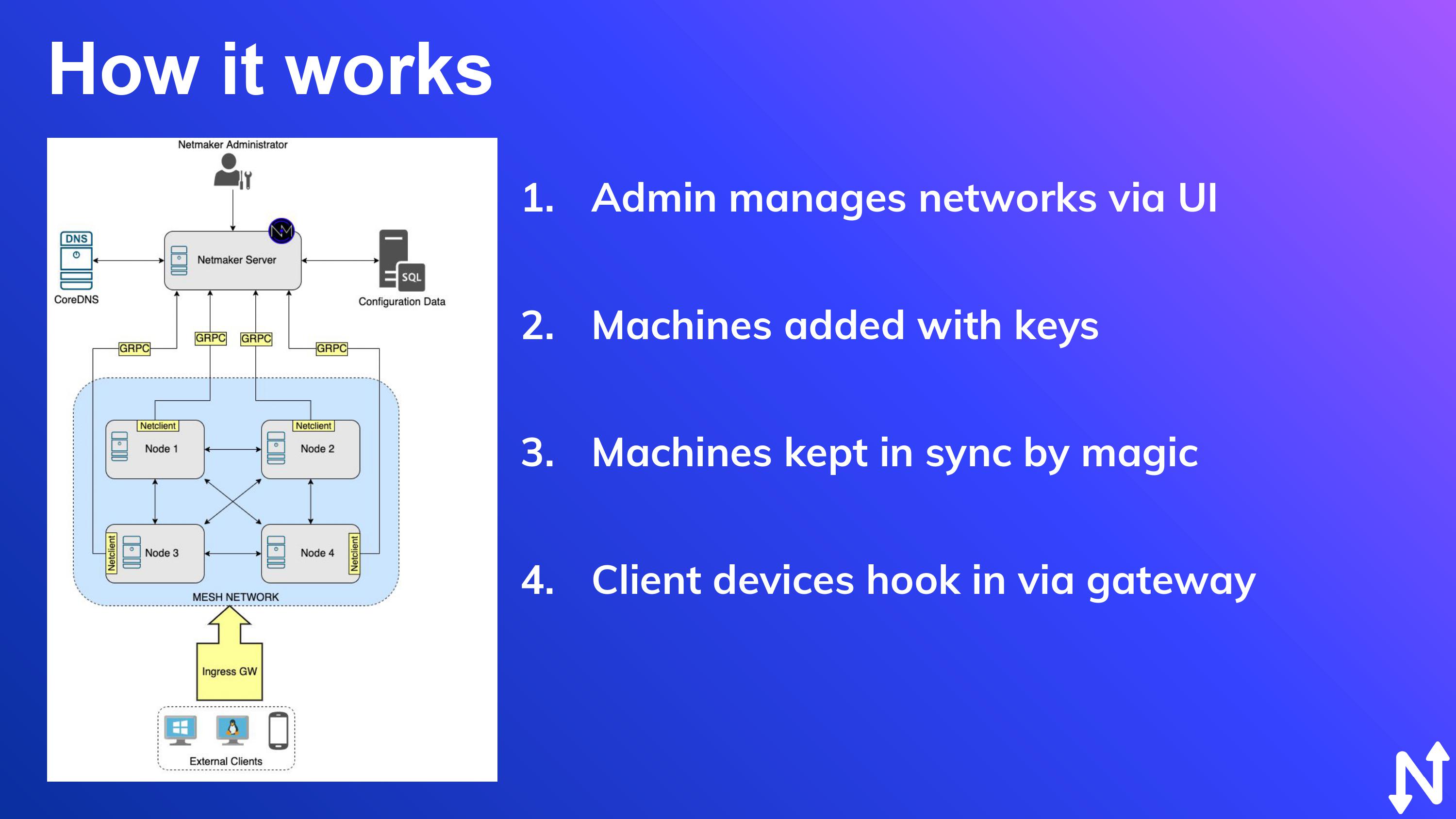

How it works

When your target audience is people who design, implement and maintain network infrastructure, you can bet that most investors you’re speaking to will not be fully au fait with the intricacies of the market. I do know VCs who have deep domain knowledge, but even the ones who are experienced may have pretty out of date information. The landscape in this space, like in so many others, changes nearly every day.

This “How it works” slide may be a little too simple, to be honest. I’d have loved to see screenshots of the actual provisioning/set-up screens to understand how hard it is to configure a network or add machines. Having said that, this is a great base-level introduction to explain the “Here’s what we do and why it matters” part of the story.

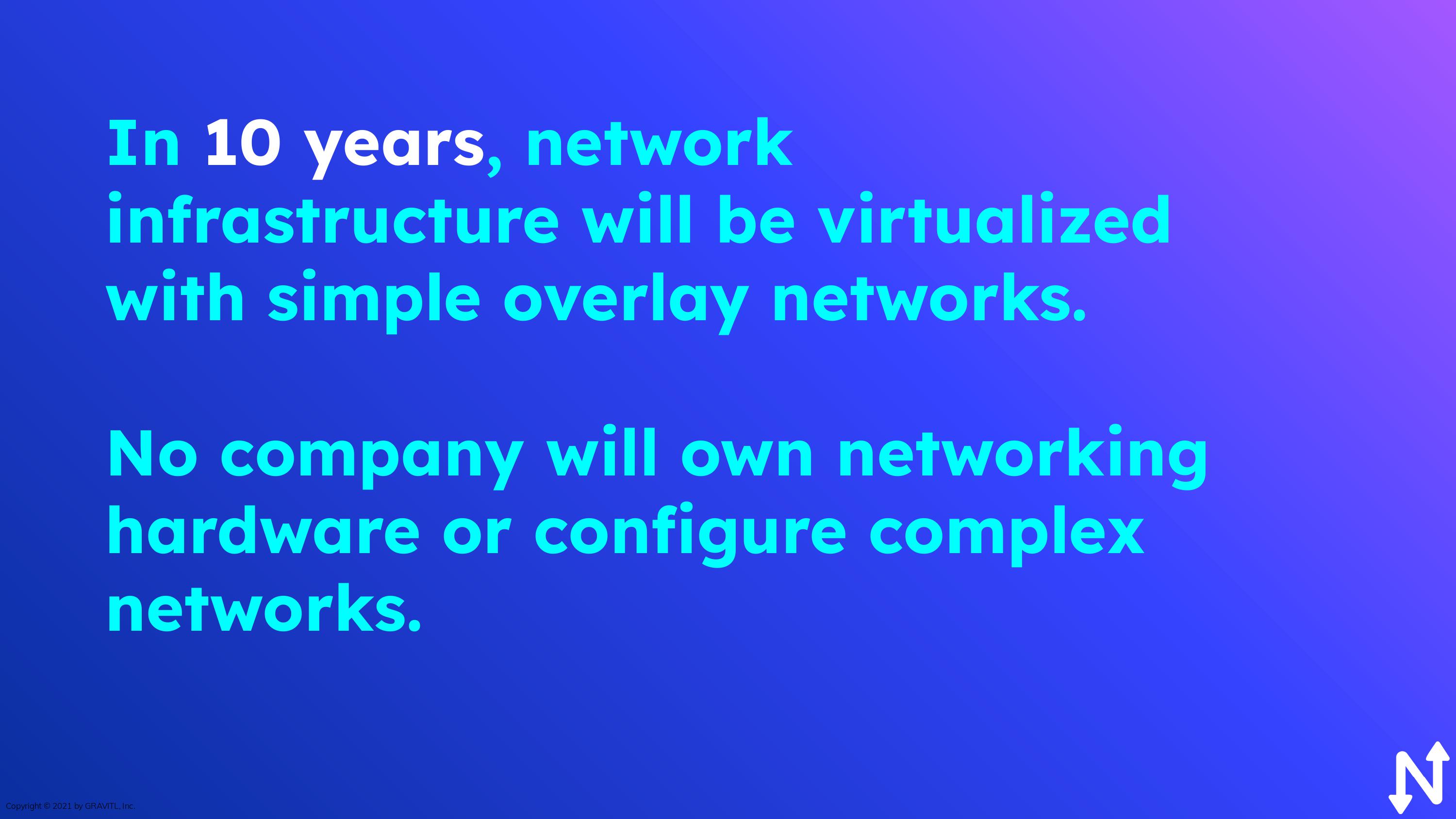

A clear vision of the future

I love how Netmaker pulls no punches in its vision for the future of its industry. This vision may prove to be inaccurate, but the company is not confused. It’s refreshing to see such clarity and the company’s ability to hook into its vision:

Now, you could argue whether this is correct. Will nobody at all own their own networking hardware? Will there be no need to configure complex networks? I’m not a network architect, but that sounds like a bit of a stretch. At the very least, the internet itself and the underpinning technologies that support Netmaker will presumably need some amount of hardware.

Nonetheless, I think the company does something right here: It paints a clear, bold and differentiated view of the future and backs that up with the steps it must take to put itself at the forefront of this movement.

In the rest of this teardown, we’ll take a look at three things Netmaker could have improved or done differently — along with its full pitch deck!

Three things that could be improved

My overarching feel of the Netmaker deck is that it is very light on plans. When you’re raising funding, yes, you should absolutely celebrate past victories, but it makes sense to also talk about what the future is going to be like.

The Ask and Use of Funds

The purpose of a fundraise is to get your paws on a sack of cash that lets you do something that you couldn’t otherwise do. It’s helpful if you have a plan for how much you’re raising and how you’re going to spend the money. Netmaker’s deck is remarkably light on details on that front.

Slide 10 has a very hand-wavy “go-to-market” slide that doesn’t say anything about where its customers will come from, what the customer acquisition cost is or what the sales mechanics and strategy is for acquiring these customers. Then, slide 11 (above) shows a product road map that is so hand-wavy as to be almost useless.

Without knowing what the 2.0 release includes, for example, just saying that you are doing a “2.0 release” means very little. These two slides show that the founders knew that the investors needed to know something about the future, but it doesn’t posit a coherent plan for what’s next.

A better way to do this would be to tie the milestones to the next funding round.

In other words: Imagine a world where you, the founder of Netmaker, are raising a Series A. Which milestones do you need to hit, which growth metrics will you need and which technology breakthroughs would you need before that round makes sense? Those are your target metrics for your current funding round.

If you’re raising enough to hit those goals, then it will all click into place: You have a reasonable set of goals, a decent plan for how to get there and enough resources to execute. If you can show all three of those things, you’re on the right path.

As a founder, you can learn from this slide to look at the deck with the perspective of an investor: Are you getting everything you need? If not, can you add more or different information in order to get there?

What’s Wiseguard, and what does Netmaker add to the mix?

Okay, so my ignorance of networking is definitely showing here. Perhaps that means I’m not the right investor to be looking at this deck in the first place.

And, this is not a good slide:

This slide had me very confused; Netmaker appears to be building a technology platform around WireGuard, which, as far as I can tell, is an open source VPN solution. It then suggests that Netmaker “simplifies networking by securely connecting devices,” but I’m not entirely clear about how that is different from what WireGuard does.

Earlier this year, I warned startups to ensure they are building companies, not features of other products, and with my ignorant eyes, I’m not clear which category Netmaker falls into.

For me, at least, it would have been beneficial to have a slide that breaks down the platform. What does WireGuard do? What does Netmaker do? If WireGuard were to fall into disrepair or stopped being maintained, how big would the risk be for Netmaker? How much does Netmaker rely on WireGuard? Is there an option to replace WireGuard with another VPN solution if needed?

If you’re a networking expert, I suspect all of those questions would make me sound like an idiot. But remember, a lot of investors may be very smart, but they may not know every detail of every industry. In this case, since the deck is pretty high level and light on details, it seems like an oversight to not include a bit more of an overview of what the tech is.

Come to think about it, the company doesn’t really double-click on what the advantages of the tech are either nor how it makes life easier, better or more secure for end users.

The traction doesn’t lie and 50% growth MoM is extremely impressive, so I’d definitely keep reading if I were to receive this deck. That said, I do appreciate it when people make life easier for me. I might not be the right investor for this company, but if I have a better understanding of what it is and how it works, I might just be able to suggest someone who could be a better fit. Or, I could forward the deck to another investor who is better positioned to evaluate the opportunity.

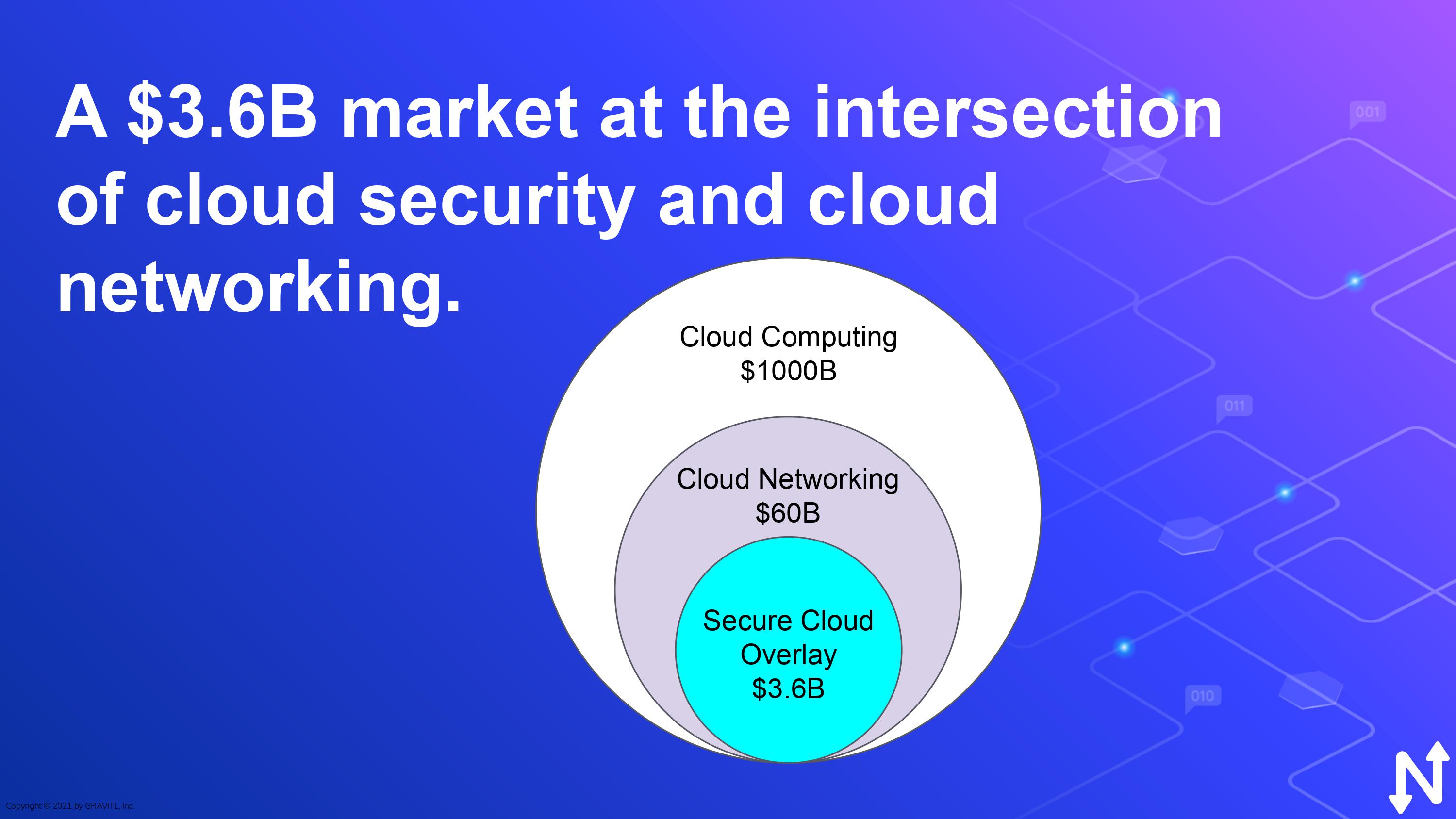

That’s a bold TAM

I see a lot of startups getting cheeky when it comes to their market sizing. See if you spot the problem in this slide:

The total addressable market of a company is the extremely optimistic, full size of the market the company operates in. If you are Toyota and launching a new small family sedan, your TAM isn’t the entire automotive market, because a small family sedan won’t replace a Ford F-150 truck, a van or a sports car. The TAM is probably “all cars of comparable sizes” or “transportation needs that are fulfilled by a small family sedan.” However you slice the market, you have to be able to defend it.

The trap Netmaker falls into here is saying it’s going after the entire $1 trillion cloud computing market. That’s simply not realistic: Even if every company in the world started using Netmaker’s VPN service, cloud computing is a different beast altogether. Netmaker isn’t suggesting in its pitch it is putting AWS, Microsoft Azure and the entire Google Cloud suite out of business. In fact, unless I’m misunderstanding, Netmaker itself uses cloud computing as part of its SaaS service delivery and so would be a subset of this market.

It could be argued that Netmaker’s TAM is all of cloud networking — if it is planning to expand its product lines in the future — but I would argue that the current total addressable market is the smallest circle on this graph: $3.6 billion.

The reason why this is important is two-fold: Investors will want to see whether the investment has the chance for a venture-sized return. Even within a $3.6 billion market, that’s entirely possible, so that’s encouraging. The other thing founders are being evaluated on here is whether they have a solid grasp of the market size. That’s less clear on this slide. If I were to do due diligence with Netmaker, I’d want to get a clear understanding of how it sees the market evolving and whether it is indeed going after all of cloud computing over time.

As a startup, you can learn from this slide how to stay level-headed: You do want a huge market, but you don’t want to come across as a founder who’s lost touch with reality.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment