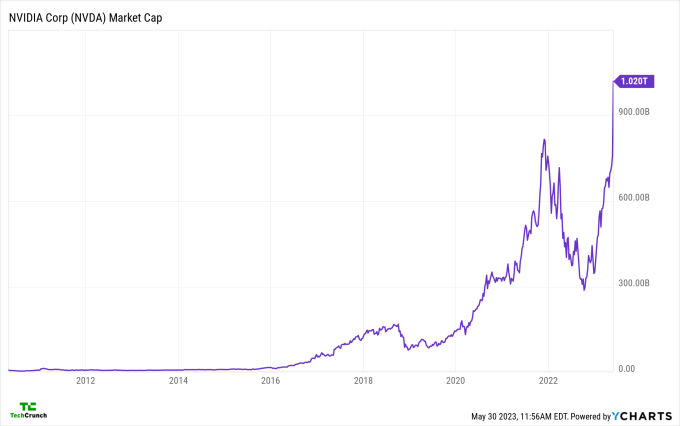

Welcome to the $1 trillion club, Nvidia.

Nvidia’s stock is up more than 6% today, pushing its shares past $413 in the wake of a widely praised earnings report.

Given that the stock market has battered tech stocks in recent quarters, how is Nvidia breaking away from the pack? What can we learn from its rise?

The club of trillion-dollar companies, measured by market capitalization, is so small that even Meta doesn’t make the cut today. Tesla is only 63% of the way there and Salesforce is not even worth a quarter of the required value it needs to join. To see Nvidia reach a market value of more than $1,000,000,000,000 is therefore a massive endorsement not only of its trailing operating results but also its anticipated future. Investors expect a lot from Nvidia.

The following chart shows its ascent:

To get our minds around what’s going on, let’s go through the company’s latest earnings report, consider what it is forecasting and discuss how investors and analysts missed the mark with their own expectations.

A look back and ahead

Nvidia is not an enterprise software company, so when we look at its results, we do not see what SaaS companies tend to produce: consistent revenue growth coupled with incremental profitability gains.

Instead, in the first quarter of fiscal 2024 ended April 30, Nvidia posted the following:

- Revenue declined 13% to $7.19 billion from a year earlier but rose 19% from the preceding quarter ended January 31, 2023.

- Operating expenses declined 30% to $2.51 billion from a year earlier and were down 3% from the preceding quarter.

- Net income increased 26% to $2.04 billion from a year earlier and 44% from the preceding quarter.

Nvidia crushed its preceding quarterly results with more revenue, lower expenses and sharply higher profitability. When we contrast that with its first-quarter results a year ago, we see less revenue, but a massive profitability boost sourced from a smaller cost base.

Investors are in love with profitability this year, so it’s not a shock that Nvidia has managed to earn a shine. But is that the whole story?

Not really

Considering Nvidia posted revenue of $7.19 billion in Q1, what would you guess the company’s revenue would be in its current quarter? If you said something reasonable, sit down.

The company is forecasting revenue of “$11.00 billion, plus or minus 2%” for the second quarter. That’s an insane 53% increase over the first quarter.

What’s more, Nvidia’s cost basis won’t move much. Per the company, GAAP expenses are only set to rise by a few hundred million from its fiscal first quarter:

GAAP and non-GAAP operating expenses are expected to be approximately $2.71 billion and $1.90 billion, respectively.

What happens when your cost basis only rises fractionally and your revenue scales to the moon, holding gross margins steady? When you consider that Nvidia had gross margins of 64.6% in the first quarter, and anticipates an even better “68.6% […] plus or minus 50 basis points” in the current quarter, well, your profitability goes boom and investors get incredibly excited.

All this excitement can be partly explained by the good results, but it may be more due to the fact that analysts dramatically underestimated how well Nvidia would perform. Analysts had only expected the company to report $6.52 billion in revenue in the first quarter, and for the current quarter, against Nvidia’s $11 billion forecast, had expected a mere $7.18 billion. Put another way, Nvidia’s analyst troupe forecasted revenue for its current quarter below what it managed last quarter and far below what the company actually expects.

Whoops.

What drove Nvidia’s revenue in the first quarter? Data center revenues. The company reported that data center-derived revenue was “a record $4.28 billion, up 14% from a year ago and up 18% from the previous quarter.” Data centers will be a key revenue driver for the company in its current quarter, too. Here’s how the company broke down its guidance in its earnings call (Fool transcript):

Let me turn to the outlook for the second quarter of fiscal ’24. Total revenue is expected to be 11 billion, plus or minus 2%. We expect this sequential growth to largely be driven by data center, reflecting a steep increase in demand related to generative AI and large language models. This demand has extended our data center visibility out a few quarters, and we have procured substantially higher supply for the second half of the year.

All hail AI, in other words.

The old riff about making money on the gold rush by selling picks and shovels is in full effect. As every company works to build, tune and deploy AI models, there is massive demand for the silicon required to power those efforts. That’s what Nvidia builds, and in the wake of the GPU crunch caused by crypto-mining, it is well positioned to vacuum up corporate spend.

You could even cast Nvidia as a proxy trade for AI: If you want to put your money in the AI boom but can’t invest in say, OpenAI, you can buy Nvidia shares and effectively purchase a chunk of the key provider of hardware for AI-related work. It’s not a hard trade to see, and I presume that a good number of investors are piling in.

If you scroll back to the top of this post, you will note that the Nvidia market cap chart has some ups and downs. Such is the game of chip-making, where demand cycles are, well, cycles. Investors appear to be betting that the AI boom is just getting started and are valuing Nvidia as if it is going to rain profits for a long time.

The company’s current-quarter guidance makes it plain that at least for now, the hype is real.

Comment