Have you ever eaten at Cava? I have not, but fans of the fast-casual restaurant chain that serves Mediterranean food were quick to explain the company on Twitter after it filed a Form S-1 for its IPO recently.

“It’s chipotle for 30+ people who feel like they should eat more fiber,” joked Neeraj Agrawal, a denizen of a crypto-focused think tank. Opinions here at TechCrunch were more split, with space reporter Aria Alamalhodaei calling it “one of [her] favs,” while transport reporter Rebecca Bellan described it as “fake Israeli food.”

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Regardless of who is right, lots of folks have eaten at Cava. That’s thanks to the company rapidly expanding its footprint in the United States from 22 locations in 2016 to 263 in the first quarter of 2023. Part of that growth came from a 2018 purchase of rival fast-casual chain Zoës Kitchen for about $300 million.

Cava is not the first venture-backed fast-casual restaurant chain to go public that TechCrunch+ has written about: Sweetgreen went public in late 2021 after setting an impressive fundraising track record.

Heavily VC-backed salad chain Sweetgreen heads toward public markets

Cava’s investor base includes a mix of venture firms (Revolution, Riverbend Capital) and other capital, such as private-equity firm Act 3 Holdings and growth equity outlet Kitchen Fund. The restaurant chain’s most recent funding round, a $190 million deal led by T. Rowe Price Group, valued it between $1.3 billion and $1.5 billion, depending on which source you’re looking at (PitchBook says that deal was $230 million).

What matters for our purposes is that Cava is a venture-backed company going public at a unicorn valuation.

What matters for our purposes is that Cava is a venture-backed company going public at a unicorn valuation.

Oh, how I have missed IPO filings! Akin to a cup of cool water for someone in a desert, public offerings present a wealth of hard data that can help us better understand startup markets and companies’ potential worth at exit. Sadly, because Cava is a fast-casual chain and not, say, a web3 company or a software startup, it doesn’t serve well as a comparable for tech startups looking to go public.

But, this IPO could take a large chunk of invested capital and return it to Cava’s backers and founders. Capital recycling through large exits is a key tenet of the venture model, and with exit volume in the gutter, any liquidity is good liquidity right now.

With Sweetgreen’s own IPO in the rearview mirror and its Q1 2023 results in hand, we can endeavor to land at a working valuation range for Cava. That will let us estimate how well its backers will do in its exit. And, we can consider what impact the company’s IPO may have on other startups looking to go public.

Sound good? Let’s Cava-ort and have some fun!

Much ado about lunch

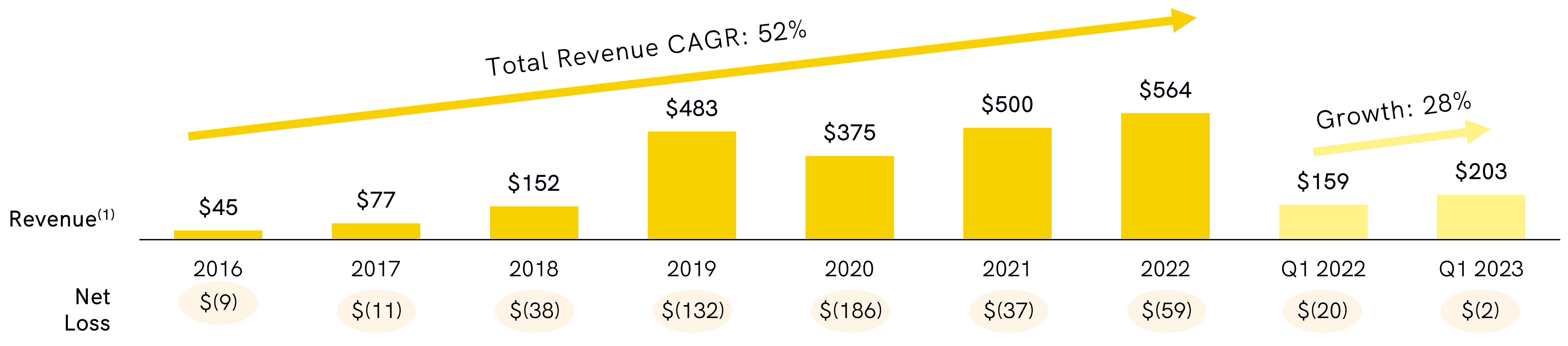

Cava’s revenue has risen every year on record, apart from fiscal 2020, because no one went to restaurants that year. Here’s the company’s revenue and net loss chart from its IPO filing, inclusive of revenue from Zoës Kitchen:

Image Credits: CavaFrom a high level, fiscal 2022 was not Cava’s best year. The company posted a comparatively modest rise in revenue and saw its net loss widen. But, as you can see from the company’s most recent quarterly result (far right in the above chart) 2023 seems to be going well so far — the company managed to increase revenue 28% in Q1 2023 from a year earlier while improving its net margins, too. For context, its Q1 2022 revenues rose just 16% year over year, although the company notes that its 2021 results were “materially impacted” due to the COVID pandemic in 2020.

In its Q1 fiscal 2023, Cava posted revenue of $203.1 million. And, the company’s rapidly shrinking operating and net losses in the quarter (about $2 million, respectively) helped Cava bolster its positive adjusted EBITDA to $16.7 million compared to negative $1.58 million a year earlier.

There’s some nuance to the above chart: it includes non-Cava locations that were, over time, converted to Cava establishments. As the company reports:

As of April 16, 2023, we owned and operated 263 CAVA restaurants in 22 states and Washington, D.C. Since the Zoes Kitchen acquisition, through April 16, 2023, we have successfully converted 145 Zoes Kitchen locations into CAVA restaurants. In fiscal 2022, we had 73 Net New CAVA Restaurant Openings, which includes the conversion of 63 Zoes Kitchen locations. We anticipate having 34 to 44 Net New CAVA Restaurant Openings in the remainder of fiscal 2023, which includes opening the remaining 8 conversions of Zoes Kitchen locations that we expect to complete by the fall of 2023.

We can infer then that the Zoës deal provided a massive lift to Cava’s overall growth as the company continues converting Zoës Kitchen outlets to Cava restaurants and will continue until about Q4 of this year.

Cava’s same-restaurant sales, or revenue from restaurants that have been open for at least a year, also reflect this trend of recent acceleration. The company said same-restaurant sales increased 28.4% in Q1 2023 from a year earlier compared to 19.9% in Q1 2022.

Investors like it when a restaurant chain posts strong same-restaurant sales, because it implies that the company is deriving value from its existing restaurants and increasing revenue by opening new outlets. For our more tech-focused readers, we can loosely compare same-restaurant sales to positive net retention in the software world, where more value (sales) is generated from an existing base (software customers). In either case, more is better.

In summary: Cava has nearly completed its digestion of Zoës, further accelerated its revenue growth in the first quarter of its fiscal 2023, cut its GAAP losses to the bone and is now posting adjusted profits to boot. That sounds like this is the right time to go public!

The Sweetgreen comparison

To get a better idea of what Cava could be worth after its IPO, let’s talk about Sweetgreen. The company went public at $28 per share, above its $23 to $25 per-share IPO price range. It raised around $360 million in the offering and earned a valuation of $3 billion.

Today, Sweetgreen is worth $9.67 per share, or $1.08 billion.

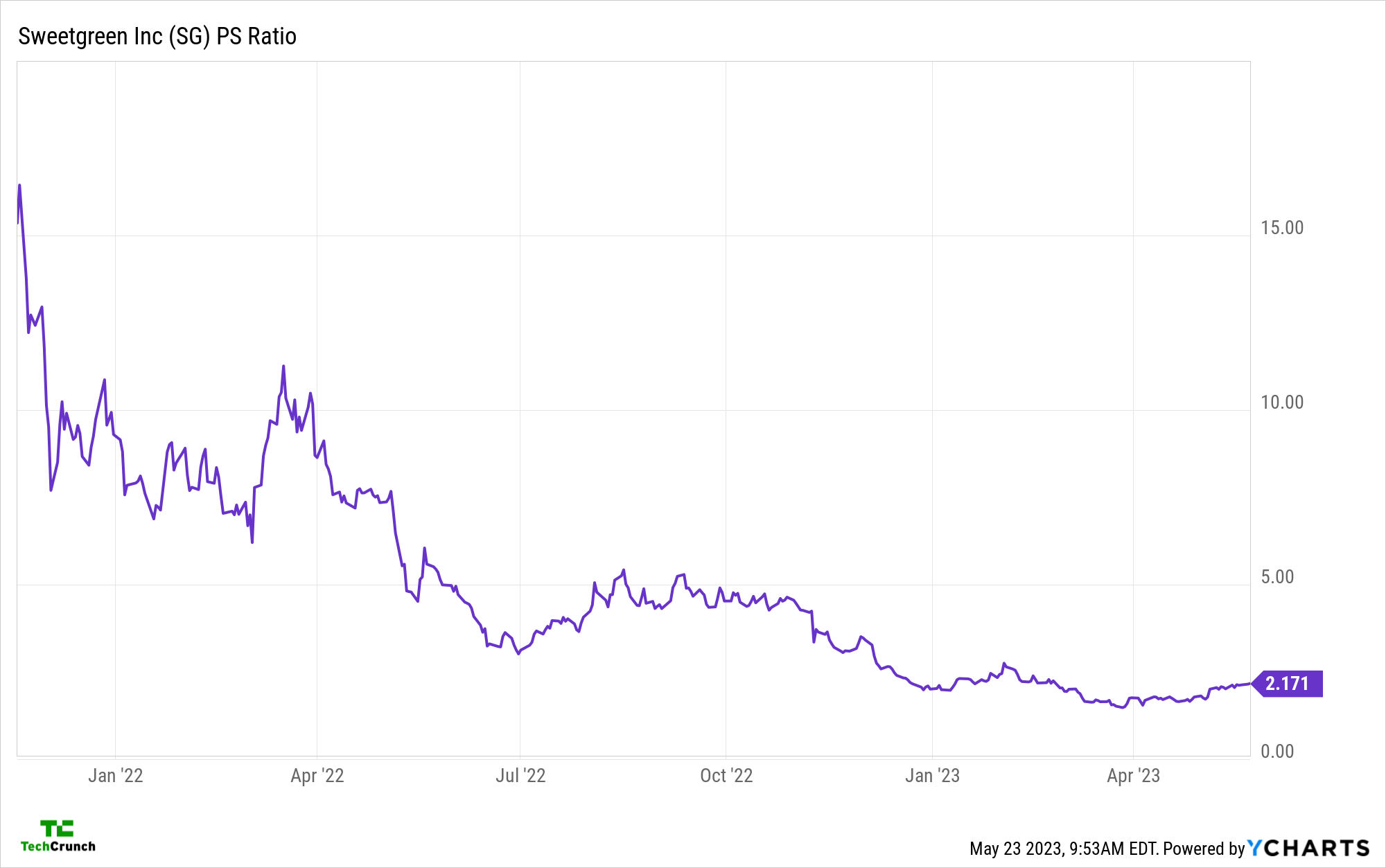

Why did Sweetgreen lose so much of its value? One way to answer that question is to track its price/sales multiple, or what we refer to as a “revenue multiple” in startup land. Over time, Sweetgreen’s revenue multiple has sharply contracted from the double digits to single digits that start with a two:

Basically, it was really easy to take companies public when a salad chain could debut with a revenue multiple of about 15x.

Investors have since changed their tune and have taken a hedge trimmer to tech firms’ valuations, meaning that tech-enabled businesses like Sweetgreen (and Cava, which touts its mobile app often in its IPO filing) were going to wind up with multiples lower than those of tech companies as they were compared to other companies in their sector. When tech valuations plummeted, non-tech companies had to go lower, which explains the above chart.

We should mention that the chart above uses trailing revenue results to generate the final figure. However, if we take Sweetgreen’s Q1 2023 revenue and annualize it, we get a very similar figure, so a multiple around 2x revenue seems like the right figure to derive from its valuation.

If we apply that multiple to Cava’s Q1 fiscal 2023 revenue (annualized), we get a valuation marker of $1.62 billion. However, since Cava reported better net margins and positive adjusted EBITDA in Q1 2023 than Sweetgreen (which had an adjusted loss), you could infer that investors would be willing to pay a higher multiple for Cava.

What’s more, Sweetgreen’s same-restaurant sales grew just 5% in the first quarter, far less than Cava’s 28.4%.

If we assume a multiple of 3x its annualized Q1 fiscal 2023 revenue, Cava would be worth $2.44 billion. In other words, Cava was worth about $1.50 billion in its last funding round, so it looks like the company’s IPO might help it land a better valuation than its last price when it was private.

Not bad!

However, we do have to consider some hurdles in Cava’s path. The conversion of Zoës locations is nearly complete, meaning that the company may have to spend more to open new outlets as it seeks to expand its footprint. And, the economy is not perfectly healthy at the moment, and any downturn could ding the restaurant chain after its debut.

Cava is also running pretty light on cash, with just $22.7 million in cash and equivalents at the end of Q1 2023. What’s more, its strong operating cash flow in the period ($25.7 million) was outstripped by its investing cash flow (-$39.1 million) in the first quarter. The company will need more capital if it is to continue expanding its footprint.

Given that Cava will likely use the IPO proceeds to open more stores and improve efficiency, investors who buy into the offering will be effectively pre-purchasing future growth. That may prove attractive.

In closing, the Cava IPO will return some capital to the kinds of investors who put money into startups. They may make less than they hoped when Sweetgreen was enjoying a double-digit revenue multiple, but it’s cash all the same. That capital may be recycled into new ventures.

More importantly, a strong IPO would slightly change the narrative around public listings right now. If investors prove to be welcome to venture-backed, tech-adjacent Cava, might they be enticed by higher gross-margin tech startups, too?

Given how few IPO filings we’ve gotten to read lately, we can only hope.

Comment