Most of the pitch decks we cover in the Pitch Deck Teardown series are for relatively young companies, but to celebrate our 50th pitch deck teardown, I figured I’d do something slightly different.

Today, we’re looking at Ageras‘ pitch deck, which it used to raise a $35 million private equity round to further expand its relatively late-stage product portfolio. Given that I’m sitting in Copenhagen, Denmark as I write this, it seemed right to cover a company that was founded here.

The company raised $73 million from New York-based investment fund Lugard Road Capital in early 2021 and closed this $35 million round about a year later.

So, what does it do? In the words of its founder:

What started as an online marketplace for small business owners to find accountants in Denmark has now expanded into a financial cockpit used by more than 1 million SMEs across Europe and the U.S., giving them a single, centralized destination for nearly all their needs — bookkeeping, accounting, payroll services, invoicing and now financial services.

I’ll be the first to admit that very late-stage decks aren’t my forte, and I know a lot less about private equity than venture capital. But let’s take a look and see what we can learn!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

With 31 slides, the Ageras deck is a bit of a beast. Some of it is redacted to keep the firm’s secrets, er, secret. The overall structure is there, however, and we can observe some interesting points on weaving a story of a 300+ person company with a global footprint.

- Cover slide

- Slogan slide

- Overview slide

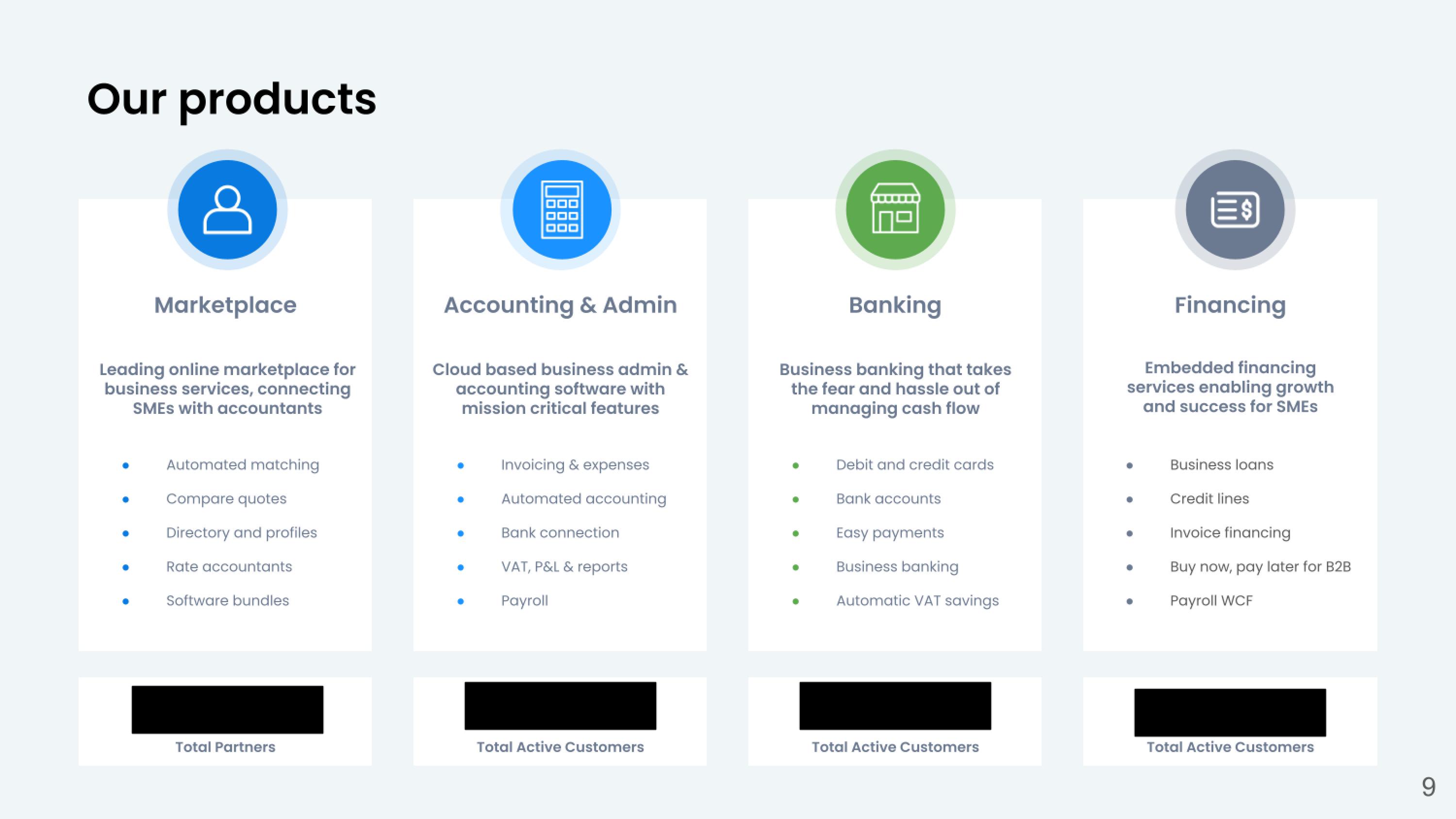

- Products overview slide part 1

- Products overview slide part 2

- Traction slide

- Customer growth slide

- Products interstitial slide

- Product breakdown slide

- Product: Marketplace overview slide

- Product: Marketplace “how it works” slide

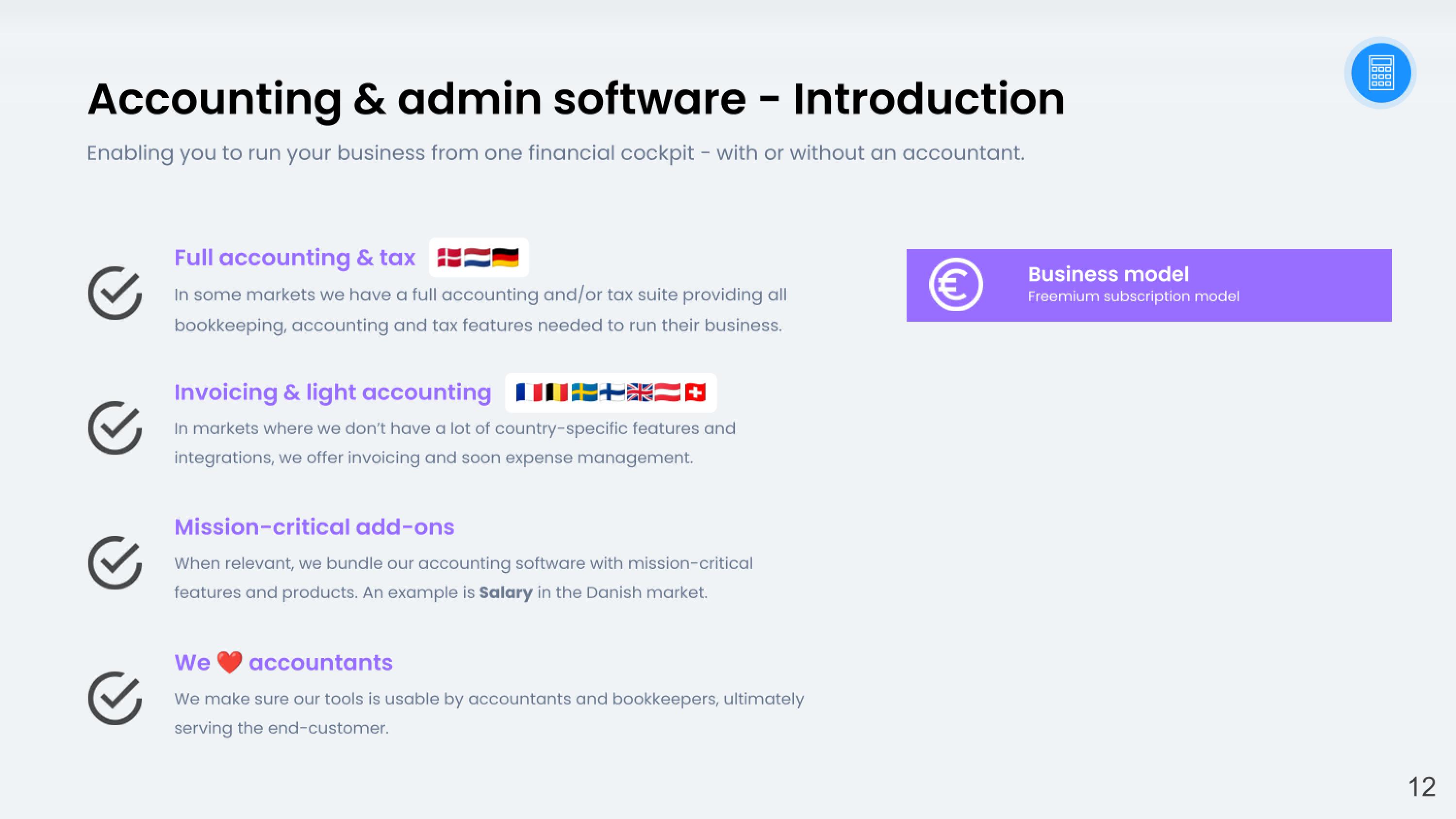

- Product: Accounting & admin software introduction slide

- Product: Banking introduction slide

- Product: Financing introduction slide

- Target customer slide

- Market-size slide

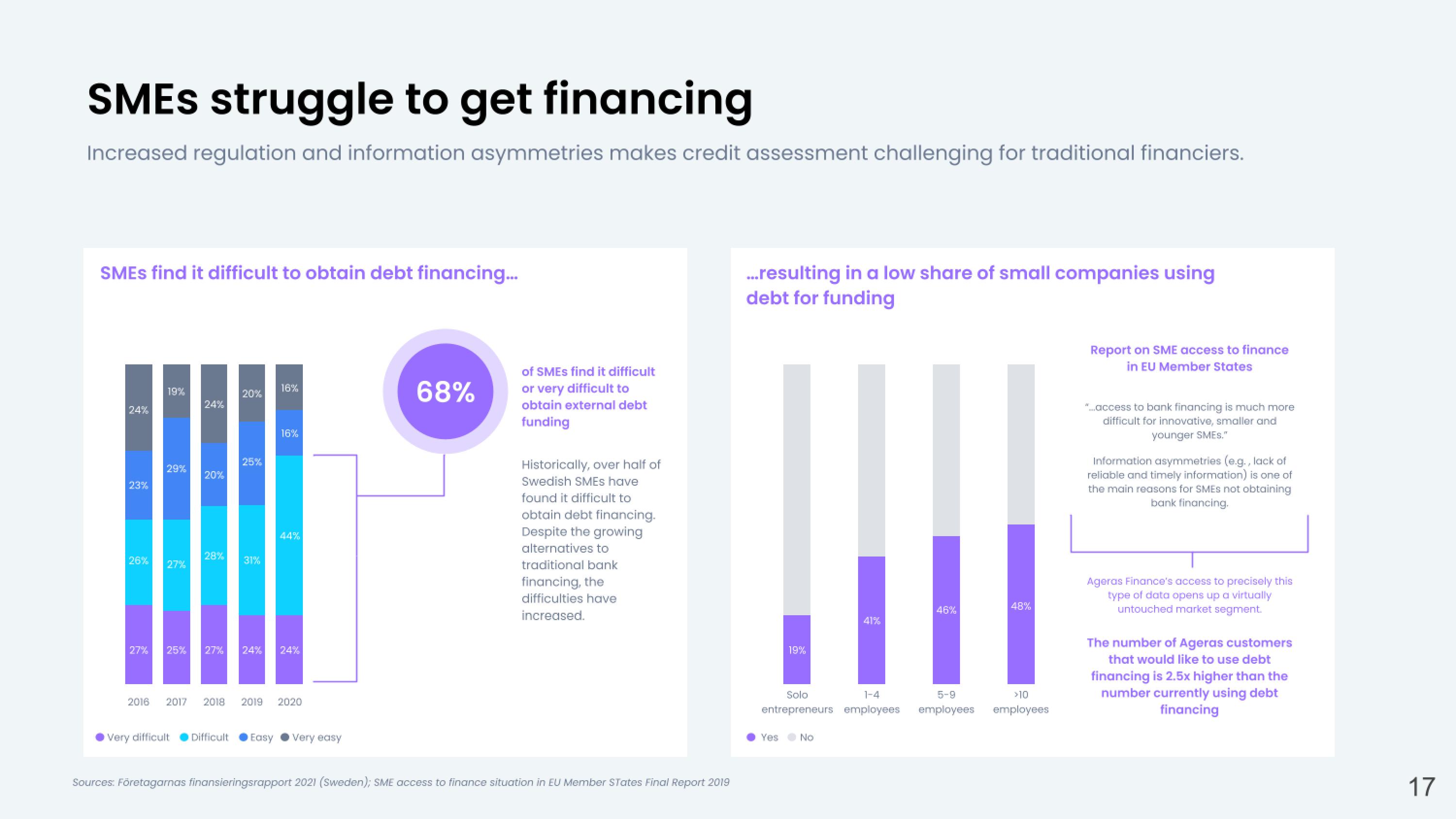

- Problem slide (“SMEs struggle to get financing”)

- Solution slide

- Go-to-market slide

- Mission slide

- Strategic focus area slide (redacted)

- Product roadmap slide (redacted)

- Acquisitions slide

- Revenue growth slide (redacted)

- Unit economics slide (redacted)

- Profit & loss slide (redacted)

- Balance sheet slide (redacted)

- Team slide part 1 (“Meet the founders”)

- Team slide part 2

- Organizations slide (redacted)

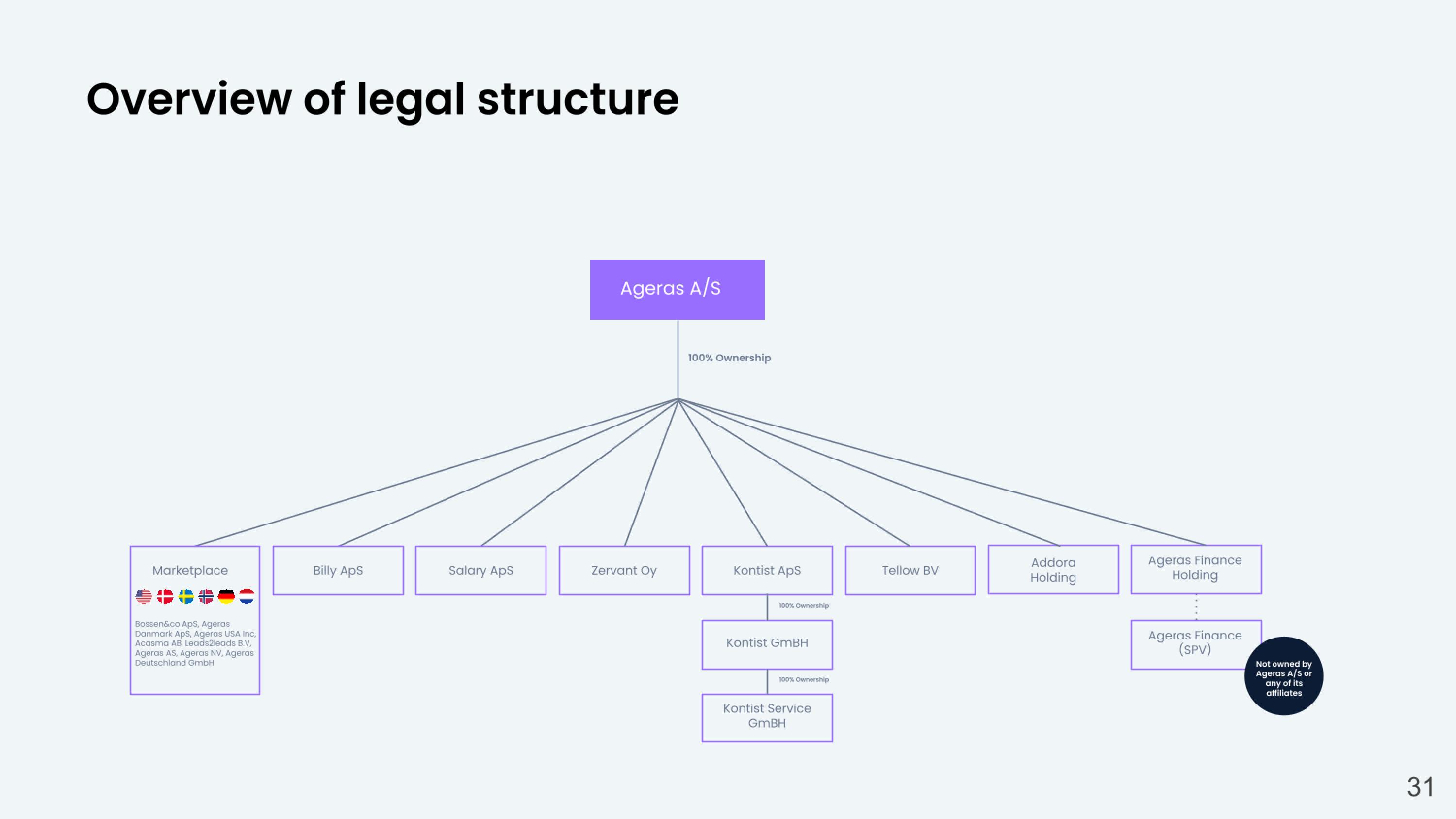

- Legal structure overview slide

Three things to love

There’s a lot going on in this deck. Not all of it is great (and, as always, we’ll cover that in the second half of this teardown), but the highlights are as bright as they can get.

Comprehensive product portfolio

Ageras has been around for 11 years, starting off as a service to match small business owners with accountants, tax professionals and bookkeepers. Then the company started adding related services and grew from there. Obviously, that’s a complex story to communicate, but the team does a truly masterful job of giving an overview:

As a mature company with international operations, the product offering is going to differ from country to country according to local compliance rules and laws. The pitch deck breaks down the variance in an easy-to-ingest manner:

Shrewd use of data

As Ageras gets access to more financial data and connects its customers with professionals, something interesting emerges out of that synthesis: It knows more about the financial health of its customers than nearly anyone else.

As such, it found that it could offer financial services (e.g., small business loans) with lower risks than a bank that doesn’t have the same amount of day-to-day visibility:

In effect, Ageras is leveraging its data so it can offer more loans to what it refers to as “medium-risk” businesses.

This slide teaches us that it’s a good idea to always be on the lookout for adjacent services that can evolve out of a strong business. When Ageras was just matching companies to accountants, it wouldn’t have been able to pull this off. But as its customer base and amount of available data increased, the opportunities did, too.

Some late-stage flex

I wanted to share a couple slides from this deck because I don’t often see such materials in earlier-stage pitch decks and they intrigued me.

As complexity evolves, it makes sense that the company needs an international structure to support its operations in various countries:

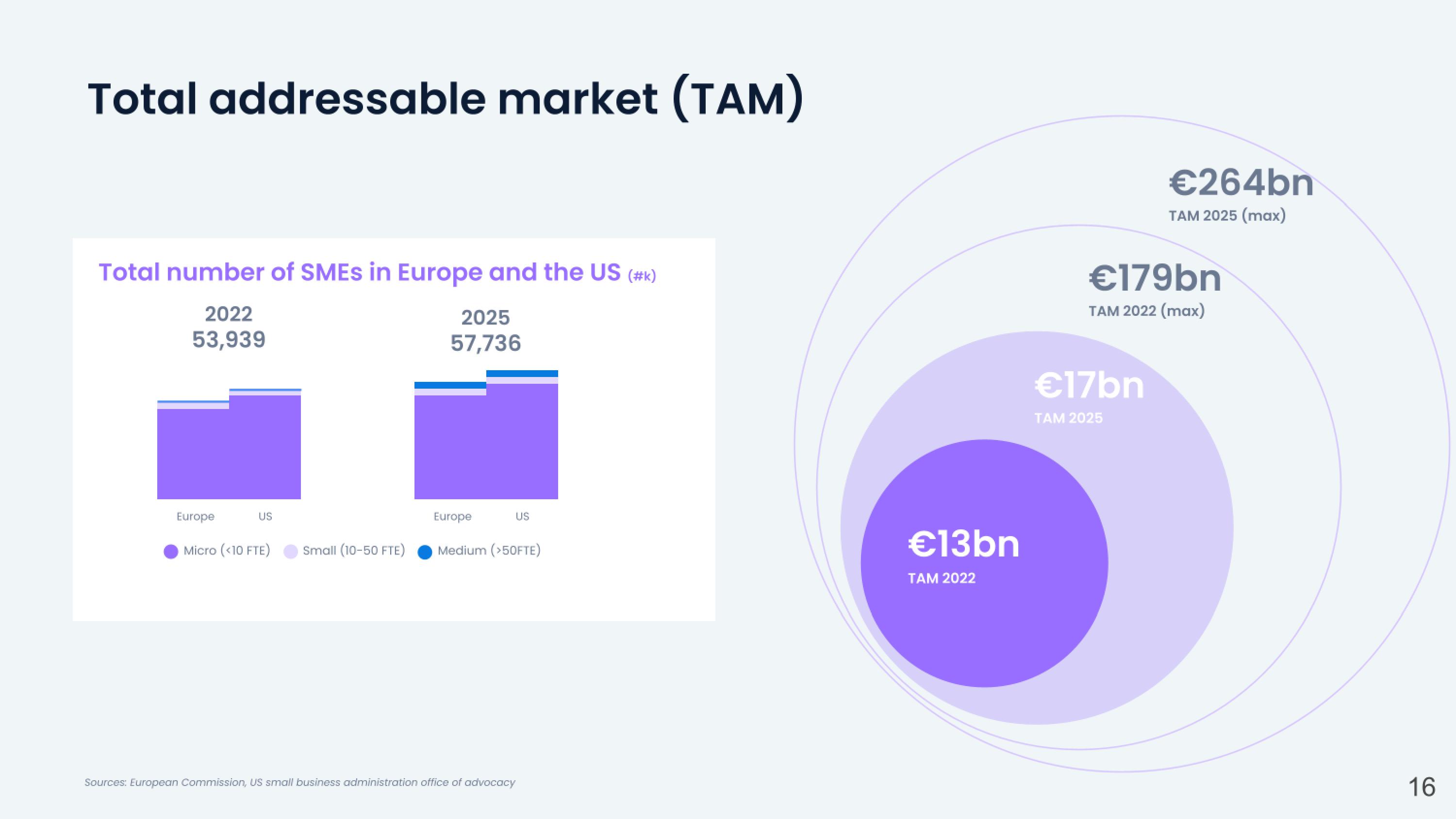

Ageras has been growing into new markets and verticals by acquiring companies. The slide itself, I think, has a couple of major flaws (we’ll explore those later on), but its presence in the deck is a great flex for a late-stage company:

The company redacted the data from slide 19, but you can still learn something from it: Customer acquisition cost continues to be crucial, and if you can report it as a trailing average graph, you’re telling investors that you know it’s important, you’re monitoring it, and you’re actively working to improve it.

In the rest of this teardown, we’ll take a look at three things Ageras could have improved or done differently, along with its full pitch deck!

Three things that could be improved

Unless the amount is mentioned in one of the redacted slides, Ageras doesn’t share how much it is raising or why. It’s possible the company just needed a quick $35 million to make an acquisition or two, but I’m confused because there’s no direct line drawn between the fundraise and the expected outcomes. Still, I’m not going to dwell on this too much since we have other things I can whine about.

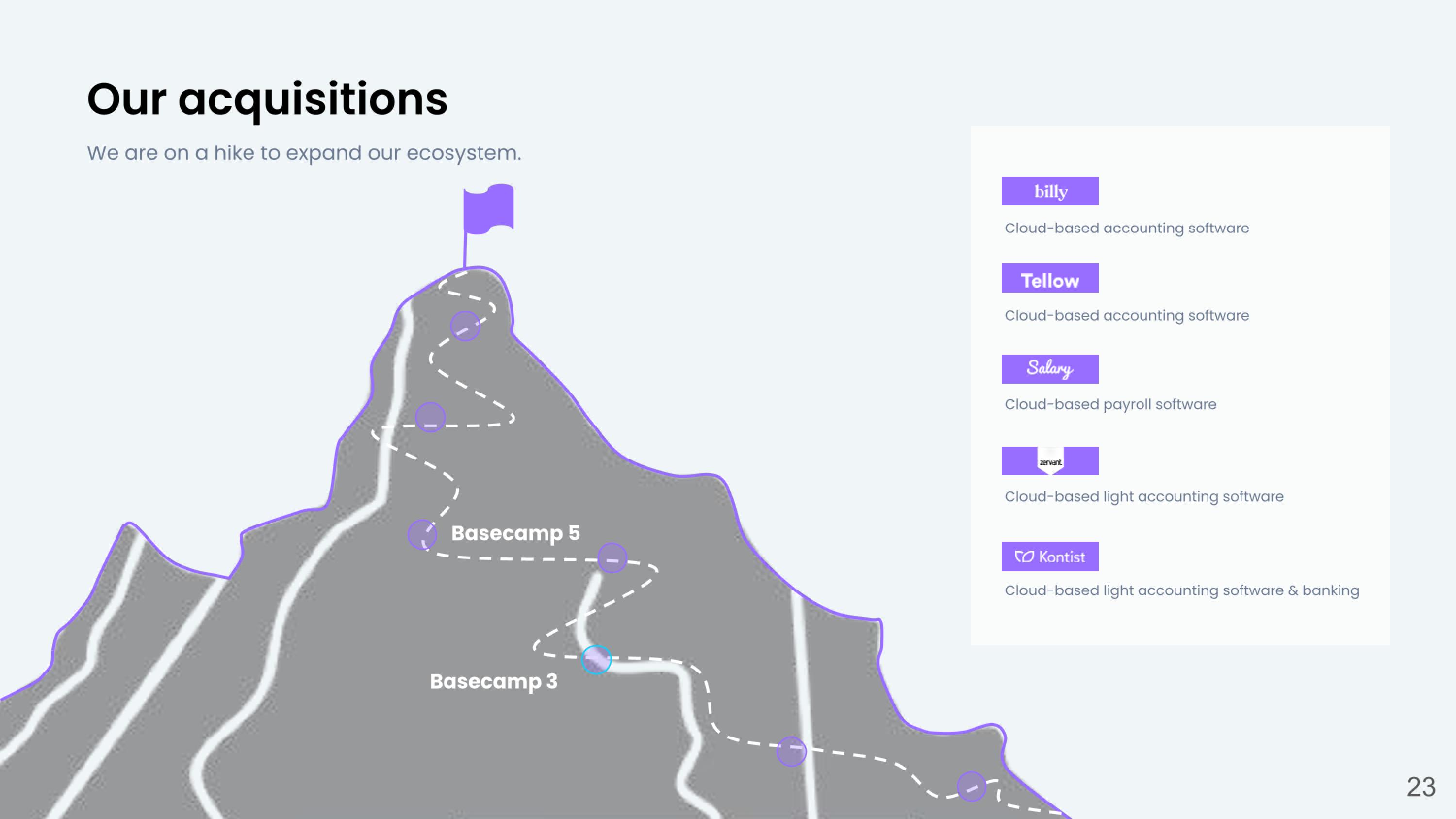

That’s not how market sizing works

Somehow, the company manages to size up its market with both a bottom-up approach (on the left) and use the language of a top-down approach on the same slide, and it still fails to make sense.

The numbers are about the future (2022 and 2025), but I simply don’t know how to read this graph. Why are we talking about different TAMs? How is it growing from €13 billion to €264 billion? What do the circles represent? Even if those are the total addressable markets, what are the beachhead markets the company is going after? Without a voiceover, this slide is nigh incomprehensible.

I’m not going to argue one point: It’s obvious that small and medium-sized business accounting and financial services is an enormous market and there’s plenty of market share left to fight for. But, if you’re going to put a slide in your deck arguing that, it needs to make sense on its own.

Way too much product focus

If I counted correctly, Ageras spent a third of its deck on product slides. That’s great, but I’d hazard a guess that the investors, by and large, don’t give a crap about how the products work.

What they do care about is the land-and-expand model of using the product portfolio to attract customers through various channels, and then grow the revenue per customer over time. Somehow, the company seems to get halfway there and then fails to connect the dots.

The story could be simplified with a single overview slide that explains the value proposition of each product line, along with how they interact and amplify each other. The company sort of does that in an opaque way, but then waffles on about the products for far too long. It has traction and 200,000+ paying customers. That means that the product works.

I think this deck could be significantly shortened to perhaps just 18 slides without much hardship:

- Cover slide

- Traction slide

- Solution slide (an overview of the whole platform)

- Target customer slide

- Customer growth slide

- Revenue growth slide

- (An actually good) Market-size slide

- Opportunity slide — instead of a problem slide. I suspect in this case this would be related to the SME financing product (see Slide 17 in the “what is good” section above)

- Go-to-market slide — including CAC

- Competitive landscape slide including how Ageras Group has a differentiated competitive edge

- Acquisitions slide done well (see below)

- The Ask slide — how much are you raising?

- Company roadmap slide (explaining where the funds from The Ask are spent)

- Team slide — focusing on “how we hire and retain top talent”

- Legal structure overview slide

And then some appendices:

- Unit economics slide

- P&L Slide

- Balance sheet slide

Congratulations, you bought some companies

If you’ve ever been on the receiving end of an acquisition, you know that it can often spiral into a shitshow. Buying companies and integrating them into your existing company structure is painfully hard. So hard, in fact, that most statistics show that between 70% and 90% of all M&As fail in one way or the other, usually because of some unforeseen snafu around integration.

So, this slide:

It’s great, but Ageras Group may as well be waving a huge red flag. I get that vacuuming up startups sounds good on paper. But if that’s a core part of your growth strategy, I’d want to see if Ageras is very good at rolling up smaller companies, adding them to the product lineup and integrating them with the core business and each other.

This slide tells none of that story, and I suspect a lot of the due diligence for this round would have (or, at least, should have) involved questions about the acquisitions and how the wrinkles, if there were any, were ironed out.

Of course, nowhere in this deck does the company say why it was raising the money, so perhaps Ageras’ startup-buying days are behind it. But if that isn’t the case, it would have been prudent to dwell on this matter a little more.

Bonus: Come on, you can do better

Thirty-one slides and you can’t find space for a competitive landscape slide? Seriously? That’s weak sauce amateur hour.

If I were a potential investor, I’d rake the founders over the coals for this one. This is a fantastically competitive industry and I can name half a dozen competitors without going to Google. I don’t need to see a list of names here, but I do need to know what Ageras feels its competitive advantage is over all the other offerings out there.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment