Smart, a London-based startup that helps employers and their employees manage and monitor their pensions, said that it has closed $95 million in Series E funding. It plans to use the capital to expand its international footprint and make acquisitions, it said.

Aquiline Capital Partners, a new backer, led the investment, with previous investors Barclays, Chrysalis Investments, Fidelity International Strategic Ventures, DWS and Natixis Investment Managers also participating. The valuation is not being disclosed but Sky News, which leaked the news out yesterday evening, noted that it was at “only a modest discount” to its previous fundraising — meaning a slight down round.

For some context on what the figure might be, PitchBook estimates Smart was valued at $564 million (or £451 million at current rates). Moreover, it was reported back in January 2023 that Smart was trying to raise £100 million ($123 million), significantly more than the $95 million it’s announcing today, five months later.

Smart declined to comment on these details; nor did it dispute them.

Downward pressure

Tech valuations have been seeing a lot of downward pressure in the last year, even in cases where companies have been demonstrating growth. Smart said that group revenue in 2022 was £67 million, up 65% compared to 2021. It also claims to have £5.5 billion in Assets Under Management (AUM) on its platform and is on track to grow that to £10 million by end of June 2023.

“This investment is strong recognition of Smart’s success and journey to date, and highlights the immense opportunity that lies ahead. It is also a resounding vote of confidence in the U.K.’s fintech sector, and its leadership in financial services provision,” co-founders Andrew Evans and Will Wynne said in a joint statement. “We are on a mission to transform retirement, savings and financial wellbeing… This is a $62 trillion global sector in the early stages of being disrupted, and we are uniquely positioned to take advantage of that. We have already reached scale and profitability in the UK, with Smart Pension now serving in excess of one million savers, and this backing allows us to achieve that scale and profitability in our global markets across the group. We welcome Aquiline to our board and we’re incredibly excited for the years ahead.”

Founded out of London in 2014, Smart emerged in the wake of the U.K. government’s auto-enrollment pensions legislation two years previous, mandating that employers provide a workplace pension scheme by default rather than requiring workers to opt-in. The purpose of this was to ensure more people were saving toward their retirement via a private pension, but given that people may change jobs every few years, this has made it somewhat unwieldy to keep track of their myriad different pension funds that may be scattered across different providers — it can be an administrative minefield.

And that, essentially, is what Smart helps with, serving as the infrastructure for digital-first pensions management.

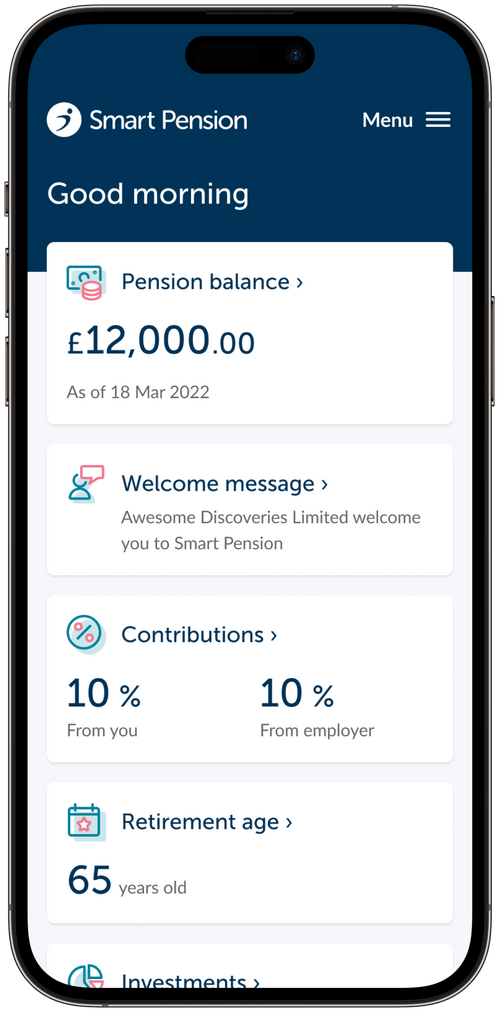

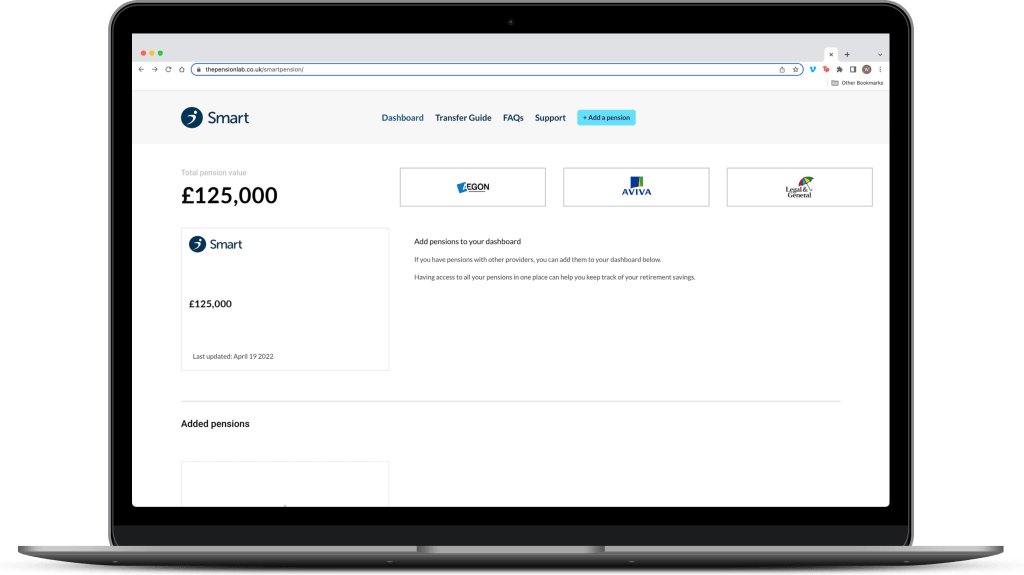

On the one side, Smart helps employers fulfil their auto-enrollment obligations by setting up their pension schemes, and the company in fact operates its own “master trust” which it says currently serves 70,000 employers and more than 1 million individuals. On the other side, Smart also enables savers to consolidate and keep on top of their different pensions, so they always know the current status of their retirement pot. Smart does this via a retirement savings technology platform that it has built, called Keystone.

-

Smart Pension app. Image Credits: Smart

The company has also been weighing in on how the government has been looking to put new guidance and rules in place to improve transparency and clarity for pension scheme policy holders.

Going global

While the trillion-dollar U.K. pensions market is large enough in its own right, the company has expanded into mainland Europe, the U.S., the Middle East and Asia, funded by at least $230 million in external investments over the past seven years, though the company also raised an undisclosed Series C round in 2020, which included a minority investment from Barclays.

With another $95 million in the bank, Smart says it plans to expand into further international markets, as well as make some strategic acquisitions — this fits a bigger trend that has seen some consolidation in the fintech realm, and even with the turmoil in today’s market, investors are betting on it riding out the storm.

“Smart’s distinct retirement technology leadership coupled with Aquiline’s deep experience in the retirement technology industry makes this a compelling investment, as does the growing global need for better retirement saving technology,” said Jeff Greenberg, chairman and CEO of Aquiline, in a statement. “Smart has consistently delivered impressive commercial growth, and is backed by an array of top-tier investors whom we are delighted to join. Under the leadership of Andrew and Will, we have every confidence that Smart is a multi-billion pound company in the making.”

Smart has made acquisitions for inorganic growth in the past, with previous deals including Ensign Master Trust in October 2022, and Stadion Money Management, which focuses on retirement solutions, in January 2022.

Comment