Shares of Amplitude, Airbnb and Twilio are down sharply this morning following their earnings results yesterday.

It might seem odd to group these companies together given the different sectors they operate in: Amplitude does digital product analytics, Airbnb provides a marketplace for consumer lodging rentals and Twilio sells communications services for software products via APIs. What could they have in common?

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The answer seems to be their growth forecasts for the year, which came in below what Wall Street was hoping for.

While we were less than impressed with how slowly the largest American tech companies are expanding their revenue, it appears we’re not dealing with an issue that only impacts Big Tech. Their smaller peers are seeing similar headwinds, too.

This morning, we’ll go over each company’s results and then we’ll hear from Amplitude CEO Spenser Skates. Lastly, we’ll look at a broader index of modern software companies’ growth rates and put all that together to glean takeaways for startups.

This morning, we’ll go over each company’s results and then we’ll hear from Amplitude CEO Spenser Skates. Lastly, we’ll look at a broader index of modern software companies’ growth rates and put all that together to glean takeaways for startups.

The (financial) road ahead

Airbnb needs no introduction, so we can jump straight to the numbers. The company reported better-than-expected revenue and its first GAAP profit in the quarter, while also generating fistfuls of cash. It certainly feels like a good result, especially given that revenue expanded 20% at Airbnb’s age in this economy.

However, Airbnb expects revenue to increase by 12% to 16% in the second quarter from a year earlier. That’s quite a bit less than the 58% growth it saw in Q2 2022, and it’s also a decline from the 20% it grew in Q1 2023. Investors did not like that forecast.

As for Twilio, it reported better-than-expected profit and revenue for the first quarter, but its revenue forecast of $980 million to $990 million for the second quarter, or growth of just 4% to 5%, left investors unsatisfied, especially as analysts were expecting a far greater $1.05 billion in revenue.

Amplitude’s shares are trading at about $9 today after closing at $11.63 yesterday. Why? Not because it had a bad first quarter: Amplitude actually beat profit and revenue expectations.

No, it was the company’s talk of the future that was the issue. After cutting around 13% of staff in April, Amplitude lowered its full-year revenue forecast to $266 million-$269 million (12% to 13% growth) from $283 million-$291 million (19% to 22% growth).

See the trend yet? Reasonable growth in the first quarter but a slower, harder and worse rest of the year doesn’t exactly make for a positive melody to hum.

What’s driving the slowdown?

Well, it’s partly the result of these companies being compared to their 2022 results, when some of the growth was still driven by post-COVID demand spikes. Twilio, for example, noted in its own earnings call that it has “a really tough comp relative to last year” to try and beat. Airbnb is working to surpass its own post-COVID results, when it posted impressive gains in revenue.

Another factor is the worsening macroeconomic climate. The push to cut costs at companies big and small is seriously impacting how many tech companies are increasing revenue.

To exemplify that point, here’s a series of short excerpts from our chat with Amplitude’s CEO yesterday, tidied up for readability.

First, here’s his take on the state of the economy and how it affects Amplitude:

[It is] definitely going to be a tough year from a number of respects, no way around that. Criss, our CFO, has been looking at things and [Q2 2023] through the rest of the year is going to be tough. No question. So, first and foremost, I think the biggest thing we’re seeing is that macro had gotten worse in [Q1 2023] relative to any quarter last year — more companies doing layoffs, more spend reductions. And on top of that, because [Amplitude uses] volume-based pricing, that reduction is more extreme for us than for other companies.

And here’s his take on how macroeconomic issues can impact a software company with offerings priced similarly to Amplitude:

Where [the slowdown] shows up for us is: ‘You’re not going to expand because you don’t need to expand [spend].’ The new stuff that you do sell, you’re gonna have to sell at a reduced rate. That is the nature of being in an early category. I wish we had done a better job of forecasting that we were more exposed to the macro swings in the average company. That’s the one little wrinkle that I think I could have done a better job [with] in retrospect. But we’re doing that now.

The lesson for startups is simple: Expect it to be harder to grow this year.

And, startups should not expect things to get better anytime soon, even if Twilio did make some positive noises about reaccelerating parts of its overall growth portrait this year.

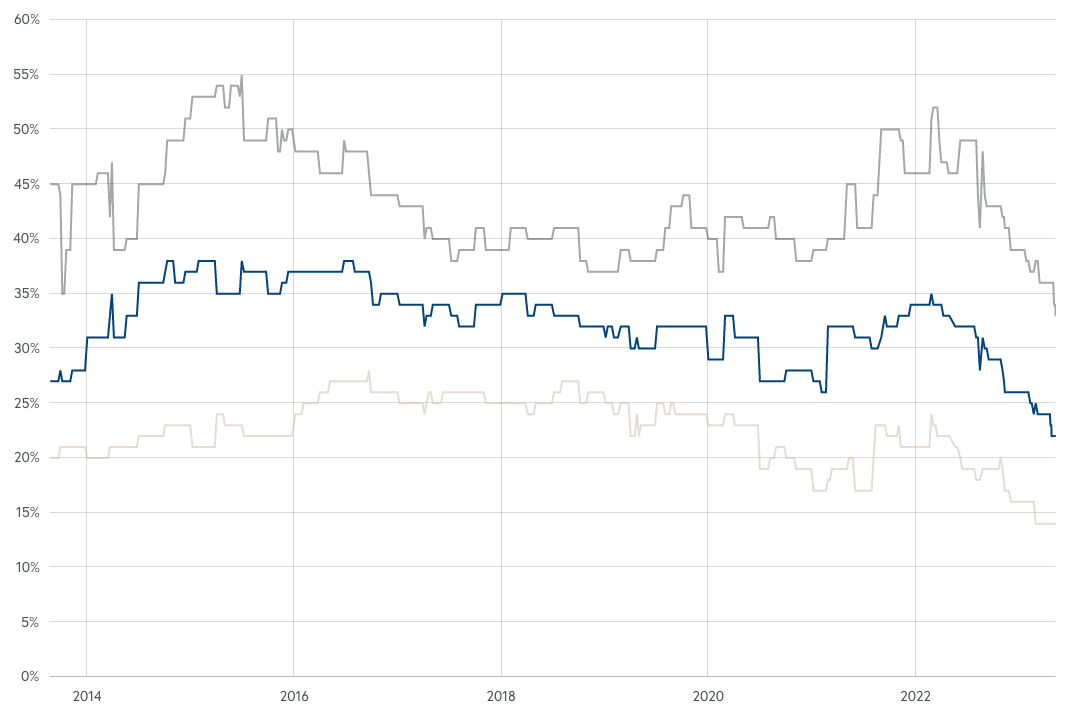

A quick note on technology corporate growth rates more generally: We’ve looked at a number of companies this quarter, but in a somewhat scattershot way. Here’s a chart from the Bessemer cloud index showing historical growth rates at public cloud companies. See if you can spot the trend:

If you haven’t: The blue line is the median figure for companies in the index, and it’s at an all-time low since the inception of the index.

We really feel for the startups priced at peak valuations that now have to deal with tepid customer spending. It’s bad in two directions at once.

The sticky bit for startups is that unlike public companies, they remain unanswered questions. Amplitude can weather a tough year’s growth and power through to the other side because it has a quarter of a billion dollars of cash and marketable securities and a quarterly free cash flow burn rate in the single-digit millions. That’s an ocean of time, and since it’s already public, it can almost afford to muddle through a tough year so long as its view of where its market is going winds up correct.

Startups don’t have that luxury. They tend to have higher burn rates as a percentage of both revenue and cash balance, and because they’re still private, they can’t easily self-fund if needed. It’s harder to fundraise without a liquid stock, after all.

The slowdown in growth at public tech companies is likely being mirrored at startups as well, but they don’t have the same flexibility to endure a period of slow growth. Talk about being stuck between a rock and a hard place.

Comment