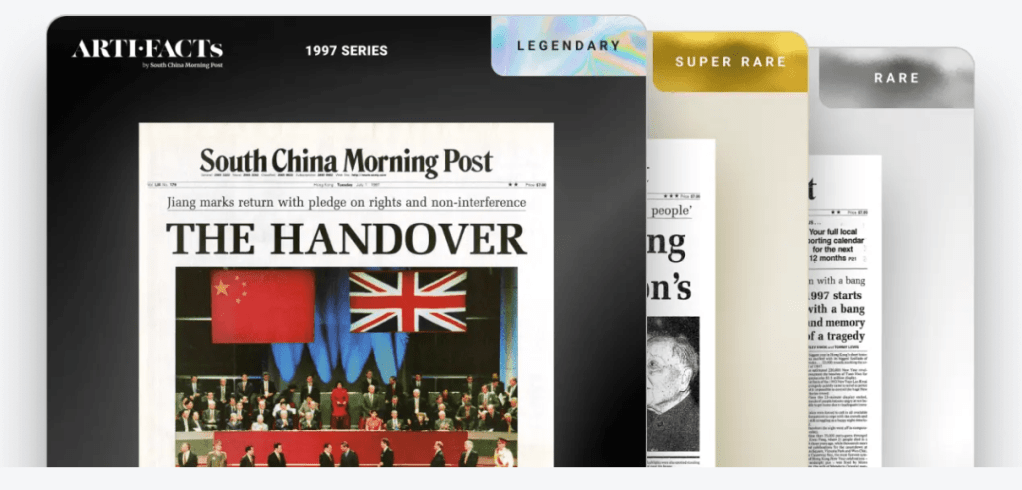

When an NFT series commemorating the handover of Hong Kong from the U.K. to China generated $260,000 in sales, Artifact Labs, the startup that launched the collection, saw the long-term potential of tokenizing historical artifacts and making them immutable and accessible to the public.

Artifact was born out of South China Morning Post, Hong Kong’s flagship English newspaper bought by Alibaba for $262 million back in 2015. Its first project comprised non-fungible token versions of SCMP’s front pages from 1997, the year of Hong Kong’s handover, with each item’s rarity level determined by the significance of a certain day’s events.

The NFT issuer has embarked on an independent journey since spinning out of the parent firm last year. Artifact announced today that it has raised its first outside funding of $3.25 million led by Hong Kong-based family office Blue Pool Capital with the prolific web3 investment firm Animoca Ventures participating.

From a strategic point of view, “Animoca is obviously heavily invested in web3 and believes that NFTs and ownership of digital assets is the future, so we are filling a very nice part of that around collectibles,” the company’s CEO Philip Pon told TechCrunch in an interview.

SCMP remains a “large” shareholder following the financing round, said Pon.

Technical boost

Artifact works with a handful of third-party partners to power its NFT transactions. Its 1997 collection was minted — the process of creating a token on the blockchain — on Flow using Blocto wallets, but it’s also able to mint NFTs across other chains, including Ethereum, Polygon and BSC.

In addition, the company has received grants from Dapper Labs, the creator of the popular NFT series NBA Top Shot, and Filecoin, a decentralized storage solution.

The startup is boosting its internal technical stack as well. It recently bought the source code of Refinable, an NFT infrastructure provider, for an undisclosed amount. The acquisition, according to an announcement, would allow Artifact to develop a decentralized NFT marketplace. The company will also spend the seed funding on adding technical headcount.

Despite going down the marketplace path, Artifact doesn’t see itself as a challenger to OpenSea as its focus is more on traditional institutions. “We are building a marketplace for museums and cultural institutions. Whilst we admire OpenSea, we are probably a bit more niche,” said Pon.

In the nascent crypto industry where the fundamental pieces are still taking form, developers and projects are actively making improvements to the field. In the area of on-chain preservation work, Artifact outlined a new metadata standard in a proposal to Ethereum.

“Artifact Labs is taking a leadership role in this domain, through its innovative integration of blockchain technology, and their newly proposed EIP-6596, which we believe will be an important standard for museums and custodians of culture going forward,” said James Ho, head of Animoca Ventures.

Hong Kong as home

Artifact is geographically positioned to tap a potentially large pool of collectors. Thanks to its favorable tax system, Hong Kong has long been the Asian hub for art dealing. In 2020, the city overtook London as the second-largest art auction market behind New York.

It comes as no surprise that Artifact plans to work with other types of cultural institutions beyond its genesis of tokenizing newspapers. So far it’s struck partnerships with RMS Titanic Inc., the company granted the rights to salvage the wrecked ocean liner; Hong Kong’s popular home-grown brand G.O.D.; and the Hong Kong Philharmonic Orchestra, which is jointly designing a metaverse-style virtual concert with Artifact.

The company is also in confidential talks with several major museums in Hong Kong and other parts of Asia to help create on-chain versions of their collections. Long-running multinationals are also its target clients.

To date, Artifact boasts around 17,000 members in its Discord community. It monetizes by charging project fees from its institutional and IP partners and will explore a revenue-sharing model with its clients in future NFT sales, according to Pon.

The timing seems ripe for Artifact and other web3 businesses in Hong Kong. The city recently announced plans to legalize crypto retail trading over licensed exchanges, providing the necessary infrastructure for everyday consumers to buy and sell digital assets.

The company has a team of around 16 staff mostly based out of Hong Kong. Its geographic expansion plan will follow the cultural centers of the world, with major museum hubs like New York, London and Paris being the likely next stops, the CEO said.

Update on May 9, 2023: Corrected to reflect that Blue Pool Capital is a family office.

Comment