It appears things are not going well for startups these days.

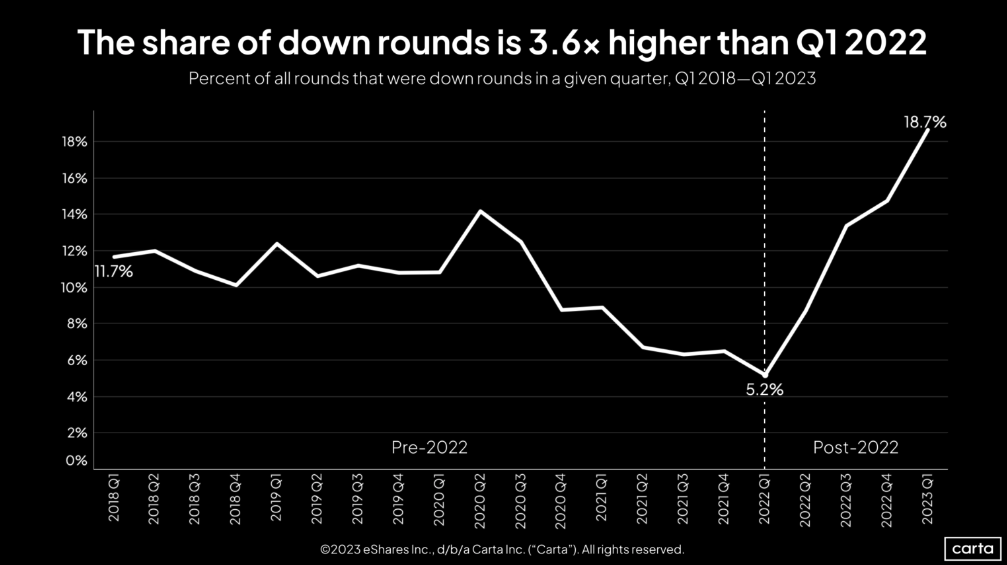

Down rounds, or a funding round in which a startup raises capital at a lower valuation than its last investment, have become more common than the venture community has seen in nearly half a decade. According to data from Carta, down rounds nearly quadrupled in number in Q1 2023 compared to a year earlier.

Down rounds are bad because they can lead to outsized dilution, unhappy investors, employees fretting over the value of their equity and other less than winsome events. They are new to many startups and were quite rare during the most recent venture boom, when so many startups were raising multiple up rounds in the same year that it became a mini-trend.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

It’s not shocking to see down rounds becoming more common, but it is somewhat surprising that they accounted for nearly one-fifth of all venture investments Carta saw in the first quarter. Things have gotten worse for startups much sooner than we anticipated.

Furthermore, Carta reports that a minimum of “40% of all investments in Series A and Series B companies were bridge rounds in Q1, the highest figures of the 2020s.” The same forces driving the prevalence of down rounds are at play here: Namely, the pace and value of venture capital deal-making are in retreat, and as the public markets have reset, so have valuations for startups at all stages.

Furthermore, Carta reports that a minimum of “40% of all investments in Series A and Series B companies were bridge rounds in Q1, the highest figures of the 2020s.” The same forces driving the prevalence of down rounds are at play here: Namely, the pace and value of venture capital deal-making are in retreat, and as the public markets have reset, so have valuations for startups at all stages.

Down rounds, flat rounds and more complex venture terms

When we went over Carta’s initial take of its Q1 2023 data, we found that fewer dollars were going to work at lower prices.

That might sound like an odd combination of events. After all, if startups are cheaper, why aren’t venture investors putting more capital to work? It’s because venture investment is essentially a momentum trade, in which rising prices for startup shares lead to investors being able to raise more capital, which allows them to put more money to work at even higher prices.

Yes, it is something of a self-reinforcing cycle. During periods of exuberance, if you press a VC about why they are moving so quickly and skipping nominally important techniques of intelligent investing like due diligence, they will say something about needing to play the game on the field.

Conversely, when the value of tech stocks and therefore, tech startups, is in retreat, VCs have less to crow about to their own backers, which limits capital flows to new venture funds. We therefore see fewer venture capital deals and dollars in the market. Instead of playing the game on the field, VCs and other startup investors demand slower deal-making, more diligence and so forth; they change the rules when they can.

Put another way, we’re seeing more down rounds as venture investment pulls back. If you’re an investor, you can now get more for your dollar and you’ll put less capital to work. Ironic, sure, but it’s also a pretty standard result of a startup downturn. For founders in need of dollars, however, it’s a mess.

When we consider that 18.7% of rounds that Carta saw in Q1 2023 were down rounds and that the same figure was just 5.2% in Q1 2022, what’s terrifying is that the number could get even worse.

Observe the following chart:

I don’t see any reason for this trend to suddenly arrest, let alone reverse. Carta provided a good summary of the state of venture from where it sits inside tens of thousands of startup cap tables (emphasis ours):

There were fewer investments and less capital raised by startups on Carta in Q1 2023 than in any first quarter since 2017 — a sharp contrast to Q1 2022, which saw more deals and the second-highest total capital raised of any Q1 in recent history.

After several years of steady growth, the venture market is on pace for a second straight year of declines. Across all stages, Carta logged 906 venture capital investments in Q1, ending a streak of 21 consecutive quarters in which deal count had reached at least 1,000. That’s a 35% decline from Q4 2022, the largest quarter-over-quarter dip since at least 2016.

Given those terrible statistics, there’s no way the trend of down rounds is going to slow down or reverse. Given the sheer number of unicorns with indefensible valuations that will have to raise capital before they can even hope to go public, we wouldn’t be shocked to see down rounds taking up more of the startup fundraising pie for a few quarters.

Thinking out loud, if about 40% of Series A and B rounds in Q1 were bridge events and nearly 20% were down rounds in the first quarter, the number of venture funding events that we could call “wins” for startups may be in the minority of all deals. That’s pretty damn bad.

For investors, however, there is a silver lining: It’s now much cheaper to buy equity in companies that look poised to weather the storm and end up being worth lots of money later. Investors can enforce more favorable terms in deals, too: Carta noted that in the first quarter, investor-friendly terms like “participating preferred stock and attractive liquidation preferences” spiked sharply in frequency when compared to both Q4 2022 and recent local minimums.

More importantly, getting into good companies’ cap tables at even an up-round valuation is likely cheaper than it has been in years. The maxim “great companies are built in hard times” may be true, but we should add a corollary: “Outstanding venture returns are built when startups are having a hard time.”

Comment