Careerist claims it closed an $8 million round of funding with a tight 12-slide deck and gave us a lot to learn from in the process. Not all in good ways, but I’m getting slightly ahead of myself.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

The team submitted this slide deck with the note that it was submitted exactly as it pitched it to the investors.

- Cover slide

- Mission slide

- Problem slide

- Solution slide

- Traction slide part 1

- Traction slide part 2

- Business model slide

- Go to market/customer funnel slide

- Client rating and net promoter score slide

- Market slide

- Team slide

- Thank you slide

Three things to love

This deck sets off a number of alarm bells for me — I’ll get to why in just a moment — and I imagine the founding team fought an uphill battle pitching this to investors. Having said that, the company did go through Y Combinator and claims it was successful in raising an $8 million round from Cathexis, Xploration, Cold Start Ventures, Grant Park Ventures and others. Let’s dig in and look to see if we can find some clues as to why the company caught the eye of these investors.

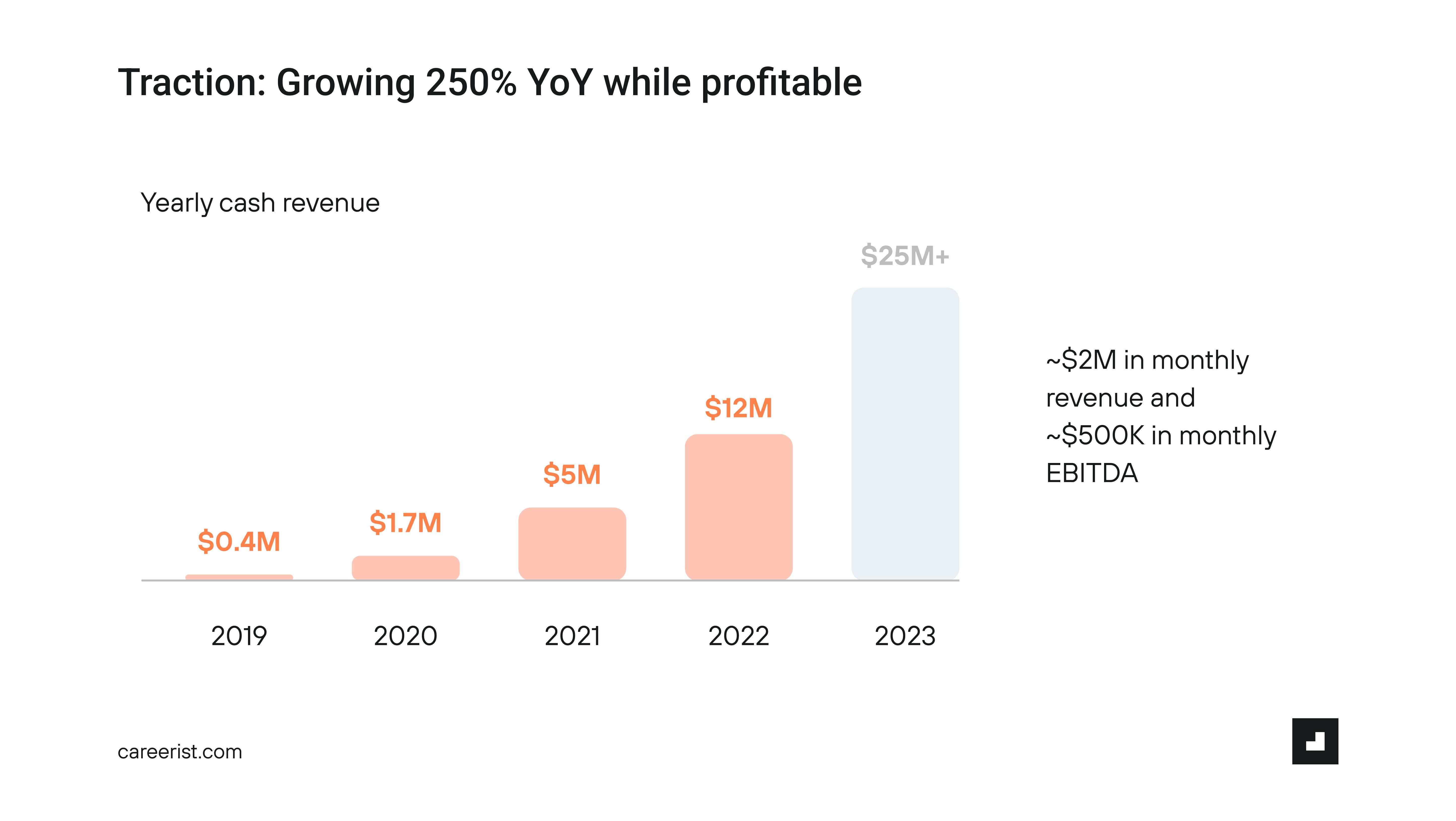

If you have traction, nothing else matters

Traction truly resolves any issues a company may possibly have. Building a company that is growing from half a million dollars to $12 million of revenue in four years is pretty impressive, especially given that up to this point, according to its own press release, the company had raised just $1.2 million of capital. Turning $1.2 million of investment into $12 million of revenue, it turns out, is enough to catch the attention of investors.

Extraordinary customer acquisition

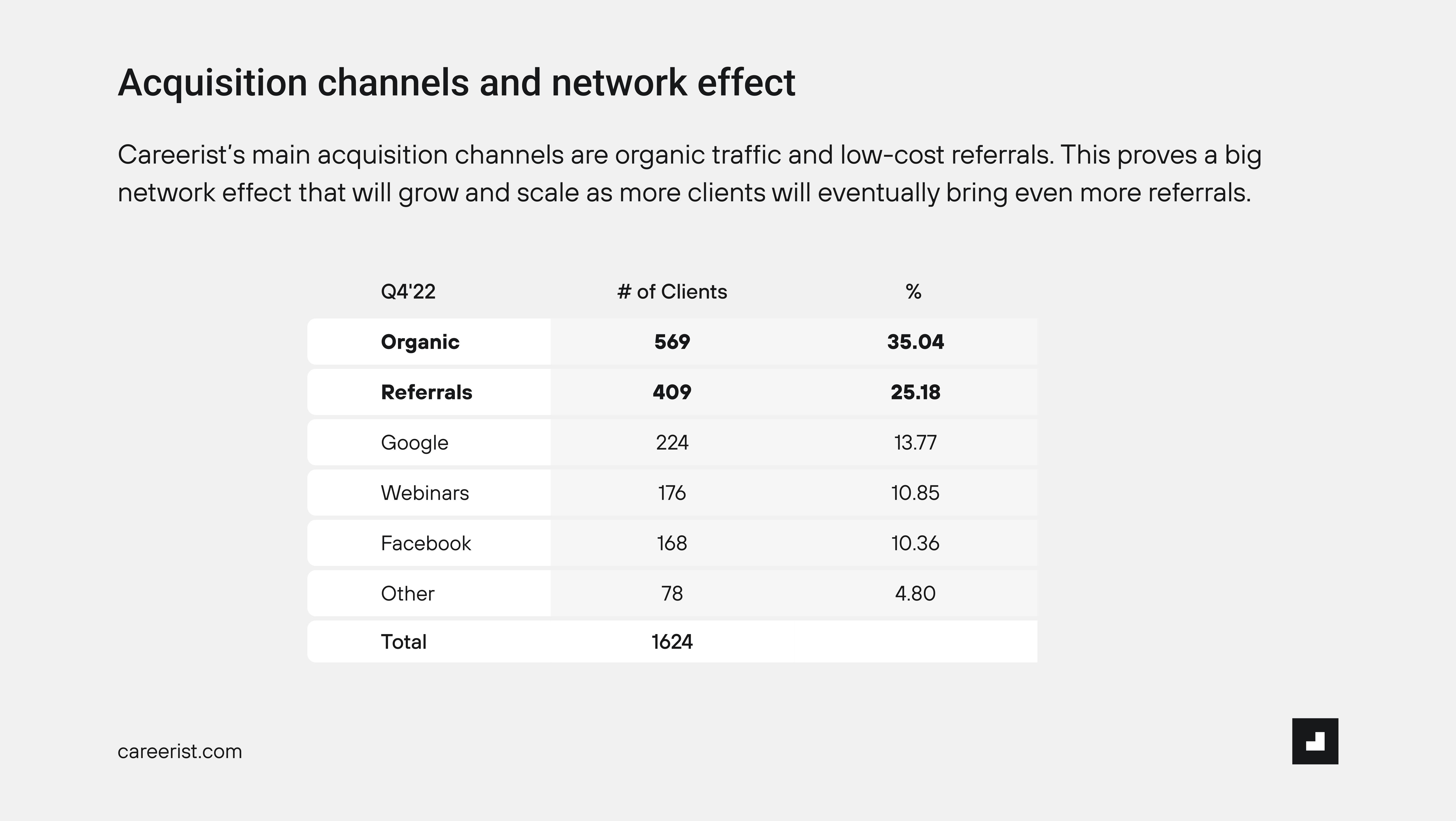

In order to drive that much revenue, you’ve got to find your customers somewhere, and it seems like Careerist cracked that nut:

On its slides, the company claims that it gets 35% of its traffic organically and another 25% from referrals. Those are two extremely powerful, low-cost acquisition channels that can drive extraordinary, high-value customers. But that’s a double-edged sword. Referrals generally do scale well alongside other channels: If you get a 0.2 referral on average per customer, and you acquire 10 customers, you get two “free” customers due to referrals. The challenge is with the organic traffic, which is much harder to scale on demand. In other words, once you close an $8 million round of funding, how are you going to accelerate your sales dramatically?

It doesn’t specify whether the other channels (Google, webinars and Facebook) are paid acquisition channels. If they are, I’d expect to see the cost of acquisition (CAC) here, and an analysis on whether these customers also end up referring additional customers. But overall, there’s a lot to love on this slide: Finding 1,600 customers who are paying you $12,000+ each (see slide 7 in the slide deck, below) is objectively impressive.

The cool thing is, you can sense-check those numbers: The company claims that it has 1,600 customers and has done cumulative $19 million of revenue. That works out to around $12,000 per customer, proving that the numbers are internally consistent.

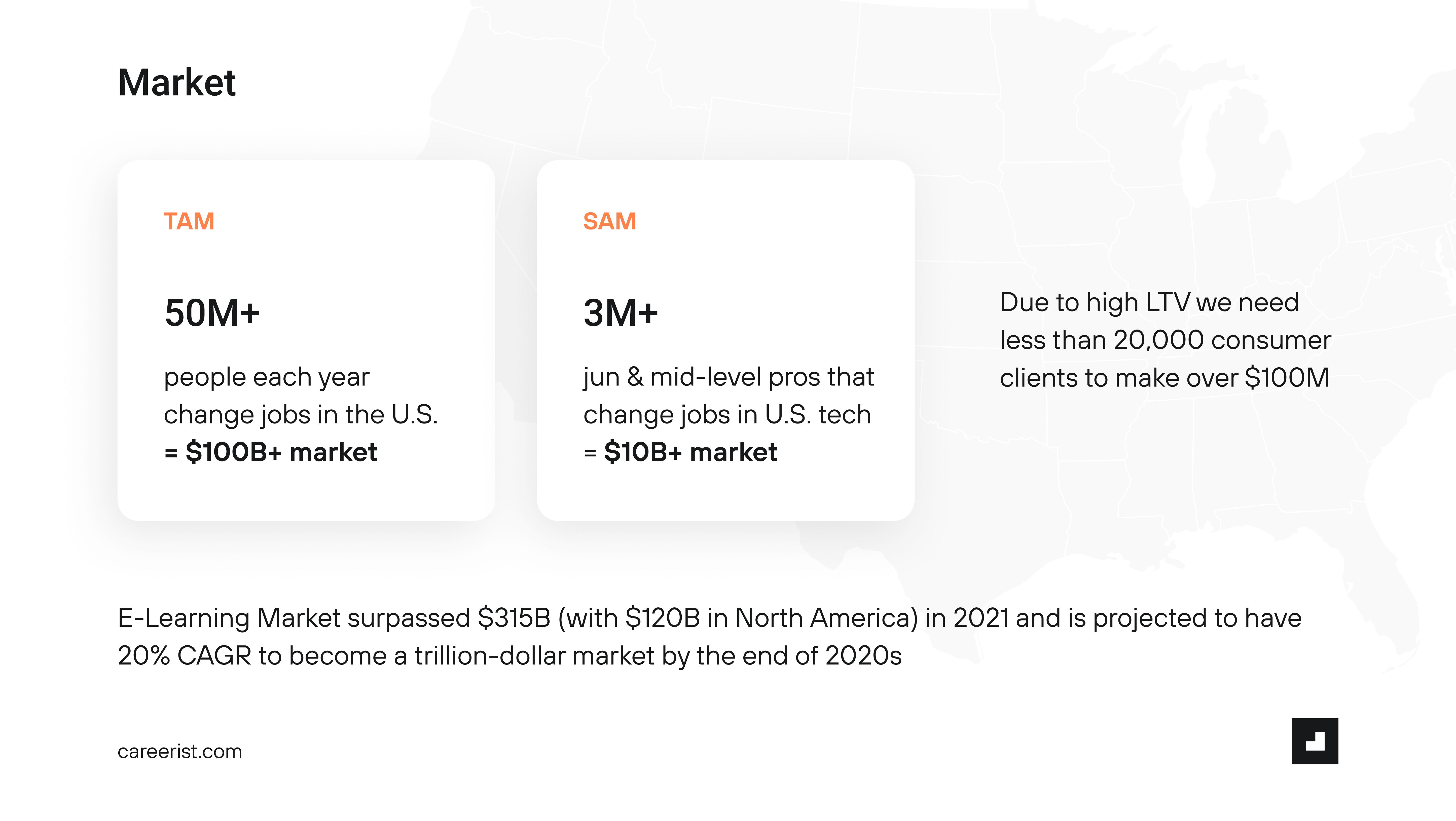

That’s a hell of a market size

Careerist finds itself in a curious space here, with a huge opportunity. In fact, if the company wasn’t seeing extraordinary traction and lifetime value (LTV), these numbers would be hard to believe. But with the traction in place, these numbers seem more or less plausible. Besides, in truly enormous markets (hiring, training, etc.) market sizing is essentially just a checkbox.

One example of that would be toothpaste: There’s no doubt that there’s a huge market for it, and no investor will argue with you about that. The questions then become “What can you do to gain a foothold in those markets?” and “What are your marketing and customer acquisition channels?” Careerist only partially answers those questions, and that worries me a little.

The above are some of the positives in the Careerist pitch deck, but unfortunately, there are also a few Texas-sized red flags that make me wonder how the company was successful in raising money at all. I suspect the answer, as I alluded to above, is because of its traction. In the rest of this teardown, I’ll take a look at three things Careerist could have improved or done differently, along with its full pitch deck.

Three things that could be improved

There are quite a few things missing or problematic in this deck, and unfortunately it starts right when you open the first slide.

That’s a major red flag

On the cover of its slide deck, it shows a quote from TechCrunch. Sure, it misspells the name of the publication (it’s TechCrunch, not Techcrunch), but that’s forgivable.

Whenever I am evaluating a pitch deck, I verify as many of the claims I can on a deck.

Let me share an example. Careerist claims that 50 million people in the U.S. change jobs every year. That sounds way too high, so I did some cursory Googling to check it out. I found that “The average person will change careers 10 to 15 times during their working years.” If the average person works from age 18 to 68, that means they work for 50 years. Divide by 15 and you get an average tenure of about three years. “In 2022, it was estimated that over 158 million Americans were in some form of employment,” with every person changing jobs every three years or so.

That means that the numbers add up, more or less: The 50 million people changing jobs number seems high, but it’s probably roughly correct.

So, when I saw a slide deck that quotes TechCrunch on the cover, you’d better believe that I did a quick search to find anything we wrote about the company. It turns out that the only time TechCrunch has written about Careerist is in the summary of all the Y Combinator companies in August 2021. That isn’t really market validation; we wrote about 377 startups in that cohort, and we only wrote a very short summary of each of them. Most importantly; what the company says we wrote, we didn’t actually write:

The company added the “[and fintech]” to our quote. The use of square brackets in quotes is sometimes used editorially to clarify a quote. For example, if a founder is talking about a fundraise, but refers to the fundraise as “it” in a quote, we might replace it with a phrase that makes it more clear. That would update the quote from, “Oh, we had a hard time with it,” to “Oh, we had a hard time with [the fundraise].” It’s worth noting that in the quote Careerist uses on the cover of this slide deck, there’s no reference to fintech in our article anywhere. Journalistically that is super problematic. At serious publications, that’s known as fabricating quotes, and it could get you fired on the spot.

Of course, a pitch deck is not journalism, but as an investor, that put me on super high alert: If a company is willing to bend the truth on a cover slide, what other truths will it distort? It made me go back and try to fact check whether the fundraising round even took place. I couldn’t find any publication that covered the $8 million round. The only reference I could find to it is on Business Insider, but that article is also about the pitch deck, not about the fundraise.

I reached out to all the investors the company claimed invested in the round, but I wasn’t able to confirm before the time of publication that it was an $8 million round nor that the firm was a part of the round. Only one of the investors lists Careerists on its portfolio page. As a media-savvy investor, that is just red flag after red flag after red flag. That doesn’t mean I wouldn’t invest in the company per se, but it would make me do extra-thorough due diligence in the deal.

The worst part is that the TechCrunch quote isn’t even helpful. It’s just a quick summarization of what the company is, not a review or analysis; it merely appeared on a list.

How are you going to grow?

Careerist’s pitch deck is almost completely devoid of any information about what the company is going to do next. That’s highly unusual (and a little suspicious). Raising a funding round typically means that you’re building something new, maybe to expand your sales or to help build the company in other ways. That could take the shape of an ask slide, an operating plan, a product roadmap or a go-to-market plan.

None of these exists in Careerist’s deck.

Judging from the deck alone, it looks like the company has no plan for what it wants to do with the money, and without a clear vision for what the funds would accomplish. Leaving out this crucially important set of info is doing Careerist a disservice: Investors are going to want to see some sort of plan, and this is the place to share that.

Slide 8 (as discussed above) does this a little bit by outlining how the company is acquiring customers — and with a customer value north of $12,000, it can certainly afford to spend some money here. However, the company fails to explain in any amount of detail what its plan is to reach its next group of customers. In fact, Careerist brags about how it is acquiring customers through channels that don’t scale easily, which does the opposite of build confidence.

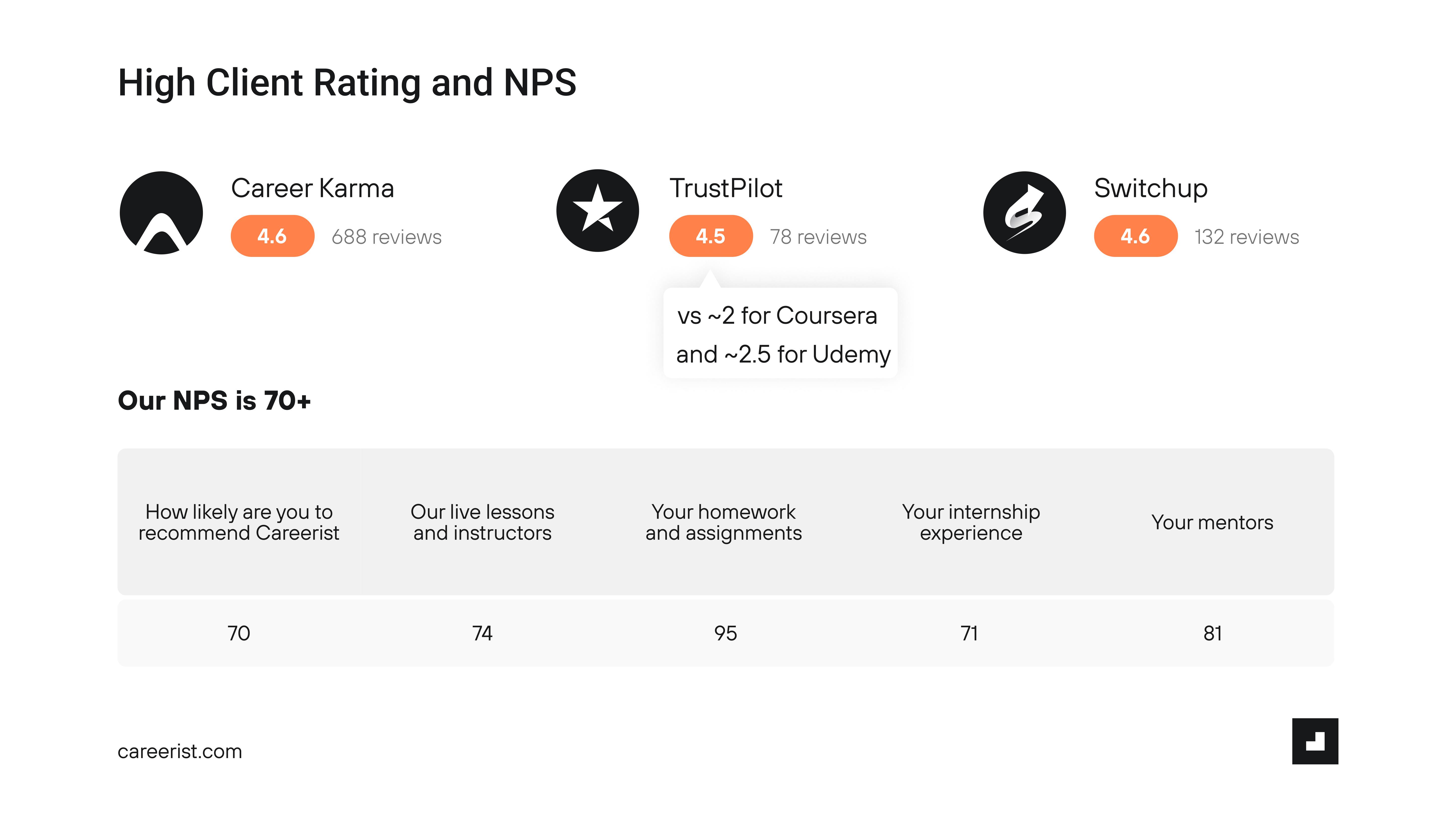

What are these numbers‽

This slide is extraordinarily confusing, because it includes a number of different numbers. The Career Karma and Switchup reviews track; the number of reviews has gone up for both; and the rating remains high. However, the company claims to have 78 reviews with a 4.5 rating on TrustPilot. As I’m writing this, it has 40 reviews with a 4.0 rating. I have questions. The other thing that confuses me is the comparison with Udemy and Coursera; these are very different industries. That either means that I have misunderstood Careerist’s business and business model, or the company’s making an apples-to-oranges comparison. Not sure which, but it’s generally not advisable to confuse your investors.

I’m also confused about the NPS scores. The net promoter score is usually a response to a single question: “Would you be willing to recommend a business or product to a friend, colleague or acquaintance.” The answer is on a 1 to 10 scale. From there, you take the answer and calculate the NPS based on a formula. Most companies have one NPS for the whole company and maybe one NPS per product. In other words, the left-most question (“How likely are you to recommend Careerist”) is how I would expect to see an NPS question. The rest of the questions don’t make sense and are not NPS scores: “How likely are you to recommend your homework and assignments to your colleagues” is a nonsensical question. It’s possible that the company asked its customers how happy they are with the lessons, homework, internship and mentors, but those numbers don’t flow to NPS scores.

In a deck that is lacking many real, meaningful numbers, my Spidey-sense starts a-tingling when the numbers that are there are partial or seem to be nonstandard.

I know I already praised the company’s traction chart (slide 5), but now that I’m sitting with the numbers and thinking about them, I’m not sure about that number, either. Revenue in isolation is impressive but not helpful to ascertain whether a company is viable. I’d also want to see customer lifetime value over time, customer acquisition cost, cost of goods sold, etc.

The company does say it has $2 million in revenue and $500,000 in monthly EBITDA. For most stock-listed companies, if your EBITDA is above 15%, you have an impressive business (here, we are looking at 25%, so that’s good). But for a company that is trying to look like a tech company, I’m left to wonder what all those costs are and whether there’s an opportunity for increasing the margins. Again, those are metrics that I would expect founders to track and be able to report on, especially at the Series A stage, but once again, that’s missing here.

Given that I’m already suspicious about the deck overall, why the company seems to be hiding so many of the important numbers rings all my alarm bells at once.

A final note

This pitch deck teardown is pretty salty, and I’ve repeated several times that I’m on high alert and worried about the veracity of the data in the deck. I hasten to add that I have no additional context here beyond the deck itself. That’s unusual for an investor, and realistically, if I received this pitch, I would take a meeting with the company based on the traction and revenue graph alone. From there, perhaps the company has a tight voiceover that explains all the misgivings and suspicions that arise.

Or maybe the company has an incredible live financial dashboard that it pulls up as part of a pitch. And maybe it has a detailed plan for how much it is raising, what it will accomplish with those funds and how it will raise its Series B in 18 to 24 months.

On its own, this deck is lacking a lot of important information, which makes it not an ideal deck (pitch decks should be able to stand on their own, and if not, consider providing a send-home deck). The main caveat is that it’s a very different experience being walked through a deck rather than just picking it apart out of context.

Having said that, check out Orange Chargers’ deck to see an example of a deck that gets all of the above very right.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment