Honeycomb raised $50 million to make the new landscape of platforms and services more observable. Its long-term goal is to make life easier for people operating large software platforms.

“What we saw in 2015 and 2016 is the world moving in a direction where that complexity was unavoidable, whether in a heightened interest in being able to do things like breakdown by customer ID or this exploding complexity that was about to come onto the scene driven by Kubernetes, microservices and containers. We [believed] the world [was] going to need a tool like this that allows users to have both speed and flexibility,” Christine Yen, co-founder and CEO at Honeycomb, told TechCrunch in a previous interview.

I find this fascinating and was excited to go through the company’s pitch deck to learn more.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

The company didn’t remove any slides from its 18-slide deck, but it redacted revenue numbers and blurred customer and competitor logos.

This is a quick breakdown of the honey Honeycomb used to land $50 million in the hive:

- Cover slide

- Data summary snapshot slide

- Problem slide

- Solution slide

- Competitive landscape slide

- Product category overview slide

- Customer landscape slide part 1 (mostly redacted)

- Customer landscape slide part 2 (mostly redacted)

- Market positioning slide

- Value Proposition slide

- History/product timeline slide

- Go to market interstitial slide

- GTM: Land-and-expand approach slide

- GTM: Gaming vertical slide

- Going Forward interstitial slide

- Team slide

- The Ask slide

- Closing slide

Three things to love

Honeycomb is building a product that — based on its traction alone — is clearly needed, and it does a good job weaving its story.

This is how you do an “ask” slide!

![[Slide 17] Look at that! Yess!! Image Credits: Honeycomb](https://techcrunch.com/wp-content/uploads/2023/04/HoneycombSeriesDPitchDeck-slide-0017.jpg)

One of my pet peeves about slide decks is that the vast majority of founders get this slide wrong. It’s a breath of honey-scented air to see a company get it so right. Honeycomb clarifies the need ($50 million) and precisely what it will do with the money: Runway into 2026, a specific ARR goal and the option to focus on growth or stabilize into a running, profitable business. It also states IPO readiness as a goal (which is a little fuzzy; does that mean it wants to be ready for the IPO and then raise another round to do the IPO, or does the $50 million include all the housekeeping that’s needed to complete an initial public offering?), along with some slightly ambiguous, but clear-enough goals around channels and product.

I’d use this as your baseline for an “ask” slide. Be clear, be focused. Show what your fundraise will accomplish. (While the company mentions 2026, the runway isn’t the main focus of the slide, which is exactly how it should be.)

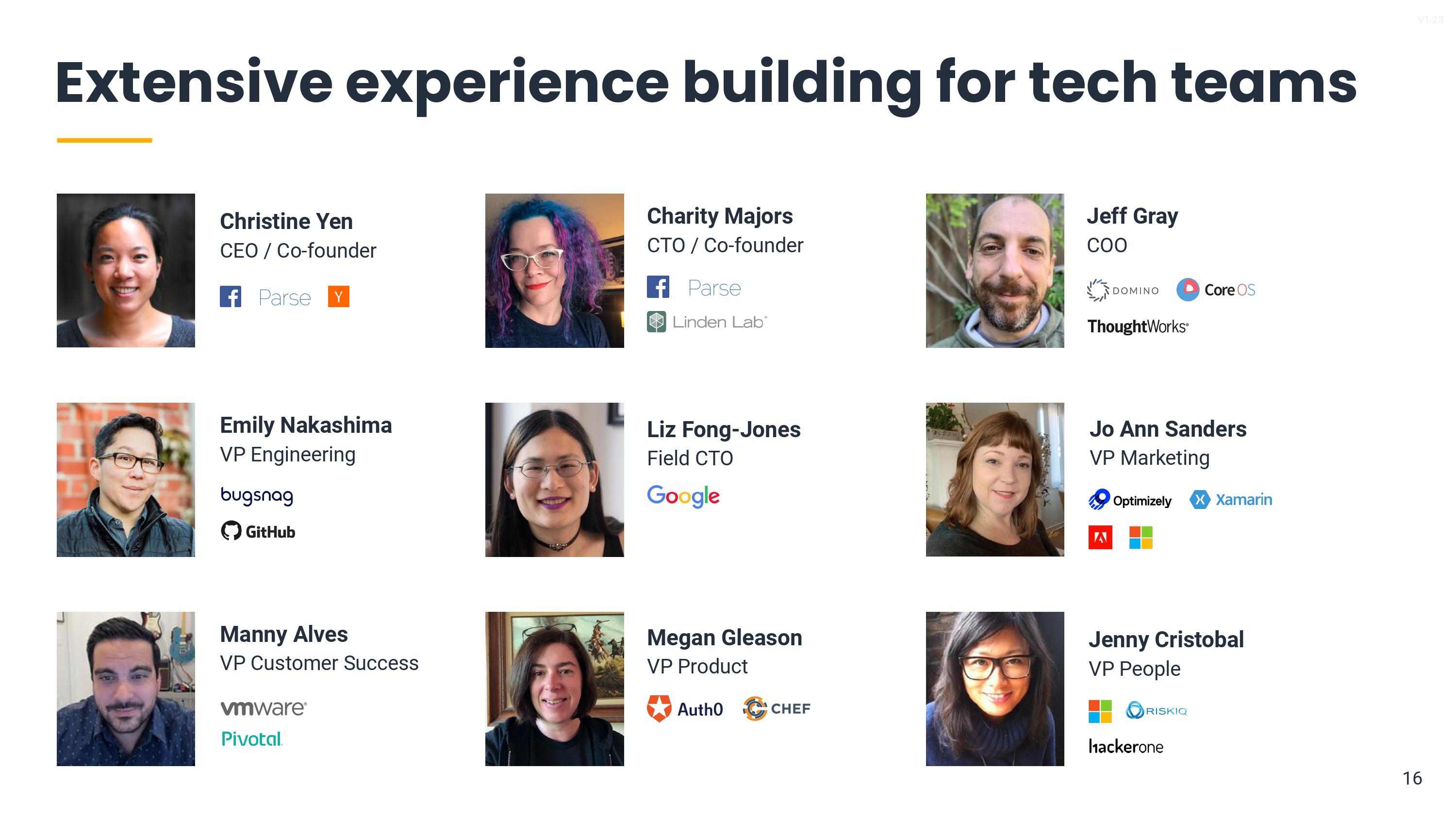

I wish more team slides looked like this, but …

OK, for a team slide, this isn’t great: It doesn’t explain why all of these people have a founder/market fit, and it doesn’t show why this team is uniquely positioned to drive Honeycomb to the next level. Specifically, for a round that suggests an IPO might be imminent, I want to know that at least some of the folks in leadership know how to pull that off or at least have support from people who have IPO experience.

And yet, this team is refreshing in how diverse it is, which is sadly quite rare in the startup world, and especially in B2B enterprise SaaS businesses. Having a diverse leadership team doesn’t happen by accident; it’s a concerted effort in hiring and team building. Investors, take notice.

Of course, this isn’t an easy “fix.” If you’re putting together a slide deck to raise your next round, and that’s the first time you realize your team slide is filled with Stanford-educated white dudes, well, no amount of creative storytelling can save you. It’s essential to think about the type of company you want to build and put into the world. As a startup founder, you get to make choices about the kind of org you want to create.

So, who needs this anyway?

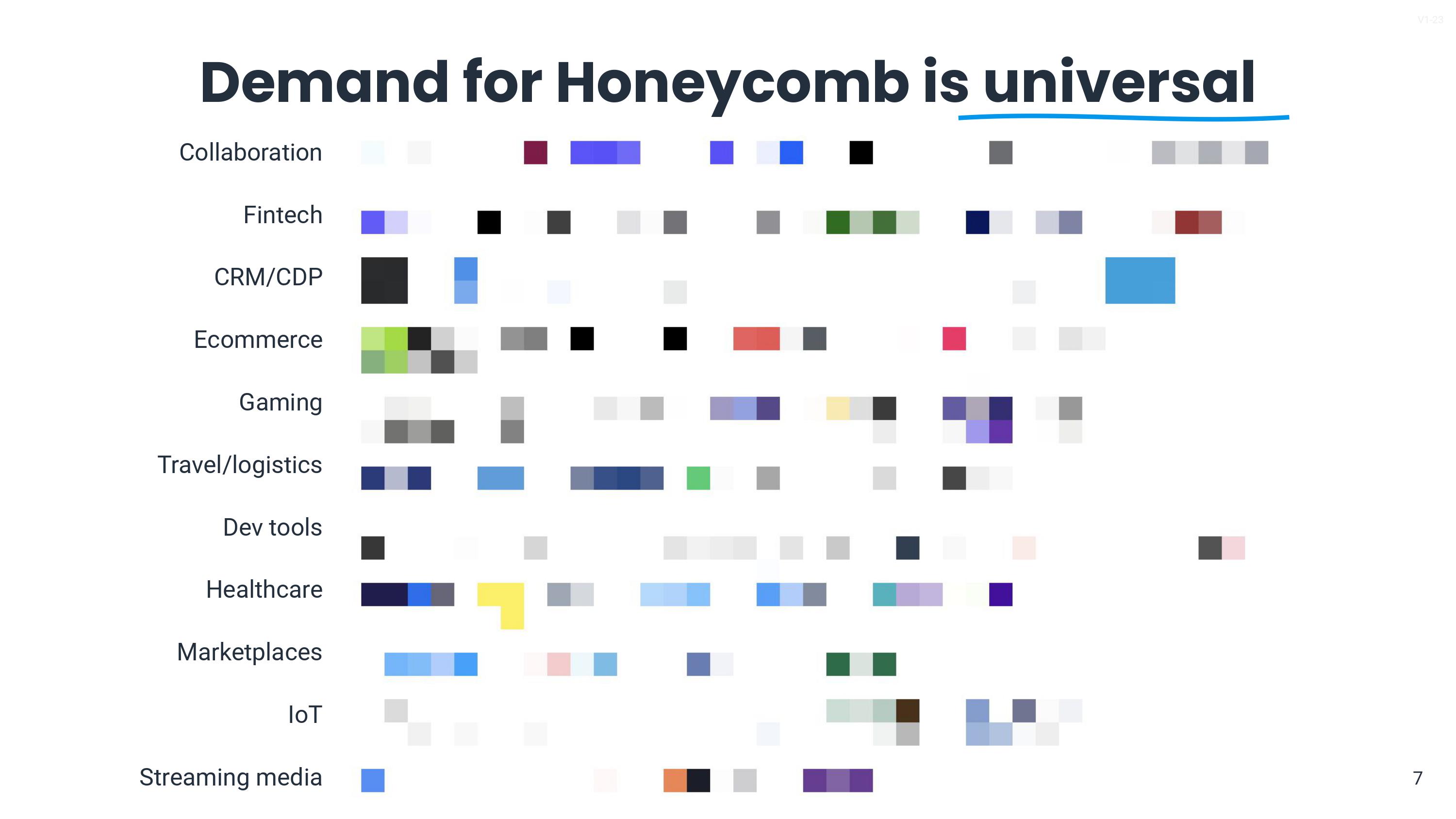

For folks who aren’t steeped in development and software, a software engineering observability platform may seem very niche indeed. Blurred-out logos be damned, this slide does a great job at telling the story:

Trust me when I say that there are some serious, well-known brands on this slide. But even with the logos blurred out, this slide does a magnificent job telling the company’s story: It shows the breadth of companies and sectors that work with Honeycomb. “Who is this product for?” is a question all investors will ask, and with this slide, it’s clear that the answer is: mostly everyone.

Three things that could be improved

So! Fifty million dollars doesn’t lie, but I can we still find places to improve the pitch. As I mentioned above, the team slide could do some heavier lifting (here’s more about why the team slide is so important), but that’s not the only slide I would tweak.

Er, how do you make money?

There’s not much in the company’s deck about how it generates revenue, and it’s lacking the underlying SaaS financial mechanics. For a Series D, I would expect extensive metrics, such as customer growth, revenue growth, average customer spend, churn, customer acquisition cost and lifetime value. The company’s pricing plan is usage-based (smart!), and it employs a land-and-expand playbook. That’s probably sensible for this kind of startup, but that approach comes with a slew of measurable KPIs as well, and none is sufficiently explored in this deck.

Of course, some of the relevant slides that have details blurred out may show some of this detail, but it looks like none of it is formatted in the way I would have expected.

Some startups like to show investors their working dashboards instead of replicating the data and visuals in a slide deck, which can work well. But I still encourage including a screenshot of the data in the deck, and then offer to look at the live data during a pitch.

Consider what the most relevant data is for your would-be investors, and ensure you have that on-hand during the pitch.

What is this slide?

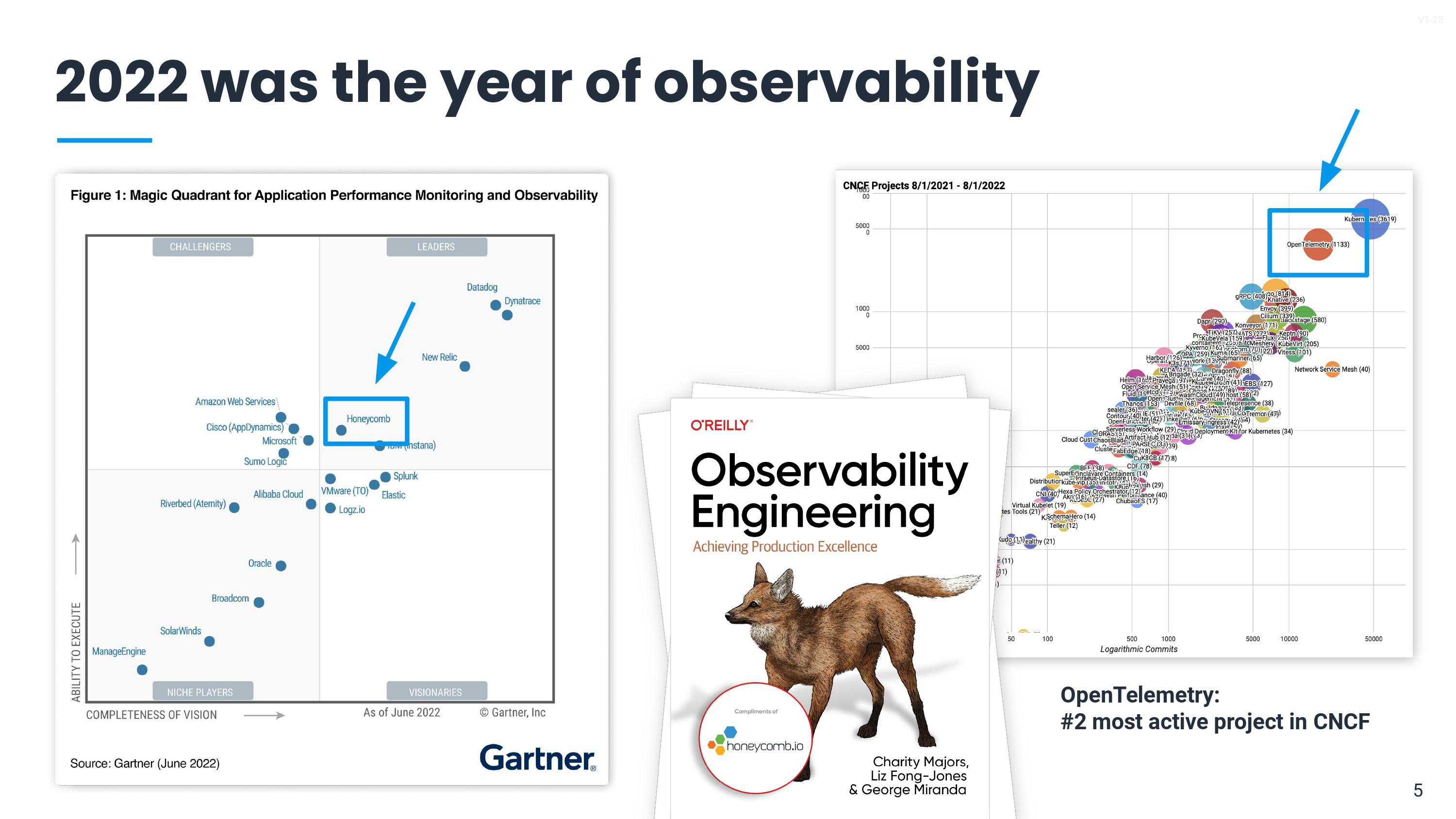

I really struggled with what to name Slide 5, as you can see in the list of slides. I went with “Competitive landscape slide,” but that’s not quite accurate. Let’s take a closer look together:

This slide has three pieces of information on it, and trying to read the slide without the benefit of a voice-over, here’s what I see:

On the left, there’s a chart prepared by Gartner. That’s great; Honeycomb has gained the attention of one of the big consulting firms, which is a milestone in itself. But in that four-axis graph, it is dropped somewhere in the undifferentiated middle, alongside a flurry of important competitors (AWS, Cisco, Microsoft, Sumo Logic, IBM). It’s unclear how Honeycomb is differentiated from these behemoths, and if I were an investor, this part of the narrative would scare, rather than inspire, me.

In the middle, there’s an O’Reilly book, “Observability Engineering,” that has a sticker on it that says “compliments of Honeycomb.io.” Even after reading the description of the book on its website, it’s still confusing: Is this an independently published book, or is it essentially a marketing exercise published via O’Reilly? Without doing additional research, I can’t really tell whether the book is essentially a vanity metric (we hate those), or a legitimate entry into the discourse for this particular market. Perhaps I’m biased, because I know a fair bit about publishing but just sticking the book cover on this slide and calling it a day leaves me with questions.

On the right, there’s a graph of active projects on CNCF, and the company is the second-most active. I am not sure what to make of that; is active good? Or does it mean it has a lot of bugs that need to be addressed? If people are reporting bugs and making feature requests, it proves there’s a lot of interest, but how does that meaningfully translate into business metrics, like revenue and new customers?

It’s unclear why the founders think that these three data points connect to its mission or, crucially, the business metrics that can predict whether the company will be successful.

I suspect there’s a voice-over that ties this slide together, but remember that your deck has to withstand scrutiny on its own, too. If it doesn’t, you may need a separate send-home deck.

Think about the context with which an investor will be looking at your pitch deck. If a lot of mental gymnastics is needed to explain why something is on a slide, it’s probably not the best slide to present.

A disappointing closer

On the whole, Honeycomb’s deck is so good, and the very last slide is a great place to remind investors why they should invest.

This ain’t it. “We make the impossible possible,” is literally why the vast majority of startups exist in the first place. Scrolling through the list of past pitch deck teardowns, I think I could apply that slogan to almost all the startups I’ve looked at over the past year.

Yes, you make the impossible possible, but it’s a better idea to leave your investors with the nugget you want them to walk away with. Make it benefits driven, make it specific, make it inspirational. Do you reduce the time it takes to resolve complex bugs by 20%? Great, say that. Do you increase the efficiency of developers by 30%? Awesome, say that. When the partners of the VC firm get together, what do you want them to say to each other as the shorthand for that meeting? “Honeycomb, that’s the company that makes the impossible possible” doesn’t mean much. “Honeycomb, that’s the dev analytics company saving its customers 30% on their dev cost” is a shorthand that can help you. Stick that on the slide.

Last impressions count almost as much as first impressions. Make sure you leave your investors with something meaningful.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment