Ira Lam

The full magnitude of the impact of the current market volatility in the wake of the collapse of FTX is still unknown. The dominoes keep falling and it is hard to predict how many more projects and organizations will end up being affected. What is undisputed is how the entire industry has been impacted and that the conversation about crypto regulation has risen to the forefront.

Calls for regulation have come from every corner: from U.S. Treasury Secretary Janet Yellen calling for “more effective oversight of cryptocurrency markets” and G20 leaders bringing up the need “to build public awareness of risks to strengthen regulatory outcomes and to support a level playing field, while harnessing the benefits of innovation.” U.S. Senators Warren, Smith, and Durbin have cited the dangers of “charismatic wunderkinds, opportunistic fraudsters, and self-proclaimed investment advisors” while urging Fidelity to scrap its 401(k) Bitcoin plan.

Notably, the SEC has taken a series of high-profile actions with respect to different projects — for example, against Kraken and its staking-as-a-service program, and Paxos in relation to the stablecoin, BUSD. The SEC also proposed an amendment to expand custody rules to include crypto assets, which could limit how any crypto custodian, including exchanges, could interact with crypto. This came in the wake of a joint warning issued to banks in January by the Federal Reserve, the FDIC and OCC to be wary of digital asset firms, signaling that they were closely monitoring the crypto activities of banking organizations.

These actions are seen by many industry players as further indication that the SEC is doubling down on its attack against crypto and furthering its claim to jurisdiction over all aspects of the industry. While regulatory scrutiny has been focused on the crypto industry for some time, the magnitude of FTX’s downfall has created a climate in favor of crypto skeptics. Many are calling for a referendum against the entire industry, painting a picture of cryptocurrencies and blockchain as an industry dominated by self-serving, manipulative and reckless profiteers.

Most expect the worst: A reactive blanket crackdown on all aspects of crypto, framed as necessary to protect the public from future bad actors, seems imminent.

But there are some measured voices. One of those came from JPMorgan, which observed that “all of the recent collapses in the crypto ecosystem have been from centralized players and not from decentralized protocols.” JPMorgan’s report reaffirms the long-term institutional optimism: “We see the establishment of a regulatory framework as the needed catalyst to massively ramp the institutional adoption of crypto.” The report emphasizes the distinction between DeFi and CeFi.

A similar sentiment was expressed by Jake Chervinsky, chief policy officer at the Blockchain Association. The “middle of the bell curve” take is that FTX will trigger harsh regulations for everything in crypto, DeFi included. I don’t think so. Policymakers will have to investigate every last detail about FTX, and they’ll finally be forced to see how different DeFi is from CeFi.

The difference between DeFi and CeFi is fundamental, but often not well understood by policymakers. Leaders, builders and participants in the industry can take this inflection point as an opportunity. The conversation about regulation is intrinsically connected to ensuring a clear understanding of the distinction between these categories and how that understanding is essential to building an effective framework.

The frontier of finance

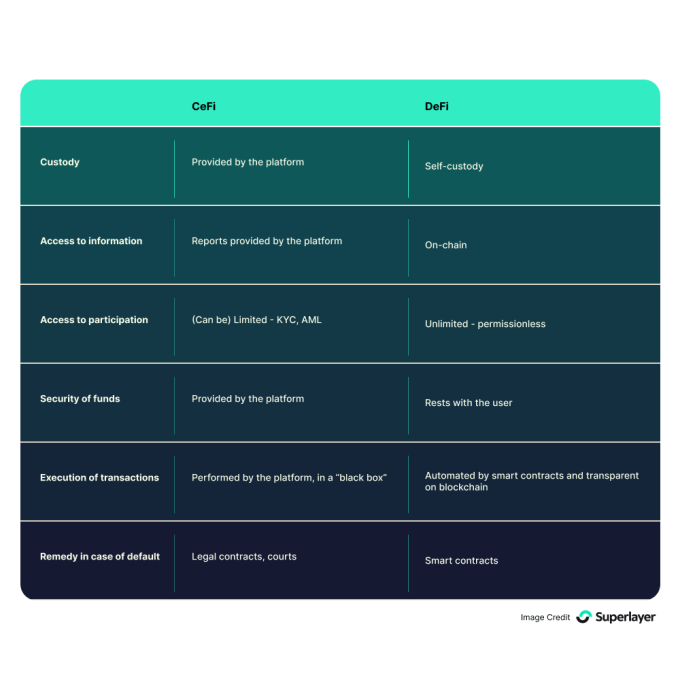

The way these two parts of crypto finance operate are drastically different. The most common regulatory heuristic is “like a bank” for CeFi and “like code” for DeFi.

In reality, there is no easy DeFi on-ramp without CeFi, and CeFi is fueled by DeFi. For DeFi to operate, user funds need to enter and exit the decentralized ecosystem, and most of its participants enter through centralized exchanges and intermediaries. At the same time, CeFi projects benefit from DeFi enabling the generation of revenue and execution of peer-to-peer transactions.

What are the risks of CeFi and DeFi?

There are inherent risks in participating in any financial activity. Bad actors, human error and greater forces always put the value of any asset at risk whether it is a fiat currency, government bond or crypto token. Eliminating all risks is impossible, but mitigating them is vital to making participation in the system attractive. And there is no more popular mission in crypto than “onboarding the next billion.”

Traditional finance (TradFi) and governments have worked for centuries to establish trust with people. They have developed multiple defenses with the promise of protecting consumers and weeding out bad actors. By removing the dependency on these traditional players, crypto is developing risk mitigation tooling at the same time that it is innovating the instruments. The risks that are inherent in any financial system manifest in new ways in crypto and in different ways in CeFi and DeFi.

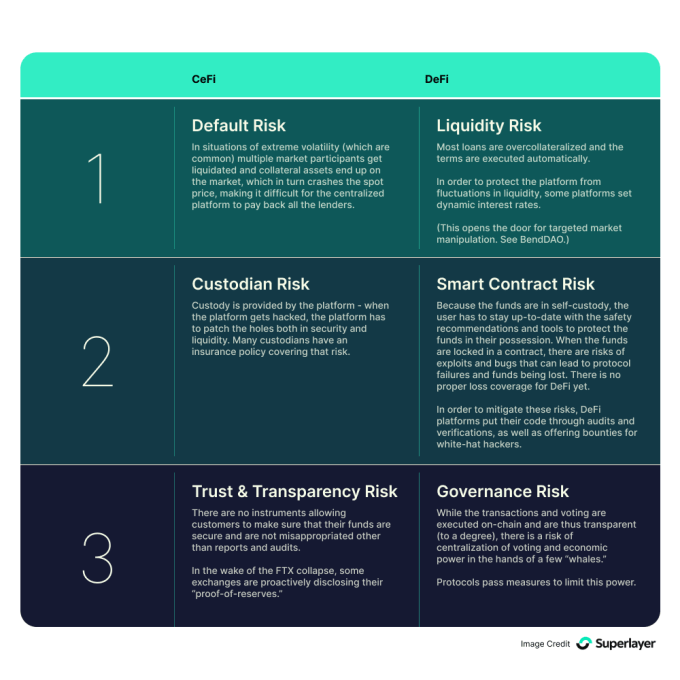

Centralized platforms are most prone to risks similar to TradFi, and they exist under heightened volatility pressure. The main risks are default risk (crypto is uninsured, unlike bank deposits), custodian risk, and trust and transparency risk. For DeFi, the risks manifest differently: liquidity risk, smart contract risk and governance risk.

The collapse of centralized crypto projects like FTX has significantly weakened trust in CeFi. It is particularly damaging because many users of these centralized platforms are new to the scene, may have entered crypto during the 2020–2021 bull run, and haven’t had time to develop strategies to manage risks. Nor did many of them understand that buying and holding crypto on a CeFi platform is equivalent to depositing funds into the custody and control of a central actor. In the case of FTX, the central actor proved to be fraudulent. Millions of users lost their crypto and millions of dollars of value.

The truth is that there is no easy path to onboarding a billion people to crypto without centralized exchanges and custodians. Most consumers rely on familiar, user-friendly interfaces, customer support and recognizable centralized parties to engage in any transaction. DeFi interfaces can be far from intuitive.

As Ethereum co-founder Vitalik Buterin put it, “Both types of exchanges will continue to exist, and the easiest backwards-compatible way to improve the safety of custodial exchanges is to add proof of reserve.” This was the path that many centralized custodians took in their attempt to build faith with retail investors.

The industry is beginning to implement self-regulation, but more work is needed.

Final thoughts

While it may be a long time before we see significant movement toward consumer protections in crypto, one thing is certain: CeFi and DeFi cannot exist without each other. For the web3 ecosystem to scale, consumers need accessible ways to enter crypto. This means both DeFi and CeFi will have to evolve to meet the demand. Additionally, the user experience needs to improve so that onboarding is much easier.

Most of the conversation about crypto regulation revolves around financial use cases and the institutions for storing, trading and buying tokens. Blockchain technology and smart contract applications go far beyond that. The core utility can be more than a financial instrument, which is what makes the space so dynamic and promising.

Regulations are in place to, among other things, protect consumers and ensure fair markets. There is no world in which crypto is “unregulated.” It is essential that regulators and law enforcement ensure that the bad actors are held accountable. It is even more important that regulations and legislation governing the bulk of the industry are crafted thoughtfully, not just reactively. Ample input from the diverse players in the crypto ecosystem can help ensure that overly broad and ambiguous language does not unwittingly stifle innovation of the powerful technology that is still in its nascent stages.

Enforcement actions should not be weaponized in a way that leads to heightened industry uncertainty, which has the effect of stifling innovation. While it may be tempting for lawmakers and regulators to aggressively react in the face of the FTX fallout, we are at a crucial moment in the development of the industry in the U.S. We cannot risk taking actions now that will permanently affect the ability of the U.S. to be a leader.

Yes, trust has been eroded. Concerted effort is required to establish trust between all parties. That means engaging rationally to balance consumer safeguards without stifling the benefits of crypto.

Comment