When the financial markets go all wobbly, conservative investors turn to scarce resources that are unlikely to plummet in value, including things like silver, gold, palladium and platinum.

Diamond Standard wants to add diamonds to that list and has created a blockchain-based system to create tokens that gives investors access to diamonds, much like how they trade other precious commodities, including through ETF-like structures on the stock market such as IAU, SLV and PLTM.

The company is bullish on diamonds as an asset class:

“Following 20% returns last year, the Diamond Standard Coin has continued to generate a positive return this year, while the S&P 500 is down 14% and bitcoin is down 50%. Investors need a new uncorrelated asset class, and this capital will enable us to increase capacity and expand our offerings,” said Cormac Kinney, the company’s founder and CEO, in a press release announcing its funding round last year. The Wall Street Journal, Coindesk and Alley Watch also covered the fundraise.

Diamonds are different from gold or silver, however. While gold is gold, it doesn’t matter what shape it is. As long as it is pure and can be melted, in theory, every ounce of gold is worth the same as every other ounce of gold.

That isn’t the case with diamonds. The value of a diamond comes down to four qualities (known as the four Cs). I’ll let Tiffany’s nerd out here, but in short, it’s down to color, clarity, cut and carat (i.e., size). This means it’s hard to make an index fund of diamonds, because they differ in four different dimensions, and one diamond can rarely be swapped like-for-like with another.

For all of those reasons, I got super curious when Diamond Standard submitted its deck for review a while ago. Today, it’s time to take a closer look!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Diamond Standard has an 11-slide deck, and it says it submitted the deck exactly as pitched for its $30 million round. When you look at the full pitch deck, note that the numbering on the slides isn’t consistent (there are two slides numbered “4” in the lower right-hand corner and no slide 6). So in the list below I am using the PDF page numbers.

- Cover and mission slide

- Summary slide

- Solution slide (“Introducing the smart commodity”)

- Problem slide (“Diamonds are severely underallocated”)

- Market Opportunity (marked as slide 4 on the deck)

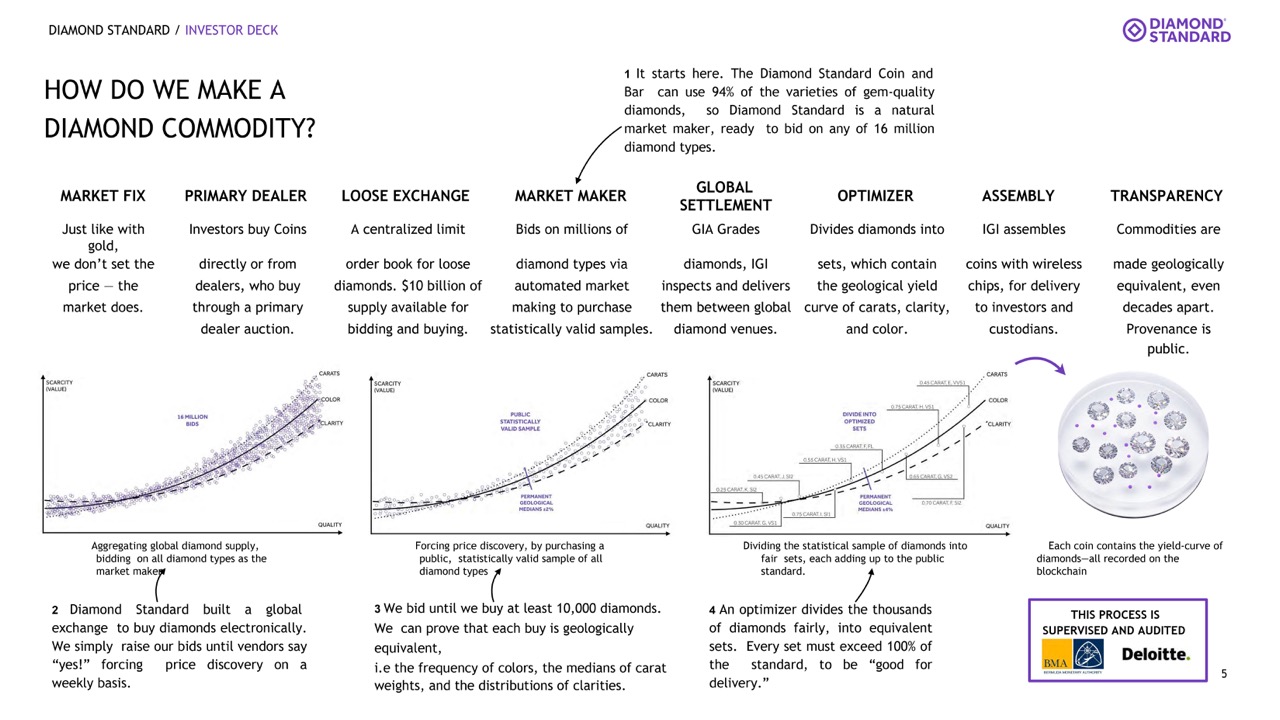

- Roadmap slide (“How do we make a diamond commodity,” marked as slide 5 on the deck)

- Product slide 1 (“Diamond Standard Exchange”)

- Product slide 2 (“Diamond Standard Recycling”)

- ESG slide (“Diamonds are a powerful ESG investment”)

- Founder slide

- Organization slide

Three things to love

For those of you who’ve been following the full pitch deck teardown series, you may have noticed that there’s quite a lot of information missing from this deck, even just based on the list of slides. I’ll get to that in a moment because we do have some highlights to celebrate first.

Opening with the mission

I often advocate for a strong slide 1+2 combo to set the tone for a pitch. Diamond Standard takes that to the next level by putting its mission on the very first slide. It’s a refreshingly direct way to start:

Diamond Standard’s choice to put its mission front and center is a solid one. It lists its core mission (“To benefit investors by establishing diamonds as a liquid hard asset like gold.”) and then goes into some of the more tactical aspects of what it’s doing: creating digital assets that can be used to create fungible diamond commodities, enabling liquidity and creating diamond-backed futures, options, funds and exchange-traded securities.

There’s a lot going on on this slide and I’m sure designers would have a thing or two to say about how it’s put together. But it accomplishes something really important: It explains with great clarity the what and how of the company’s planned operations. That’s a hell of an accomplishment for a complex business such as this, and putting that information front and center is downright inspired.

Cracking the diamond conundrum

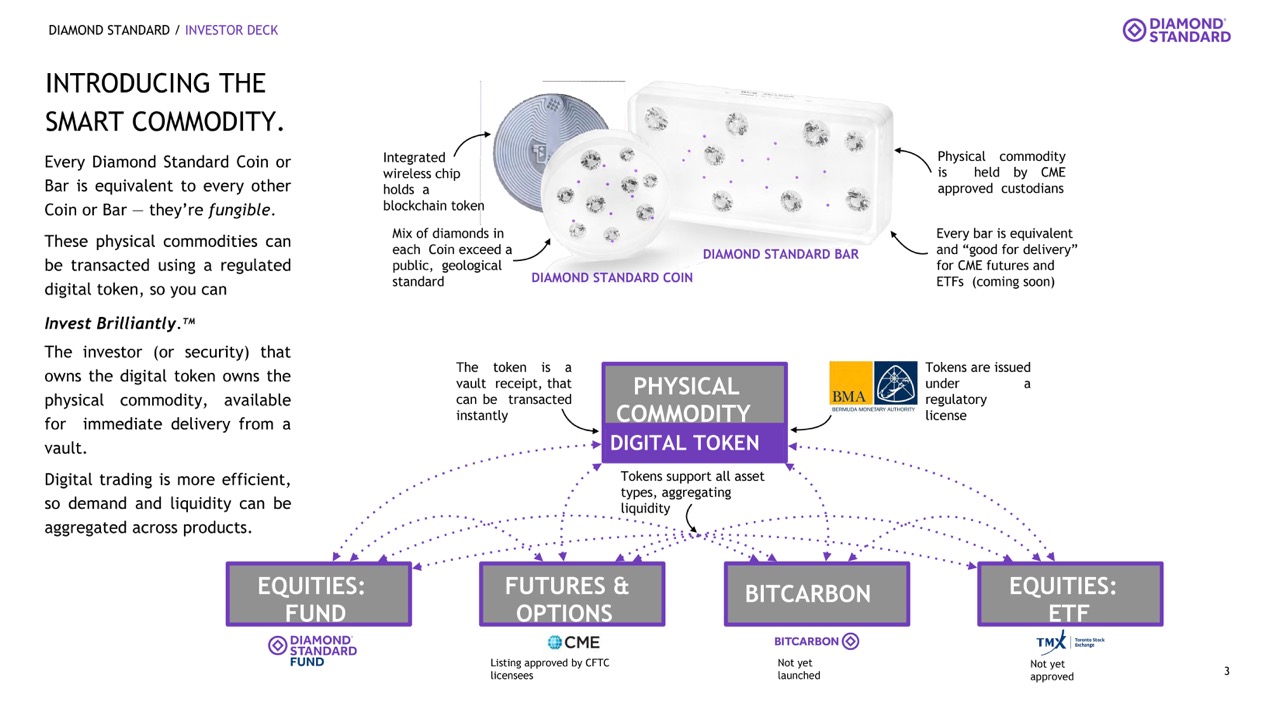

Remember what I said about diamonds being different and, therefore, hard to commoditize? Diamond Standard has a solution: It puts a bunch of diamonds into a single coin or bar and claims that averages out the diamonds’ value, making each unit fungible. In other words: Every unit should be worth as much as every other unit.

Diamond Standard’s way around the individuality of diamonds is pretty clever. Instead of arguing over the individual value of a diamond, it simply heaps a bunch of diamonds together, puts them into a single unit (called a coin or a bar) and slaps a blockchain token onto the unit. The bars of diamonds are kept in a CME-approved storage facility, and the bars and coins can be sold based on who holds the digital tokens.

If you want your actual bar or coin, you can request it to be shipped to you so you can bury it in a hole in the ground behind your house, keep it in a safe or juggle them while giggling maniacally.

Again, this slide isn’t going to win any prizes for design (What are all of those arrows for? Why so much text?), but it does have a major benefit: It explains how the company solves one of the core problems with turning diamonds into a tradable standard without having to go through an inspection by a balding, belouped diamond expert called “The Head.” I also hereby admit that all my knowledge of the diamond trade is from watching “Snatch” a couple hundred times, so perhaps take that part of my commentary with a couple pinches of diamond dust.

A hell of an opportunity

For Diamond Standard to make sense, you have to believe three things:

- Investors will want to continue to invest in precious commodities.

- Diamonds could be one of those commodities.

- Diamond Standard’s approach to turning diamonds into such a commodity makes sense.

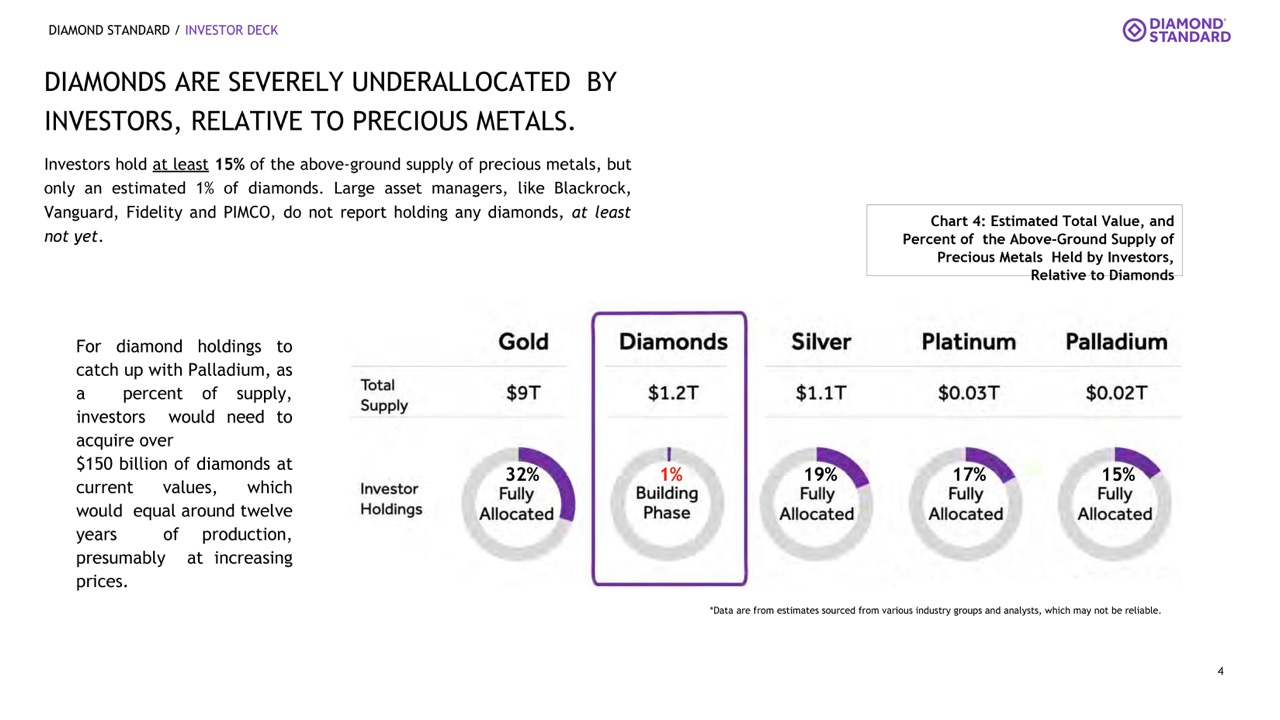

If I were to summarize this slide, I’d say “A rising tide raises all boats, and a tide is a-coming.”

If (and that’s the big “if” here) Diamond Standard can convince investors that this is a new commodity worth trading, it’s easy to see that there’s a huge market available for the picking here. For starters, there will be a speculative opportunity as the market picks up, and once it saturates, there will be an ongoing opportunity for buy-and-hold investors — the same category of investors who buy precious metals.

What you can learn from this slide is that if you can visually align yourself with a competitive alternative to a few huge, well-established markets, you’re in a really interesting and compelling position as a potential investment.

Three things that could be improved

I’m not gonna lie, there is a lot that I absolutely detest about this deck. The design is awful. There’s a lot of data missing, and based on this deck alone, I suspect the company would’ve had to suffer through a long and painful due diligence process to raise its funding.

Having said that, the company did raise $30 million from an illustrious group of investors (co-led by Left Lane Capital and Horizon Kinetics) and I suspect that the opportunity was simply too big to let a subpar deck get in the way of an investment round.

In the rest of this teardown, we’ll take a look at three things Diamond Standard could have improved or done differently, along with its full pitch deck!

Where’s the receipts?

One way founders can prove the viability of what they are building is to show off the traction behind a product. I understand that Diamond Standard had to do some heavy lifting on the regulatory and tech fronts before it could go to market, but the biggest question I have about all of this is if it fundamentally makes sense.

Gold is gold. Silver is silver. Palladium is palladium. Platinum is platinum. All of these are high-value, relatively rare commodities with relatively stable prices. Diamonds are … fundamentally different, as described above. So if you tell me that investors are willing to trust diamonds like they trust precious metals, I’d expect to see some sort of proof — in the form of traction — that this makes sense.

Instead of traction, we get this:

This incredible slide contains 350 words or so, three graphs and no real answers about whether the buyers of these blockchain diamond pucks agree that they are equivalent in some way with the more established precious metal commodities.

In fact, nowhere in the deck does the company seem to say much about demand. There are no quotes from traders, it doesn’t cite any market research as to whether people are willing to accept diamonds as commodities and no letters of intent are referenced. Given that this is one of the most obvious core issues with diamonds as a commodity, I’m very surprised it’s not been addressed in the deck.

Why is this the right founder?

The company’s founder and CEO is Cormac Kinney, who has quite the track record as a serial entrepreneur. However, the question a team slide should answer isn’t whether someone is a great founder (that helps, of course), but whether they are a great founder for this particular market.

I was about to lambast the company for the lack of relevance on this slide when I looked up the founder’s LinkedIn page. I found that his most recent venture was Flont, a company that, per Forbes, was working to “change how people buy fine jewelry online,” and it appears Flont later pivoted to a jewelry rental company. The site is no longer online, but the Internet Archive gives us an idea: $60 per month jewelry rental.

It’s truly mind boggling to me that Kinney’s five years of experience in the jewelry industry didn’t warrant a mention on the team page of a company that’s doing something related to diamonds.

You can learn from this slide that you must remember what investors are looking for: Founder-market fit means that, as a founder, you have an unfair advantage in the market you are about to enter. If you have it, flaunt it. Or flont it, in this case.

ESG, tho‽

I get that everyone wants to be on the eco-train, but buying diamonds and encasing them so you can put them on the blockchain … .

This slide reads to me as greenwashing bingo. Reading between the lines, what I think I am seeing is: “Hey, we found a cheap way to get diamonds that we can use for our coins and bars, which is giving people an option for selling their loose diamonds.” That’s fine. As a company trading in would-be commodities, it’s fiscally responsible to try to get the best deal you can for the diamonds you’re buying.

Calling it an ESG investment is … a pretty bold stretch. At the very best, if Diamond Standard is very successful, demand for diamonds will go up not down. Given how diamonds are mined (or conjured out of thin air with significant energy expenditure) and the fact that the company is planning to use 85% recycled diamonds (and, therefore, 15% non-recycled diamonds), my sense is that you have to squint so hard that you’re practically closing your eyes for this to make sense.

On top of that, blockchains aren’t known to be the most eco-friendly (of course, there are exceptions to that rule) and there are remarkably few details available about how Diamond Standard tackles the blockchain side of its business.

As a startup, it’s probably a good idea to think about how ESG plays into the full life cycle of the business. If you’re claiming that you’ll have positive effects, it’s important to back that up. A big reason to include ESG in your pitch is if you want to appeal to investors who have that as part of their investment criteria. Those investors tend to be pretty strict on what passes as a climate-friendly or ESG-forward investment.

I’m willing to concede that Diamond Standard might pass muster, but I’m not immediately convinced based on this slide.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment