Insurance is one of the few industries that have remained largely unchanged over the past few decades at a low level: You suffer losses as a direct result of something going south, and you get paid by your insurer.

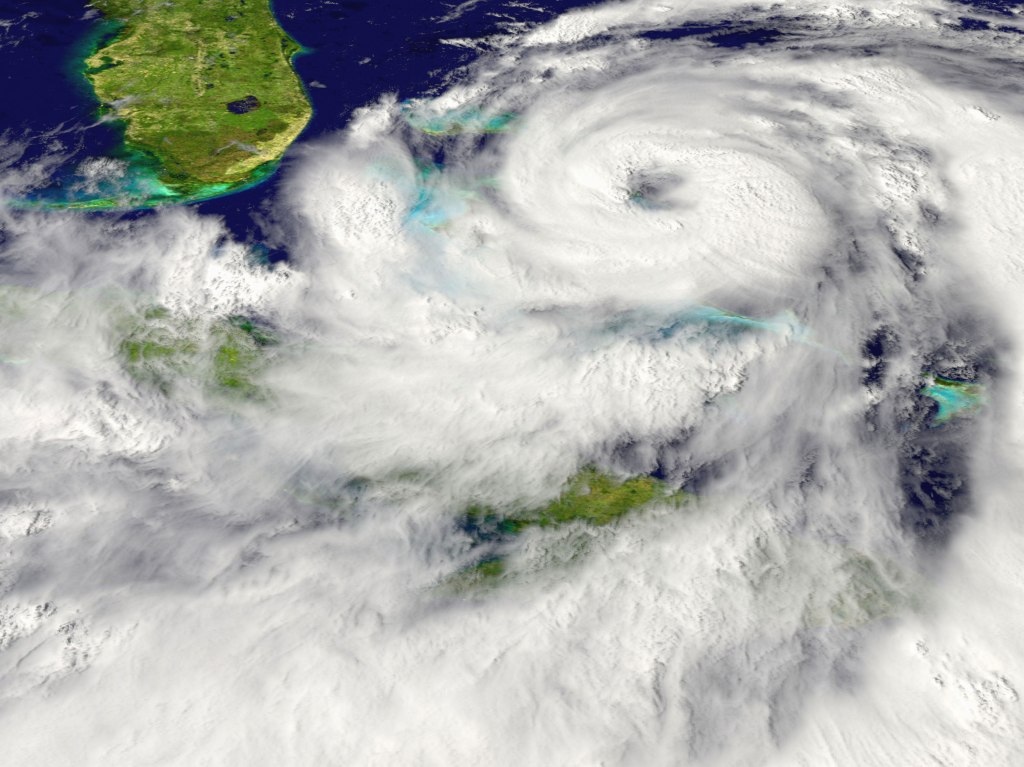

But that old model doesn’t always work. For example, a construction company in a region regularly affected by hurricanes might see its projects surviving these storms mostly unscathed, but it might still see losses in terms of time and other potential costs because crews simply couldn’t make it to work.

Your traditional indemnity policy might pay this company based on the magnitude of its losses but wouldn’t have to pay for those unforeseen, follow-on costs because they aren’t “damages” in the usual sense. One could argue the company is getting the short end of the stick here.

Parametric insurance, on the other hand, ensures that everyone can win. Instead of insuring customers based on the magnitude of the losses incurred, parametric contracts insure customers against the magnitude of events. So in our example, the construction company may see a payout if there is a certain “trigger event,” such as the area is hit by a Category 4 hurricane or higher, or if the wind speed reaches a certain, pre-specified mark.

Investor Nina Mayer, a principal at Earlybird Venture Capital, defined it quite succinctly in our recent insurtech survey:

Parametric insurance (as opposed to traditional indemnity insurance) is an insurance type that pre-specifies the amount of payout based on concrete “trigger” events. For example, the payout could be linked to a certain weather event, such as the height of a river above the flood point.

This type of insurance is also called index-based insurance because it relies on data and automation, a combination that explains why this approach is enjoying tailwinds. Instead of filing and reviewing claims, both parties can rely on information showing that a trigger event occurred.

Leveraging data in this way makes the process more efficient for both the insurer and the insured. “The key advantages of parametric insurance are fast payouts, high flexibility and the option to provide coverage for losses that are difficult to model,” Mayer said.

The fast payouts that this model facilitates make it particularly useful for weather-related insurance, where those affected are most benefited by quick access to funds. That is clearly evidenced by the number of insurtech startups building parametric solutions for this space.

Investor Florian Graillot, the founding partner at astorya.vc, said that “in terms of use cases, weather insurance has been the hottest topic so far both in terms of the number of startups launched in that space and by the scale of the most advanced players.”

Weather-focused use cases

Because parametric insurance doesn’t require filing claims, and because weather data is plentiful, it is particularly relevant when it comes to offering coverage to low-income farmers.

For instance, Igloo, a Singapore-based insurtech focused on underserved communities in Southeast Asia, recently started selling a Weather Index Insurance product in Vietnam that it described as the country’s first parametric insurance.

Similarly, IBISA uses an index-based approach to provide agricultural microinsurance to small farmers in emerging countries, starting with the Philippines, India and Niger.

Opportunities for parametric weather insurance also exist in high-income economies. For example, Hillridge hopes to help “farmers in Australia and beyond obtain weather-index protection,” according to its website, and Raincoat has similar plans in Puerto Rico.

Not all weather-related parametric insurance is targeted at farmers, either. For instance, IBISA backer Insurtech Gateway, one of the funds that recently participated in our investor survey, also invested in FloodFlash, which offers commercial flood cover to landlords and businesses.

What’s next

Beyond weather, “there are many other opportunities to tackle,” Graillot said. For example, parametric insurance can also be applied to risks related to cloud outages, travel or cyberwallets.

Regardless of sector, parametric insurance holds immense opportunity because there is still space for startups to bring solutions that address problems beyond property catastrophe reinsurance.

“Parametric insurance is a very exciting space; we’ve been discussing it for a few years now, but there are still only a few players delivering it at scale,” Graillot said. “Nevertheless, that addresses a real need in the market around what we call ‘new risks.’ Not every insurer is offering such products: The risk didn’t exist a few years ago, and it is growing fast. Hence, there is a real challenge to spot relevant datasets and get a sense of them through algorithms. This opens the door to more insurtech/insurance partnership rather than competition.”

Indeed, there’s space for startups to bring in parametric insurance to augment traditional indemnity products. David Wechsler, lead investor of insurtech at OMERS Ventures, explained it succinctly with an example: “So if you still want earthquake coverage on your homeowners insurance, adding an earthquake parametric product ensures a rapid, no-questions-asked payout in a time of need.”

As smart devices become ubiquitous, there’s ever more data for insurtech companies to harness. “The potential to collect real-time data via IoT devices will help to either prevent events from occurring or automatically trigger payouts based on certain parameters,” Mayer said. “Areas of insurance that could extract the most value from this might include home insurance, car insurance and crop insurance.”

Mayer even listed a bunch of potential applications: “IoT sensors can detect potential hazards such as leaks, fires or break-ins and automatically trigger payouts or even help to prevent those hazards. And sensors and devices installed in vehicles can collect data on driving behavior, such as speed, distance or location, and trigger payouts for accidents or other events that meet specific criteria, or again, prevent those accidents.”

We’ve already covered how the rise of telematics — smart car features — was leading to a shift in usage-based car insurance: Instead of paying insurance based on how much they drive, car owners could now pay based on how they drive. Combine that with parametric insurance, and it could make for another interesting trend to watch.

Comment