Back in February, Northspyre announced it had raised $25 million to bring costs under control for big building projects. (TechCrunch’s Mary Ann Azevedo mentioned the fundraise in her fintech newsletter.)

It’s a huge industry with powerful potential — so how does a company like that tell the story of what it’s building? We’re lucky enough to be able to share Northspyre’s pitch deck with you today. Get the crowbar; let’s break this thing open to see what’s inside.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

The company tells me it removed a few of the most financially sensitive slides from the deck before sharing it with us; what is left behind is a spectacularly well-designed, clean and clear deck.

- Cover slide

- Problem slide 1

- Problem slide 2

- Product slide

- Market size slide

- Solution slide

- Value proposition slide

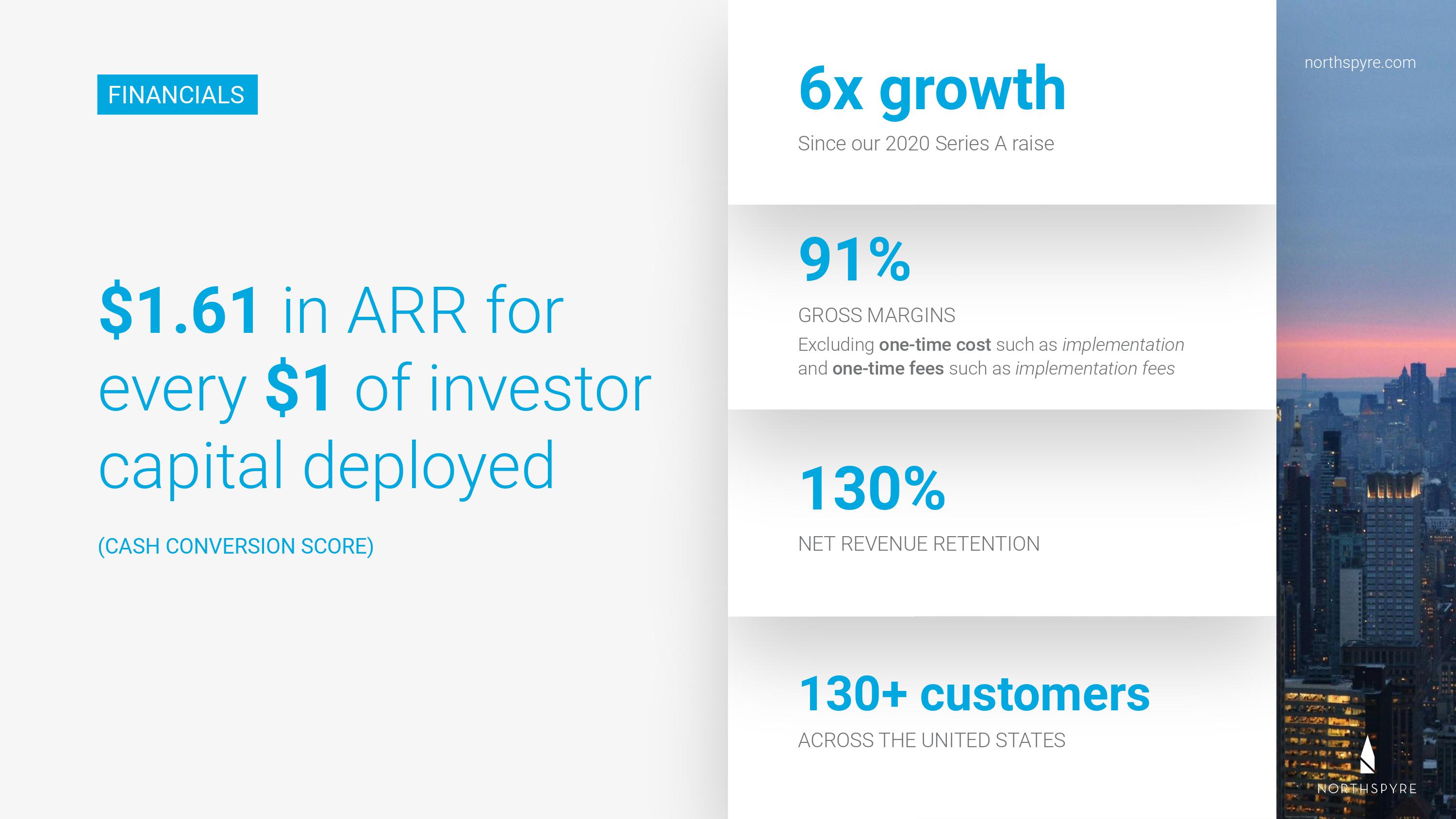

- KPI slide (marked as “financials” slide)

- “The ask” slide

- Team slide

- User testimonials slide

- Financing history slide

- Thank you and contact slide

Three things to love

Northspyre has a mature and well-designed deck that is a sight for sore eyes compared to many of the others we’ve looked at as part of this series. Here are a few highlights.

Gotta love this mic drop of a market slide

For some markets, you have to go in-depth to explain why this is a market worth going after. That’s particularly true for technology companies that are working in emerging industries. Construction ain’t one of those, and so you kind of get away with anything. Including:

A quick Google search gives U.S. real estate development numbers ranging from $2 trillion to several times that number. I don’t think anyone is going to argue with the fact that this is a big potential market, and you can probably get away with saying you’re taking a slice of that market and calling it a day.

However … the one thing to be careful of here: When you’re talking about market sizes, you’re not usually talking about the size of the full value of goods sold. If you are eBay, your market size isn’t the list price of all of the sneakers, video games and cars listed on the site; it’s the buyer’s fees and sales commissions of the same. In other words: The market size for eBay for the sale of a single PlayStation 5 is probably around $30 or so not $500.

Northspyre is getting dangerously close to making that mistake here: Even if the company executes with utter perfection, it isn’t going to become a $2 trillion company. To be fair, they aren’t necessarily claiming that here — and it’s probably irrelevant, given that the market is intuitively huge — but for a perfect score here, the startup could have figured out what its real TAM/SAM/SOM numbers are and have an intelligent conversation about that.

Be very careful about what it is you’re actually promising as your market size. By all means: Report the top-line number for the entire market, but you have to drill down from there to get the full picture.

Answers the “why” beautifully

It’s always a really solid idea to explain why and how a customer might benefit from using your product. This slide (combined with the market size slide above) tells a powerful story there. The company suggests that teams can save 2% to 6% of their build costs. Multiply that by the $2 trillion market size, and a picture starts to form: Northspyre is promising up to $120 billion worth of cost savings in an industry that is hungry to cut costs. It’s a great story, made even stronger by including a link to a return on investment calculator.

A fair few startups are unable to tell the “but why should I care as an investor?” story, and it’s a relief to see Northspyre avoid that trap. This is a solid value proposition and a great idea to highlight to your investors.

KPIs

The company has this slide listed as its “financials” slide. It isn’t; financials are usually presented either as an operating plan or as “proper” financials showing more in-depth spreadsheets or overviews of what the next three to five years of a company look like. This slide is mislabeled, but that doesn’t mean it doesn’t tell a helpful part of the story:

I would probably label this slide “traction,” or “key performance indicators,” or perhaps even “our story in numbers.” Whatever the right label is, these numbers aren’t kidding around: Six hundred percent growth since 2020 is awesome (although it would be good to know how it measures its growth — number of customers? Revenue? Number of projects?).

Gross margins of 91% are SaaS-level returns, and 130% net revenue retention is beyond impressive. It means that, on average, customers increase their spend with Northspyre instead of churning away. A customer count of 130 is less impressive — presumably, some of those aren’t the most important customers — but it shows that the company at least has a pipeline for acquiring customers that is scalable up to a point. Those are all positive.

The other great thing is that it shows that Northspyre knows what the important KPIs are: gross margin, NRR, growth and number of customers are all worth tracking.

The $1.61 of ARR for every $1 invested is a little fuzzier, and I’m less sure why this particular number is on this slide. If this is a historical number, I’d be eager to understand how confident the company is that it can continue along this trajectory. How sure is it that if it raises $20 million, it will have an additional $32.2 million added to its ARR figure by the end of the 12-month period? If that confidence is low (or comes with caveats), it means the company is peddling numbers that are a little on the vanity side of things.

Now, I’m not going to give Northspyre a hard time here. It has additional slides on financials that are removed from this deck, so it’s possible there’s other helpful data elsewhere.

But as a startup, what you can learn from this example is to ensure that you signal to your investors that you know what the most important metrics are within your business. Pair that with a “go to market” or “growth” slide to draw the historical lines into the future, and you’ve gone a long way toward highlighting why you’re worth the investment.

In the rest of this teardown, we’ll take a look at three things Northspyre could have improved or done differently — including how its product slide isn’t, in fact, a product slide — along with its full pitch deck!

Three things that could be improved

Northspyre is offering an interesting product in an enormous market, but that doesn’t mean it made its deck as much of a slam dunk as it could have been. Here are a few of the head-scratchers.

Erm, interesting product slide, there

I was a little surprised to find the product slide before the solution slide — usually, the product slide is tactical, while the solution slide is strategic — but in this deck, the order kind of works because the product slide isn’t, in fact, a product slide.

The product slide isn’t really a product slide, but it’s very good nonetheless. A product slide would say more about how, specifically, the product reduces the pain point for its customers.

That’s not really what’s happening here. Instead, this product talks about the target audience (“for real estate developers”) and does the vaguest hand-wave about the technology (“automation, data-analytics and AI”) and talks about the market opportunity (“Our customers each allocate…”). It also sets the vision/mission for the company (“Northspyre is the operating system for real estate development and capital deployment”).

So, er, there are good things happening on this slide — and I love the screenshot of the dashboard — but overall, this is one of the least satisfying product slides I’ve seen in a long time.

As a startup, it’s a good idea to read the assignment before filling out the answer; if you label your slide “product,” it had best touch on at least some of the things that investors are looking for in a product slide.

So close, yet so far

I love the huge letters peeking out from behind the skyline; that’s a nice touch. I’m also glad that there’s an “ask” slide at all. (Yes, you need one, and most founders — Northspyre included — get it wrong). But there’s a ton of information missing here that isn’t shown elsewhere in the deck.

It’s awesome that you’re launching new products — but what are they, how do they intersect with the current product offering and how does that facilitate market expansion? You don’t have to go into tremendous detail on the “ask” slide, but hint at it and add a separate product road map slide.

Scaling your go-to-market? Awesome, but what are the goals? “Scaling” means if you add one new customer, you can tick the box, and that’s not what we’re talking about.

Finally, “advancing our core road map” is essentially synonymous with “launching new products,” I believe (unless the company means its core product road map and has additional road maps for its other products).

This slide would be so much better if it were more specific. I’m 100% making these numbers up, but what if, instead, this slide read:

We plan to launch two new products in the next 12 months: One for smaller projects and one that helps builders avoid supply-chain-related delays. We’re planning to double our customer base to more than 300 customers and increase our ARR by 250% within the next 18 months.

By making the ask tied directly to specific deliverables, the investors will be able to do something super important: determine whether, if the company can deliver on those goals, it puts it closer to an acquisition or within range of the next round of financing.

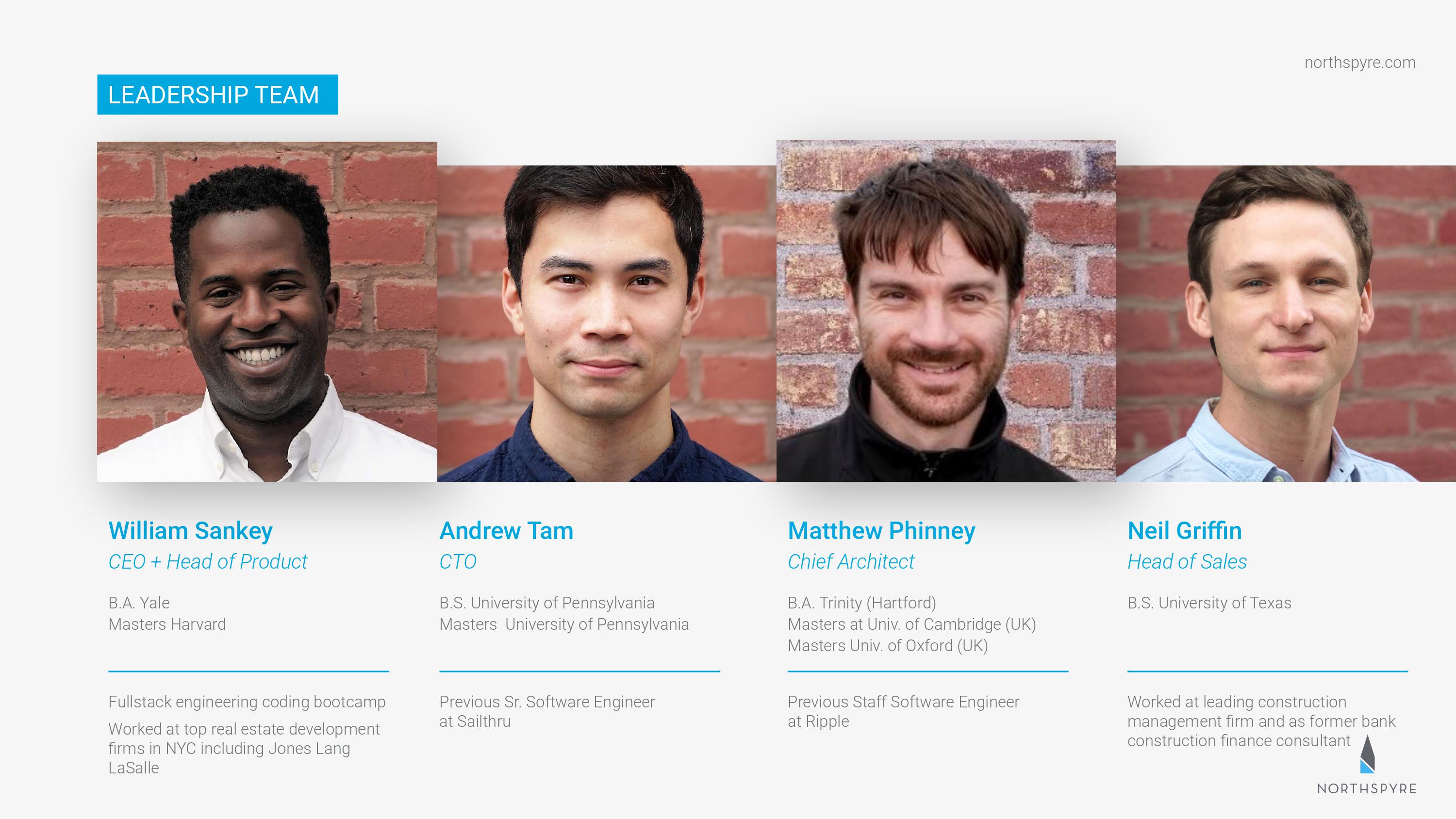

This is not a good team slide

Realistically, with the numbers Northspyre is delivering, it doesn’t really matter what its team is; it has gotten this far and delivered a lot of really great results. What investors are looking for, at this stage, is whether this team can deliver (or hire folks who can deliver) the outcomes needed over the next 12 to 18 months.

Let me talk you through what I see when I’m looking at this slide:

Negatives:

- Why does the CEO have an engineering coding bootcamp listed? That shouldn’t in any way be relevant to this stage of the company.

- Everyone has degrees, which is neat, but the company doesn’t list what those degrees are or give any hint as to whether they are relevant to the product or market space.

- “Senior software engineer” and “staff software engineer” aren’t job titles that make me think, “Yes, these are the right people to lead the technical development of a construction software platform.” Sailthru is a marketing automation company, and Ripple, if I’m not mistaken, is a crypto company of some sort. None of this makes me go, “Yes! This is the team I cannot miss out on!”

- No obvious experience with companies at this stage of growth.

- No previous startup founder experience listed.

Positives:

- Experience in real estate development for both the head of sales and the CEO.

- Diverse team (although it would have been good to have some women in senior leadership too).

Realistically, none of this truly matters; as we said, having great traction is good. But it also means that you can downplay the team slide even further. Remove everything that isn’t relevant: If the degrees are in spaces that make sense, include them and name the course of study.

In truth, what this slide tells me is that Northspyre is successful in spite of its senior team, not because of it, and perhaps that’s OK: It shows that they have staying power and the grit it takes to drive the company forward. If I were making this slide, I might include only the CEO and CTO here, list how many other staff there are and perhaps say something about the advisers or other investors that somehow de-risk this company.

Hiring is hard. Growing is hard. Building teams with coherent culture and structure is hard. Help the investors understand that you’re up for that.

As a startup on the fundraising trail, remember that having founder-market fit is one of the most important aspects you’ll be judged on. Do you have in-depth domain knowledge, and do you have the adjacent experience that makes this investment a lower risk, purely by you being part of the company? If so, shout about that on your team slide.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment