The IPO market thus far in 2023 has been a goose egg, and we probably won’t get any interesting IPOs for another quarter or two. This is incredibly sad for your friendly, local TechCrunch+ reporting crew who love an S-1 more than anything else.

The good news is that when we do get the IPO train back on the rails, we should be able to see a pretty good run of public-market debuts.

Let’s talk about why.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

If you delve back through Silicon Valley Bank research, which now feels rather different than it did two weeks ago, you can get a pretty good idea why institutions are not expecting a flurry of IPOs in the near future. In its State of the Markets report for the first half of 2023, SVB predicted that the market for “U.S. VC-backed tech IPOs will likely remain dormant in H1 2023.”

Thus far, that’s been 100% correct.

However, the bank also predicted that as “the market gets clarity on the [interest] rate ceiling [and] forward revenue multiples align with long-term averages and pent-up demand builds from institutional investors” and unicorns, we should expect no fewer than ten IPOs in the back half of the year from venture-backed companies.

When we first read that a while ago, it felt a touch optimistic. Why would we go from zero to double digits in such a short timeframe?

We’ve since gotten a bit more context. TechCrunch+ recently spoke with Arjun Kapur, a managing partner and founder at Forecast Labs, on the IPO question.

(Forecast Labs is a sister entity to Comcast Ventures. The latter is a venture shop that invests in areas of strategic interest to its parent company, Comcast NBCUniversal, a corporate amalgamation that stretches from internet access to cable television to content itself. Forecast, in contrast, trades equity for access to television advertising, essentially offering lower-than-market rate CPA-based advertising on the tube for equity. It’s a pretty interesting model for companies that want to reach a larger consumer audience but at a discount.)

Kapur’s perspective backs up SVB’s — he expects some consumer-tech IPOs in the second half of 2023, or early 2024 at the latest — but it’s more granular. Kapur argues that during the tail end of the last venture boom, lots of tech companies raised money at rather expensive multiples of the potential revenue they’d make in the future. He says that matters, because that potential for revenue growth disappeared at many of those companies when the market turned. This means that startups that raised capital at a multiple that would take them a few years to grow into are now in even worse shape than we previously thought.

If you mix in expensive venture round pricing with slowing growth and more conservative valuations, you get a host of unicorns stuck halfway out the IPO window, unable to retreat with grace to the private markets or exit to the world’s stock exchanges.

Not all the unicorns currently wedged between late-stage venture and an S-1 are going to survive, but the healthier ones should be able to get their books in order and pursue an IPO later in the year, per the folks on the ground in startup land. Time heals all wounds, etc.

Other voices are calling for a more liquid exit climate in the back half of the year, too. Fin Capital, which invests in fintech companies, expects not only a good chunk of startup M&A this year thanks to big tech cash balances, it also predicts the tech IPO market will unlock in the latter half of the year.

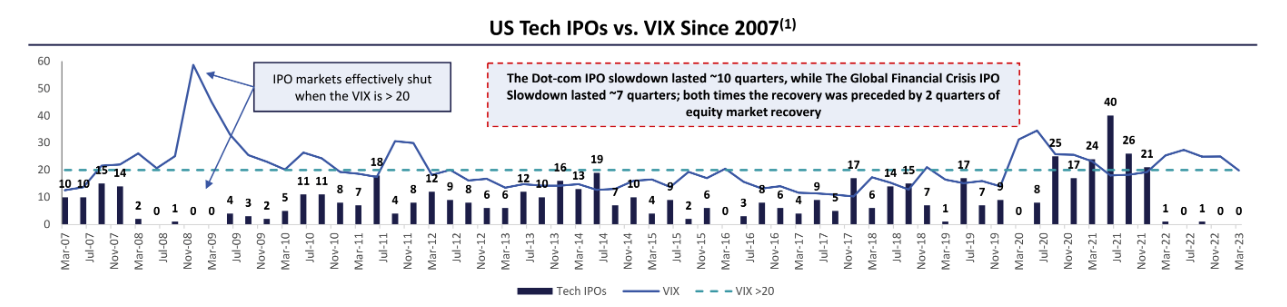

Notably, Fin brings market volatility (measured via the VIX) into the equation, noting that when the indicator is over a reading of 20, IPOs tend to evaporate. As the chart below from its Q1 Public Navigator presentation shows, we’re getting back to a VIX level where we could see the IPO market unlock:

Interest rates

Recall that SVB mentioned interest rates. Why do they matter in this conversation? As rates rise, riskier investments lose their shine and unprofitable companies see their valuations being compressed. Essentially, as low-risk investments yield more, riskier assets shed luster. We bring that up now because in the wake of the SVB crisis, we’re seeing investors expecting the pace of interest rate hikes to slow down.

Yes, it is ironic that SVB’s IPO predictions were predicated on interest rate optimism (more or less) and the bank itself wound up giving us a lot of clarity on that.

For tech startups, a more limited series of rate hikes could provide some lift in tech shares. That would lower the valuation pressure between their last private rounds and potential IPO pricing, helping kick off, say, the Instacart IPO or the Reddit IPO or some juicy B2B IPOs that we’d love to dig into.

Mix in the fact that we have seen a recent, modest reflation of tech revenue multiples, and the back half of 2023 is starting to look far more enticing than the first half of the year.

Fin also mentioned interest rates, saying that more “rate path clarity” for hikes would be “supportive for new IPOs.” We agree, but clarity about slower rate hikes would be even better, yeah?

I don’t want to promise anything, but it could be just a quarter or two until we are back to hammering away on S-1 filings like it’s 2021 all over again. Please, let it happen. We’ve waited so very long.

Comment