Raphael Mukomilow

After the challenging year that was 2022, one might think that the coming months are not looking great for VCs or founders.

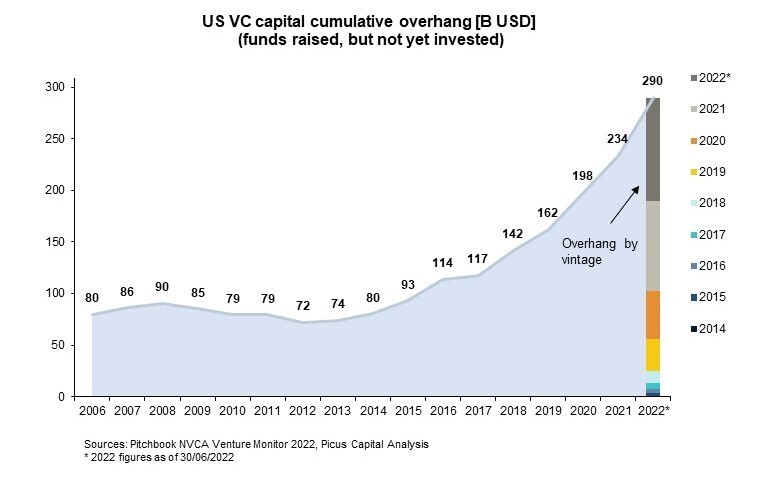

But, “dry powder” — money raised by VCs that hasn’t yet been deployed — has risen to record levels. Venture capital investors in the United States, for instance, are sitting on a $290 billion powder keg that’s ready to ignite a new wave of tech startups.1 Investors are understandably cautious. But if handled wisely, the payoff could be big, especially because valuations have normalized drastically.

But why has this happened and what does it mean for the tech industry? And why does the current market environment offer an unprecedented opportunity for investors?

Tech stocks are seeing significant valuation corrections

Tech stocks have been through a storm this past year.

The Nasdaq composite index has seen losses of 32% since last January. For instance, Meta, Amazon, Netflix and Google have seen their shares plummet by 63%, 45%, 48% and 34% since the start of 2022, respectively. For only these four stocks, such a decline has meant a decline of $2.3 trillion in market value — that is 1.4 times the cumulative market capitalization of all 40 companies in the TecDAX, Germany’s largest stock market index.2

Such declines were driven by a correction in valuation metrics. In 2021, the average enterprise value for listed cloud software companies was, at times, as high as 20x NTM revenues. Since the valuation correction in early 2022, multiples have normalized and are now at around 5x to 10x NTM revenues.3

But last year’s downturn also affected private-market startups. The average valuation of Series C rounds fell by about a third to $336 million in Q2 2022 from $500 million in Q4 2021.4

The lack of funding, skyrocketing layoffs, inflation and a recession have led some pundits to label the tough climate as the “startup apocalypse.” But despite these challenging circumstances, tech trends show signs of hope.

The tech sector has remained resilient

Strong growth in cloud and AI have kept key tech trends steady, largely in part due to huge shifts in the way we work. Spurred by the need to ensure they’re prepared for the future, organizations have poured money into upgrading their digital infrastructure and processes.

For example, global annual spending on cloud technology services rose 21% from 2019 to 2022 and is expected to rise by 19% until 2025. Meanwhile, global annual spending on digital transformation rose by 15% from 2017 to 2022 and is forecasted to grow by 12% until 2025.5

The current economic downturn should not be interpreted as an inherent crisis of the tech sector, nor as a fundamental change of trends, but rather as a normalization of valuations and funding levels. Demand for key tech markets remains consistently high, so the tech industry itself did not become less attractive than it had previously been.

All-time-high dry powder levels forecast future pace of investment

There has never been more capital waiting to be invested by VCs. Uninvested “dry powder” reached a record high of $290 billion in 2022, dwarfing the $117 billion of capital that was raised but had not been invested back in 2017.

Despite the downturn, strong cash supply and tailwinds for spending on digitization are leading some market participants to believe we’re in a strong investment cycle.

Carried interest, the share of profits earned by venture capital managers, could add another incentive for VCs to invest sooner rather than later.

Huge opportunities for VC investors and startups

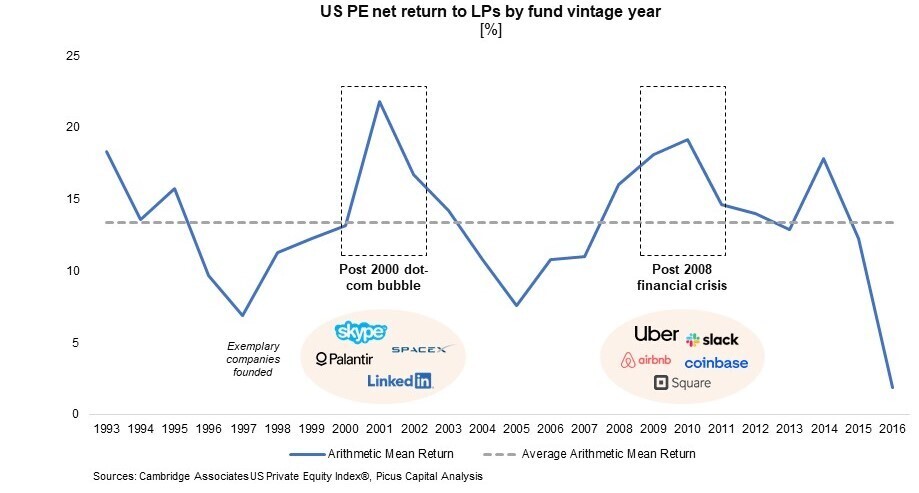

Steady tech trends, stock market corrections and record levels of liquidity in the venture capital and growth equity markets all point toward what could potentially become very attractive vintage years for the startup ecosystem and VC investors.

Historical numbers show that a crisis within the investment landscape has often been followed by years of systematic outperformance of returns, and history has a way of repeating itself.

When the dot-com bubble burst back in 2002, funds launched during and shortly after this period reported returns that were significantly above average. The same thing happened shortly after the financial crisis in 2008.

In both cases, U.S. private equity investors reported average net returns of 15% to 20%, compared to the 13% average return they saw in previous years.6 Fund vintages that were set up after downturns have systematically outperformed other investment periods and resulted in above-average net returns.

Local ripple effects of global trends

This financial motherlode could spell great things for startup investment across the world. We’ve also observed the same trends at a local level.

In Germany, for example, tech valuations have declined significantly. The TecDAX, which tracks the performance of the 30 largest German tech companies, had seen losses totaling 25% throughout 2022.

VC funds are today notably more cautious about where they’re deploying their funds. Investment volumes dropped 30% in Germany in the last year: Between Q1 and Q3 2021, German VCs invested $11.2 billion into startups, but in the same period in 2022, VCs only invested $8 billion.7

All this has led to an accumulation of dry powder. Top German VC funds recently announced that they have raised combined funds of €3.2 billion in the last three quarters — that’s almost as much as 2019, 2020 and 2021 combined (€3.5 billion).8

While crises often bring about new challenges, they also bring new opportunities. In this market environment, we see clear potential for VCs to lead the way and ignite the next wave of tech investment.

1 Source: Pitchbook NVCA Venture Monitor 2022, Picus Capital Analysis

2 Source: Capital IQ

3 Source: CapitalIQ via Meritech Capital 2022 “SaaS Crash“

4 Source: Carta State of Private Markets Q1 2022 Report

5 Source: Gartner, Statista, International Data Corporation (IDC), Picus Capital Analysis

6 Source: Cambridge Associates US Private Equity Index®, Picus Capital Analysis

7 Source: Crunchbase, CB Insights State of Venture Global I Q3 2022

8 Source: Picus Capital Analysis

Comment