This column would like to apologize for somehow missing the buildup to Getaround‘s SPAC combination, which was voted on yesterday and began trading this morning. I don’t know how we managed to get so far behind on this particular news item, but we will rectify our tardiness today.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Getaround allows consumers to rent cars from one another, taking a cut on the transactions. As you can imagine, it’s a marketplace-style company. It was a venture capital darling, raising hundreds of millions of dollars while private, including a $200 million round in 2019 and another $140 million in 2020.

It had a choppy early-COVID period but has since managed to announce and close a combination with a special purpose acquisition company.

Early direction of Getaround’s stock after the deal closed and it began to trade under the “GETR” ticker symbol has been sharply negative. Indeed, in the first moments of its trading under its own name, Getaround lost around 65% of its value. It now trades for around $3 per share.

Why did Getaround go public, and why has the reaction to its SPAC combination been so negative, so quickly? To get into our questions, we’ll examine its historical results and 2022 earnings through the third quarter.

Why did Getaround go public, and why has the reaction to its SPAC combination been so negative, so quickly? To get into our questions, we’ll examine its historical results and 2022 earnings through the third quarter.

Sound good? Let’s have some Friday fun.

Getaround and go public

This year brought about an end to the 2021 IPO rush. Last year, TechCrunch had multiple tech IPOs to track at any given time; it was delightful. This year, with tech stocks in the gutter, IPOs have dried up and the SPAC game has gone from red-hot to (nearly) entirely moribund.

So much so that the recent demise of two higher-profile SPAC combinations led many publications to all but close the casket on such transactions. Despite the doom and gloom, however, Getaround was busy.

The deal combined Getaround and InterPrivate II Acquisition Corp. As with other SPAC deals, Getaround is merging into the blank-check public company, with its partner changing its ticker symbol and name to the tech shop in the transaction. The deal means that Getaround becomes a public company and raises a packet of cash in the process. (Getaround claimed “$228 million of gross proceeds” in a release concerning the final transaction.)

Where the company was valued in the transaction depends on how you prefer to do the math. During its SPAC roadshow earlier this year, Getaround estimates that its value post-combination would be $1.18 billion in equity terms and around $900 million when measured along enterprise value lines (which include the subtracting of cash from the company’s equity value).

It’s worth less now that it has begun to trade, but those numbers indicate to us that the company’s deal valuation was material. Getaround was just around the unicorn mark in equity terms when it completed its combo, which might not compare incredibly favorably with the scale of capital that it raised while private — Crunchbase counts $568 million in total funding raised by the company during its life as a startup — but does make the debut big enough to matter.

So what are investors getting for their buck? Getaround posted net revenues of $40.4 million in 2019, $58.7 million in 2020 and $63.1 million in 2021. Its growth in 2020 and 2021, it should be noted, was in doubt at one point. Getaround cut staff in January 2020 and saw its top line dip when the pandemic initially kept a portion of its customer base home. As TechCrunch wrote in October 2020 when it closed the previously mentioned $140 million investment:

In January, the startup reportedly laid off 150 employees, reducing field operations and the size of numerous global teams. In March, bookings dropped 75%, according to CEO Sam Zaid. Getaround laid off 100 employees. Zaid pointed to struggles within SoftBank, which did a $300 million Series D round in the company in mid-2018, as part of the reason.

To go from that bookings collapse to full-year revenue growth was impressive. That Getaround managed to post even more growth last year is less surprising but still a welcome result.

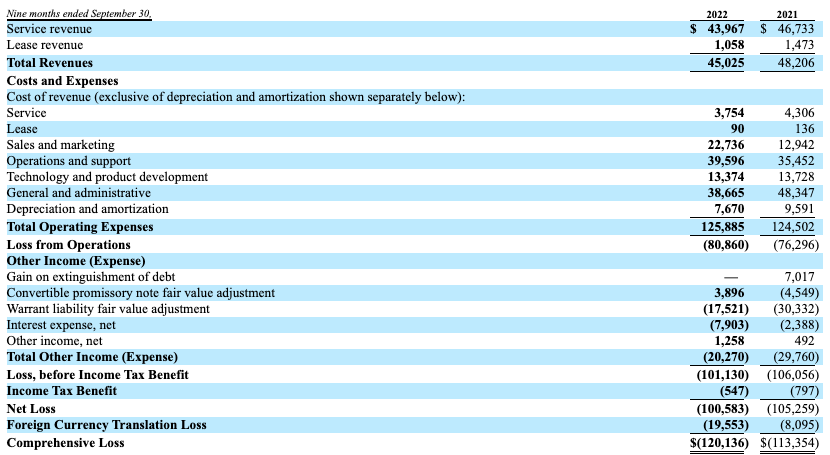

That said, Getaround was pretty darn unprofitable last year, and this year it is no longer growing as it once did. Per a November filing with the U.S. Securities and Exchange Commission, the company reported the following results through Q3 2021 and 2022:

Revenue declined when we compare the first three quarters of 2022 with the year prior, total operating expenses ticked slightly higher, and its operating and comprehensive losses ticked up modestly. Negative growth and rising losses are not usually the substance we see when a company goes public.

There is some nuance to the above numbers, including forex changes that clipped total revenue somewhat. But the overall picture that we get from looking at Getaround’s income statement is that this is a company of reasonable scale but far from profitability. We’re not only looking at GAAP numbers; Getaround’s operating cash burn was $63.2 million in the first nine months of 2022, compared to $53.3 million during the same portion of 2021.

It doesn’t look super strong.

So why go through with a SPAC deal if the company was going through a period of growth deceleration? With a limited cash profile heading into its SPAC combo — Getaround claimed cash and equivalents of just $27.2 million at the end of Q3 2022 — the company needed more capital, we reckon. It got that. But at a pretty material cost, namely a sharp reduction in its value.

Frankly, if we’re doing our sums correctly, Getaround is now worth in equity terms around its cash balance, giving it an interesting enterprise valuation, to say the least.

When we started to poke around the Getaround deal this morning, we had a spark of hope that perhaps it would combat the recent IPO freeze; perhaps this deal could cast a little light on an otherwise stagnant market for tech offerings. Nope.

Back to hibernation, folks.

Comment