On November 14, Nestcoin, one of the startups leading crypto and web3 efforts in Africa, announced that it was laying off several employees. At least 30 employees across various departments were let go, while those who were left at the company had their salaries slashed by as much as 40%, according to people familiar with the matter. The news is, in part, connected to the downfall of crypto exchange FTX, according to chief executive officer Yele Bademosi.

Bademosi revealed the news in a letter to investors enclosed in a tweet. He acknowledged that Nestcoin held assets, which the Financial Times pegs at $4 million, in the bankrupt crypto exchange platform FTX to manage operational expenses. Most FTX customers have been unable to withdraw their funds from the platform as the Bahamas-headquartered company goes through bankruptcy proceedings.

Bademosi also disclosed that FTX’s trading-focused sister entity Alameda Research, one of the investors in Nestcoin’s $6.45 million pre-seed round announced this February, had less than 1% equity in the startup. Other African companies that have received money from Alameda and FTX include Chipper Cash, Mara, VALR, Jambo and Bitnob.

There has been speculation that FTX and Alameda may have required their portfolio companies to hold their assets on the FTX exchange as part of their investment terms. However, it appears that if such terms existed, they didn’t apply to every company, or some may have turned down the offer. VALR, for instance, said it was never asked for said terms. FTX offered to invest in Bitnob via stablecoins, to be held in custody on the defunct exchange, but the Nigerian crypto platform declined, according to two people familiar with the matter. Both companies have publicly stated that they had zero exposure to FTX in the wake of its crash.

Mara confirmed to TechCrunch that it didn’t enter into any such arrangement and doesn’t have its assets sitting on the bankrupt crypto platform. Chipper Cash wasn’t exposed either, according to two people familiar with the company’s dealings with FTX. Jambo has yet to respond to TechCrunch’s requests for comment.

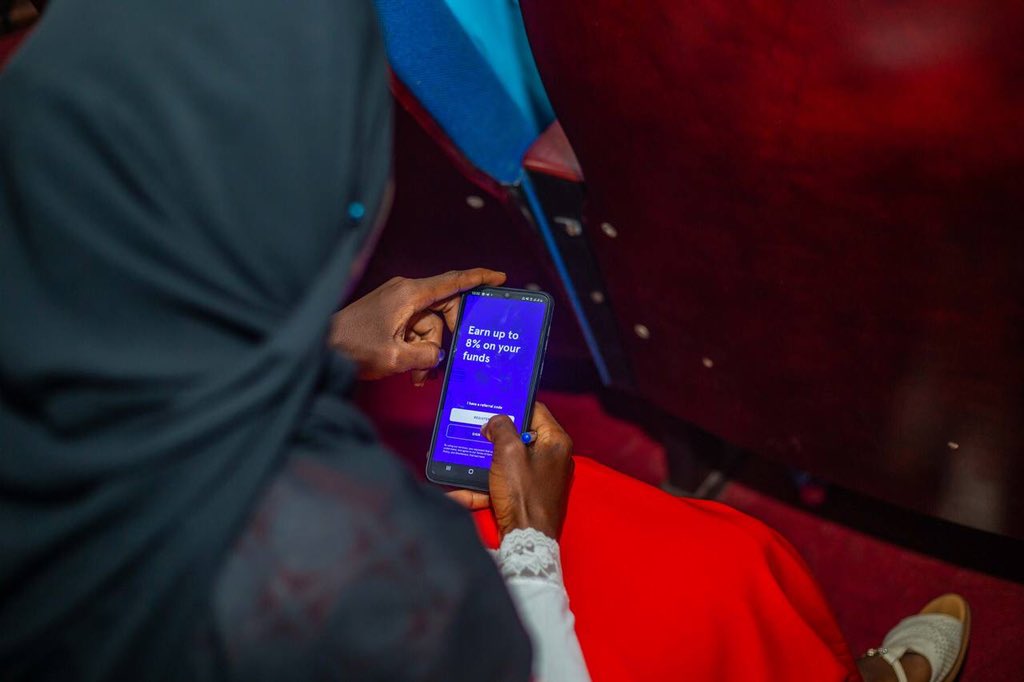

To many crypto companies and retail customers, FTX acted as a bank, offering an 8% annual interest rate on the stablecoin stored on the platform. It was the perfect marketing required to onboard several customers in Africa and challenge Binance, the world’s largest crypto exchange by volume, for market share. Before its demise, FTX managed to acquire over 100,000 customers in Africa, sources told TechCrunch. In addition to trading on the platform, these customers used FTX to convert their local currencies to dollars and gain yield on savings.

African web3 startup Nestcoin declares it held its assets in FTX, lays off employees

For the past two years, FTX built a considerable following among the crypto community in Africa by capitalizing on the continent’s unstable banking access and rapid adoption of cryptocurrency (mostly via remittance use cases). It’s also worth emphasizing that FTX’s business in Africa was not just another attempt to add to the platform’s overall volume; it was instead an area of focus for the company. Before FTX CEO Sam Bankman-Fried (known as “SBF”) saw his $32 billion crypto behemoth evaporate this month, FTX was processing billions of dollars monthly and planned to set up an office in Nigeria, according to two people familiar with the company’s dealings.

Integral to raking in these numbers, after just a few months in the region, were three full-time employees working remotely and a contract team of about 30 campus and trading ambassadors who preached the SBF gospel at college-wide events to anyone who cared to listen. However, following the events of the past two weeks that brought about FTX’s tumble, many of them, including local celebrities signed as brand ambassadors, have been left bemoaning their decision.

For example, on the day FTX declared bankruptcy, Harrison Obiefule, the PR and marketing manager for FTX in Africa, tweeted that he was in hiding and “getting threats and calls nonstop from celebrities, family and friends, and strangers.” Meanwhile, TechCrunch learned about retail customers who had various amounts of money locked up on FTX, ranging from $7,000 saved up for a World Cup trip to a celebrity who lost “millions of naira,” and a trader who had $2 million on FTX before the Sequoia-backed crypto platform imploded.

“All my UK ISA [Individual Savings Account, an account that allows users to save and invest free from UK tax] I saved for the past 15 years was what I lost,” Victor Asemota, a veteran of the Nigerian tech industry and strong advocate for FTX in Africa, narrated to TechCrunch on a call. “You know those days you’d laugh at people who lose money in Ponzi schemes. I never knew it could happen to me. This is the biggest Ponzi scheme ever. It’s crazy — it’s the last thing anybody expected.”

The repercussions for FTX’s meltdown are severe. FTX bankruptcy filings state that it owes money to over a million people and businesses after SBF used billions of dollars from customer money to prop up Alameda Research. But as FTX and its chief executive undergo criminal investigation, this event will push forward regulatory changes for crypto across various markets. In countries like Nigeria where the government previously banned cryptocurrency transactions through licensed banks and introduced a digital currency to reduce incentives for using unregulated crypto, the crackdown against crypto usage might intensify.

“The CBN [Nigeria’s apex bank] and regulators will argue that they were right for banning crypto,” said Asemota, who has invested in several crypto upstarts. “Those of us advocating for crypto all look stupid and they now look right because of FTX. I fear for crypto companies in Nigeria.”

Once valued at $32 billion, FTX marketed itself as a platform where people could safely trade crypto and make returns. Now valued at nothing, FTX owes creditors at least $8 billion. Its bankruptcy filing has also revealed a house that commingled assets and didn’t have its books in order. In one case, FTX erroneously included BTC Africa, the parent company of Kenya-based payment automation and settlement platform AZA Finance, and its subsidiaries as entities under its Chapter 11 bankruptcy filings. FTX, via a tweet, later retracted the statement and removed AZA Finance and its subsidiaries, among other entities, from the filings.

Press Release: Clarification on Certain Entities Not Included in Chapter 11 Filings. pic.twitter.com/rxmY2f2iTB

— FTX (@FTX_Official) November 12, 2022

This April, FTX announced a partnership with AZA Finance to roll out African and digital currency pairs and expand trading in nonfungible tokens (they managed to launch the fiat rails for Ghana and Senegal prior to FTX’s collapse). That partnership, according to some sources, morphed into an M&A play where FTX was close to acquiring AZA Finance pending regulatory approval. However, AZA Finance CEO Elizabeth Rossiello has denied the acquisition talks and told TechCrunch that both were just partners.

“You’re either a shareholder or you’re not, and they were not,” the chief executive said. “And if they were a shareholder, we would have had to file a change of control in the UK, where we’re licensed. It’s public record that it never happened. They didn’t invest in us, they’re not a shareholder, and there was no acquisition.”

For the people in the back who source incorrect information @FTX_Official was a client of @aza_africa full stop. 1) They were not shareholders and we are not affected by their bankruptcy or situation. They were very small clients as they had just recently launched

— Elizabeth Rossiello (@e_rossiello) November 11, 2022

While referencing FTX’s new chief’s statement on the company, Rossiello described FTX’s error as “a complete lack of internal controls” resulting from the resignation of its legal and compliance team. She also stated how unfair it was for small fintechs, including those with no access to customers’ deposits, to get highly regulated while platforms that held billions in customers’ funds such as FTX are held accountable to no one.

“Fintechs like us that have boards with much information and oversight even find it hard to raise money. But because some people look a certain way or tick a certain box, they get all the funding, no governance, no reporting, and no accounting department. I mean, it’s unfair and just goes back to the who gets funded question, which I think is the real story here.”

If you want to contact us with a story tip, you can do so securely here.

Comment