Bitcoin prices have continued to hold near $20,000 this past week, but some miners are crumbling as spiking energy prices and historically low hash prices cut into profits.

Even though bitcoin’s price has been down for a while and has fallen about 56% year to date, the dominoes just began to fall for bitcoin miners. What’s driving the implosion?

“There are a lot of different issues in motion. Obviously the global recession is looming, on top of inflation and rising prices of electricity,” Christopher Perceptions, founder of PerceptForm and CEO of NoCodeClarity (no-code web3 apps), told TechCrunch.

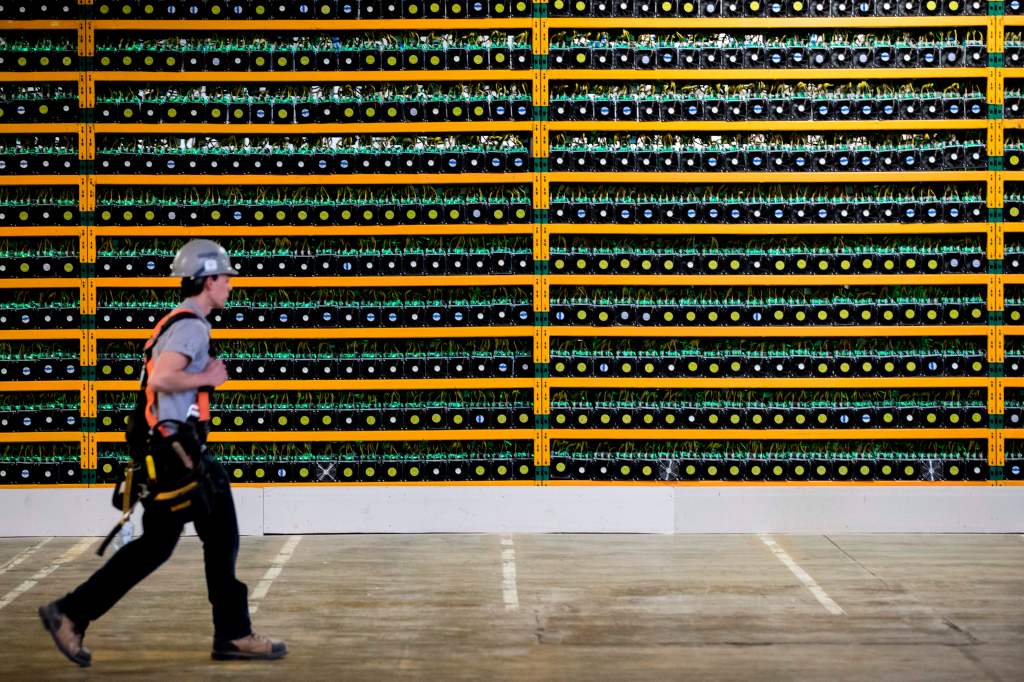

“Miners are struggling for a multitude of reasons right now,” Nick Hansen, CEO of crypto-mining firm Luxor, said to TechCrunch. “We’re seeing historically low hash price, which means that miner revenues are at all-time lows.”

Hash price is a metric to determine the market value for each unit of hashing power, which is set through changes in bitcoin mining difficulty (which is currently high) and the price of the cryptocurrency.

The hash price is near a historical low, according to data on Hashrate Index, Luxor’s bitcoin mining data analytics. The current hash price is about $70.72, down 80.5% from $361.82 on the year-ago date.

Additionally, energy prices have increased across many markets, which means miners’ expenses are at all-time highs, Hansen said.

At a high level, the higher the hash rate the greater the difficulty to mine bitcoin — meaning that it takes more electricity to do so, Perceptions said. “If the electricity price is high, it’s harder to make a profit.”

“The history of bitcoin mining is the history of managing the fixed cost for land, hardware, labor and security against the volatility of bitcoin prices,” Taariq Lewis, founder of Volume Finance, said to TechCrunch. “All bitcoin miners have proven that without control of the actual hardware design, they are terrible forecasters of bitcoin prices and the relevant revenues, and eventual profits, that those prices will control.”

Miners also have taken on debt, which puts a strain on cash flows. The amortization schedules are very aggressive at around 24 months, which puts a burden on free cash flows, Hansen said.

“Loans collateralized by mining machines have more aggressive amortization schedules due to the [return-on-investment] period of mining machines being generally quite short,” Hansen said. “In the past, the best models generally used a 24-month payback period for mining equipment, and after that, they would be considered obsolete.”

During the first and second quarters of 2022, about 70% of public bitcoin miners’ funding was in equity, while the other 30% came from debt, according to Hashrate Index. The amount of debt varies by miners, but the loan terms are generally 20%-30% for aggressive lenders, Hansen said.

The capital is mainly used to finance new mining machines, while some of the debt might be used for infrastructure or land, Hansen said.

“There was also a big movement for mining institutions to go public via SPAC last year [when] they were trying to grow really quick,” Perceptions said. “We talk about how we have to move fast, but that can come with a cost when you break within your own organization because you grew too fast and that may have happened for some mining businesses.”

On Monday, London-based bitcoin miner Argo Blockchain said a deal to raise $27 million, or £24 million, from strategic investors fell through. Its shares have fallen over 75% in the past month on both the London Stock Exchange and Nasdaq.

“Argo is continuing to explore other financing opportunities,” it said in the shareholder letter. “Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations.”

Because Argo has failed to raise additional capital, there is an increased likelihood that the bitcoin miner could shutter in the near future, according to a note by Marcus Sotiriou, an analyst at digital asset broker GlobalBlock.

In addition, Core Scientific, the largest bitcoin miner by computing power, warned investors last week that it may have to explore bankruptcy if it can’t improve its financial standing. Core Scientific’s shares plummeted over 82% in the past five days.

And the bitcoin mining pain doesn’t stop there — another firm, Compute North, filed for bankruptcy in September after owing up to $500 million to at least 200 creditors, according to CoinDesk.

“The team at Compute North are some of the smartest engineers and leaders that I have ever come across,” Lewis said. “Their struggle underlines the immense difficulty of even simply being a data center for bitcoin miners. If your customers are volatile and vulnerable when the climate for digital assets is in a downturn, then your business is volatile and vulnerable.”

But even with an uncertain future, mining investments are still transpiring. Last month, the largest crypto exchange by volume, Binance, launched a $500 million lending project for both private and public miners.

While this may be a bad time for big mining firms, now is “the time for the independent miner to shine” because they don’t have to rush and can take their time building out their operations, Perceptions added.

So what’s next for bitcoin miners? The answer is unclear.

In April, bitcoin mining execs and experts from Core Scientific, Hut 8 and Bitfury took to the stage at FTX and SALT’s Crypto Bahamas event to discuss the future of the mining industry. The focus surrounded maximizing efficiency and sustainability while pursuing regulatory clarity.

“All of us are focused on the issue of power provision,” Mike Levitt, co-chairman, co-founder and CEO of Core Scientific, said at the time. “We want to bring our costs down, but the fact of the matter is we are helping utilities and others bring more renewable power. Renewable power is less expensive power, and that wasn’t true 10 to 15 years ago, but it is now.”

Levitt and other panelists agreed it’s more attractive to run an energy-efficient business, to both shareholders and from a financial perspective.

“The recovery in this situation looks like one of two things,” Hansen said. “The price of bitcoin increases, which in turn raises hash price and reduces pressure on miners, or difficulty decreases significantly, which results in miners making more bitcoin.”

The latter is “highly unlikely,” though, Hansen said, since so many new-generation machines are on the horizon, which would make it more difficult for miners to get a share of the pie. “I would expect the only real respite comes from an increased bitcoin price.”

Comment