News broke this morning that UserTesting, a former startup that went public last year, is selling to private equity (Thoma Bravo, Sunstone Partners) for $1.3 billion, or $7.50 per share in cash. The deal, expected to close in the first half of 2023, does include a “go-shop” period, in case a better deal crops up.

Holders of UserTesting shares have some cause for joy. The customer insight platform is selling for what it describes as a “premium of approximately 94% over [its] closing stock price” yesterday. As a result, shares of UserTesting soared today as investors digested the news.

UserTesting dropped earnings this morning in conjunction with the deal news, giving us a window into its health. We can cross those numbers with the final price that UserTesting will command in the sale to improve our understanding of the value of smaller technology companies — at least when compared to the giants of their industry.

The lessons thereof are pretty simple and not great for yet-private unicorns.

Looking at the deal, it’s clear that single-digit SaaS multiples are not merely real but durable. UserTesting is exiting at a nearly 100% premium for a fraction of the price at which it went public last year. Unless the company is a financial mess, that’s terrifying for unicorns that raised money last year.

To understand the $1.3 billion price tag, we should start with a look at UserTesting’s recent Q3 results. To wit:

- Revenue: $49.4 million, up 28% year over year.

- Subscription revenue: $47.5 million, up 32% year over year.

- Net loss: $15.2 million, an improvement from $9.6 million in the year-ago period.

- Operating cash flow: -$500,000, an improvement from -$7.2 million in the year-ago period

These numbers are far from dire. Indeed, 28% to 32% growth puts UserTesting between the middle and high growth rates for public software companies today. Throw in huge improvements to its operating cash burn, nearing UserTesting into self-funding territory, and you might wonder why it’s selling at all.

Two things explain the transaction, I reckon. The first was growth deceleration; in Q2 2022, UserTesting’s aggregate and subscription growth rates were 36% and 40%, respectively, each far stronger than the numbers that the company put up in Q3.

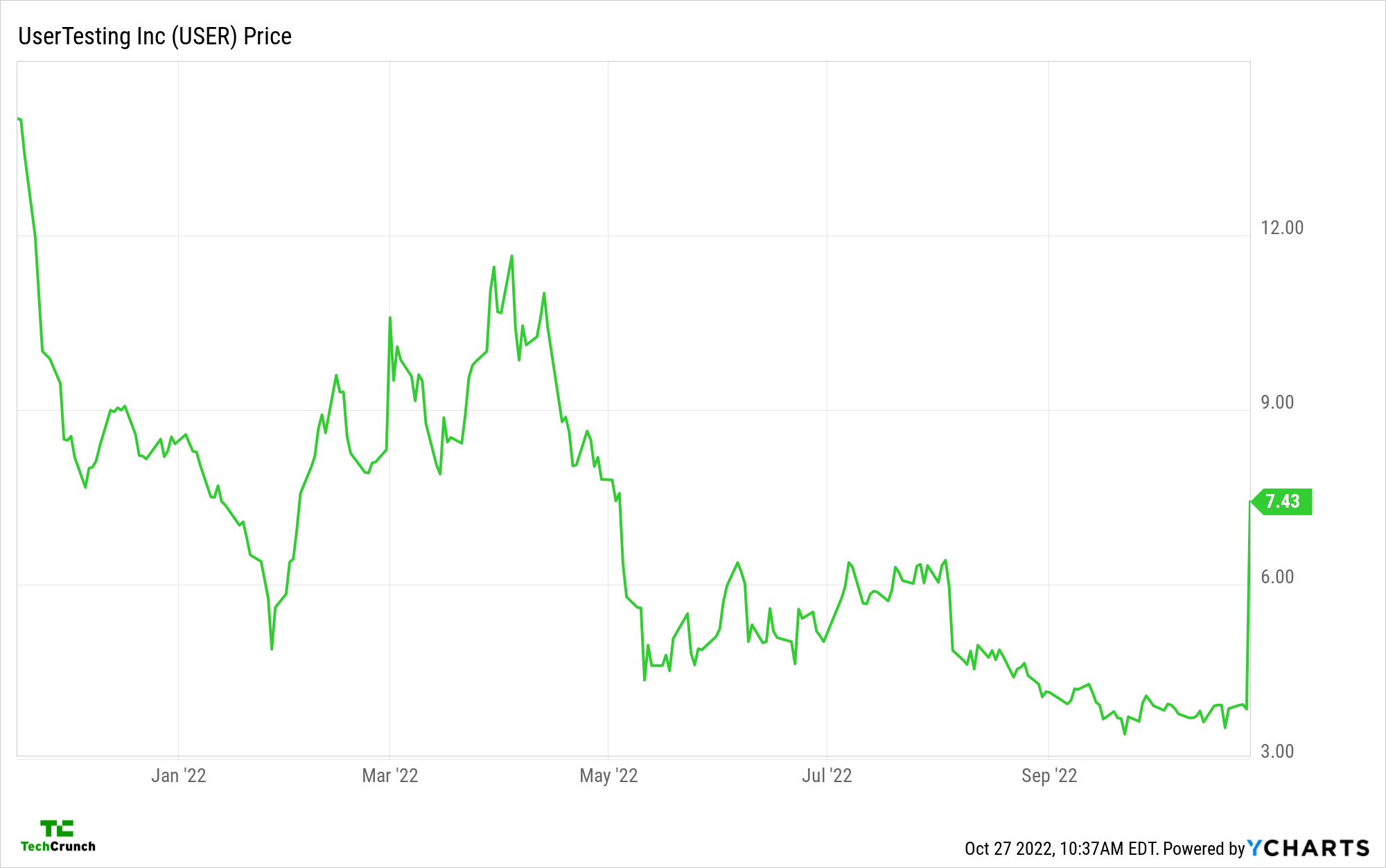

And its share price had fallen so far that it was effectively on fire sale. Here’s the chart:

From an IPO price of $14 per share, under the company’s hoped-for range of $15 to $17 per share, UserTesting’s value had fallen below $4 per share in recent days. Selling for $7.50 per share, then, helps UserTesting recover a good portion of the value it lost since its public-market debut.

It’s not surprising to see a yet-growing software company that’s nearing operational cash flow breakeven but trading near record lows get snapped up by private equity. (The plan is to combine UserTesting with another Thoma Bravo acquisition.) But what is a bit of a shock is just how much the investing class is picking up for such a small price.

UserTesting’s Q3 revenues put it on a roughly $200 million run rate. At a $1.3 billion price tag, it’s selling for around 6.5x its current top-line pace. That multiple falls further if we consider its NTM revenues, or those we might expect it to generate in the next four quarters.

With UserTesting’s multiple not set at a “fair” price, per se, but rather at a price that will allow external investors to buy it lock, stock and barrel, you really do have to wonder what fraction of unicorns are worth even $500 million, let alone $100 million. Recall that in May we noted data from Bessemer indicating that 150 out of around 1,000 unicorns had reached $100 million worth of annual recurring revenue.

That means, as you can quickly deduct, that 850 had less than $100 million worth of annual recurring revenue (total unicorn counts vary by source; all note 1,000 or more, globally). If they all got the same multiple that UserTesting was just served for a whole-cloth buyout, the number of actual unicorns in the market could get very, very thin.

This is why we aren’t seeing IPOs today, frankly. So many companies went public last year at prices that this year’s investing climate won’t support. To such a large degree, it turns out, that even a sale premium can’t get UserTesting back to a bit more than half of its IPO price. Damn.

You wonder if the markets even could recover enough in the next four or eight quarters — more on this subject tomorrow, by the way — for unicorns to hold onto their billion-dollar valuations, let alone improve on them, even if we bake in growth along the way in our math.

Unicorns were once rare. Then they became pretty common for a few years. It turns out that unicorns stayed rare — it was just that a bunch of startups got to cosplay for a while there while money was too cheap and too available.

Comment