Daniel Hoffer

Commerce is as old as humanity, and yet innovation in how to build better and more efficient companies not only continues but is accelerating. Although many forms of business innovation exist, marketplaces seem simplest at first glance, but they have evolved significantly from exchanging goods in the town square to digital forms that keep growing increasingly efficient. Marketplace CEOs can reframe their thinking about marketplace structure in a way that increases the availability of popular products and enhances the customer experience while minimizing capital outlay.

The fundamental definition of a two-sided marketplace is some sort of platform through which buyers transact with sellers, or, alternately, “demand” transacts with “supply” (two-sided is considered to be the most “classic” marketplace structure, though three-sided and n-sided marketplaces exist, too). The marketplace itself can be a digital platform, technological or human middleman, or even a location, and its value is determined by how efficiently and effectively it facilitates transactions, and, if you’re an investor, how quickly the marketplace is growing, how much money the marketplace itself makes (“rake”) and how defensible it is from potentially competitive marketplaces and disintermediation, among other things.

Retailers are a familiar example of marketplaces, because they aggregate products from multiple manufacturers (“supply”) and offer the aggregation to consumers (“demand”). During this exchange, the retailers must pay upfront for the products that they subsequently mark up and sell.

In the last 15 years or so, the “sharing economy” gave rise to a new form of marketplace: the “asset-light” marketplace. Venture capitalists celebrated potentially the most valuable form of marketplace ever and funded the likes of Uber, Lyft and Airbnb. There are key differences between asset-light marketplaces and more traditional marketplaces. While a retailer purchases the shampoo before selling it to the consumer, and the taxi company purchases the cab, Uber does not purchase the car before making it available, and Airbnb does not purchase the house before renting it out.

Asset-light marketplaces manage to make money from things they don’t own or even fully control merely by facilitating the introduction and payment between the supply and the demand. Yet, these “asset-light” platforms own the relationship with the customer, can scale without the capital investment required by “asset-heavy” marketplaces such as retailers, and ultimately generate so much money that they can transform entire industries.

While asset-light marketplaces have proven to be a powerful innovation, the asset-light model has limitations and has led, somewhat full circle, to the development of certain asset-heavy platforms that are better suited to meeting some customer needs.

If you’re Ozon and you want to ensure that the secondhand motorcycle works well before you sell it, you have to buy the bike so that a mechanic can tune it up and clean it before it goes on the market again. If you’re Rent The Runway, you buy the dress so that it can be dry-cleaned, repaired and rented out again as quickly as possible before it is resold (Rent The Runway’s 250,000-square-foot warehouse is the largest dry cleaner in the world).

If you’re Opendoor, you buy the house quickly and fix it up before flipping it on the market. This extra step in the business model that involves transforming the asset typically requires an asset-heavy approach in which you buy the item first; it is in the transformation where some of the value is created. These asset-heavy marketplaces are often called “heavily managed” marketplaces and require higher margins to cover the costs associated with carefully reviewing and often improving the goods.

Most venture capitalists prefer “asset-light” to “asset-heavy” marketplaces because the former typically require less capital — and therefore less dilution for their investors — to scale. But some asset-light marketplaces struggle to satisfy their customers because not all the assets they can make available are equally appreciated by their demand-side customers.

For example, imagine you’re Lyft and have a subset of customers who require wheelchair-accessible vans. Sure, you have access to some of those, but do you have enough? Or you’re car subscription platform Drover (acquired by Cazoo) and your most popular cars get snapped up quickly, while the less popular ones languish much longer before they get rented out. (For the sake of simplicity, I am conflating the notions of hard assets alongside operations and services, since in service-related businesses there are operational elements at play that can generally be thought about similarly as hard assets.)

When you’re an asset-light marketplace, you’ve given up a lot of control, not just over the quality of your inventory (are your Lyft cars clean and is the experience positive?) but also over the selection of your inventory (does Lyft have enough wheelchair-accessible vans?). While the topic of inventory quality could merit an article of its own, my focus here is on inventory selection. Because sometimes you need to be more in control of your inventory selection to best serve your customers. If you’re the CEO of a marketplace, what’s the best way to think about inventory selection and achieve it?

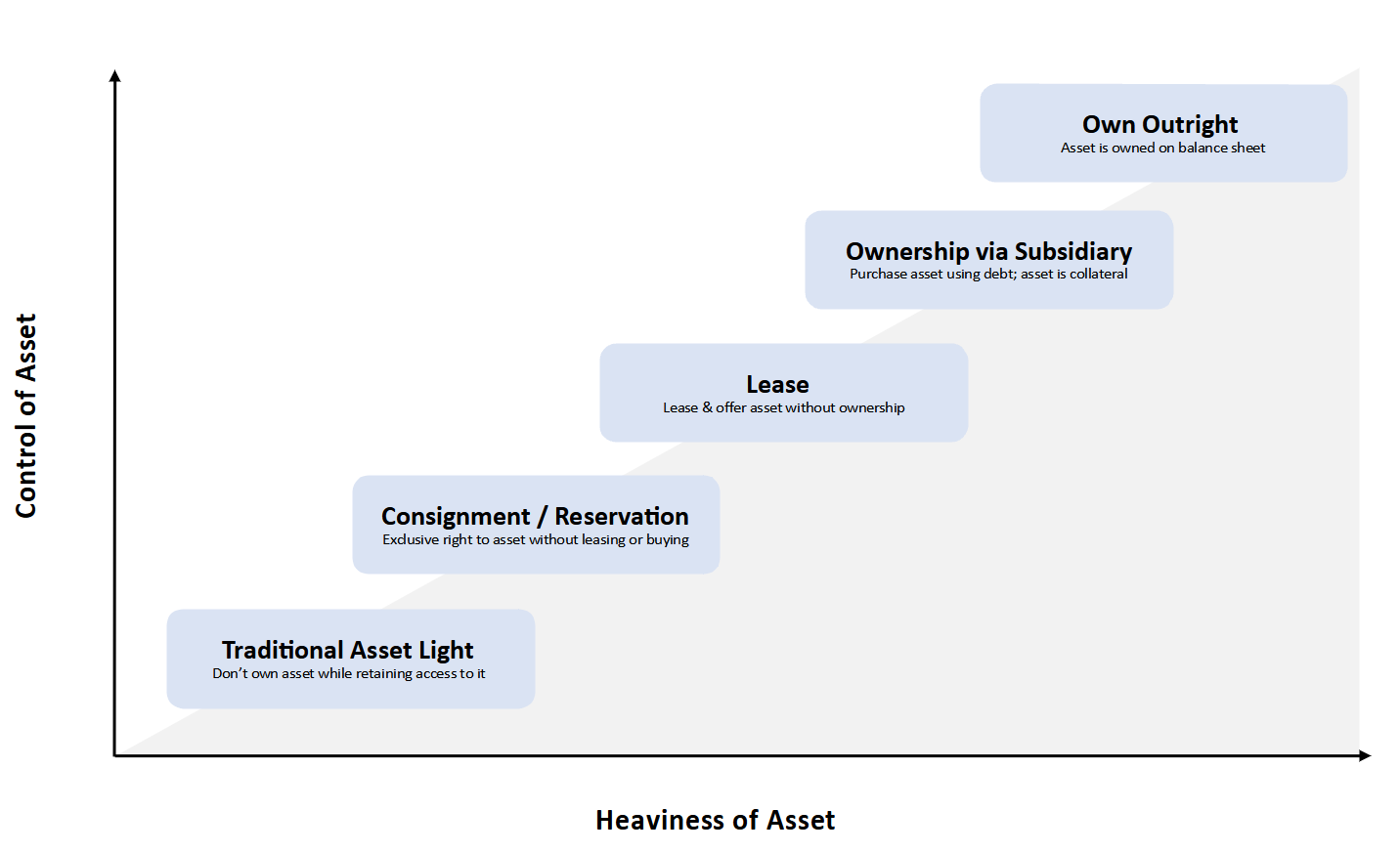

The “lightness” of assets in a marketplace belongs on a spectrum, because there are more choices than simply buying or not buying the asset you are selling. In order of heaviness (least to most), the options are:

- Don’t own the asset at all while still retaining access to it (the purest definition of “asset-light”).

- Reserve the asset without leasing or buying it. This requires willingness from the asset owner to make it available only to you and not to other parties as well (which they might be open to because the asset doesn’t depreciate from use in this scenario). Consignment models typically fall in this category.

- Lease (and use) the asset without owning it. From a capital perspective, this requires the ability to pay a recurring amount of money to retain access to it (though much less than actually owning it).

- Purchase the asset using debt and create a separate company to hold the asset (the asset itself often serves as collateral for the debt).

- Purchase the asset and put it on your balance sheet (this is maximally “asset-heavy”).

Importantly, CEOs don’t need to be locked into just one of the structures above. They can mix and match the above to achieve the most capital-efficient profile of asset-heaviness for their business. Within the same company, some assets can be made available via a purely asset-light model, while other assets may be available on a consignment/reservation basis, and still others that are subject to the highest demand might be purchased.

Some companies start out as asset-light or asset-heavy and then evolve in the opposite direction along the spectrum. In 2020, Lyft, which pioneered the asset-light model, moved toward an asset-heavier model by purchasing Flexdrive, which operates a fleet of rental vehicles composed of owned vehicles as well as vehicles leased from third-party leasing companies. Lyft has also recently embraced an asset-heavier model through its entry into micromobility (electric scooters and bikes).

In general, the heavier the model, the more control the company has over the customer experience, including the selection, quality and instant availability of the asset, as well as the option to somehow improve the asset. When availability of the right sort of asset is in question, an asset-light model may make sense for less in-demand assets, while for more in-demand assets, one of the “asset-heavier” approaches outlined above may make more sense.

CEOs who are seeking to build their marketplace in a capital-efficient manner will be well served if they consider the full suite of options available to them on the asset-heaviness spectrum. Capitalizing on an asset-light approach can be one of the best ways to build a thriving and valuable marketplace, but savvy operators can benefit even further from this innovation by strategically considering when to embrace heavier approaches to maximize the availability of the most desirable assets and best deliver a superior customer experience.

Author’s note: Thanks to Raj Kapoor, Ezra Galston and Josh Breinlinger for providing feedback on this article prior to publication, and Logan Szidik for help with company research.

Comment