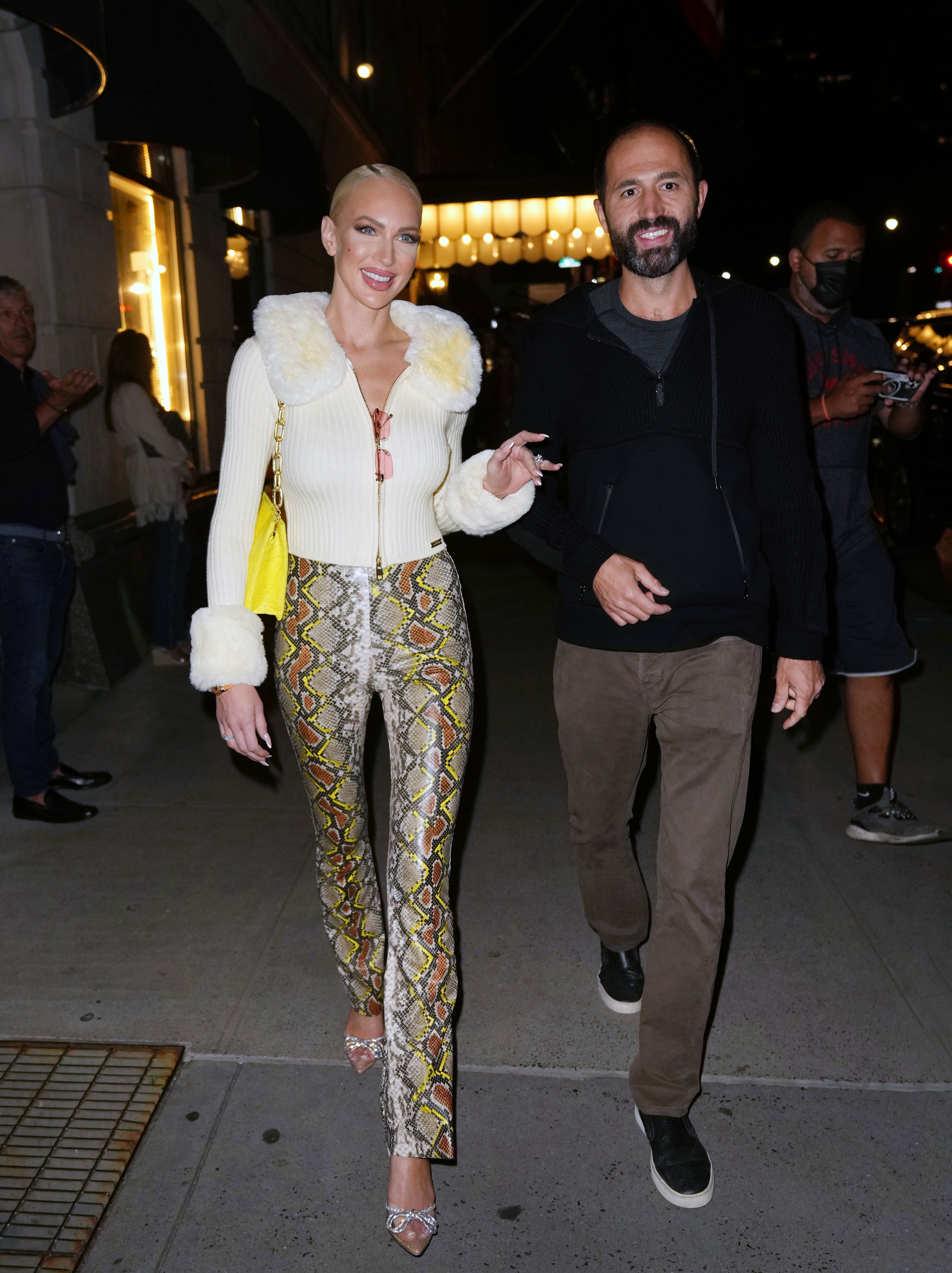

For fans of both reality television and web3 (hopefully that group includes more than just this reporter), Christine Quinn’s move to leave the Oppenheim Group and co-found a brokerage with her husband to serve the crypto-rich was quite the bombshell. Now, RealOpen CMO Quinn and CEO Christian Dumontet, who married Quinn in a swan-filled soiree on Selling Sunset season three, have finally shared some long-awaited juicy details about their company’s product roadmap (!!!).

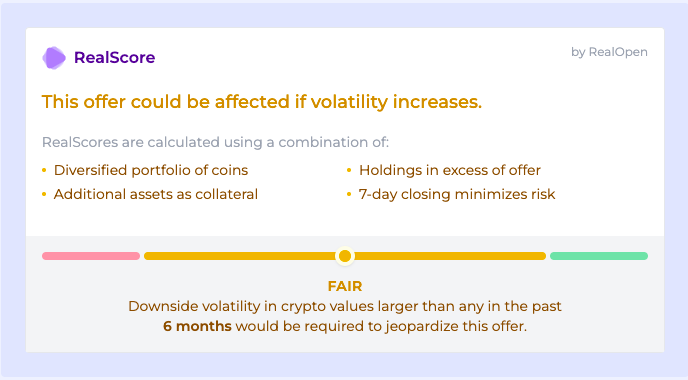

The pair sat down for an exclusive interview with TechCrunch to discuss RealOpen’s latest product, RealScore, a crypto credit scoring system for buyers and sellers of luxury real estate. Their brokerage primarily serves high-net-worth clients who want to purchase property using cryptocurrency. The RealScore software they have developed serves as a tool for both parties in a transaction to assess the strength of an offer, taking into account the mix of tokens used in the offer and attempting to predict their volatility, according to Dumontet, who previously founded and bootstrapped Foodler and sold it to Grubhub for over $50 million in 2017.

Before we got into how RealScore works, Quinn explained why a client would want to buy a house using crypto instead of cash in the first place. Crypto “whales” who hold a significant portion of their wealth in digital currency prefer to move fast in business, and buying property is no exception, Quinn said.

“I’m finding a lot of clients who actually want to close quickly because of the volatility [of crypto],” she said. “Because of that, we can choose the day, down to the minute, that they want to do so. We live in an instant gratification generation where people want things quickly. With a traditional home mortgage, you’re looking at a four-week close, or it could be longer sometimes [due to] inspection contingencies.”

Some of Quinn’s clients value speed so highly that they are okay with just seeing a property over FaceTime before agreeing to move forward with a deal, she said.

“I’ve seen people who have said, I’m good with the contingencies, I don’t care if there are termites or if I have to fix the chimney,” Quinn added.

Buyers pay RealOpen’s sellers in cash, which means they have to convert their crypto into dollars before closing a transaction, Dumontet explained. But they usually can’t wait until the last minute to liquidate their funds, because sellers need to be able to evaluate the buyer’s ability to pay before agreeing to the transaction, which can be complicated if the buyer holds crypto at the time of making the offer. For the buyer, converting crypto to cash triggers a taxable event that “can’t be undone,” Dumontet explained.

“The process of shopping for a home can take months if they’re looking at various properties. If it’s one of the more particular buyers, they’ve lost participation in the crypto market. They may have an excess of cash because they want to buy a property at price X, but they want to have a buffer above that because they’re not quite sure what the property prices are and what the seller will accept,” he said.

That’s where RealScore comes in — it is essentially the software engine that powers RealOpen’s brokerage. By using RealScore, buyers can defer converting their crypto into cash until the very instant the transaction closes without having to explain to a seller what the value of their offer is beforehand, according to Dumontet.

The platform allows buyers and sellers to see algorithmic predictions about the likelihood of price movement across the various crypto assets involved in a transaction based on historical data, Dumontet explained. The RealScore for an offer is calculated using correlation coefficients that illustrate how different types of digital currencies are related, helping a buyer decide if they should diversify the mix of assets that make up their offer and when to formally extend one, he said.

Ultimately, this allows both parties to come to a shared understanding of an offer, which often results in a quicker transaction process, Quinn added, noting that RealOpen can complete “Know Your Customer” (KYC) diligence on a customer in a matter of minutes and close a transaction in a single day. RealScore’s analytics can also be a helpful tool for Quinn and Dumontet to use to motivate buyers who were already considering purchasing a specific property to take the leap.

“It gives us an opportunity to go to our clients and say, hey, actually, right now is a really good time if you want to do that transaction. So it helps us as well so that we have a universal language between our clients,” Quinn said.

Quinn said the RealOpen platform has over $150 million worth of exclusive listings, primarily in Miami, which has emerged as a hub for cryptocurrency. Outside of Miami, Quinn said, RealOpen’s crypto focus has attracted a strong pipeline of listings from sellers all over the world.

The brokerage contracts with a network of ~50 local agents licensed in each jurisdiction, Dumontet added. The company employs three full-time engineers and has a four-person management team, including the co-founders, he said.

While RealOpen’s main focus is on buyers in the crypto world, the RealScore platform can also help both parties assess all-cash offers. Since the company officially launched in April 2022, it has closed just under a dozen transactions for its customers, Quinn said, though she did not share details on how many of those offers included crypto.

RealOpen says it can facilitate transactions in all cryptocurrencies, though Dumontet noted that bitcoin, ethereum and stablecoins are the most popular choices among buyers. Both Quinn and Dumontet, who was an early adopter of crypto in 2013 when Foodler began accepting payments in bitcoin, said they are confident that the asset class is here to stay.

Next up on RealOpen’s product roadmap are features tailored toward people looking to buy investment properties using crypto, not just homes they themselves will occupy, Dumontet said.

“If you look at the traditional [real estate platforms such as] Zillow and Redfin, the user interface is all the same. You input your parameters, price range, geographies, bedrooms, bathrooms, house type, and then you see your list and go from there … But when you think about asset diversification, real estate is an excellent investment. It’s got leverage, and interest rate arbitrage, which you don’t see on other types of assets,” he added.

Quinn, meanwhile, hinted at even bigger long-term ambitions for RealOpen, saying she hopes to eventually diversify beyond real estate and bridge digital assets with all sorts of physical goods.

“One of my girlfriends is actually a diamond dealer. She’s the one who designed my ring, and she said, ‘a lot of my clients have tons of cryptocurrency, and they would love to buy diamonds for their wife, how can I do this?’ And I said, well, the process is exactly the same as it is for people who want to buy cars and stuff like that,” Quinn said.

All eyes will certainly be on Quinn as she continues building the venture that pulled her away from the television series and brokerage that brought her massive fame, but in her usual style, she seems confident that she is up for the challenge.

“I think the Oppenheim Group will not exist in seven years. It can only scale for so long. Sotheby’s, Berkshire Hathaway, I think those will be around forever, but I think boutique brokerages will be a thing of the past. So for me, it was just all about getting on the forefront,” Quinn said of starting RealOpen.

Real estate investing giant Fundrise breaks into venture capital

Comment