Earnings season is slowing, with the largest U.S. tech companies already having reported second-quarter results. But oftentimes the most interesting results come not from your Amazons or Apples, but from smaller concerns — and even those that are not traditional tech companies. SoftBank, for example.

Today, the Japanese conglomerate and startup investing powerhouse reported earnings that were more than a little bleak. SoftBank’s quarterly losses, worth around 3.2 trillion yen ($24.5 billion), were its largest in history, leading to the company posting the following image atop its investor presentation:

They do say an image is worth a thousand words. So what went wrong? How did SoftBank lose so much money? The Vision Fund, its two-part effort to put more than $100 billion to work in private companies. Let’s see what caused the damage.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

But before we do, it’s worth noting that the Vision Fund has already undergone a period of transition. In the wake of the WeWork IPO fiasco, it got a bit tougher on companies, with profit becoming the watchword of its world. But that didn’t mean that SoftBank stopped putting capital to work — nor was it immune from changing market conditions. Let’s take a look.

How to lose a few dozen billion dollars in three months

SoftBank’s earnings are too complicated to spell out here in complete detail, so we’ve prepared excerpts from its reporting to walk you through its results that pertain to Vision Funds 1 and 2.

First, we need to talk about time. SoftBank has a weird fiscal calendar. We often see tech companies use a fiscal calendar that is offset from the traditional yearly calendrical accounting by, say, a single month. Many SaaS companies have their fiscal year end on January 31 of each year so that they don’t close out their fourth quarter during the doldrums of the holiday period. Microsoft is more extreme, having its fiscal calendar offset ahead by two full quarters. That means that when it is, say, calendar Q1 2022, Microsoft is busy with its Q3 fiscal 2022.

SoftBank is the reverse. The June 30, 2022, three-month period was, in fact, SoftBank’s Q1 fiscal 2022. I don’t know why; it’s just the way things are. So when you see that date noted below, we’re not pulling the wrong data — SoftBank simply has a peculiar way of describing time.

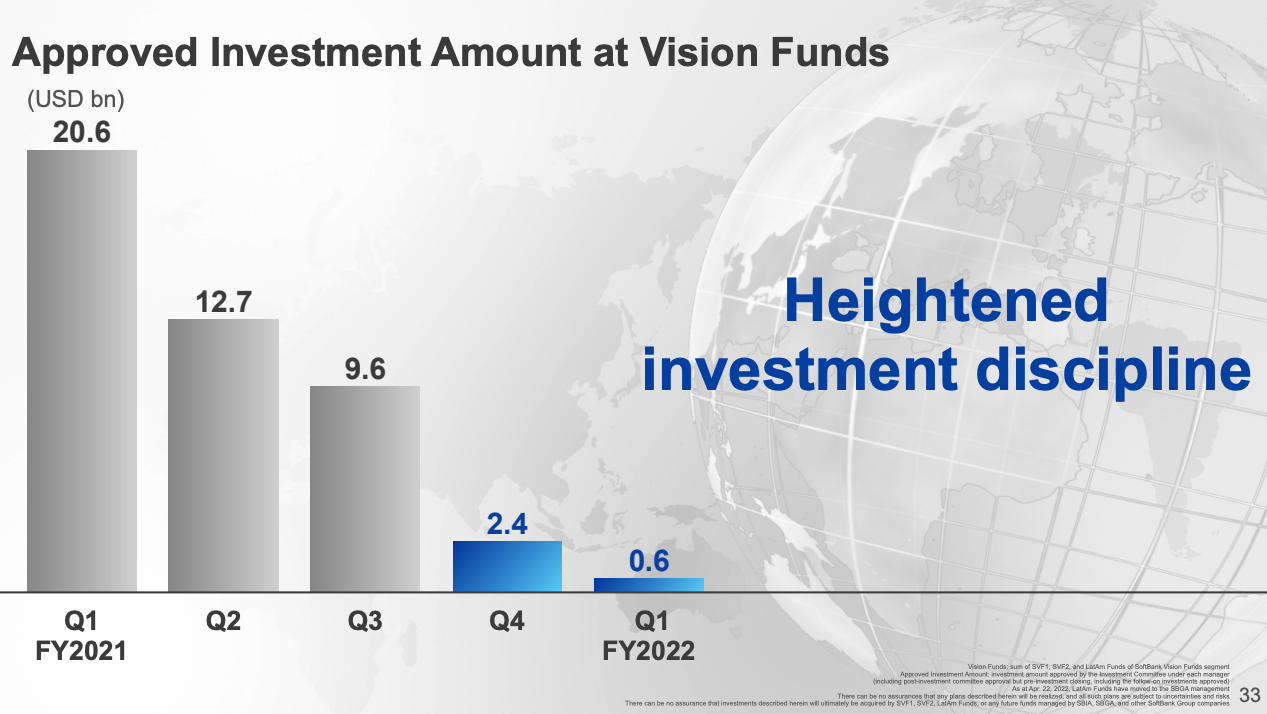

Anyhoo, here’s the pace at which SoftBank has been investing, as TechCrunch noted in our first look at the company’s earnings this morning:

That’s quite the deceleration, from $20.6 billion in calendar Q2 2021 to just $600 million in the same period of this year. SoftBank can’t really slow down much more without reaching a complete halt. Still, having invested $3 billion thus far in calendar 2022, the Vision Funds are hardly sitting out the startup investing game.

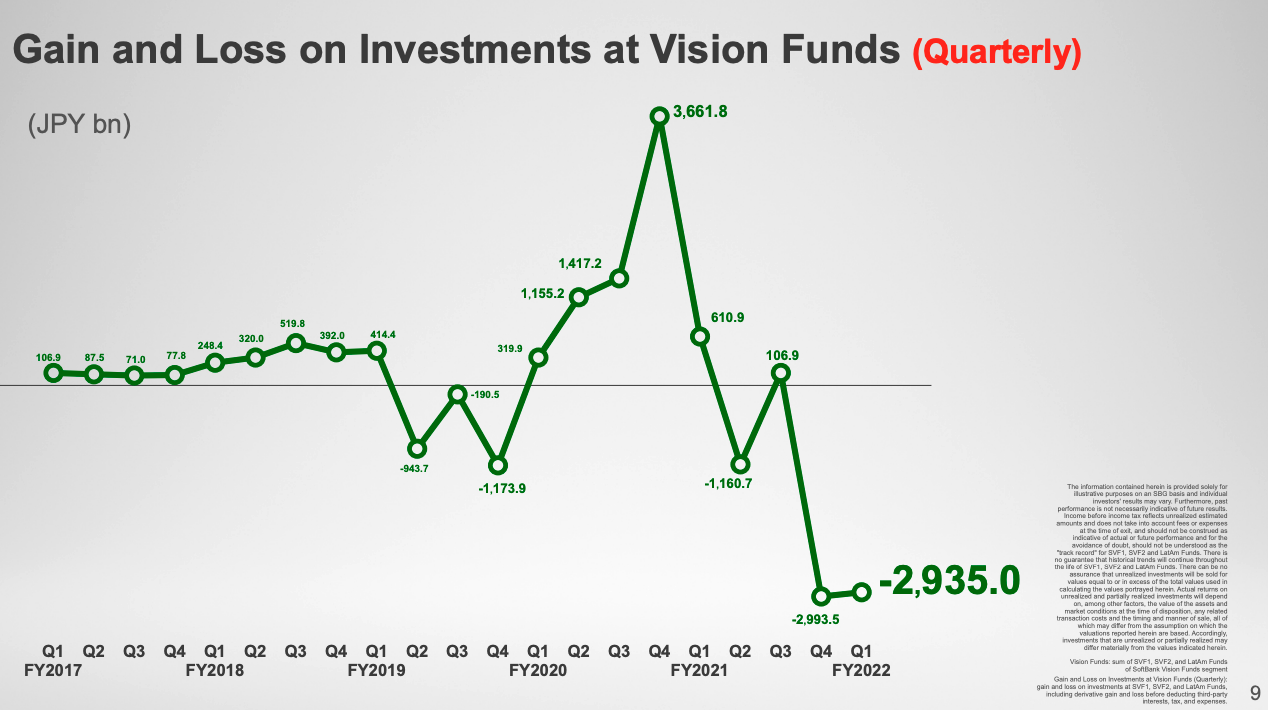

Why is SoftBank slowing its roll so sharply? Because its recent losses from investments have proved equally acute:

When your investments are generating huge returns, you have market permission to keep writing checks. But when your investments are losing huge sums in three of the last four quarters, you have to apologize a bit.

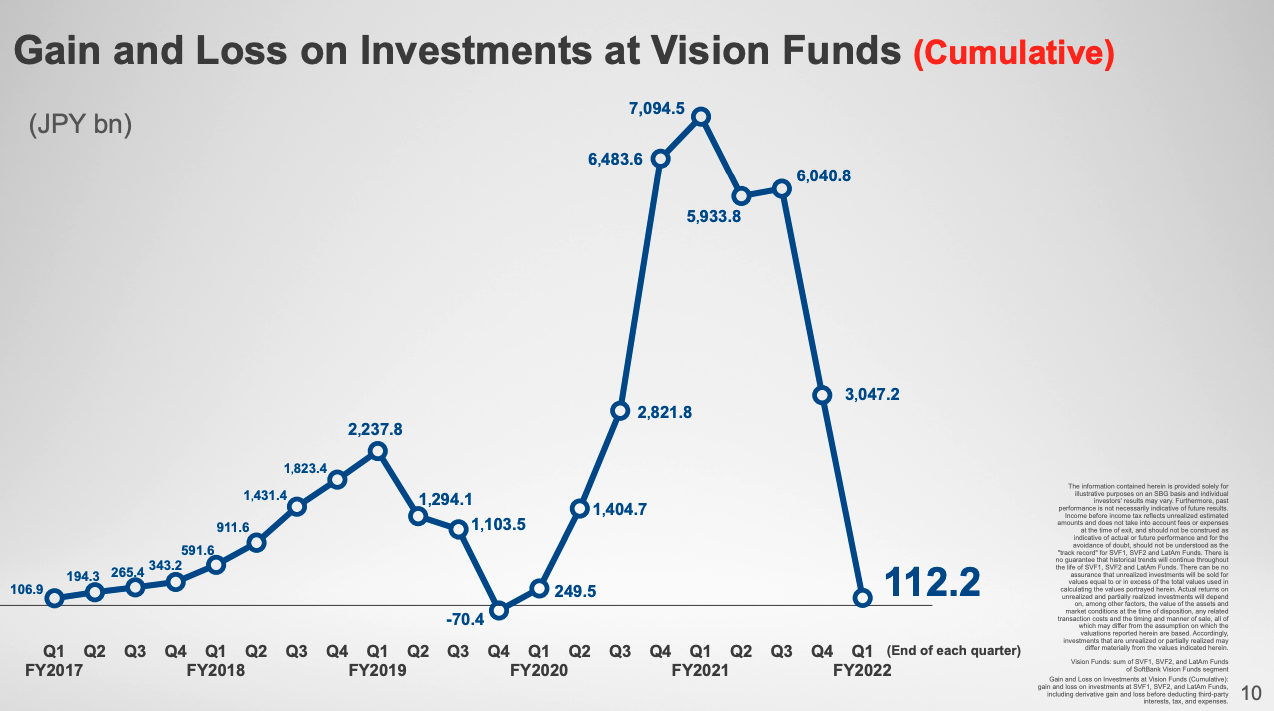

So steep have SoftBank’s Vision Fund losses proved in recent quarters that nearly every single yen or dollar of the gains that the fund has generated over time has been eliminated:

(Just for reference, 7.1 trillion yen is worth more than $50 billion today, while 112 billion yen is worth just over $800 million. That’s a lot of deleted value.)

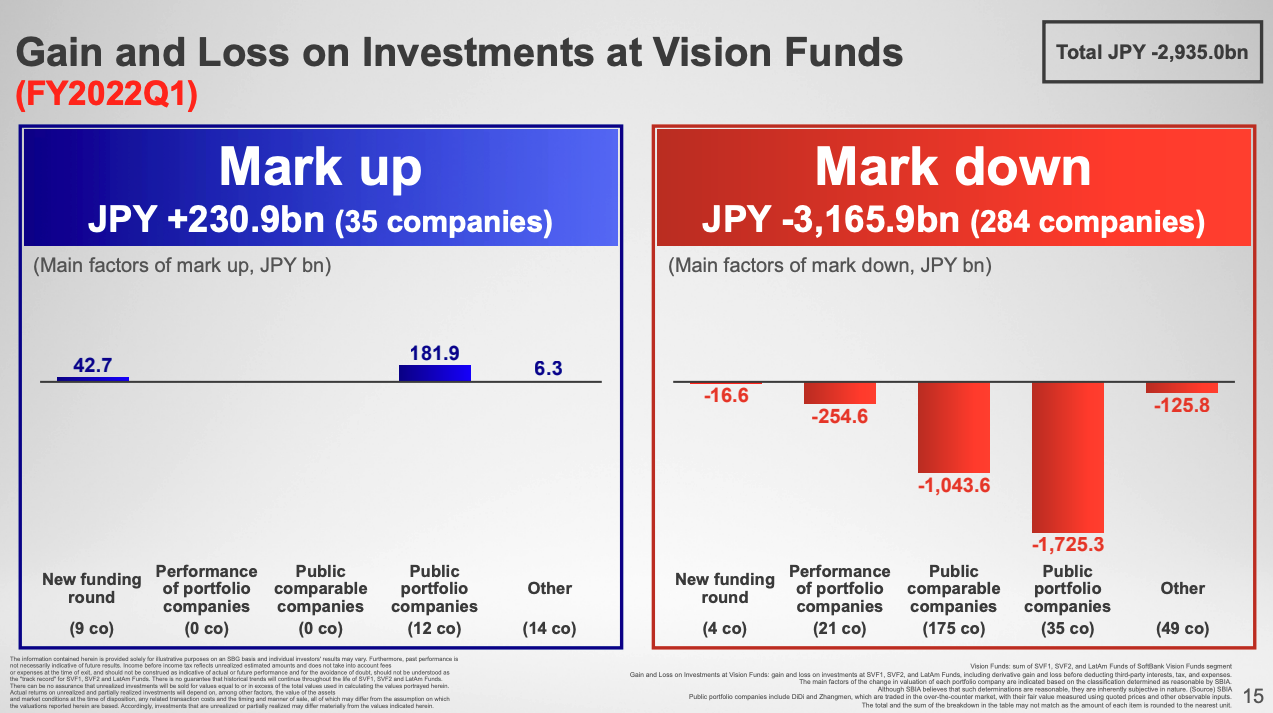

What drove the shocking declines? In the second calendar quarter of 2022 (Q1 of SoftBank’s fiscal 2022, mind), the following:

Focusing on the chart on the right, we can see that some portfolio companies tripped over their own shoelaces (“performance of portfolio companies”), some tripped over the shoelaces of their public comps (“public comparable companies”), and some tripped over their shoelaces post-IPO (“public portfolio companies”).

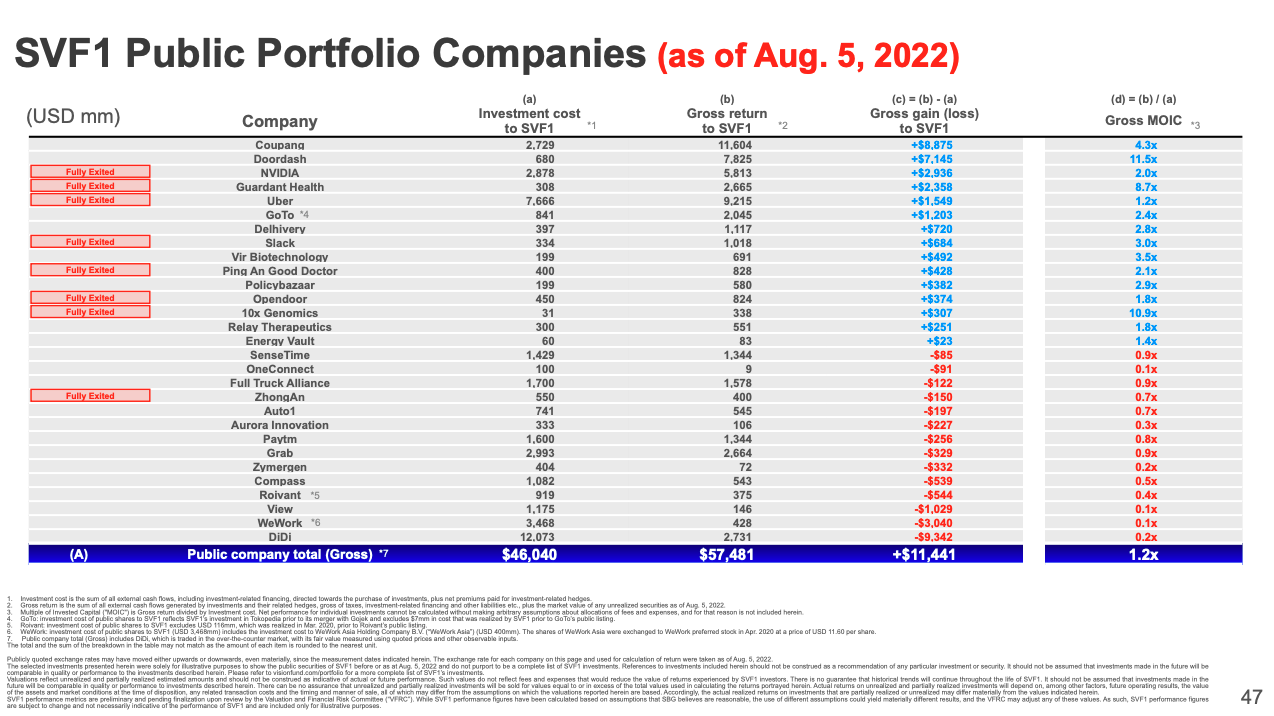

If we place our attention on the “public portfolio companies” portion of the SoftBank Vision Fund losses, here’s the rundown for Vision Fund 1:

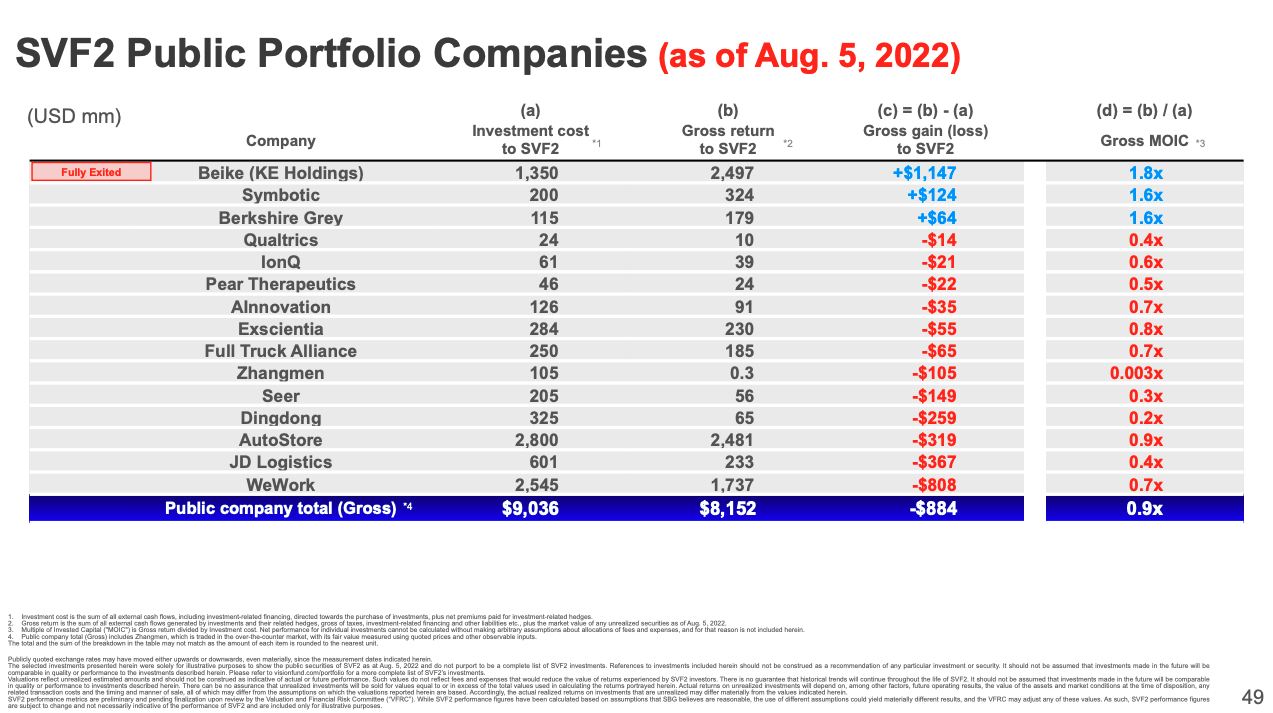

And Vision Fund 2:

Reading these charts, we can summarize as follows:

- If you thought SoftBank lost a lot of money on WeWork, just check out how much money it lost on Didi!

- It also lost a lot of money on WeWork!

- The first Vision Fund is also down more than $1 billion on View and more than $500 million on Compass and Roivant.

- The second Vision Fund has smaller per-investment public company losses, but very little profit to outweigh its deficits.

Naturally, the above only detail firms that trade on stock market exchanges, but as we saw from the third chart in our post today, those losses were the sharpest at the Vision Fund empire in calendar Q2 2022, making them the most pertinent.

Overall, the Vision Funds are still up a little over their lifetimes, but even a very modestly negative quarterly result for the current period would push the entire equity empire into loss territory.

The Vision Fund was always a funded vision; today we learned just how cloudy that perspective is proving, at least in the near term.

Comment