We cover a lot of health startups here on TechCrunch, and you know what it’s really hard to get any sort of excitement about? An online pharmacy that raised yet another round of funding.

Don’t get me wrong, Alto Pharmacy raising a Series E is impressive, as is raising $200 million. But realistically, those companies often don’t turn up on my radar: They are too big to be startups and haven’t had a liquidity event (i.e., an IPO, an acquisition or a bankruptcy), so there’s not a lot of news there.

“Company disrupted an existing industry with a new business model, has been doing well for a while and is now raising more money to do more of the same, except more” is hard to tell a compelling story around. Especially when that — albeit with slightly smaller numbers — was also the story back in 2017. And in 2020, when the company raised a $250 million Series D.

I know that sounds a little lackluster for someone who writes about companies for a living, but, I mean, listen to the founder’s quote from the company’s press release regarding this fundraise:

“We’ve been laser-focused for the last seven years on building solutions to the foundational issues plaguing the broken pharmacy industry. We’re so proud of the progress the team has made, quietly solidifying our position as the market leader in the rapidly growing digital pharmacy market,” said Alto co-founder Jamie Karraker. “We’re thrilled this new funding will enable us to continue to define this evolving industry and to help even more patients get the care they deserve.”

That’s a lot of words to say, well … yeah: Company disrupted an existing industry with a new business model, has been doing well for a while and is now raising $200 million to do more of the same, except more.

In the fast-moving, sexy world of early-stage startups, it’s often hard to forget that there is a middle ground. Some companies exit quickly for billions of dollars. Some crash and burn in a cavalcade of lawsuits. But as reporters, we are doing ourselves (and our readers) a disservice: There’s a huge number of companies that grind themselves to the bone on the way to success, customer by customer, metric by metric, market by market. Let’s be honest, there are not a lot of companies that raise five rounds of institutional growth funding, with half a billion dollars worth of investment raised along the way.

When you make it that many rounds in and that many years down the line, you had better have some incredible tricks up your sleeve, solid metrics and some plans for what to do next to get the company to where it needs to be. It seems like Alto did — it told the world about its $200 million fundraise in January this year. Then, on June 30, the company announced it has a new CEO in the form of ex-Amazon exec and 25-year GM veteran Alicia Boler Davis.

Having read all of this, I was curious to see how a company tells the above story in the form of a pitch deck to investors. And, perhaps most notably, which parts of the story don’t show on the pitch deck.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- Cover slide

- Traction and metrics summary

- Cover slide — business overview

- “The Current Pharmacy Experience is Highly Inefficient” — problem slide

- “Pharmacy is the Largest Consumer Industry Still Offline” — opportunity slide

- “The Current Experience is Broken for Patients and Providers” — problem slide

- “The Alto Experience Fixes That” — solution slide

- “Alto Patient Value Proposition” — value proposition slide

- “Alto Provider Value Proposition” — value proposition slide

- “With an End-to-End Software Platform Powering the Next Generation of Pharmacy” — product slide

- “Alto Offers a Differentiated Approach” — competition slide

- ” Alto Uniquely Aligns the Broader Healthcare Ecosystem” — market context slide

- Cover slide — Commercial and growth strategy

- Revenue traction slide

- “Our Growth Strategy” — go-to-market slide

- “Alto is Scaling Rapidly and Efficiently” — regional rollout slide

- “Alto’s Provider-Driven GTM Motion Drives Patient Engagement, Enabling Wallet and Margin Expansion” — marketing strategy slide

- “Expansion Opportunities for Alto are Attractive and Significant” — adjacent market growth strategy slide

- Cover slide — operations overview

- “The Pharmacy Sits in the Middle of a Complex and Confusing Supply Chain” — operational chart slide

- Closing slide

The company did remove three slides from the deck it sent me, and some of the numbers in the deck were redacted. Two of the removed slides were product demo screenshots and the last contained financially sensitive content.

Three things to love

There’s a lot of incredibly smooth data and presentation in this 21-slide deck, with some huge wins along the way. Here are three of my favorites:

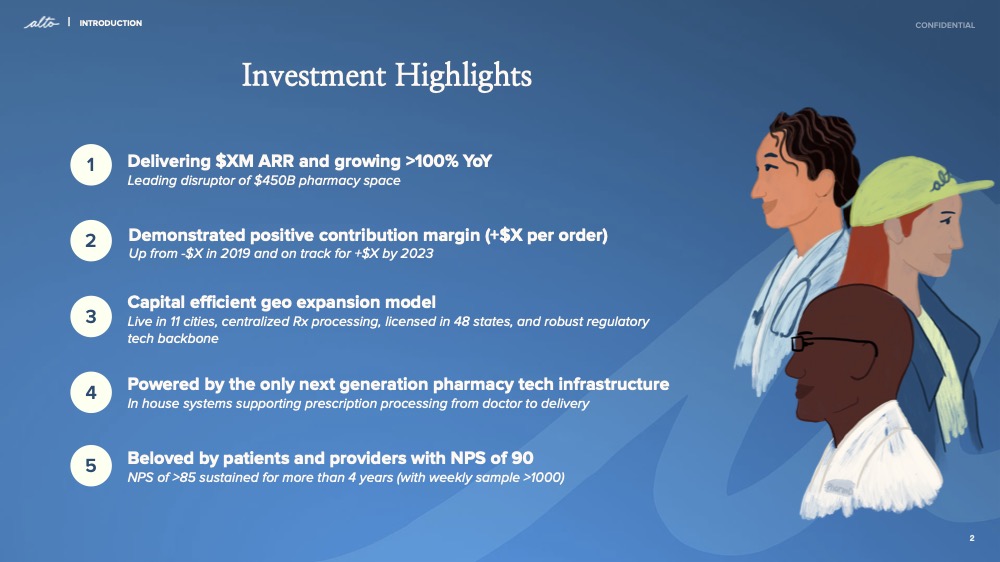

Hit ’em with data

Traction is everything — that’s true for every startup, but it becomes more and more important the longer the company has been around. Hitting those milestones, growing that growth — it’s the name of the game. Alto doesn’t mess around, crashing straight into a five-point summary of why the investors should show them the money. Frankly, this slide is an award-worthy list of accomplishments.

Doubling its ARR year on year is a hell of a mark of growth that’ll get every investor asking, “How, and can you do it again?” “Positive contribution margin per order” is finance speak for “if we sell more of this stuff, we’ll make more money.” The company also shows that the figure was negative in 2019. That means back in 2019, the company was losing more money the more orders it fulfilled. In the intervening three years, it turned that around and set an even more beneficial goal for next year.

The geo expansion model is very interesting; if, later in the pitch, the company can convince me that it did 11 geo rollouts and now has a playbook for how to conquer new markets, that could mark the company as a relatively safe bet, for a startup.

Reading between the lines and beyond the business-speak: The company is growing incredibly quickly and has fantastically happy customers. It is out there raising money because its operating and R&D expenses are high enough that overall it is running at a loss. But if it is able to streamline marketing and customer acquisition, it could become a profitable company. And, look! It has a way of rolling out to new markets easily and quickly.

It’s an incredibly good summary of an impressive company, and as an investor (if I invested at the late-growth stage), I’d be pretty excited about the next 55 minutes of my life.

“Mature market ripe for disruption”

(opens in a new window)

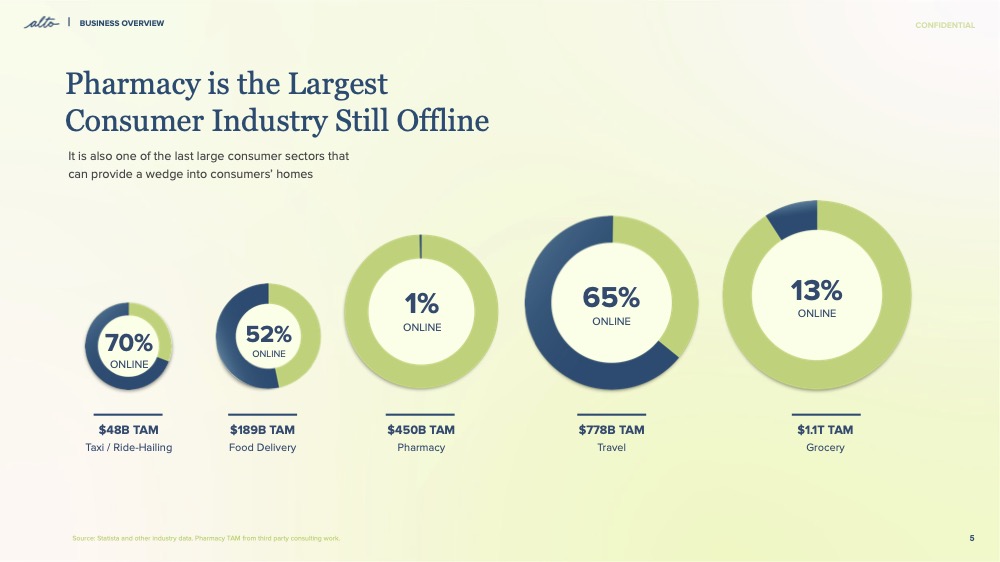

This slide tells two incredible stories, both related to market size and opportunity. For one thing, as an industry, drugs are bigger than Uber and all food delivery services combined. The other is this: Food delivery and ride-hailing and travel have all gone online, and you can probably think of a dozen unicorns exits in each of those categories. If I were the CEO, I’d be jumping up and down at this point, pointing at that 1% number and strongly insinuating something along the lines of, “How badly wrong do we have to get it to not be successful in this market?”

Based on the company’s performance to date and the enormity of the market — unless there are some major red flags that show up later in this pitch, this is starting to look more and more like a pretty safe investment with a huge opportunity attached. There’s a class of VCs that are entirely geared up to nudge startups that last a little way from “doing well” to IPO, and I wouldn’t be at all surprised if we saw one of those in the near future from Alto.

Also, folks, this is how you do a market-size slide. It’s so well done.

Let’s traumatize the reader a little

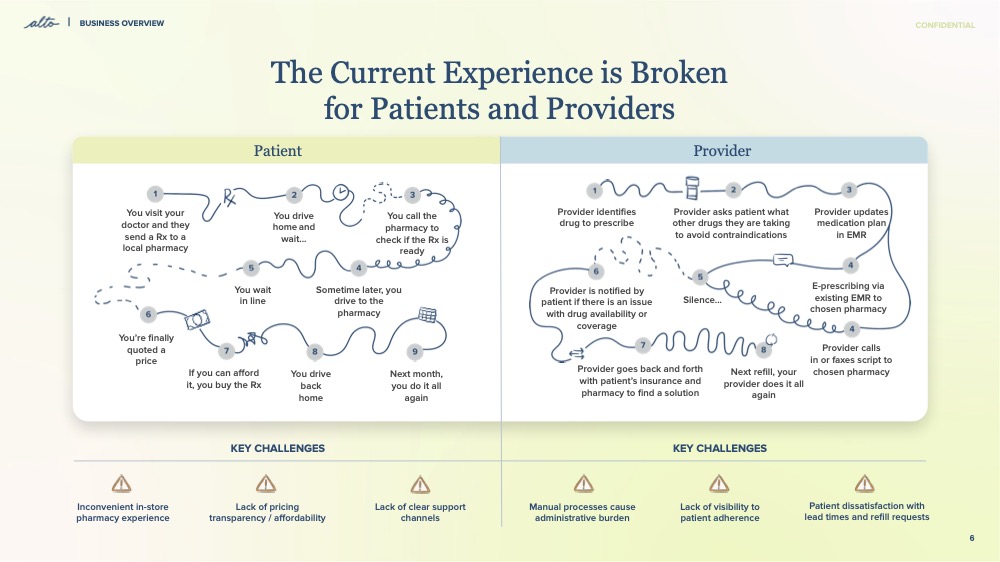

The best storytelling trick in the how-to-pitch playbook is to make it come to life. And, in the U.S., with its unmentionably complicated healthcare, the above diagram is painfully familiar. From procuring a prescription from your doctor to having the drug in your hands can be a Sisyphean task of frustration and murderous rage. By playing into that experience and then waving a magic wand to make it all better, you tickle the empathy bone in your investors.

You get exactly one guess to guess what Slide 7 is.

Oh OK, then, because you asked so nicely:

It is a storytelling trick as old as marketing itself: Set up a painful problem that the audience can identify with, then sell ’em the problem to that same issue in the very next scene.

It’s so simple, but Alto does it so fantastically well here.

In the rest of this teardown, we’ll take a look at three things Alto Pharmacy could have improved or done differently, along with its full pitch deck!

Three things that could be improved

If you’ve been following the pitch deck teardown series for a while, you know what I’m about to say: They raised a boatload of money, so the pitch deck was obviously plenty good. But can we find a couple of things to improve?

Of course we can!

Who’s on the team?

There was a really obvious omission from Alto’s slide deck: Where’s the team slide? Who are the founders and the senior management team? How big is the team? What are the plans for growth?

The whole pitch deck is suspiciously quiet about the matter — and it is particularly odd, given that six months later, a replacement for the founder-CEO was announced; the new executive reportedly takes the helm on September 1. There are a lot of ways of reading this narrative. One is that the investment was made with a condition: Go headhunt a different CEO to take the company through the next stage of growth. The other is that the co-founding team was starting to realize that the company had outgrown them and their experience and that they actively went on the fundraising trail with the express intention of replacing themselves as part of the fundraise.

“What we’ve tried to create at Alto is a company in healthcare that is both financially successful AND truly cares about the humans we serve and help every day. It takes a very unique combination of skills to do that, but Alicia has proven that’s who she is,” Alto’s co-founder and CEO, Jamie Karraker, said as part of the company’s fundraising announcement.

Yeah, but what are the numbers?

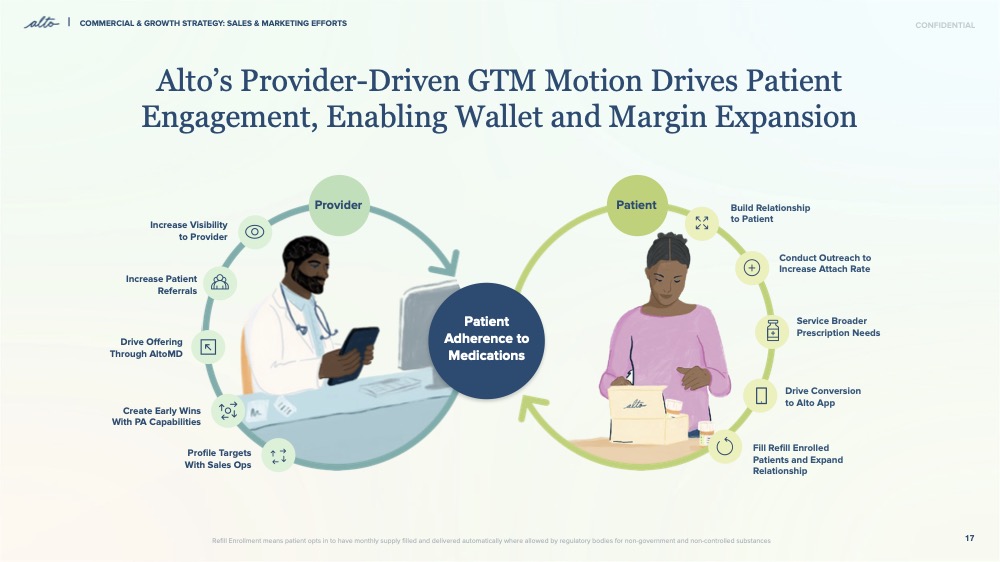

The company did mention that it removed a slide of numbers, so it’s possible that it included more in its deck, but for this type of company, I would expect a lot more numbers as part of a financial investment pitch. Slide 17 (above) includes a little bit about the company’s acquisition model — seemingly a hybrid B2B2C model where the providers are part of the customer acquisition funnel. That’s all good and well, but I’d want to know more. A lot more. Give me an operating plan!

What’s the acquisition cost versus the customer’s lifetime value, for example? What’s the run rate for the company? How many staff does it need, want and currently have? I’d expect to see details on how a geo rollout in a new market is planned and executed, and perhaps more numbers-driven convincing on how the company is growing. Slide 14 does show revenue growth for the company, but I get the sense that there’s a lot more happening inside this company than just revenue growth — and I’d want to see more operations-dashboard-type stats to help understand how the company operates. Not including them makes me think the worst and means that the founders would definitely get an interrogation in the Q&A session at the end of the pitch.

Where the hell is Mark Cuban?

You may have heard of Cost Plus Drugs (CPD, Mark Cuban’s suddenly-launched-out-of-the-blue public benefit corporation that’s operating in this market as well, and I’d be lying if I wasn’t looking for CPD on Alto’s slide deck. See if you can find it:

It’s a trick question — it isn’t there, but there’s also no way it could have been. Alto announced its fundraise on January 27, just three days after Mark Cuban announced the launch of his own pharmacy. Now, it’s possible that Alto was planning to tell the world about its fundraise earlier and decided to go live as soon as it could after the new competitor launched, or it could be a complete coincidence. Either way, I can’t immediately figure out if things got easier or harder, but things certainly got a lot more interesting for Alto and its investors overnight.

I know I snuck this slide in the “things that could be improved” column, but it’s actually possible it’s exactly the opposite in this case — yes, in Mark Cuban, the company will have found a formidable opponent. But it also opens a ton of doors: Alto has a huge head start and a big, brand-name competitor entering the fray can actually be a good thing. It shows that other people have spotted the market opportunity and are fighting for market share.

In the case of Alto, though, that’s good: If only 1% of the pharmacy market has gone online, that means there’s 99% of the market to fight for. Even if CPD does spectacularly well, Alto could benefit. For one thing, CPD’s website is so hideously ugly and Web 1.0 that I’d be struggling to trust it; Alto’s, in comparison, is a far more slick example. In the long run, it will come down to numbers. If Alto’s go-to-market pricing strategy is “30% cheaper than other pharmacies,” and CPD’s pricing strategy is “15% above the price we buy it at,” it could turn into an ugly, price-driven race to the bottom.

So, not really a “thing that can be improved,” in this case, but certainly a reminder of how quickly things can change in the mercurial world of startups and how timing is everything.

Having said that, I’m still not happy that PillPack (which Amazon bought for just shy of a billion in 2018 and is still operational today) and Blink Health (which has raised a lot of cash over the years) are missing from the competition matrix. There are also a bunch of smaller, more niche pharmacies, including Emme and The Pill Club, both of which focus on contraceptive pills. On top of that, there are other specialized pharmacies (Ro and Done, focusing on erectile dysfunction and ADHD meds, respectively) that could potentially be shown off next to Hims, which would have made this competition slide a bit more believable.

The full pitch deck

Here’s Alto Pharmacy’s full Series E pitch deck:

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.

Comment