Rhys Spence

These are turbulent times. Given the circumstances, it’s hardly surprising that public markets are creaking and only niche sectors remain either unaffected or in a marginally positive position. Edtech is no exception.

Today, Brighteye Ventures published its Half Year European Edtech Funding report, built around Dealroom’s data. The report primarily focuses on investment activity in Europe but is contextualized with what we are seeing in other markets.

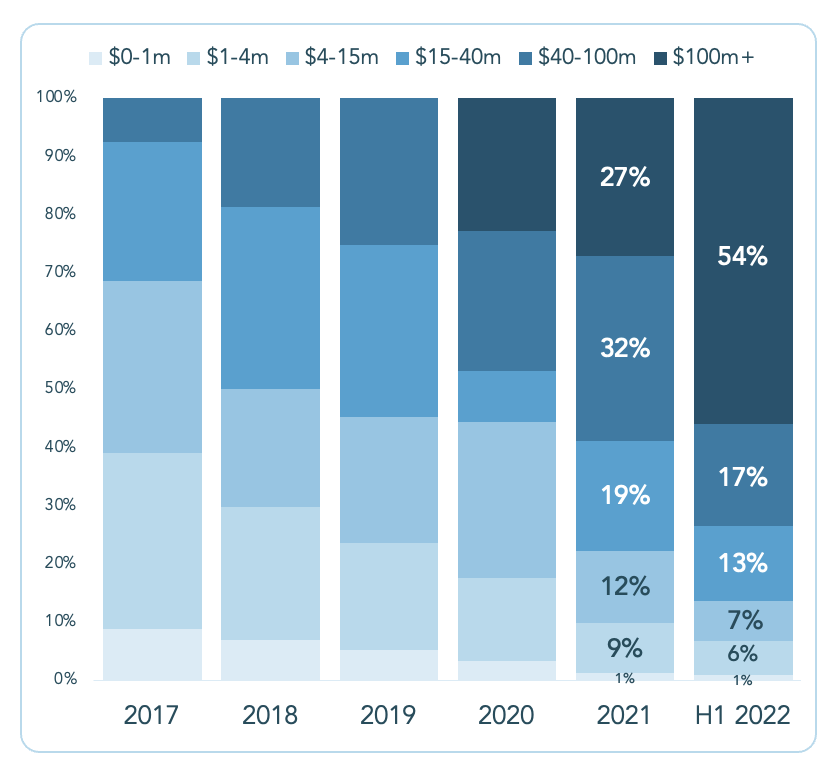

Global VC funding into edtech startups totaled $6.5 billion in H1 2022 compared to a total of $20.1 billion raised in 2021. This pullback in global funding can partially be explained by fewer edtech mega-rounds (over $100 million) in H1 2022 compared to previous periods.

The first half of 2022 saw 16 so-called mega-rounds, compared to 24 in the second half of 2021 and 30 in the first half of 2021. At the same time, the number of early-stage rounds, categorized as deals under $15 million, has fallen fairly consistently since a peak in H1 2018.

Note that this doesn’t necessarily reflect lower activity in the ecosystem — it simply means that more early deals are being done by angels and via involvement with incubators and accelerators, which are not comprehensively covered in the data.

We were pleased to see that the European edtech ecosystem has managed to maintain most of its momentum, at least for the time being. The fact that the sector has secured $1.4 billion thus far in 2022, 40% more than a year earlier, demonstrates its resilience to maintain growth even amid challenging conditions.

This isn’t surprising given the inverse correlation between worsening macro employment markets and appetite for education, particularly in the market for post-18 education.

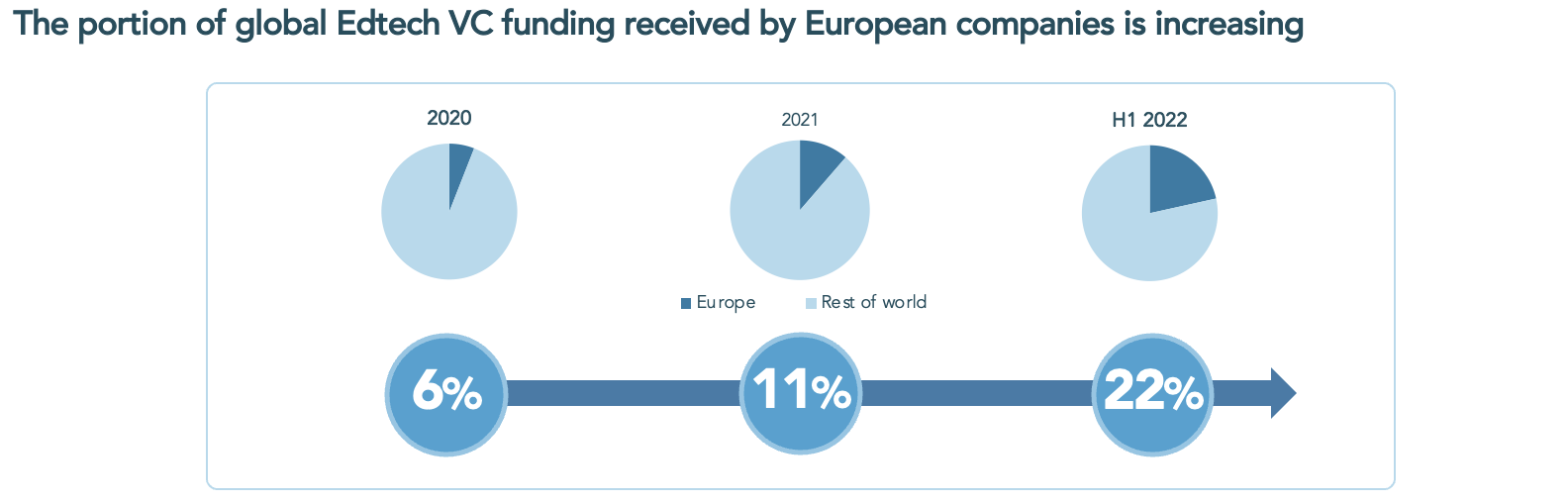

This resilience isn’t present across the world, though. As the data shows, edtech in Europe is proving more resilient than in other regions. This is evidenced by both the comparison between 2022 and 2021 figures and the increasing proportion of global edtech VC investment secured by European startups — rising from 6% in 2020 to 11% in 2021 and to 22% in H1 2022.

We remain cautiously optimistic that the European market will continue to see early- and later-stage deals in the second half of this year, but we do expect the number of deals done this year to be about 25% to 30% lower than in 2021, in addition to lower VC funding in the second half.

The fact that we’re seeing fewer deals but more funding in the market means the size of the average deal has gone up. Indeed, the average deal size in Europe this year is about $13.1 million compared to $8.4 million last year. We believe this reflects investors doubling down on companies that they think will survive and thrive in the current environment.

The U.K. leads the way, as it has in recent years, when it comes to both deal count and total VC funding secured this year on the continent. Indeed, more than twice as many rounds were raised by U.K. edtech companies than any other European country. However, the U.K. saw only 35 rounds raised so far in H1 2022, compared to 87 in 2021, which leads us to expect a lower deal count across Europe.

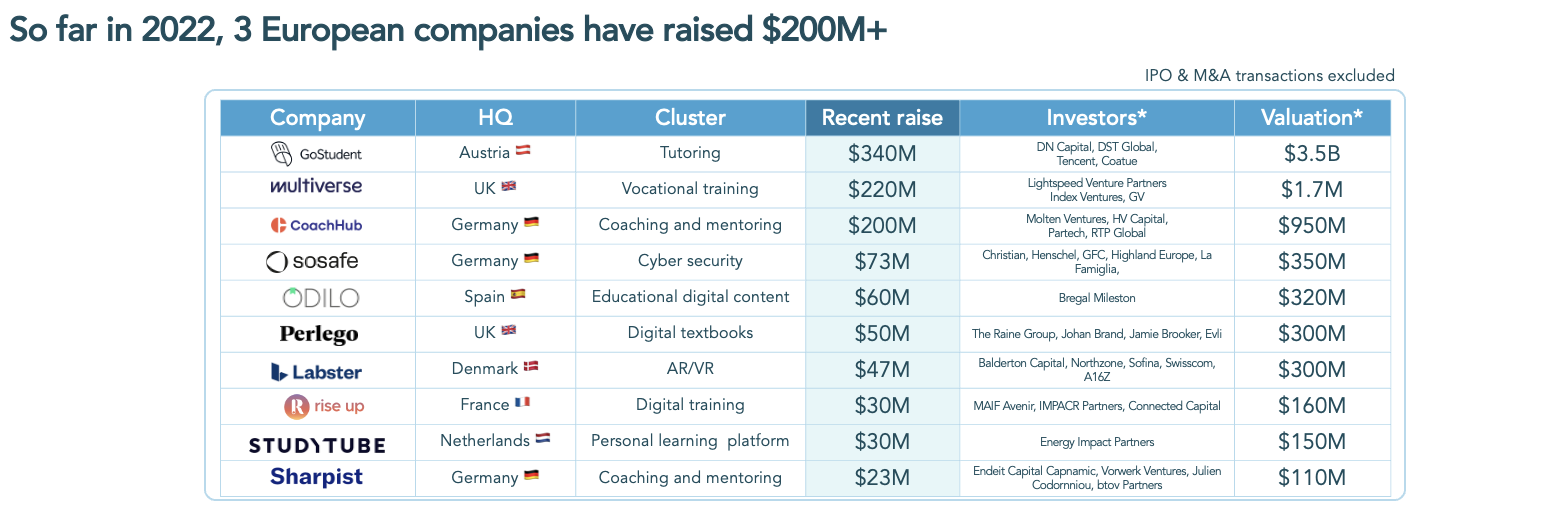

It’s worth noting that so far in 2022, three of the top 10 largest rounds were raised by companies based in Germany, which is fast becoming a thriving ecosystem. The largest deal was also raised in the DACH region — GoStudent’s $340 million Series D.

The three largest deals in Europe, all $200 million or more, spanned three verticals, which bodes well for the depth of the ecosystem. These deals were secured by GoStudent (Austria), Multiverse (U.K.) and Coachhub (Germany).

As funding rounds get bigger and the number of deals falls, it’s not surprising that we’re seeing bigger deals account for an increasing portion of total European edtech VC funding. In 2021, just 27% of funding was raised in rounds over $100 million, but this figure leapt to 54% in H1 2022. Meanwhile, only 14% of funding was secured in rounds under $1.5 million in H1 2022 compared to 22% in 2021.

We expect the European edtech market to maintain some positive signs of resilience, but naturally, the ecosystem cannot be immune to the headwinds it faces.

So what does all of this mean for founders?

In short, fundraising has become more challenging and is likely to remain so for some time. Just because you can raise doesn’t mean you’ll necessarily be able to raise at a premium to your last round.

If you can grow quickly and efficiently, capital is still available. Otherwise, you should try to give yourself as much flexibility as possible with runway (ideally more than 24 months) and consider prioritizing profitability over growth, as well as exit opportunities.

The picture is slightly rosier if you’re at the pre-seed stage. Generally, seed funds operate on time horizons of six to nine years, so they are less likely to be affected by the current downturn in terms of the pace of deployment. Seed valuations are based less on traction and more on potential, the size of the round and the team working on the project.

We do, however, expect the median size of seed rounds to decline in coming quarters. The expectations aren’t likely to be very different when you’re raising a Series A 18 months from now, so understanding what is expected now will help you better gauge key metrics needed for the next round of funding and how to best allocate your seed funding.

That said, there remain some positives for edtech companies.

Part of our pitch at Brighteye is that education is a recession-resistant industry. As we mentioned earlier, economic downturns drive people to seek training and governments to increase spending on training and education. Conversely, booms increase the return on knowledge and expertise.

VCs are still writing checks after raising large funds during the previous, more obviously sunny period, and lower investment expectations pose less emphasis on the “growth-at-all-costs” approach. This gives founders and early teams the ability to build at a more rational pace, which is generally favorable for edtech companies. It’s also likely that there will be less noise in the space, given there are fewer companies getting funded, which will essentially result in less competition, at least in the short term.

The good news is that if you’re in edtech, you’re operating in a relatively resilient sector in terms of funding availability and with relatively reliable, and sometimes increasing, demand. The less good news is that the number of deals done this year, at all stages, will likely be lower than we saw in 2021.

It will be a challenge to navigate this environment, but we look forward to doing our bit to help the sector through to calmer seas ahead.

Comment