The Wall Street Journal recently reported that Klarna, a European buy now, pay later (BNPL) provider, is considering raising capital at a valuation of around $15 billion. The new figure is both a dramatic decline from Klarna’s mid-2021 valuation of more than $45 billion and the $30 billion figure it was reported to be targeting earlier this year.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Klarna is not alone in losing value in recent quarters. Since its June 2021 fundraise, the value of fintech companies has fallen sharply. And, the European consumer point-of-sale lender has also seen a drop in the value of its best-known public comp, American BNPL player, Affirm.

BNPL in 2022: 4 fintech investors discuss regulation, trends and how to stand out

But given what’s going on in the BNPL sector, Klarna’s predicament is no surprise — besides the general drop in tech companies’ worth, consumer electronics and computing giant Apple recently said it would launch a BNPL product, which also hurt Affirm’s stock.

The impact of the repricing of BNPL companies goes beyond merely Affirm and Klarna. A host of BNPL-focused startups that raised capital during the 2021 venture capital peak are also digesting a dramatically different fundraising, and valuation, landscape. Klarna is simply the biggest, best-known and most valuable private company caught in the mix.

Because we have its Q1 results from last month, we can interrogate its possible new valuation in comparative terms with Affirm to see how the companies stack up. When Klarna was reported to target a $30 billion valuation for its new funding round, this column dug into its results against Affirm’s. Let’s run the math again, this time using new Klarna data and a dramatically changed price.

Because we have its Q1 results from last month, we can interrogate its possible new valuation in comparative terms with Affirm to see how the companies stack up. When Klarna was reported to target a $30 billion valuation for its new funding round, this column dug into its results against Affirm’s. Let’s run the math again, this time using new Klarna data and a dramatically changed price.

Klarna’s Q1 2022

When Klarna reported its first-quarter results, headlines focused on the fact that it was cutting 10% of its staff. The company said that while it was “still seeing strong growth across the business,” it was “time to consolidate and capitalize on the strong foundations [it had] established.”

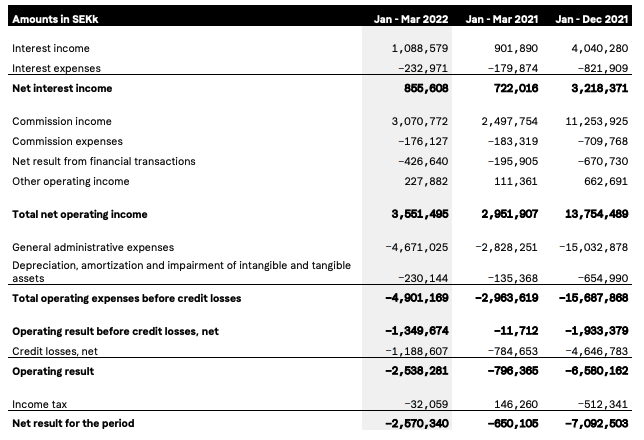

Looking at the company’s numbers, it’s not hard to see why Klarna decided it needed to trim expenses. Observe:

The company’s net operating income (a revenue figure) rose just 20% in Q1 2022 from a year earlier, which compares poorly with the company’s general administrative costs increasing by 65% in that period.

As a result of that mismatch, Klarna’s operating loss before credit losses widened to SEK 1.35 billion ($132.6 million) from SEK 11.7 million ($1.1 million), while its operating result worsened to a loss of SEK 2.54 billion ($249.3 million) from SEK 796.4 million ($78.2 million).

Klarna had many positive statements about its operations for the quarter, but slowing growth and rising unprofitability are rarely a combination that leads to outsized valuation gains, bringing us back to the question of just what Klarna is worth.

Klarna at $15 billion

This May, Affirm reported GMV of $3.9 billion in calendar Q1 2022 (fiscal Q3 2022), up 73% from a year ago, and a 54% rise in revenues to $354.8 million. Total revenue minus transaction costs rose 37% to $182.4 million, and operating loss widened 8.2% to $226.6 million from a year ago.

Today, Affirm is worth $5.24 billion, per Yahoo Finance. Using its calendar first-quarter results to set a run rate for the company, Affirm is worth 0.34x its annualized GMV, 3.7x its annualized revenue run rate and 7.2x its annualized revenue less transaction costs.

We have no opinion as to whether those prices are reasonable. Affirm did say in its most recent earnings report that it “plan[s] to achieve a sustained profitability run rate on an adjusted operating income basis by July 1, 2023,” which means it’s aiming to be able to consistently post adjusted operating income from its next fiscal year. For reference, in its most recent quarter, Affirm saw adjusted operating income of $4 million.

How does Klarna’s Q1 look in comparison? Here are the numbers:

- Q1 2022 GMV: $20 billion, up 19% on a YoY basis.

- Q1 2022 “net operating income” (a revenue figure): $352 million, up 20% on a YoY basis.

Against a $15 billion valuation, Klarna is worth 0.19x its annualized Q1 2022 GMV and 10.6x its current net operating income run rate.

At a $15 billion price tag, then, Klarna looks cheap compared to Affirm when we consider its relative annualized GMV run rate multiple. However, the companies appear in the same ballpark if we compare Affirm’s annualized revenue less transaction costs multiple (7.2x) and Klarna’s annualized net operating income multiple (10.6x).

When we last looked at the two companies, we noted they had similar annualized GMV multiples, but that Klarna appeared more expensive in net revenue terms. Now that Klarna’s valuation looks likely to be cut in half, the numbers have been flipped. Now Klarna appears inexpensive in GMV terms and far more reasonably priced in revenue terms (loosely).

Recall that in our last analysis, we noted that Klarna appears to convert GMV to net revenue at a fraction of the rate Affirm does, meaning that its GMV is, again speaking loosely, somewhat less efficient in terms of revenue generation per dollar of transaction facilitated.

From this very high-level perspective, it makes some sense that Klarna would therefore trade at an annualized GMV multiple discount to Affirm. Now closer to one another in revenue multiples terms, it appears that the two companies are in better valuation sync, provided that Klarna’s round does close around the $15 billion mark.

All told, Klarna’s business is interesting, large and sorting out a changed market. Much like Affirm’s own, unsurprisingly.

Let’s close by noting that Klarna is still a success story at a $15 billion valuation. It’s just not as a big a success story as the company’s last private round led the market to believe. It turns out that investors valued BNPL companies far in excess of their real value last year. Affirm’s decline from a 52-week stock market high of $176.65 per share to just $18.30 today is evidence of that fact. Klarna is hardly alone in eating valuation lumps in 2022.

Comment