Just how hard will it be for some high-flying unicorns to go public? The question gets more serious and worrisome by the week.

To understand how much the late-stage market has changed in the last few months, we’re once again pulling public market data that we will contrast against mega-unicorn Databricks’ known results. Recall that we executed this experiment in February, when the data analytics company announced that it closed 2021 with $800 million in ARR, and in April, when we took a look at the company under the harsher lights of a declining market for software revenues.

That downward trend continued, meaning that it’s time to take another pass at the exercise.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

I promise that we’re not picking on Databricks for any reason other than that it committed the well-known sin of being more transparent than is traditional during its growth phase. By that I mean it shared a host of data points during its life as a private company. For that we are thankful. Sadly, because many of its peers preferred to hide their — let’s be clear: lesser — results, we are left using Databricks as our benchmark for how much things have changed in SaaS land.

It’s never great to punish the honest for their candor, but we also can’t avoid working to understand the current market — it’s our job. So, more with Databricks data today, even if we are reaching the point of cruelty.

So let’s chat results and valuations and see just how much work Databricks might have ahead of it to go public. Keep in mind that extension rounds at prior terms are coming back into vogue (Gusto is one example of this trend among the multi-unicorns), so we could see the company collect quiet capital without a public repricing before it does list. Our eyes, of course, are peeled.

So let’s chat results and valuations and see just how much work Databricks might have ahead of it to go public. Keep in mind that extension rounds at prior terms are coming back into vogue (Gusto is one example of this trend among the multi-unicorns), so we could see the company collect quiet capital without a public repricing before it does list. Our eyes, of course, are peeled.

Now, let’s have some fun.

A historical tour of Databricks’ valuation multiples

Pulling from our February and April coverage, a historical rundown of Databricks’ valuation and fundraising:

- Q3 2019: $200 million run rate, $6.2 billion valuation — 31x run-rate multiple.

- End of 2020: $425 million ARR, $28 billion valuation — 66x ARR multiple.

- August 2021: $600 million ARR, $38 billion valuation — 63x ARR multiple.

- End of 2021: $800 million+ ARR, $38 billion valuation — 47.5x ARR multiple.

Knowing what we did in April about the historical growth of Databricks’ revenue, we estimated that the company was at around $1 billion in ARR at that date, so we’ll go ahead and calculate the following ratios using both $1 billion and $1.1 billion ARR numbers for the company. You can decide which you think is a fairer estimate.

Now, at $1.0 billion in ARR, Databricks is worth 38x its annual recurring revenue. At $1.1 billion, 34.5x. That’s not a huge difference, mind, so no matter how you handicap the company’s recent growth, Databricks is worth around mid-to-high 30x its current top line. The question is how far from market reality that number is today.

In April, we noted that Altimeter’s Jamin Ball calculated the median multiple for the top-five most richly valued public cloud companies at 27.5x (enterprise value/NTM, though we’re calculating market cap/ARR in the case of Databricks; given limited debt among unicorns, the numerators are close, and the denominators are both forward-looking, so don’t sweat the discrepancy). Since that point, things have gotten worse.

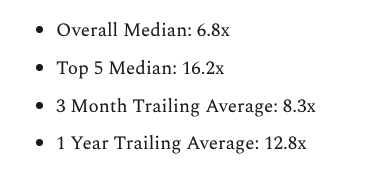

How much worse? Here’s the latest from Ball, using data pulled on May 27, or last Friday:

For Databricks’ IPO timing, it’s bad news: 16.2x is far less than the top-five median of 27.5x that Ball calculated just weeks ago. At the newer 16.2x multiple, Databricks would be worth $16 billion to $17.8 billion today, or less than half its prior valuation.

Is there any good news to be had? The company is accreting ARR at a rapid clip, which could give it a chance at a top-three multiple, instead of merely the median of the top five. But at some point even Databricks, replete with strong historical growth rates, runs into a ceiling when it comes to picking public-market comps; they only get so good.

Presuming that Databricks can grow to around $1.4 billion worth of ARR this year — our estimate from April — Databricks might be worth $23 billion or so at current prices. That’s a packet to be sure, but still $15 billion under its final private valuation.

I’ve spoken with Databricks CEO Ali Ghodsi a number of times over the years, and something that he told me was that his company didn’t maximize for valuation when it raised. So it could have picked an even higher valuation to be measuring from today. Happily for Databricks, it did not do that, meaning it has less of a gap to shade in ahead of an IPO, provided that it wants to hold its prior valuation fast.

Are we being too harsh? A number of things could be flowing in Databricks’ favor that we cannot spy from our current vantage point:

- Growth at the company could be faster than we are anticipating, boosting not only its revenue base but also its expected public-market multiple.

- The company’s margins could be above-average, granting it a richer multiple in a public debut than we are currently anticipating.

- Or, you know, the market could be overcorrecting at the moment, and Databricks can just wait until things get a bit less icky out there, meaning that it can just keep on doing its thing until the market comes back to it.

The final option there implies ample cash reserves, but the company did last raise $1.6 billion, so it’s presumably not cash-poor today.

In April we could draw up a growth scenario that made Databricks’ valuation largely match up with the public markets. Today that’s not possible, unless there’s more to the story than what we can see, and those hidden factors make the data company all the juicier. That is the news.

More when we have it.

Comment