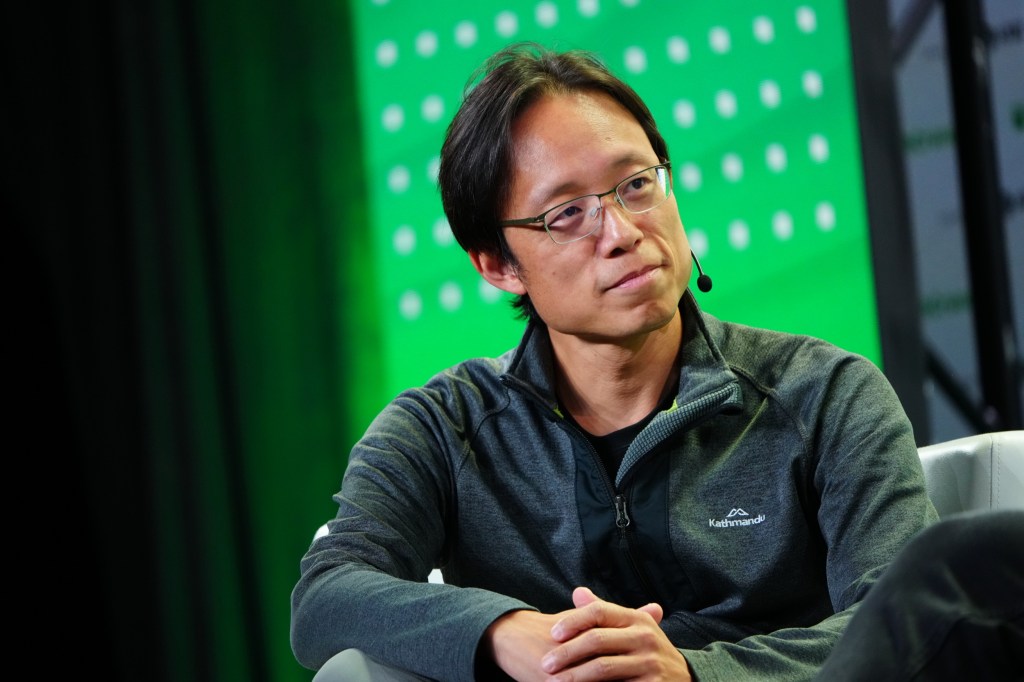

On the Chain Reaction podcast this week, we spoke with Kevin Rose, a serial entrepreneur whose efforts — including most famously Digg –have been well covered in TechCrunch over the past couple decades.

Rose is a partner at the VC firm True Ventures, but his latest project is an NFT startup called Proof Collective, which recently launched a much-hyped 10,000 NFT collection of pixelated owls. Rose and his partners banked $80 million off the primary sale of the Moonbirds project, and are using that money plus a much more conventional $10 million funding round led by Alexis Ohanian’s venture firm Seven Seven Six to build a “web3 media company.”

“We’re in this to build a big, massive, brand new kind of media company from the ground up,” Rose says. “We didn’t need to raise from Alexis or True Ventures, but the reason why we did is so that people could understand we were serious about building a lasting business here.”

Now, those Moonbirds are trading for at a minimum of around 25 Eth these days, which tracks to about $50,000 at today’s Ethereum prices, though the exchange rate has taken a bit of a haircut in recent weeks. In our conversation, we dove into a variety of topics with Rose, including the recent market downturn, which he sums up as “risk showing itself” in the midst of a very long journey away from fiat currencies.

“If nothing fundamentally about the mechanics behind the scenes has changed, which I guess obviously is not the case when it comes to something like UST or Luna, but if everything else is sound in terms of the technical infrastructure behind the scenes for Bitcoin or Ethereum or whatever it may be, then I’m just of the mindset that I don’t ever really think about going back out to fiat at any point,” Rose says.

The broader pullback in crypto markets has accompanied a more modest retreat in public markets over the past couple weeks, but while plenty of venture firms have seemed to be taking a hit, last week’s aggressive retreat knocked firms with substantial crypto holdings particularly hard. Rose says his firm isn’t looking to be reactive in order to try and game a potential bear market.

“We’ve never sold a token, so that’s the one thing that’s awesome about our funds, we can look founders in the eye and say we’re not in this to flip it. So, I don’t care if we’re sitting on a 20x or 50x, or negative 50% discount to whatever the token price is like, we believe that it’s going to take you a decade to build something really substantial in this new space… To bail on the founder is the absolute worst thing you could possibly do and it’s just not in our DNA.”

Venture firms have found plenty of new backers over the past couple years to invest in crypto-centric funds or vehicles with crypto close to their center. While many of these LPs likely are enduring their first major crypto downturn, Rose believes that most backers know what they are getting into chasing crypto returns.

“I think when you talk to individual LPs, they wouldn’t be investing in a crypto fund if they didn’t understand the multiples that they were hopefully aiming for and the risks that they were taking on,” he says. “If you take a look at everything that venture is dipping their toes in the waters of — crypto is the riskiest bucket of them all.”

You can listen to the entire interview with Rose (above), where we discuss his mixed feelings toward the metaverse, the challenges facing pseudonymous founders and web3’s inclusion problems.

Crypto VCs can’t just buy ‘community’

https://techcrunch.com/2022/05/12/winter-is-coming/

Subscribe to Chain Reaction on Apple, Spotify or your alternative podcast platform of choice to keep up with us every week.