Earlier this week, TechCrunch’s Equity podcast noted the chaotic price movements of crypto assets and predicted Coinbase’s earnings later this week could either smoothen or further complicate the path forward for startups in the web3 ecosystem. If Coinbase reported strong numbers, it could calm some concern about another crypto winter, the logic went.

That didn’t happen.

Last night, Coinbase’s first-quarter earnings report sent its already depressed stock plummeting, causing the former public-market darling’s shares to fall further beneath the $100 per-share mark. That’s far, far below the $368.90 all-time high the stock touched last year.

Today, Coinbase’s stock opened at just $54.66, down 25% from yesterday’s close.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

This morning — as UST burns and other crypto assets, like the newly launched ApeCoin, face extreme selling pressure — we’ll examine Coinbase’s results and what went wrong with its business in the first quarter.

Crypto bulls will dismiss any criticism of the company’s performance as a blip in the larger progression of crypto. For the rest of us, the report makes for a useful lens for scoping the current state of the consumer crypto market. Let’s go!

Crypto bulls will dismiss any criticism of the company’s performance as a blip in the larger progression of crypto. For the rest of us, the report makes for a useful lens for scoping the current state of the consumer crypto market. Let’s go!

Fewer users + more costs = big losses

In the first quarter, Coinbase’s revenues dipped 27% to $1.17 billion from a year earlier, and operating expenses more than doubled to $1.72 billion. The huge step-up in spend was partially because of the company’s much larger headcount — it had 4,948 full-time employees in the first quarter, up from 3,730 at the end of 2021 and 1,717 at the end of Q1 last year.

Coinbase, which also reported less revenue than it did in the fourth quarter, appears to be beset by a few major issues.

In the first quarter, it had fewer active users (9.2 million in Q1 2022, compared to 11.4 million in Q4 2021 and 6.1 million in Q1 2021), which led to lower trading volume ($309 billion in Q1 2022, compared to $547 billion in Q4 2021 and $335 billion in Q1 2021).

Trading volume is the key revenue driver for Coinbase, so lower trading activity directly hurt revenues in the first quarter, which also saw more costs.

Notably, Coinbase was not profitable in the first quarter — after reporting GAAP profit for a series of quarters, the company swung to a $430 million net loss. That compares miserably to a Q4 2021 net income result of $840 million and a year-ago result of $771.5 million.

In more bad news, analysts expected revenue of $1.48 billion in the first quarter, which means Coinbase missed expectations by a country mile.

Taken together, the declining user count, rising costs and erased profitability made Q1 a tough quarter for the company.

That leaves us with what lies ahead for the exchange.

More bad news

Credit where credit’s due: Coinbase doesn’t fuck around and hide the bad news.

While the following numbers won’t hearten investors, they do in fact warm my heart because they are clear and understandable.

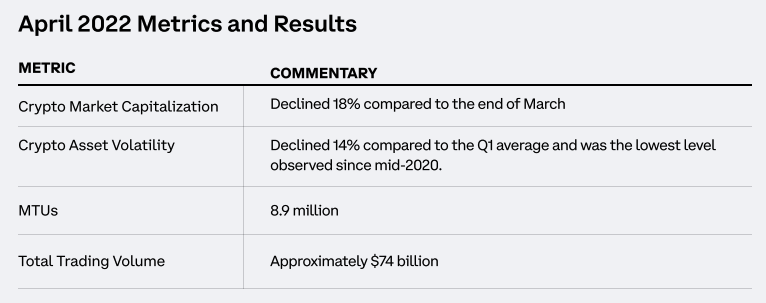

Coinbase gave us a brief look into what’s happened thus far in Q2:

Those numbers are not good, as they mean Coinbase will see fewer monthly transacting users (MTUs), and if the April pace holds up, lower total trading volume.

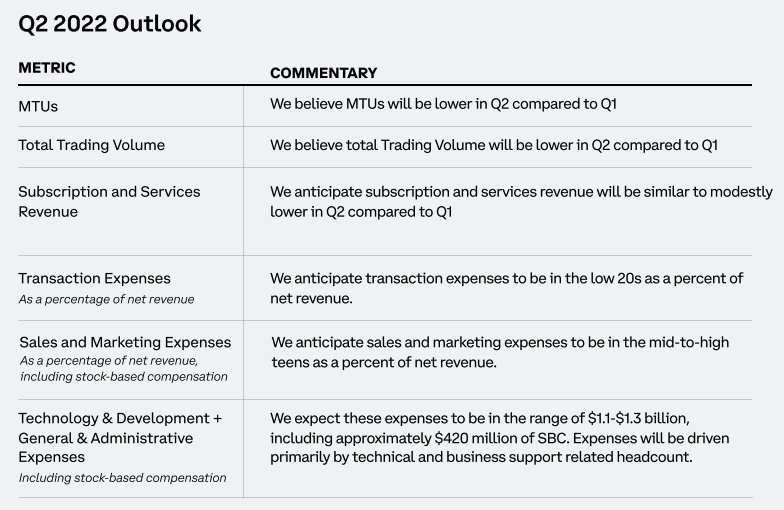

The result of the above is a series of projections that are, well, bad:

So Coinbase does expect MTUs to decline this quarter compared to the first quarter. It also anticipates total trading volume will decline if the current pace doesn’t improve. And it expects R&D and G&A costs to be roughly in line with the first quarter ($1.2 billion). In short, Coinbase’s revenue is set to shrink this quarter, and its bottom line may be even further in the red in Q2.

The company remains incredibly well capitalized, though, so it’s in no danger of any near-term liquidity issues. But with falling revenues and evaporating profits, it is certainly worth a lot less than it was.

What does this mean for crypto startups?

We’re staying brief this morning to prevent this little column from spiraling to several thousand words. In sum, then, the massive decline of Coinbase’s value is a problem. It sets a very poor precedent for the ability of crypto companies to retain value post-IPO and could harm the future exit value of many startups, meaning that they could struggle to raise capital at attractive prices.

Moreover, Coinbase’s results show that the aggregate crypto market is shrinking. This means there is less market activity for crypto-focused startups to operate against. That’s bearish.

Up top, we noted that lots of folks won’t give one hoot about which way Coinbase trades given their unshakeable view of what the future of money looks like. Fair enough. But even the true believers are going to have to manage a market in decline for at least the current quarter.

Comment