Historically, homeowners could only tap into the equity of their homes by taking out a home equity loan or refinancing. But a new category of startups have emerged in recent years to give homeowners more options to cash in on their homes in exchange for a share of the future value of their homes.

One such startup, Palo Alto-based Point, announced today that it has raised $115 million in Series C funding after a year of rapid growth. The company declined to reveal its valuation.

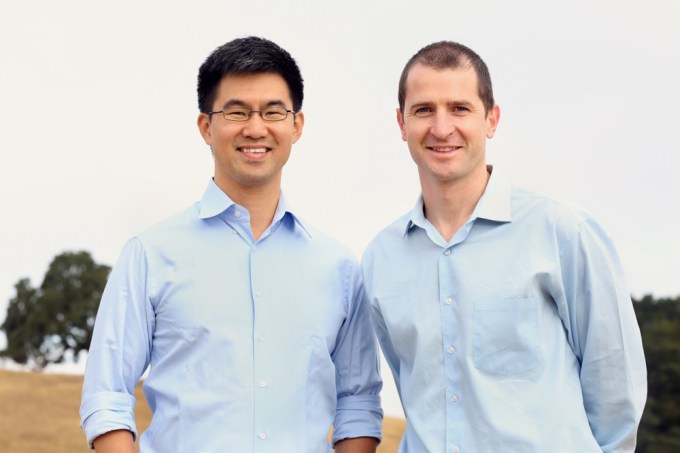

Interestingly, the startup was founded by a trio that includes Alex Rampell, who is today a general partner at Andreessen Horowitz (a16z) and who also co-founded buy now, pay later giant Affirm. He teamed up with Eddie Lim and Eoin Matthews to start Point in 2015 prior to joining a16z. Rampell is on the company’s board, but is not involved in the day-to-day operations of the company.

So, what exactly does Point do? In an interview with TechCrunch, CEO Lim describes the startup as a marketplace that teams up homeowners with institutional investors. The company’s flagship product, Home Equity Investment, is designed to allow homeowners to get cash in exchange for a certain percentage of future appreciation of their home. Point says that last year, it received over $1 billion in new capital commitments from real estate and mortgage-backed securities (MBS) investors.

The way it works is that Point first evaluates the finances of applicants and makes a provisional offer. Point then values the home — often with an in-home appraisal — and updates the final offer. Once all closing conditions are met, Point says it will fund the investment within four business days. On average, the size of the Home Equity Investment (HEI) that Point makes is 15-20% of the home’s property value.

Its average investment is around $100,000. And the average value of homes on its marketplace is around $700,000, according to Lim. The investors typically invest about 15-20% of a home’s value. So if a home is worth around $1 million, they will put in $150,000 or $200,000.

Homeowners, Lim said, use the cash to do a variety of things — such as conducting home renovations, starting a small business, funding a child’s education or saving for retirement.

“We have homes valued at $250,000 on our marketplace as well as multimillion-dollar homes, and everything in between,” Lim said. “It can be a very compelling way to get cash.”

“The homeowner is not obligated to pay us back for 30 years,” Lim told TechCrunch. “Of course, most folks have some kind of event or sell their home, or refinance, well before 30 years.”

The executive likened the process to a venture capitalist backing a startup.

“It’s like [an investor] making a VC investment into the home,” Lim said. “We invest in your home, and share in its future appreciation and upside.”

Since inception, Point has invested in more than 5,000 homes. While Point has been around for several years, Lim said it has seen “the vast majority of that” growth over the past year, according to Lim. Specifically, he said, Point’s funding volume was up over 5x in the first quarter of 2022 compared to the first quarter of 2021.

“We‘re kind of in a watershed moment for the U.S. housing market, and probably have been for a year or two now,” Lim told TechCrunch, “where home equity has never been so abundant, and yet so inaccessible.”

Indeed, a recent report indicates that “Americans are sitting on $26 trillion of home equity.”

The company believes that the advantage to a homeowner of using Point, as opposed to taking out a home equity loan or refinancing, is that they have “no monthly payments, no income requirements and no need for perfect credit.”

Lim describes Point as an “asset-light fintech for home equity.”

“We don’t own any assets and rather, connect homeowners to investors,” he explains. “As a marketplace, we charge fees on both sides of the transaction. And we also charge asset management fees with the investor.”

Currently, the company operates in 16 states, including California, New York, Florida, Massachusetts, New Jersey, Washington, Colorado, Pennsylvania, Illinois, Maryland, Michigan, North Carolina, Arizona, Minnesota, Oregon and Virginia, as well as Washington, D.C. It plans to enter 11 additional states by year’s end, including Ohio and Nevada.

The rise in mortgage interest rates have had a negative impact on startups in the digital mortgage space as the number of refinancings and new home purchases declines. But in this case, that may actually be serving as a tailwind for Point and companies like it, although Lim emphasizes that Point is not out to replace refinancings, for example.

“People can still refinance and use Point,” he told TechCrunch.

Other companies in the space include HomePace, which just last week raised a $7 million Series A led by home builder Lennar’s corporate venture arm, LENX. HomeTap raised more than $60 million in funding in December. Last October, Point announced a $146 million securitization. And in February, Unison completed a $443 million securitization.

WestCap led Point’s Series C, which also included participation from existing backers a16z, Ribbit Capital, mortgage REIT Redwood Trust, Atalaya Capital Management and DAG Ventures. New investors include Deer Park Road Management, The Palisades Group and Alpaca VC.

The investment brings the startup’s total raised to date to more than $170 million in equity capital.

Point plans to use its new funds to scale its offering so it can “support more growth,” as well as toward the launch of new products and expansion of its national presence. It also, naturally, wants to hire more “pointers,” as Lim called the company’s staff. Presently, the startup has 210 employees.

“In many, many ways, we’re just getting started,” Lim told TechCrunch, “in terms of how many homeowners are out there and how much equity is out there. We ultimately want to bring this to every homeowner in the United States.”

Laurence Tosi, founder and managing partner of WestCap, was actually an angel investor in the company before leading this round via the growth equity firm. He first backed the company in 2018.

“WestCap is leading this round in Point because they have developed the best and most consumer friendly solution for consumers with the most flexibility and least financial burden,” he told TechCrunch. “Point empowers homeowners to safely manage their wealth and invest in their future, even when unforeseen circumstances arise.”

Tosi — who is the former chief financial officer of both Airbnb and Blackstone — believes that Point’s offering stands out from competitors in that it works with regulators, has securitization capabilities and a “best-in-class investor base” while “offering investors above-market, risk-adjusted returns.”

For his part, Rampell — who led the company’s seed and Series A rounds, and invested in its Series B as well — said in a statement that “the strength and depth of the team that Eddie Lim has brought together at Point and its innovative approach to providing financing to homeowners has been apparent.”

My weekly fintech newsletter, The Interchange, launched on May 1! Sign up here to get it in your inbox.

Comment