Just over a year ago, UiPath was among the most favored startups in the world. Last February the company raised a massive $750 million round at a staggering $35 billion valuation. The robotic process automation, or RPA company, was firing on all cylinders.

By the time that UiPath went public in April of last year, its final private price looked a bit, well, pricey. The company’s early IPO price range was underneath its last valuation, but after raising that range and pricing above it, the unicorn was still valued at a modest deficit to that $35 billion figure.

During its first day’s trading however, the company managed to crest the price set by its round worth three-quarters of a billion dollars. TechCrunch chatted with the company’s CFO about its method of going public at that time, and the timing of its debut for more context; the executive praised the ability to attract new investors in a traditional offering, instead of the more trendy direct listing option.

UiPath’s value shot to as much as $90 per share, pushing its valuation to around $43 billion per YCharts data.

Since then, however, things have gone poorly for UiPath, at least in valuation terms. The company was down over 3% at $18.29 per share on Friday afternoon, bringing its valuation under $10 billion. From red-hot unicorn to uneven IPO, to strong early trading, to a painful descent — what went wrong with UiPath?

TechCrunch has two hypotheses: The first being that the company simply got caught up in a broad repricing of technology revenues by public-market investors; this is not a new story, and if it explains the UiPath valuation declines would put the technology concern in good company. However, there could also be a technology-related explanation at play, as well. And, of course, both factors could be at play at once.

To understand what may have happened with UiPath’s disappearing valuation, let’s first talk numbers and then riff on the tech side of the coin!

Did UiPath just get hit by the market’s technology repricing?

UiPath remains a company on the move. In the fourth quarter of its fiscal 2022 — in English, the three months ending January 31, 2022 — the RPA market leader reported revenues of $289.7 million in total revenue and a quarter-ending annual recurring revenue (ARR) figure of $925.3 million. From those data points you can see how the public markets have changed their mind about the value of software revenue.

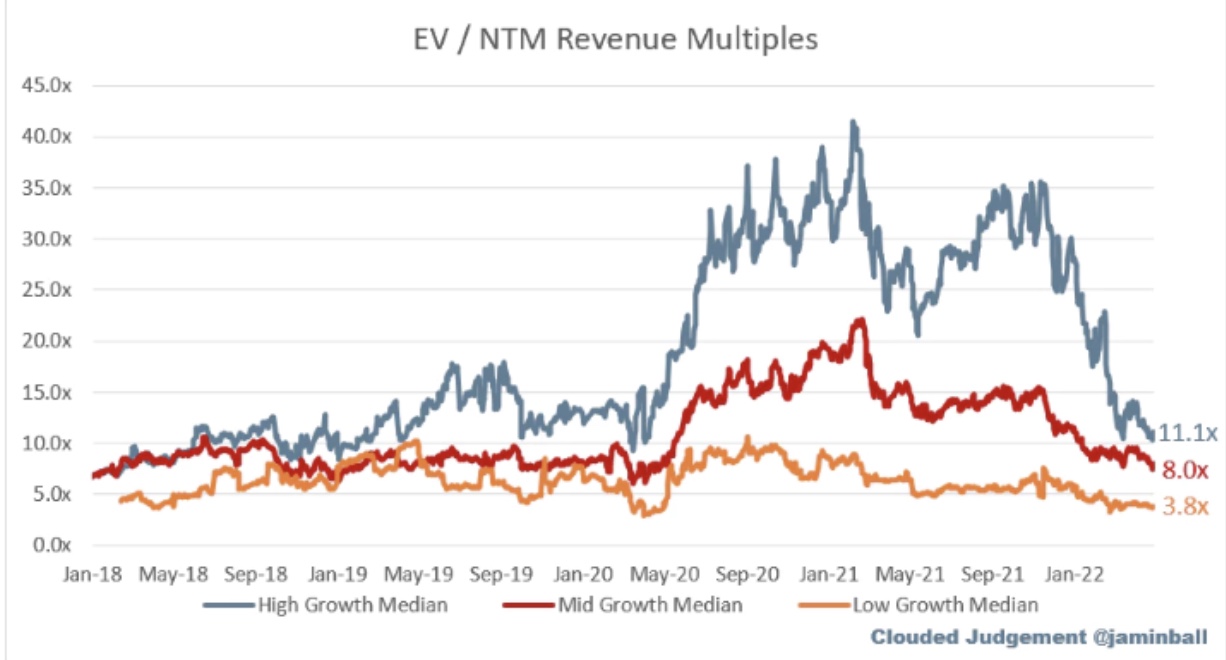

How so? With nearly $1 billion worth of ARR and a market cap this morning of around $10 billion, UiPath is only worth around 11x its annual recurring revenue. With 39% revenue growth in its most recent quarter, the company fits neatly into the high-growth SaaS bucket. Data via Altimeter Capital’s Jamin Ball details just how far the value of high-growth SaaS companies have come down in recent quarters:

The value of UiPath peaked in April and May of 2021, back when multiples were much higher and has come down since, like the value of other high-growth SaaS companies has per the above chart. What we care about today is whether the company is fairly valued today, or if it is trading at a discount to its market peers.

Given that UiPath is worth around 11x its ARR today, and the median high-growth SaaS company is worth 11.1x its next twelve months’ revenue, we are done, yeah? Not so fast. Ball defines high-growth SaaS as those public software companies with greater than 30% growth. UiPath most recently posted 39% growth, a far superior number. By some very loose comparative math, then, we can see that UiPath actually feels cheap when we compare it to its peer set.

Even more, UiPath expects around $1.08 billion in total revenue in its new fiscal year, giving the company a next-twelve months revenue multiple of 9.2x. That also feels cheap, especially when we consider how quickly the company is growing and we consider where its peer set is valued today.

Does it matter that UiPath loses money? The company’s operating profit fell from $14.6 million in its year-ago quarter to $50.9 million in its most recent three-month period. Our read is that the company’s rising unprofitability is not good — UiPath’s operating losses grew even more sharply during its last fiscal year than they did in the final quarter of that annum — but that it hasn’t yet grown to the point of being a differentiated issue.

Most high-growth software companies are unprofitable, pushing money into sales and research as they accrete ARR. Perhaps UiPath’s fall from operating profit to operating losses helped fuel its valuation descent, but as we’re comparing it to other unprofitable companies when we consider its valuation today, its current pace of loss is not more than a modest sin.

Summing, we cannot we can’t explain all of UiPath’s valuation declines simply in market terms, or due to falling profitability. Could there be more going on? Let’s consider the tech.

More than just RPA

UiPath has been the clear market leader in robotic process automation, technology that enables companies to create automated workflows with legacy technology where modern AI is difficult to implement and pricey, but perhaps investors believe that market alone could be a bit restrictive for a public company.

Forrester reported in March that the RPA market was expected to reach $6.5 billion in revenue by 2025, but that the industry could begin to flatten by as early as next year. With $1 billion in revenue already — a significant chunk of the market — could investors be worried about UiPath’s growth outlook?

Perhaps, if UiPath were strictly RPA, but the company dabbles in much more, says Craig Le Clair, a Forrester analyst who covers this space. He thinks that UiPath is covering enough adjacent ground to make up for any slowdown in RPA alone.

“I don’t think they have been too narrowly focused on RPA … They have expanded well into adjacent areas like document extraction and process discovery. They are the strongest company in the segment and well financed in this growing market,” he said.

But he also warns that Microsoft looms as a threat given its aggressive pricing and license footprint, and he believes the company needs to just double down and execute. Perhaps that is why it announced this week that it’s bringing in a highly experienced co-CEO in former SAP and Google Cloud exec, Rob Enslin.

“I believe the addition of Rob Enslin is extremely positive. Daniel Dines’s strength has always been on establishing a great company culture and product innovation, which he can focus on even more. Rob built Google Cloud from a risky bet to being in the same league as Azure, and AWS, not an easy task given Google had few enterprise credentials [before he came along], being a B2C company. He also has very strong industry connections,” Le Clair told TechCrunch.

So while the core RPA market growth could decelerate next year, UiPath appears to be insulating itself against that with an expanded platform and vertical market approach. As an example, the company announced this week it was releasing a financial automation as a service offering on Finastra, the financial services cloud.

Amit Kumar, vice president of financial Services at UiPath says that it could be just the start of more packaged automation solutions aimed at specific industries. “As customers pursue broad digital transformation efforts, they may need additional support from industry specialists, which could be in the form of secured infrastructure such as the Finastra platform as well as in process mining, process discovery, deployment and ongoing maintenance support,” Kumar explained.

In a TechCrunch+ investor survey last year, Laela Sturdy, general partner at CapitalG was optimistic about the future of the category.

“We’re a long way from needing to think about the space maturing. In fact, RPA adoption is still in its early infancy when you consider its immense potential. Most companies are only now just beginning to explore the numerous use cases that exist across industries. The more enterprises dip their toes into RPA, the more use cases they envision,” she said at the time.

When you consider all of that optimism, it’s even more baffling that the market has treated the company so poorly.

Given that we are writing in the wake of the popping of one of the most aggressive valuation climates for technology companies in recent memory, it’s not a surprise that we’re seeing some companies take lumps. The case of UiPath, however, is slightly hard to grok. Consider it one more lesson in the 2022 education we are all receiving in how quickly the worth of tech companies can change.

Comment