Jeremy Abelson

More posts from Jeremy Abelson

We speak with about 200 private companies every quarter, and the vast majority of our conversations over the last three months have revolved around one question: What am I worth now?

Many private companies are faced with lower valuations — a down round or secondary trading at lower levels — especially if their last valuation was set in the last year or two, regardless of how much they grew in that time.

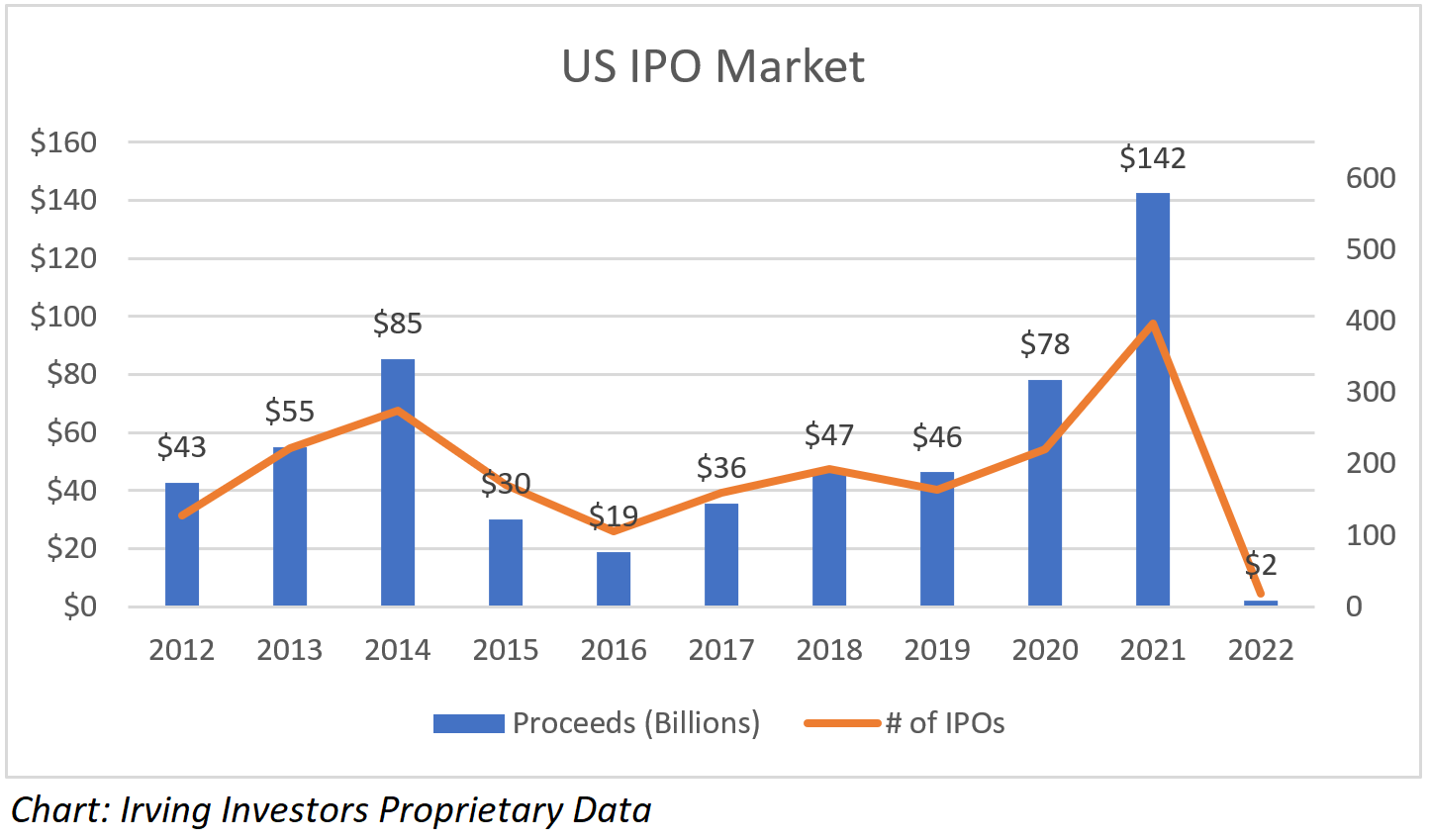

The public markets have trended downward, investor priorities have shifted and the IPO window is essentially shut, with Q1 IPOs (18 deals with $2.1 billion raised) at their slowest annualized rate in over 10 years.

The recalibration of public stock valuations is very real for high-growth tech companies, and even more so for unprofitable high-growth tech firms. The trickle down effects of this recalibration, along with significant liquidity constraints, are being felt by private companies.

Refreshed valuations

To answer the question of what you’re worth now, we first need to:

- Define where public market multiples are, and where they have come from.

- Provide a valuation framework that can be applied to companies.

- Apply additional factors that are now impacting valuations — liquidity profiles, changes in investor focus, etc.

What happened with the public markets?

A big drop.

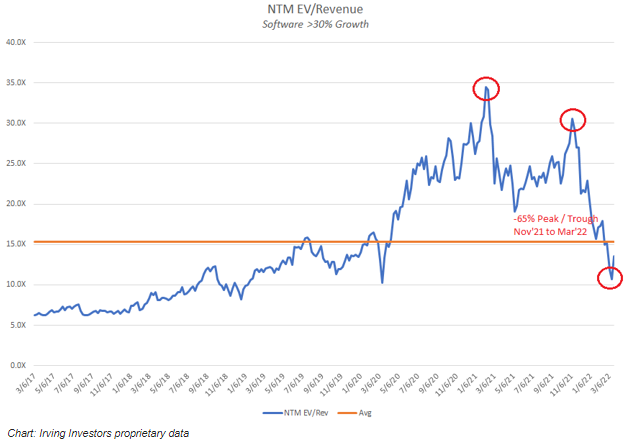

This chart shows the EV/revenue multiple for a bucket of high-growth software (30%+ year-on-year growth) names. Multiples declined 65% from peak (~31x) to trough (~12x) in the last five months. Such a drop has few precedents — this is the first time we’ve seen such a large percentage decline within a peak to trough pullback in the last ten years.

How can we apply this to companies?

While a private company cannot be directly compared to public companies, to find out what a company is worth, we must start by accurately identifying public market comparables.

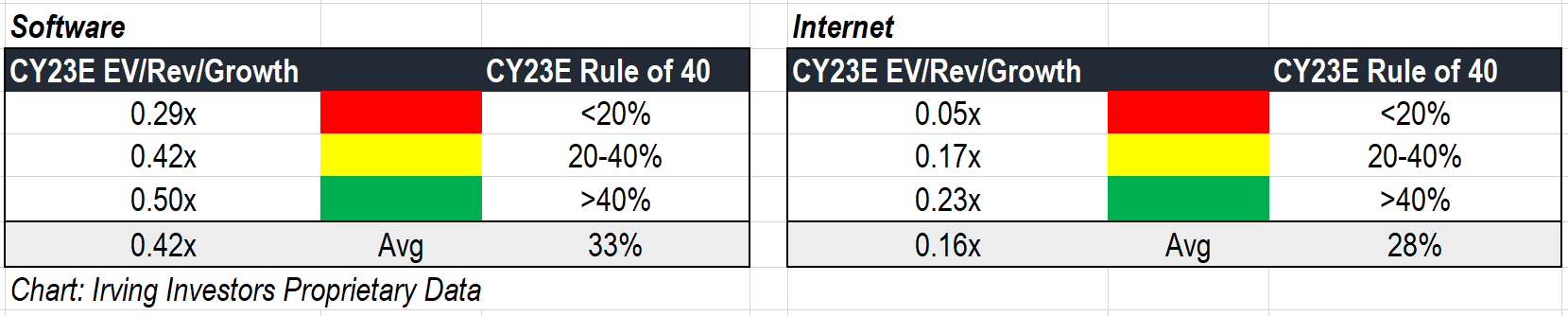

Average sector revenue multiples (in the chart above) don’t tell the full story, as every company is unique. We have to go a little deeper.

Looking at the Rule of 40 relative to a growth-adjusted revenue multiple captures the way investors are valuing companies today, and the proof is in the linear correlation.

While there is a lot of debate about profitability versus growth, The Rule of 40 lets us judge both factors. It also serves as a measure of how responsibly a company is growing.

Using EV/revenue/growth to assess the impact of the Rule of 40 is very illuminating. By adjusting for growth — essentially removing the impact of growth on the revenue multiple — we effectively isolate the premium the public markets are assigning to companies across the Rule of 40 spectrum.

With three numbers — revenue growth rate, a y+1 revenue number and the Rule of 40 — companies can use this chart to triangulate to a more company-specific enterprise value.

To show the math, for example:

Take a SaaS Software company with CY23E $250 million revenue (+50% y-o-y) and Rule of 40 (+50% growth + negative 20% EBITDA/FCF margins).

Calculation: 50 * 0.42x = 21.0x * $250 million CY23E revenue = $5.25 billion enterprise valuation

What this chart tells us

The numbers paint a clear picture. The chart shows a powerful and linear relationship between the Rule of 40 and valuation. Investors care about this metric or the construct behind it.

Most importantly, this means that the more responsibly and effectively a company is growing, the higher the multiple that company attracts.

The data also show that both revenue and growth can contribute to premium and discount rationales, and should be looked at in relation to each other.

It’s great to have metrics above the Rule of 40, although fewer than 30%, or just 37 of the 125 software companies in our comparables table, can claim that title.

What else can impact my valuation?

Liquidity constraints

Lack of liquidity causes shareholder stress, which drives increased selling, and that in turn leads to dramatic drops in pricing.

This is especially true with illiquid assets such as private company stock — that’s why the correction is always more severe in the private markets versus the public markets.

Therefore, an “illiquidity discount” must be applied. A discount applied to private company valuations versus public market valuations due to lack of security liquidity, illiquidity discounts weren’t very common in the last few years.

The illiquidity discount for pre-IPO companies (0-18 months from an IPO) has historically been ~20%+ versus its potential public valuation.

While the IPO engine was humming, liquidity was perhaps considered somewhat of a given. This quarter reeducated everyone. Security liquidity became critical, as investors needed to sell and hedge against risk.

Additionally, with the IPO window closed, investors are now highly uncertain when their private company investments will become liquid. Simply put, no IPOs equals less pre-IPO investing, which means less cash in the late-stage venture system.

Thirty-eight companies told us their 1H2022 IPOs have been delayed.

Private versus public investing: Comparative analysis

In today’s market, investors will diligently compare a private opportunity with readily liquid public opportunities.

When there is more conviction in the markets, investors flock to the private markets to find juicy returns. When uncertainty creeps in, the perceived risk of investing in private companies grows exponentially.

Take Snowflake, for instance.

Snowflake has to be the north star for all private tech companies. Crossover investors will often ask themselves: “Should I buy private company X at $XYZ valuation if I can own Snowflake at ~23x next year’s sales?”

Private companies need to compare their investment value to the option of investing in Snowflake and others like it.

Snowflake is highly liquid (~8 million ADV), has a proven track record, and its stock is currently down 40% from November 2021 highs. See its Q4 2021 numbers:

- NRR: ~178%,

- Growth rate: 101% year over year.

- Scale: over $1.5 billion annualized run rate.

- Cash flow positive: adjusted FCF margin of 28%.

- Rule of 130 (Rule of 40).

- Highly diversified customer base of 5,944.

- Consistent beat and raises.

- Top class management.

Snowflake currently trades at a 19.7x CY23E revenue estimate (0.36x EV/rev/growth), which investors believe is conservative, and its stock saw a trough a month ago at 15x (0.28x EV/rev/growth).

Where do we go from here?

While the market has quickly turned to favor the buyers, the good news is that it isn’t broken. We are just in the midst of a correction that is quantifiable and sensical. Much of the correction can be explained by inflationary pressure, increased rates and a fall from a historically high-multiple environment.

Investors are watching and waiting. There is a lot of cash on the sidelines (over $6 trillion, +15% year over year) with major TINA (“There is no (other) alternative”) versus U.S. public equities.

The sector will find stability, which will bring back investor conviction, albeit at lower valuation levels. It will take discounting to bring back investors, but this broad market stability will quickly reignite the capital markets engine.

Comment