With 12 million users and nearly $200 million in annual recurring revenue, expense software provider Emburse has built much of its business in the enterprise.

Historically, it has competed with legacy players like Concur and Expensify and ERP players.

But now Emburse is making a big push into the SMB space and going head-to-head with fast-growing startups like Ramp and Brex — the latter of which started at the SMB end of the market and coincidentally today announced it’s making a big push into software and the enterprise space.

Today, Emburse is revealing its first product — called Emburse Spend — that relies on interchange fees rather than subscriptions. Again, this is the opposite move Brex has made, which is diversifying its revenue base to include more subscriptions in addition to interchange fees.

In the increasingly crowded, and very competitive, corporate spend space, companies have either been predominantly subscription-focused or fee-based. But in time, more of these corporate spend players are evolving into being both.

The goal with Emburse Spend is to “transform the corporate card from an executive status symbol into an everyday tool for teams.” It’s aimed at employees who are “constantly” making small purchases, like software subscriptions, instead of expensing a few business trips a year. The company touts that with Emburse Spend, managers can issue cards “at any time without waiting for finance’s approval.”

Emburse’s history is a bit complex so we’ll try to simplify it for you. The company that was originally called Emburse was on the Disrupt stage in 2015 and issued prepaid cards quickly to employees.

In 2019, a company called Certify’s private equity owner, K1, acquired Emburse and another company called Chrome River that did spend management and invoice automation in the enterprise space. The three companies were combined to form what is today Emburse.

The company has three core offerings: Emburse Chrome River, which is focused on the enterprise; Emburse Certify, which serves midmarket companies and its newest one, Emburse Spend, which is geared toward SMBs.

“This is a big differentiator for us,” said Emburse CEO and Concur alum Eric Friedrichsen. “There’s real demand in the market for a company of scale that can really address the tailored needs of a specific type of organization by size and geography.”

In the company’s view, the needs of say, an Exxon Mobil, is “so different than what Pinterest needs.”

Today, SMBs make up about 15% of Emburse’s customer base, while 35% are midmarket companies and 50% enterprise. Faraday.ai and Apartment Life are examples of its current SMB customers.

“We expect all of those segments to grow,” Friedrichsen told TechCrunch. “But we expect the SMB segment to grow at a higher clip … “We see an incredible amount of opportunity in the SMB space.”

How it works

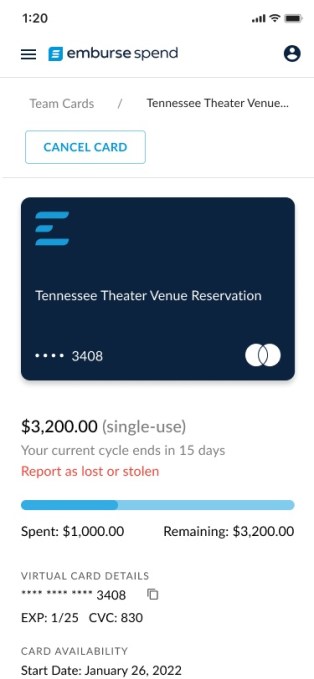

Emburse Spend, which is based on the same platform already used by the company’s existing customers, aims to give companies a way to “easily” distribute and manage virtual and plastic cards to employees while minimizing risk from out-of-policy spend. Employees can use the cards to make purchases or take business trips without needing to worry about collecting receipts or submitting expense reports, the company says.

For example, an employee can submit a request for a card based on purchase needs, which could range from software subscriptions to travel bookings. A card administrator can “immediately” issue a virtual card, with restrictions such as spend levels and time limits, automatically coded into it.

When an employee makes a purchase through their Emburse Card, they get a real-time alert on the Spend mobile app to capture an image of the receipt. The company’s OCR engine verifies that the receipt matches the card transaction data. An expense record is created, and then identified as being within, or out of ,policy.

Emburse says it’s able to do all of this because it uses “sophisticated” optical character recognition, approval workflows and machine learning to deliver “a seamless solution” for purchases and reconciliation.

Even before today’s news, cards have played a role in Emburse’s strategy. In 2021, it announced a white-labeling partnership with Mastercard, similar to the one Airbase recently inked with AmEx. The company also launched a platform allowing customers to issue corporate cards from partner banks such as Silicon Valley Bank.

“We’ve got an open platform when it comes to card issuing. I think that’s a big differentiator from the startups in our space,” Friedrichsen said. “There are cases where a customer may need our specific solution but generally our goal is to partner with financial institutions, rather than compete with them.”

Emburse is profitable, has 18,000 paid customers globally and grew its ARR by nearly 30% last year, according to Friedrichsen. It processes about $65 billion in spend annually.

“We’ve got very, very high gross retention rates,” the executive said.

Notably, the company recently hired Adriana Carpenter to serve as its CFO. In her previous role, she helped take Ping Identity through an IPO. Friedrichsen told TechCrunch that an IPO is something that is in Emburse’s future, just at the right time.

“It’s a logical step that over the next few years that we may go public. Certainly we’ve got the scale to do it. We’ve got the infrastructure to do it and we’ll make sure we’re ready if that’s the direction we end up going,” he said.

Emburse Spend is available as a free solution, and the company said it also provides savings through card rebates. “Additional capabilities” are available on a subscription basis.

For now, Emburse is mostly focused on North American and Europe with some customers in Asia and Australia. It’s hoping to expand globally.

So why has the corporate spend management heated up so very much in recent years? The COVID-19 pandemic really accelerated the need for better spend management solutions, Friedrichsen believes.

“There’s a much more decentralized workforce today than there ever was before. And so now, employees need to be able to spend money on behalf of their employer in a very efficient way,” he told TechCrunch. “It also needs to be very efficient, but with some controls in place. I think that’s one of the big reasons why this space has really taken off.”

Also, he said, technology from a corporate card standpoint has “evolved considerably” with the ability to put more controls into a corporate card than ever before.

My weekly fintech newsletter is launching soon! Sign up here to get it in your inbox.

Comment