On one hand, we’re heading into Y Combinator Demo Day week, which means that we’re about to sit back and watch a few hundred companies make their pitch to investors and the larger startup world.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

On the other, the event comes just days after well-known Y Combinator graduate Instacart decided it needed to trim its valuation to remain competitive for talent.

But the late-stage angst that we’ve explored recently is merely a facet of the total startup market, which includes both early fundings — angel, seed, etc. — and rounds like Series As and Bs. We can’t just say that late-stage startups are waking up to a changed market and call it a day. We need to understand the full picture.

But the late-stage angst that we’ve explored recently is merely a facet of the total startup market, which includes both early fundings — angel, seed, etc. — and rounds like Series As and Bs. We can’t just say that late-stage startups are waking up to a changed market and call it a day. We need to understand the full picture.

PitchBook dropped a report this morning looking at the market trends that helped drive the 2021 venture capital boom. Recall that last year was a record for venture activity in a host of geographies, with private-market capital flowing into startups at a pace that we might not see for years to come.

The PitchBook report hints that there is a slowdown afoot in total venture capital activity, with an included chart showing monthly activity in the United States slipping from its late-2021 highs. But we wanted to know more, so we dug into the data.

New data shows how far VCs are pulling back on US Series A, B, and C valuations

Based on our look at the raw figures and what we’re hearing, we’re in what could be the early stages of a venture slowdown. Just how material the period of reduced investor activity will prove to be is the real question of the day.

Party on

Not that you would really guess that things are changing, looking at early-stage valuations. This piece of information from startup founder and investor Ryan Hoover caught our eye over the weekend:

The floor (from what I’ve seen) for the latest YC batch: $20M post-money

— Ryan Hoover (@rrhoover) March 27, 2022

Some folks noted that there were some Y Combinator startups raising at $15 million, which is fractionally better than $20 million from the investor perspective. But old-school Series A prices for current-day accelerator graduates is about as clear a difference as we might be able to draw between where the startup game is today and where it was a decade ago.

But startups raising at those prices — and the investors paying up for their rounds — could be in for something of a shock later on when those companies look to raise.

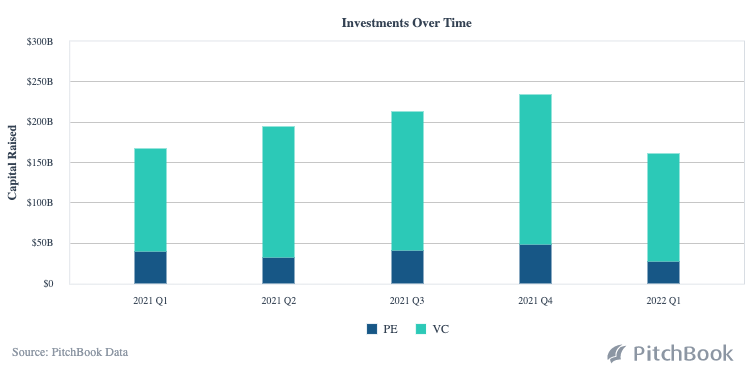

Behold my Very Beautiful Chart from PitchBook recording global venture rounds and private equity growth capital, segmented on a quarterly basis:

Naturally, the Q1 2022 data point will fill in somewhat over the coming days and weeks. But even if it does, the period may merely match its year-ago level, falling under the last three quarters’ tallies. In numerical terms, PitchBook has around $235 billion in total volume in its records for Q4 2021 and $161 billion in Q1 2022. That second figure is the smallest since at least Q1 2021.

But it’s not Q1 2022 that I am worried about — it’s Q2. I think that a lot of deals that we saw early this year were effectively late-2021 deals, which means that some of this year’s first-quarter data is not all 2022 vintage. The second quarter will not feature that aspect, and so may prove more illustrative of where the market truly is.

Why do we care? Because the persistent comment we hear from founders is that due diligence is ramping back up from private investors. And from those capital allocators? They say their business is slowing down. The data nearly shows that, thus far. But not yet, or at least not entirely; it’s too soon to pull the panic alarm from what we can see today. But we are not that far off, either.

This puts an interesting blanket atop this week’s Y Combinator event. What market are these hot little startups launching into? And are they prepared for things to get far harder once they leave the seed stage?

Comment