This time last year, Box was fighting tooth and nail to keep activist investors led by Starboard Value from taking over its board and dictating the company’s direction. If the activist investors had won, CEO and co-founder Aaron Levie might have been forced out, and the company could have been sold.

But Box prevailed, and the shareholders who backed the executive team were rewarded this week with a quarter that beat everyone’s expectations, including the company’s own.

Last quarter, Box’s revenue reached $233 million, up 17% from a year earlier, and beating analyst estimates of $229 million, according to the company. The revenue result also came in ahead of Box’s own estimates that growth would land somewhere around 12%. Its shares are up over 6% for the week as of Friday morning.

When Starboard lit a fire under the company last year, Box had reported a very different set of quarterly results. Growth was an anemic 8.3%, putting pressure on the company’s leadership to start improving growth and profitability.

Looking back with the benefit of hindsight, that quarter wound up being the low point for Box as the company began an ascent of slow but accelerating growth, as the graph below illustrates:

Levie was understandably upbeat about his company’s results, saying Box’s growth didn’t come from any one particular area — it was across the board.

“It’s been everything from small businesses that are growing quickly to large enterprises that are going through significant digital transformation. I mean, we had some major, major wins [including] large banks and government agencies and large industrial goods manufacturers. So it’s been very broad-based,” he said.

One of the primary reasons for the uptick in business is bundling, which Zendesk also saw great success with last year. It turns out that building a suite of products works out well for SaaS companies.

“I think what’s been so important from a business model standpoint is our move toward bundled plans. So we have Enterprise Plus, which is a new enterprise edition of Box that has Box Shield, Box Governance, our eSign capabilities, [and others] all in one suite. And, and that’s certainly accelerated our growth and led to more and more customer adoption of our full platform,” Levie explained.

Alan Pelz-Sharpe, founder and principal analyst at Deep Analysis, a firm that watches the content management space Box operates in, said the proxy fight was a drag on the company, and now that it’s past it, it has been able to move forward.

“Now that the proxy fight is over, it’s clear that some of the initiatives that Box had been building over the past few years to move further into the true enterprise market are paying off. The Enterprise Plus packaging, and indeed all their license packages, have been restructured in the past year in a way that makes them very competitive against legacy enterprise content management (ECM) vendors and other enterprise file sync and share (EFSS) vendors. Bundling functionality like eSignature and file migration tools into these licenses is in stark contrast to a long list of expensive add-ons that their competitors sell, making Box quite compelling,” Pelz-Sharpe explained.

After a proxy fight victory, it’s time for Box to make some bold moves

The Box Sign product Pelz-Sharpe referred to came with the acquisition of SignRequest last year. While it might have seemed minor at the time, the deal appears to have been a harbinger of the company’s plans to broaden its capabilities across the platform. In fact, Levie strongly hinted there could be more M&A this year.

“For a number of years, we were doing more incremental product expansion on top of content management, and by getting into eSign, and then some upcoming announcements that we’ll share with you in due time, we’re actually adding entire new categories on top of Box. And that’s a pretty big shift for our customers because now it means if you buy into our platform, you get a full suite of capabilities all in one architecture,” Levie said.

While all the trends appear to be moving in the right direction, can the company keep it going, and what are its projections for FY2023? Let’s take a deeper look at the numbers.

Can Box keep accelerating?

Box’s recent acceleration can be measured in several ways. Yes, revenue growth more than doubled from 8% to 17% from Q4 2021 to Q4 2022, but that’s merely looking backward. More forward-focused metrics also look good: Remaining performance obligations (RPOs) topped $1 billion at the company for the first time in its most recent quarter, for example, while billings and deferred revenue also reached new records.

RPOs are an interesting metric. During an earnings call earlier in this quarter’s cycle, TechCrunch asked Amplitude CEO Spenser Skates about the metric, which he described as something in between revenue (a trailing metric) and ARR (a metric that Skates said lacked reporting consistency). Regardless of which metric you prefer, the fact that Box has some sort of forward revenue-ish metric over the $1 billion mark feels like a milestone for the company.

The billion-dollar number is the most important metric for Box in the coming quarters.

Sure, startups like to shout about reaching a $1 billion private-market valuation, but real unicorns are the companies that generate $1 billion in revenue during a single year. Box is set to get very close in the coming year.

The company said that it anticipates between $990 million and $996 million in total revenue for its fiscal 2023. Given that we are discussing Box from a growth and not a profit perspective, we have to understand whether that number is good.

The answer is yes, but.

Yes, the number is good in that it works out to 14% growth for the year at the top end of the guided range, above the 13% growth Box managed in fiscal 2022. But, it’s slower growth than its most recent quarter.

So how should we read the company’s guidance? With some cautious optimism. (Note: Box does have some revenue seasonality, so comparing any single quarter to a full-year result is slightly reductive, but we’re playing for keeps so we’ll use hard comparisons.)

Box will face headwinds in the back half of 2022 because it has to post growth numbers that are measured against its faster-growing quarters from 2021. That fact could be why Box expects its growth to slow from 17% in its most recent quarter to 14% for the current year.

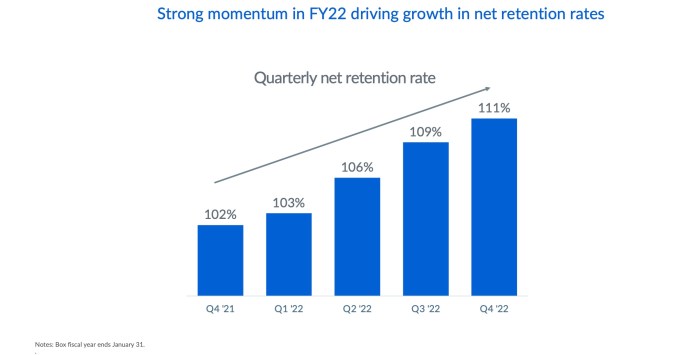

Yet, there’s reason for optimism that Box could post numbers above its guided range and squeak into the billion-dollar revenue club. Recall that selling products as a bundle is working for Box. One way to measure the success of larger, more expensive bundles is in Box’s retention rate — if it is successfully selling customers on bigger software packages, we might expect to see the company post accelerating upsells to its extant customer base.

Are we? Yes, as the graph illustrates:

On the same theme, Box is seeing accelerating “attach rates” for its products, which means it’s succeeding in selling more than one thing at a time.

Back to the M&A point from above, the company has reason to believe that it can sell more to its existing accounts over time, making more deals more likely. Box is managing a good set of metrics on its own by attaching more products and upselling more seats, but with extra firepower, perhaps it can go even faster.

Speed, or pace of revenue expansion, is now the name of the game at Box. And, frankly, at its traditional rival Dropbox as well. Both have shifted from high-growth, high-burn companies into slower-growing, more profitable concerns, albeit with very different strategies. Both, however, don’t want to be valued on profit multiples, and to get back to the land of revenue multiples, they will need to accelerate — or at least hold on to — improved growth rates.

Box proved in 2021 that its strategic product work would pay off. The current year, fiscal 2023, will be an even harder test for the company, as it has to best its improved prior-year performance. But the company’s efforts appear additive in that they are improving as a group, leading to possible continued acceleration.

There are reasons to believe that Box could have an even better year this time ‘round. We’ll be watching.

Comment