Venture capitalists and other investors have poured capital into fintech startups around the world in recent years, including a record number of rounds worth $100 million or more in the second quarter of 2020. In Q2 2020 venture-backed fintech startups raised 28 nine-figure rounds, underscoring the scale of the bet investors are making on fintech’s long-term success.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Inside that fintech wave are various hubs of activity, including payments tech, investing and banking. That last category has helped give rise to so-called neobanks, startup banking entities that offer mobile-first, consumer-friendly banking tools and services. Given the old-fashioned nature of banking in many countries (and how far out of reach banking remains for many) neobanks have seen strong uptake by users in recent years.

And the startup cohort has raised oceans of capital to help fuel its growth. In America, Chime was most recently valued at $5.8 billion after raising hundreds of millions in late 2019. More recently, neobank Revolut added $80 million to its Q1 2020 round worth $500 million. Revolut is also worth north of $5 billion. Monzo is well-funded (albeit at a recent valuation reduction), Latin America-focused NuBank is worth $10 billion, according to Crunchbase, Starling recently raised another £40 million, while Germany’s N26 is worth over $3 billion after its most recent nine-figure round.

From the fundraising perspective, then, neobanks are killing the game. And thanks to recent tailwinds from the COVID-19 pandemic that have bolstered interest in savings-related products, many of the same entities could be enjoying a strong year thus far. But recent self-reporting of some neobank’s 2019-era results details ample red ink — perhaps more than we might have anticipated.

From the fundraising perspective, then, neobanks are killing the game. And thanks to recent tailwinds from the COVID-19 pandemic that have bolstered interest in savings-related products, many of the same entities could be enjoying a strong year thus far. But recent self-reporting of some neobank’s 2019-era results details ample red ink — perhaps more than we might have anticipated.

Of course, startups don’t raise money for fun; they raise it to invest it in their operations and drive scale. So, we knew that these megafundraisers were losing money on purpose. All the same, let’s peek at the economics of several neobanks, as their now dated and thus not at all current results can provide useful context on two points: Why investors are excited to put their capital to work in neobanks, and why neobanks always seem to have another check to announce.

Monzo, Starling and Revolut

To prevent my receiving unhappy emails from irked fans of these companies, please bear in mind that we’re looking several quarters back when observing the following results.

It would be lovely to have more recent data, but with European neobanks reporting their — roughly — 2019 results in recent weeks, this is what we have. We are going to parse the numbers, but we will not conflate past performance with current results. We do not know much about 2020 neobank financial performance.

Anyhoo, to the numbers. You can read the full documents from Monzo here, Starling here (or here, if that link is struggling) and Revolut here.

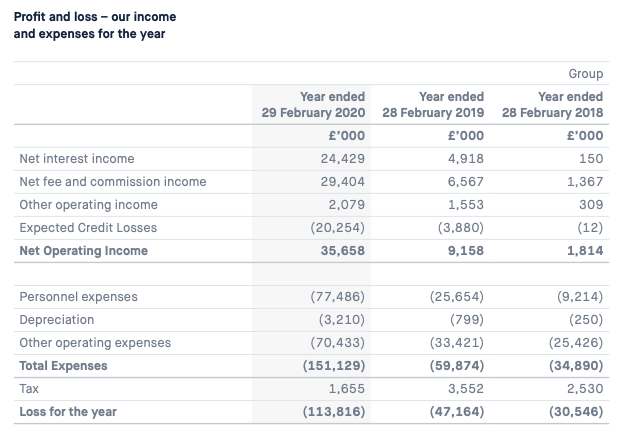

Let’s start with Monzo, which has a clear set of figures for us to peek at:

You can quickly see why investors have been excited about neobanks in these results: Observe the huge growth in interest incomes and fees/commissions on a year-over-year basis. Of course, its credit losses rose steeply as well, limiting the firm’s net operating income (we’re not going to translate results into U.S. accounting speak, for what it’s worth, as it would be rather cumbersome).

Oh the other side of the coin, we can see why neobanks are outside-investment hungry. While Monzo managed epic growth from the year ending February 2019 to the year ending February 2020, its losses swelled sharply to over £113 million over the same time period. But Monzo raised over £100 million in 2018, over £100 million in 2019, and has put together £80 million so far this year. This is the sort of expense it is being funded to generate, provided that its growth keeps looking impressive.

That Monzo had a valuation reduction in its most recent round will make its February 2021 set of results all the more interesting. But let’s add some more data to the mix.

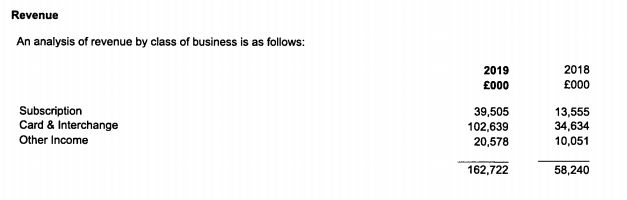

Here’s Revolut’s most recent revenue results, for the year ending December 2019:

Where it generated those revenues, in geographic terms, just for fun:

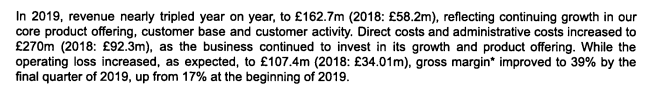

And what its growth led to, in terms of operating losses:

As with Monzo’s results, there’s lots to like there and lots that could prove concerning. It will be curious to see if the firm can demonstrate more operating leverage in the current year, reducing its operating losses in percent-of-revenue and gross terms. Continued gross margin improvement would prove useful in that hunt,.

Revolut’s £162.7 million revenue, while impressive, is a bit under the £180 million it is reported to have targeted for the year.

But like with Monzo we can see rapid growth into the nine-figure range. That’s precisely the sort of growth that private investors love to back. What we can see thus far from our two sets of neobank financial results is that while strong growth is possible, it’s expensive to generate.

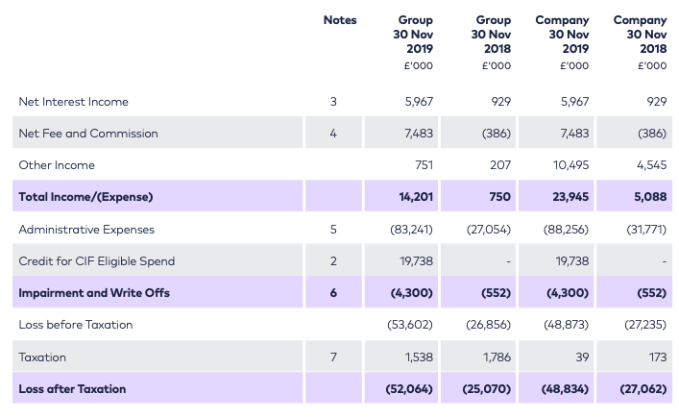

Finally, let’s turn to Starling, which has the oldest full-year data:

Without getting too deep into the account nuances here, observe that from the year ending November 2018 to November 2019, Starling managed huge revenue gains from interest, fees and the like. And that its final losses after taxation also rose sharply.

More recently, Starling reported the following: “Starling generated £6.7 million for the month of July 2020, which represents an annualised revenue run rate of c. £80 million.” So, the company has grown mightily from its late-2019 results.

I wish more startups and other high-growth private companies reported their financial results. We know that they lose money, it’s no secret! But seeing how they balance spend over time as they scale would be super interesting. Anyway, we now know a little bit more about how much it costs to build a neobank, at least in and around Europe.

Comment