The SPAC boom is behind us. The effort to leverage blank-check companies to take private companies public failed to clear the unicorn backlog, and a great number of combinations have lost value.

Examples abound. Latch is now worth around $4 per share, for example. MetroMile is worth $1.27 per share. The list goes on.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Why are companies that went public via SPACs struggling so much? Did they catch a headwind from changing market conditions that previously helped push them forward? You bet.

But the damage is also self-inflicted. Since 2022 kicked off, I’ve been waiting for earnings season to wrap so that we could execute a meta-analysis of SPAC earnings, essentially contrasting 2021 results with prior projections. Recall that many SPAC investor presentations painted a picture of essentially vertical growth.

But the damage is also self-inflicted. Since 2022 kicked off, I’ve been waiting for earnings season to wrap so that we could execute a meta-analysis of SPAC earnings, essentially contrasting 2021 results with prior projections. Recall that many SPAC investor presentations painted a picture of essentially vertical growth.

The pitch was pretty simple: This neat, young company is going to combine with a SPAC, raise a bunch of cash, and then grow like all hell. So what actually happened? Not that.

The Wall Street Journal did the work I had in mind before me, so let’s listen in:

Nearly half of all startups with less than $10 million of annual revenue that went public last year through a special-purpose acquisition company, known as SPAC, have failed or are expected to fail to meet the 2021 revenue or earnings targets they provided to investors, according to a Wall Street Journal analysis.

Even more, the Journal found that the companies that have or likely will wind up short of their 2021 targets are going to do so by some 53%. These are not small misses, in other words, but wide, embarrassing fuckups.

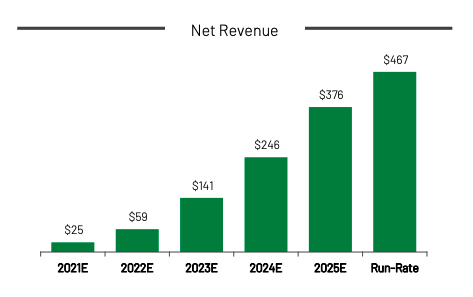

AppHarvest, a company that the Journal calls out, is a good example of the issue. Back in 2020, AppHarvest pitched its SPAC combination with the following chart:

I mean, who wouldn’t want to invest in that company? It’s going to double in 2022 from a comfortable revenue base, more than double in 2023, and then accrete more than $100 million in revenue for the following two years. AppHarvest promised a rocketship that you could buy into.

So what actually happened? The Exchange pulled the company’s earnings results and here’s the data:

- Q4 2021 revenue: $3.1 million

- 2021 revenue: $9.1 million

- 2022 outlook: $24 million to $32 million

AppHarvest missed its 2021 estimates by around 64%, and it expects to maybe meet its 2021 estimates in 2022, a full year later. That’s a pretty huge miss, even for a high-growth startup looking to scale. It’s not a huge surprise, then, that the company was worth just $3.58 per share when markets closed yesterday, down from a 52-week high of more than $30 per share.

The Journal’s analysis includes a number of EV companies, firms that often had zero revenue when they went public in a SPAC combination, or close to it. So, yes, those make SPACs look bad. But it’s not just the EV companies — including Nikola, which has proven to be a hot mess on stilts — that are struggling to make their promises reality.

Latch is a neat company. I even interviewed its CFO for the podcast. And it has done, frankly, pretty well in terms of growth. And yet it’s still undershooting targets set forth in its investor deck. Here’s what Latch told investors it would manage:

- 2020 revenues (estimate): $18 million

- 2021 revenues (estimate): $49 million

- 2022 revenues (estimate): $173 million

And results:

- 2020 revenues: $18.1 million

- 2021 revenues: $41.4 million

- 2022 revenues (guidance): “in the range of $75 million to $100 million”

Now, growing one’s revenue base from $18 million to $41 million in a single year is pretty darn impressive. But it’s still less impressive than what investors were provided in the form of forward estimates. And looking ahead, the gap between estimates and results is widening. Even Latch, a SPAC combination that I think has done a reasonable job thus far — as always, I’m just talking with you; this isn’t investment advice, ever — is going to miss its longer-term estimates sharply!

So what? Don’t lots of companies miss their guidance? Not public companies, or at least not by much. When they do, their share price gets utterly hammered; furthermore, especially in the first quarters after going public, companies tend to have their growth pre-baked to ensure that they get off on the right foot with public-market investors. SPAC combos? Well, not so much.

There are outliers, of course. SoFi reported it had a good quarter. And I recently chatted with Alight Solutions — more here, in case you want it — which is essentially flat in valuation terms. But the SoFi and Alight examples feel more like exceptions that prove the rule than contra-indicators to the general vibe that SPAC companies talked shit that they couldn’t back up.

For startups, this is all pretty poor news. The SPAC route to the public markets has some advantages that many high-priced startups could have leveraged. Pricing is sorted out in advance, and companies can line up investors to put more cash into their business in the same transaction; SPACs and PIPEs are not inherently bad ideas, they are just used by some folks to extract more value from the market than they can offer regular shareholders.

And that’s the problem — if SPACs had been used more conservatively, they could have leveraged their moment in the sun as a way to get more companies public that deserved it. Instead, we got Nikola ($7.66 per share, from highs in the $60s), Astra Space ($3.41 per share, from highs of $16.95), and so forth.

This means that any unicorn that wants to hitch a SPAC ride to the public markets has to, at once, beat back recent history and make its own pitch. With the traditional IPO window shut at the moment, how many startups are going to actually take on that level of risk? Few? None?

So we’re back to where we were: Unicorns are piling up investor debt — the amount of illiquid value they have created, multiplied by how long backers have waited for return — without any way to square up their cap table on the horizon. What a mess. What a letdown.

Comment