Remember Wag? The dog-walking app made huge waves back in 2018 when it raised $300 million from SoftBank’s Vision Fund.

Competing with rival Rover, Wag’s service fell out of our minds in the years since its mega-deal. Today, Wag is back in the news thanks to a recently announced SPAC deal that will take the company public.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

This means we get a look inside the machine.

In basic terms, Wag’s results detail a company that took blows during the pandemic as folks stayed home, meaning that they needed external dog care less than before. But, with its results ramping up, Wag expects to continue its recovery thanks to workers heading back to the office this year. The office-return dynamics make Wag’s forward-looking projections very interesting.

Let’s hammer through the SPAC deal terms and then look at Wag’s historical results and what it expects for the future. After all, the return-to-office question will impact a host of companies beyond Wag. From Uber to DoorDash and beyond, a return to more old-fashioned working conditions would rejigger our economy once again.

Let’s hammer through the SPAC deal terms and then look at Wag’s historical results and what it expects for the future. After all, the return-to-office question will impact a host of companies beyond Wag. From Uber to DoorDash and beyond, a return to more old-fashioned working conditions would rejigger our economy once again.

The Wag deal

Wag is merging with CHW Acquisition Corporation. The deal calls Wag a “vertically integrated technology platform,” notably. The release also states that capital is being provided as part of the deal by “current Wag! and CHW investors,” including “Battery Ventures, ACME Capital, General Catalyst and Tenaya Capital.” That, in a nutshell, is why we care about this deal; it’s a venture-backed company that is still raising venture capital.

In more boring terms, the “transaction values the combined company at a pro forma enterprise and equity value of approximately $350 million,” which isn’t much. Especially given that private capital into Wag to this point is around the same number. The deal, presuming “no redemptions from the CHW shareholders, [will] deliver approximately $175 million in gross cash proceeds to the combined company.”

Shares of CHW Acquisition Corporation trended lower last week, but recovered to $9.82 per share today, a slight discount to the usual $10 per share SPAC price that we tend to see pre-combination. Still, the market hasn’t thrown up its arms at the deal’s concept since its announcement. Why? In part because Wag’s numbers are pointing in the right direction.

A pandemic recovery

To understand Wag’s return to growth, we have to discuss its declines. In short, when the pandemic hit, demand for Wag’s service — dog walking, pet care, etc. — fell off a cliff.

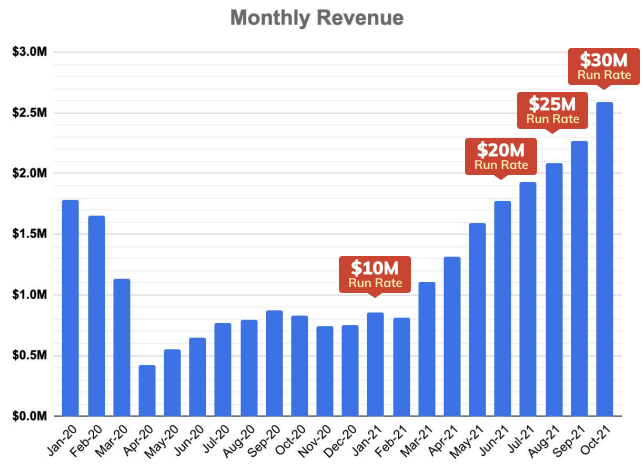

Observe:

From $1.8 million in January 2020 revenues to just over $400,000 in April of that year, Wag endured a rapid decline in its business results. Things got better into September 2020 before plateauing into 2021.

From February 2021 on, however, things went up and to the right for Wag. That ascent in the back half of the above chart explains why we are here today: Wag regained its footing and would like more capital now that it has re-demonstrated in-market product demand.

Now let’s peek at both the company’s historical results in more standard form, as well as its projections:

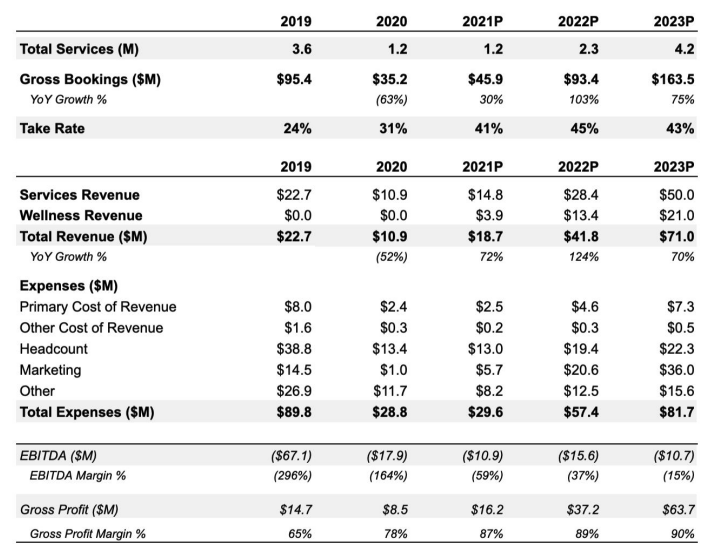

You can see Wag’s tough first pandemic year in its 2020 results, which saw its gross bookings tank by 63%, leading to a 52% decline in revenue. The company’s take rate did improve, helping its losses somewhat.

How did Wag manage to lose less money in 2020 than 2019 on an operating and EBITDA basis? By slashing its personnel costs (headcount), new user acquisition (marketing) and other (other) expenses. Indeed, revenues fell by 52% at Wag in 2020, but its total expenses fell faster, some 68%.

From there, Wag began to recover, with revenue expected to grow 72% in 2021, while total expenses are expected to scale by just under 3%. The result? Falling EBITDA losses, thanks in part to also improving gross margins. Frankly, Wag had a good 2021, based on its January-October data and estimates for the rest of the year. Perhaps the company is not at the scale we anticipated given its prior fundraising, but it had a good last year regardless, especially given what it endured in 2020.

Looking ahead, we see more growth — and a return to marketing. What’s driving Wag’s confidence that this is the year in which it can spend and collect new customers?

A return to the office?

Wag cites a study that states that some 75% of “U.S. office employees” anticipate being back in their office “full-time by mid-2022.” This is key for Wag, as it suffered from folks swapping to working from home. For the company to meet its growth targets, those same consumers need to go back to the office.

I don’t know how I feel about the projected office number, but I doubt that Wag is alone in thinking it’s correct; many an office manager looks forward to a return to observing their worker bees, rather than those bees making the same damn honey from home.

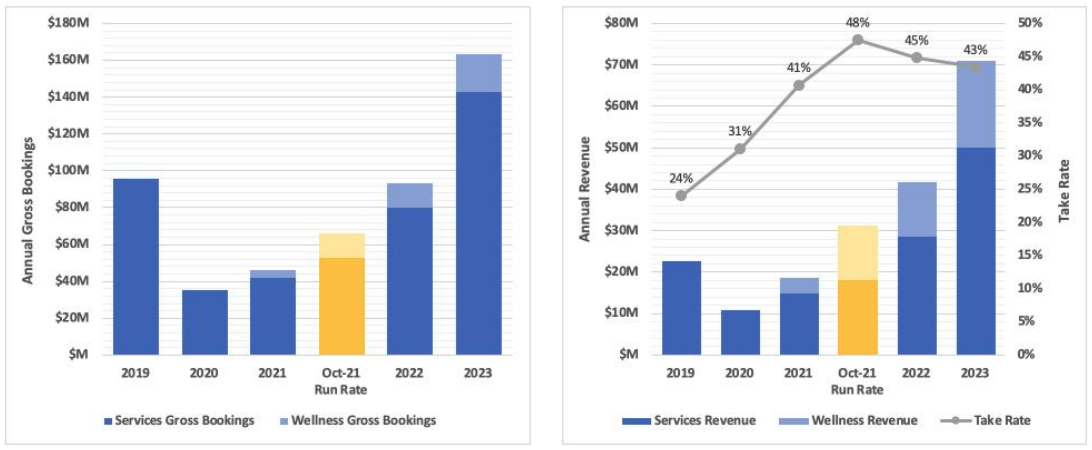

Here’s how Wag describes its future “Assuming a Slow & Steady Return-to-Work in 2022,” to use its own words:

That’s the growth story: Rising services and wellness gross bookings wedded to an improving take-rate far above its pre-pandemic levels. The result of the expectations is a ramp to around $71 million in 2023 revenues. Thought of in a different manner, the company expects to reach sub-IPO scale in a few years’ time. That’s the power of SPACs — you get public far, far younger than you otherwise might.

I expected to hate the Wag SPAC deal, but I don’t. Is it speculative? Oh gosh yes. Is it dumb? Not really; if you believe the growth story, it’s not hard to math out a winning set of conditions for yourself in the transaction.

Wag is perhaps, for our uses, best regarded as a warning sign about the differences between tech and tech-enabled businesses and their divergent valuations. But it may also serve as a reminder that bad times don’t last forever, and if your business tanks due to market conditions, those old conditions may come back. In time. Provided you have the capital to make it ‘cross the chasm, you can even wind up going public.

More when the combo starts to trade.

Comment