Update: When we wrote this, Robinhood’s stock was off double-digit percentage points in pre-market trading, and opened under $10 per share. So, it was current as of then. Since that moment, however, Robinhood shares have flipped around and rallied. Read on for the bearish setup the market was flashing at the start of the day, but keep in mind that Robinhood reversed its declines at least by midday trading!

The 2020-2021 trading and investing boom lifted a number of companies’ revenue growth, fundraising and narrative strength. Some of the best-known even went public on the back of a global trend that made their businesses shine. Now that shine is fading, and the value of select fintech concerns is in free-fall.

The best example of this reversion is Robinhood, a company that became synonymous with consumer trading and investing activity, and the meme stock craze in particular. That Robinhood added crypto trading in recent years, adding to its torrid ascent, merely makes its recent results all the more pertinent to the ways public and private markets have changed in late 2021 and so far in 2022.

Robinhood’s stock fell sharply yesterday and dropped further after the company reported its Q4 2021 results. As of this morning, Robinhood stock was worth around $10.85 per share, 71.5% off its IPO price and 87.2% off its all-time highs. What happened? Let’s find out.

What makes Robinhood valuable

The simplest way to consider Robinhood’s business is to multiply active users by average revenue per user. Users — monthly active users, or MAUs — help the company generate payment for order flow and other incomes. Average revenue per user — or ARPU, if you are into truly awful acronyms — is just that, allowing us to consider the company’s general health as MAU*ARPU = results.

More of either is good, less of either is bad. More of both in any quarter is great, less of both in any quarter is probably a disaster. Got it? OK, let’s talk numbers.

How that worked out in Q4

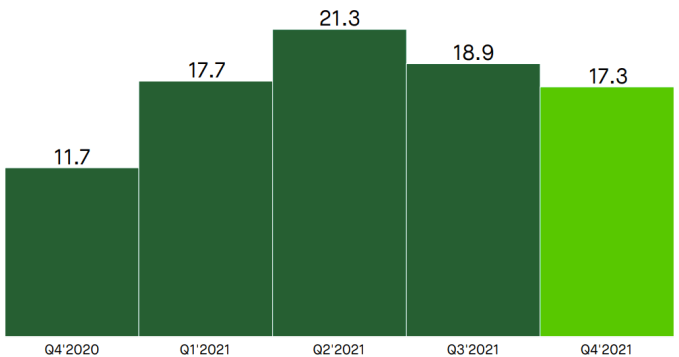

Leaning on some rather well-crafted charts from Robinhood’s investor deck, here’s the company’s MAU trajectory over time:

You can see the Robinhood ascent in these numbers, though the historical perspective is somewhat truncated. Still, even from this shortened view of the company’s growth, the consumer fintech managed to effectively double its size over two quarters in 2021, only to see its third quarter soften and its fourth quarter continue the trend.

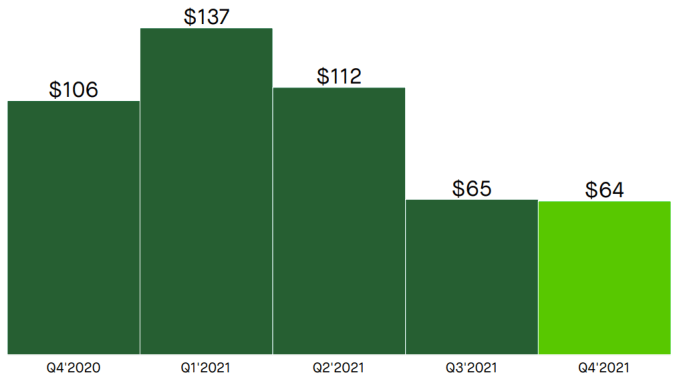

For Robinhood to make the above all right from a growth perspective, the company would need to have pretty darn amazing ARPU results. If ARPU rose sharply in quarters three and four, Robinhood could manage growth. Did that happen? No:

One small note: Robinhood writes in its deck that “[q]uarterly ARPU amounts are presented on an annualized basis,” meaning that the above is not a quarterly result; they are quarterly results, annualized.

You can already see where the Robinhood quarter is going: Falling MAUs multiplied by a collapse in ARPU means smaller revenues, right? The company, CNBC notes, actually managed to beat expectations for Q4 — showing where the bar was set, I suppose — but what Robinhood has ahead of it is somewhat grim:

For the first quarter of 2022, Robinhood anticipates that total net revenues will be less than $340 million, which assumes some incremental improvement in trading volumes versus what we have seen so far. At the top end, this implies a year-over-year revenue decline of 35% compared to the first quarter of 2021, during which we saw outsized revenue performance due to heightened trading activity, particularly relating to certain meme-stocks.

Revenue came to $363 million in Q4 2021, meaning that the company anticipates not only a sequential decline in Q1 2022 revenue, but also a year-over-year drop.

Robinhood has seen its user activity fall, as well as the value of users. The company also forecast more bad news for the current period. The result? Down goes the stock.

The cost issue

The bad news continues. Robinhood’s losses are substantial and continuing.

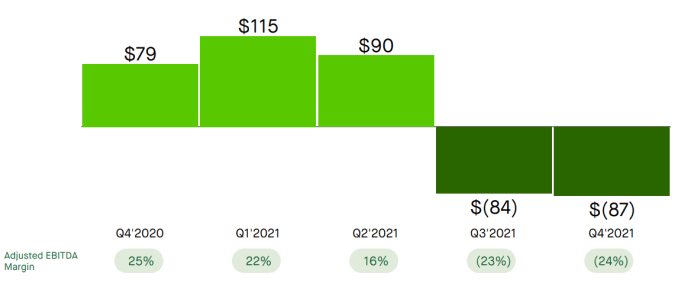

The company’s net income is super variable in recent quarters, in part due to “changes in fair value of our convertible notes and warrant liabilit[ies]” and share-based compensation expenses that spiked around the time of its IPO. So we’re going to observe the company’s adjusted EBITDA as a more consistent metric of the company’s profitability.

Here goes:

Ew. That’s nasty. A nearly 50% flip in adjusted EBITDA margin on a year-over-year basis is a mess.

So what?

The value of related companies is also in decline. Coinbase, which makes its money from trading incomes, albeit in a different manner than Robinhood, is far below its direct-listing reference price, and even further below its all-time highs. And we are seeing other trading platforms like eToro taking haircuts on their ramp to the public markets. It’s brutal out there.

A good question at this juncture is whether VCs sold their shares before Robinhood’s value disintegrated. If they held them, returns are in the tank. If they sold, they look like geniuses. Geniuses who left retail investors holding the bag. Taking from the poor to give to the rich? That’s one version of a Robinhood story.

Comment