New data from Kruze Consulting shows just how much the venture capital fundraising market has changed for startups in the last few quarters.

Kruze, which provides accounting, tax and venture capital-related services to private tech companies, has access to hard data regarding startup performance. Healy Jones, vice president of financial planning and analysis at Kruze and a former venture capitalist, put some of that information to work, using aggregated, anonymized data from startup funding rounds to detail how much revenue startups are reporting at various fundraising benchmarks over time.

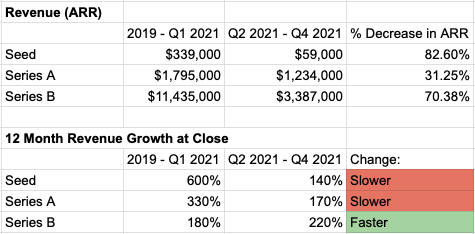

We took a look at how rapidly revenue averages have declined for startups approaching early-stage fundraising events in the last nine months compared to the preceding few years.

The results are simple: Software startups are generally raising early-stage rounds (through Series B) with lower revenue totals in recent quarters than in prior years. Data from several hundred early-stage software (SaaS) fundraises indicates that startup growth rates are not accelerating — though there is a key exception that we’ll discuss.

I don’t want the data behind the paywall, so before we get into what’s happening and why, here’s the raw information from Jones and Kruze. Note that the percentage changes to ARR levels were recalculated by The Exchange from shared data to allow a few more decimal points:

What does all that mean? Let’s talk about it.

Slimmer revenues and evolving growth rates

The data indicates that seed, Series A and Series B rounds have seen a recent and rapid decline in revenue reported by the SaaS startups raising. It also shows that seed and Series A software companies raised with slower growth rates from 2019 through Q1 2021.

What’s going on? It appears that expanding venture capital raised for investment, more aggressive late-stage funds investing earlier, and strong public-market results (until recently, that is) pushed the startup market to finance startups with less revenue — and often slower growth.

Jones told TechCrunch during an interview that larger investors that may have invested only in later-stage deals are putting their capital to work in younger startups, and that those funds have lower returns expectations than venture capital funds. That matters, as larger capital pools anticipating lower returns can pay more for early-stage startup equity and have the math pencil out. For venture capitalists who are targeting, say, a 30% internal rate of return (IRR), some startup deals might not work at the higher prices that larger investors with 15% to 18% IRR expectations can afford, Jones said.

Regardless of which market force you put the most weight behind when it comes to the changing standards for various startup fundraising thresholds, this is what a founder-friendly market looks like, turbocharged during a unique economic period.

So what?

The sharpest declines in revenue per stage are at seed and Series B. This tells us that investors are putting funds to work in less mature startups today than before, and that upstart tech companies are accelerating in capital terms out of their Series A with less progress in hand than in prior years.

CB Insights data indicates that the time between funding rounds fell in 2021. Series C and later rounds are being raised at all-time rapid paces, data indicates. Seed, Series A and Series B rounds saw their pace slow during the early pandemic (2020), making their recent accelerations slightly less impressive. But, all the same, every venture capital fundraising category that we care about got faster last year.

The shrinking pace at which startups raise proximate rounds loosely fits with the Kruze data; if the time between rounds is falling, startups have less time to accrete new top line, and revenue per round on average falls.

In all, startups are getting paid better, faster for less work than before. It’s a great time to raise, but a pretty awful time for venture capitalists trained in an era when they got more equity for their dollar.

What’s ahead?

A number of macro trends nudged the above data into existence. Of the factors that we noted above as driving forces, it’s worth considering how many are in their waning years. Yes, more money than ever has flowed into venture capital funds. But, with interest rates rising, LP interest in venture funds could fade.

The public market’s COVID-era run bolstered software valuations generally, which helped startups trying to raise capital at attractive prices. But with certain tech stocks giving back nearly all their pandemic gains, the tailwind for startup fundraising is dying down.

When it comes to large, non-venture funds investing earlier and earlier, I am not sure we’re seeing similar changes to underlying conditions, other than that safer assets becoming more attractive could impact dollar allocation away from early-stage private tech companies. We’ll have to wait and see.

But if the climate is changing for startup investment, the above data is perhaps more of a high-water mark than an indication of today’s new normal. Thus were things in the last three quarters of 2021. Will 2022 be more of the same, or will we see the numbers reverse course?

Comment