Frederik Mijnhardt

More posts from Frederik Mijnhardt

Last year set a new record for public exits, with more than 844 U.S. companies going public via an initial public offering (IPO), a direct listing, or through a special purpose acquisition company (SPAC). That’s 105% higher than 2020, which saw 410 similar companies go public, according to PitchBook.

The 20 largest U.S. IPOs generated an estimated $41 billion in pre-tax value for employees who held stock options in those companies.

Record public exit activity is good news for founders and investors, but what about the employees who were granted stock options in those companies?

We dove into our proprietary data as well as publicly available data filed with the U.S. Securities and Exchange Commission to uncover defining trends for employees from late-stage unicorns in 2021.

Here’s an overview of what we found:

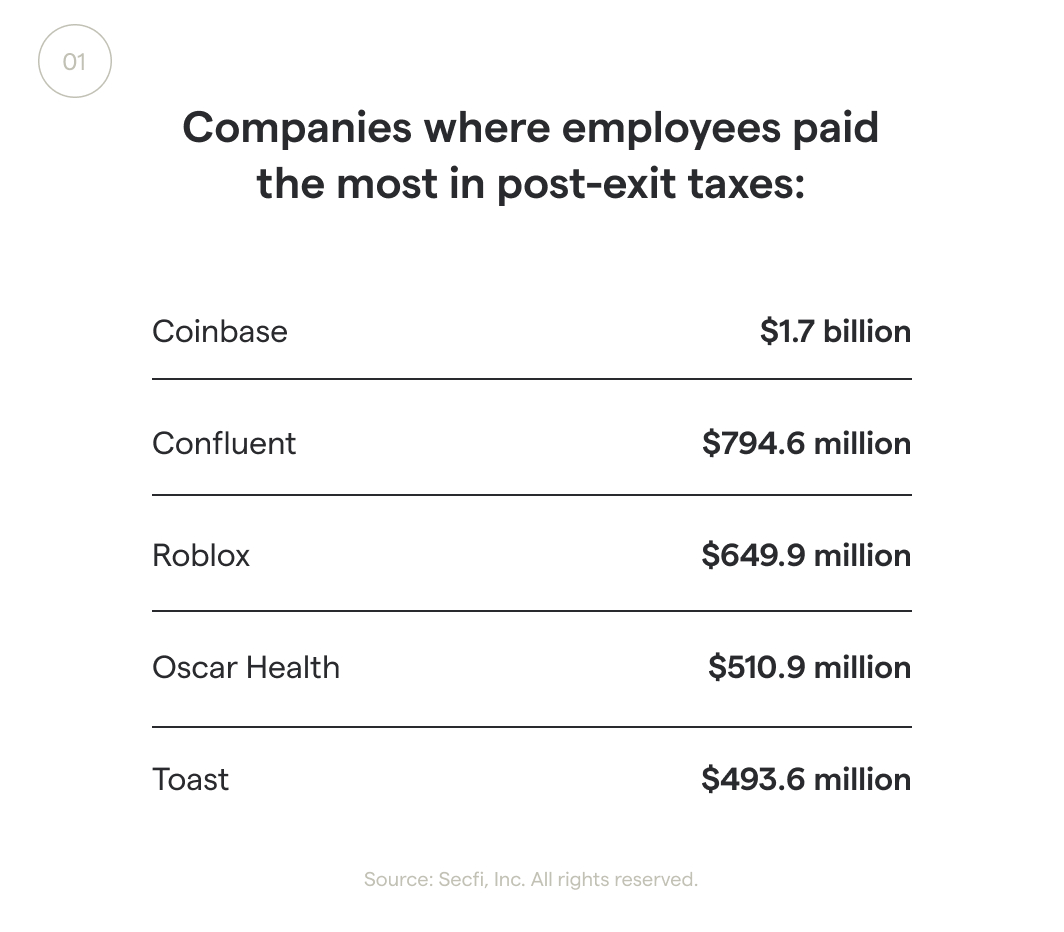

- In 2021, startup employees paid an estimated $11 billion in avoidable taxes by exercising their stock options post-exit, rather than pre-exit.

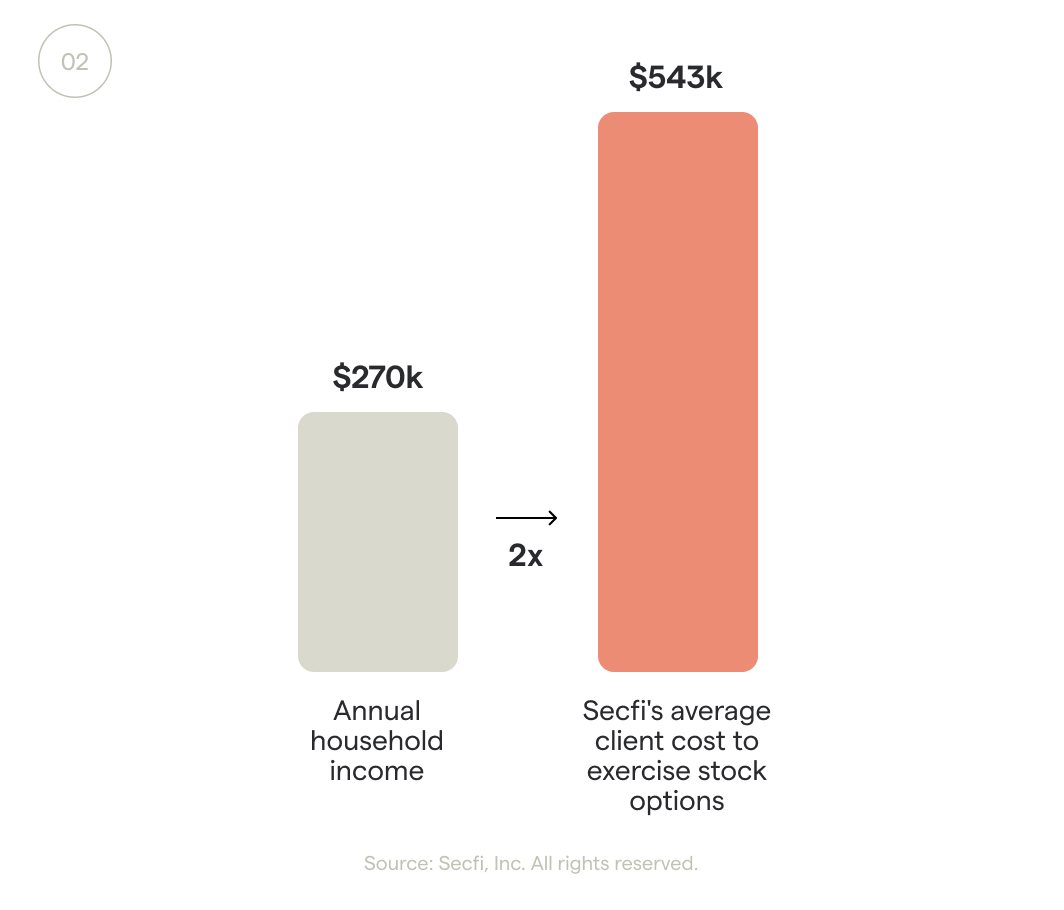

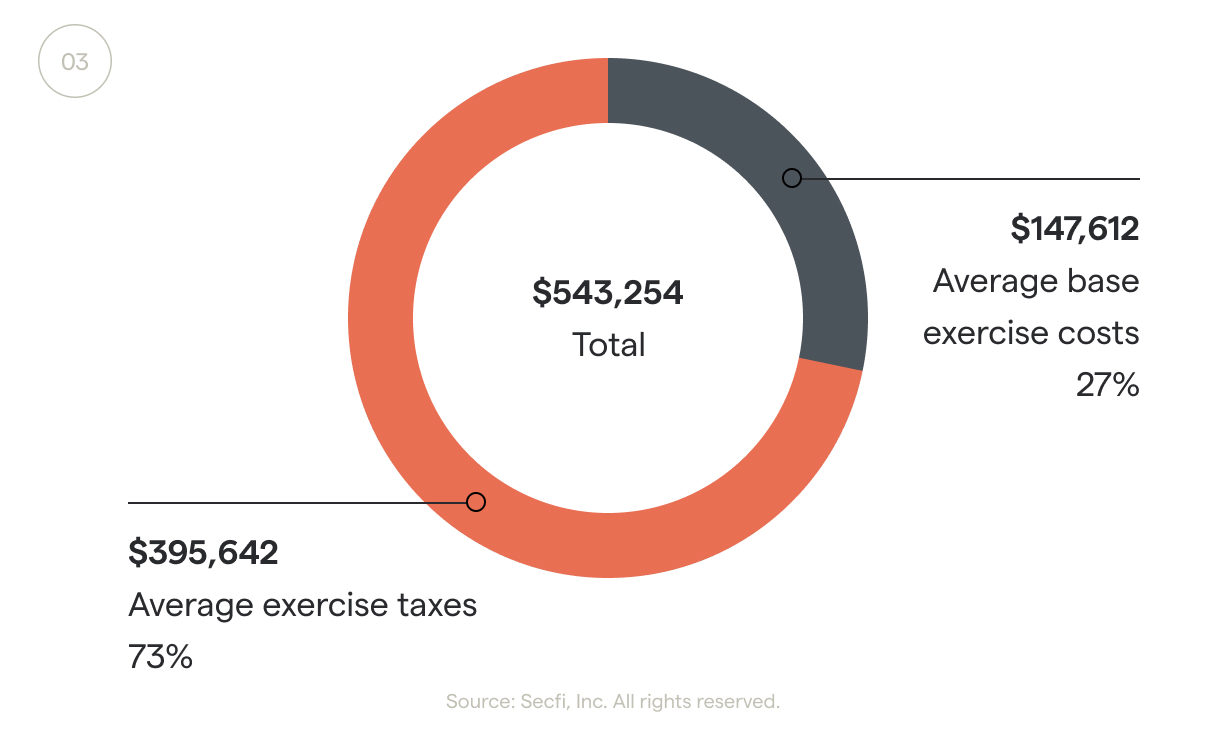

- On average, Secfi clients paid $543,254 in 2021 to exercise their pre-exit stock options (roughly double their annual household income), with taxes accounting for 73% of the cost.

- Employees at companies that went public in 2021 saved nearly $415,000, on average, by exercising before an IPO.

- Pre-exit stock option exercise rates vary widely from company to company, from as little as 2.4% on the low end to more than 77% on the high end, which could represent an indication of employee confidence in their company.

$11 billion in unnecessary taxes paid in 2021

In 2021, employees working at VC-backed U.S. startups that went public paid an estimated $11 billion in extra taxes because they waited to exercise their stock options post-exit, per a Secfi estimate of 172 U.S.-based, VC-backed public exits.

Employees could have paid less in taxes by exercising their stock options before their company went public. Doing so could have also maximized their gains when selling their shares. In 2021, high stock option exercise costs remained a major barrier to people exercising their stock options early.

The cost to exercise stock options in 2021

In 2021, it cost the average Secfi client $543,254 to exercise their stock options — roughly twice their average annual household income of $270,000, per Secfi data.

High exercise costs continue to represent a major pain point for startup employees. It’s the main reason why many employees are either forced to forfeit stock options when leaving a company or to exercise their stock options after their company goes public, in a transaction known as a cashless exercise. Cashless exercises carry the highest possible tax rate, and result in startup employees collectively paying billions of dollars in short-term capital gains taxes that they would have otherwise avoided if they had instead exercised their stock options while their companies were still private.

Taxes make up 73% of the total stock option exercise cost

In 2021, taxes made up nearly three-quarters of the total cost to exercise stock options for Secfi clients, according to our estimates.

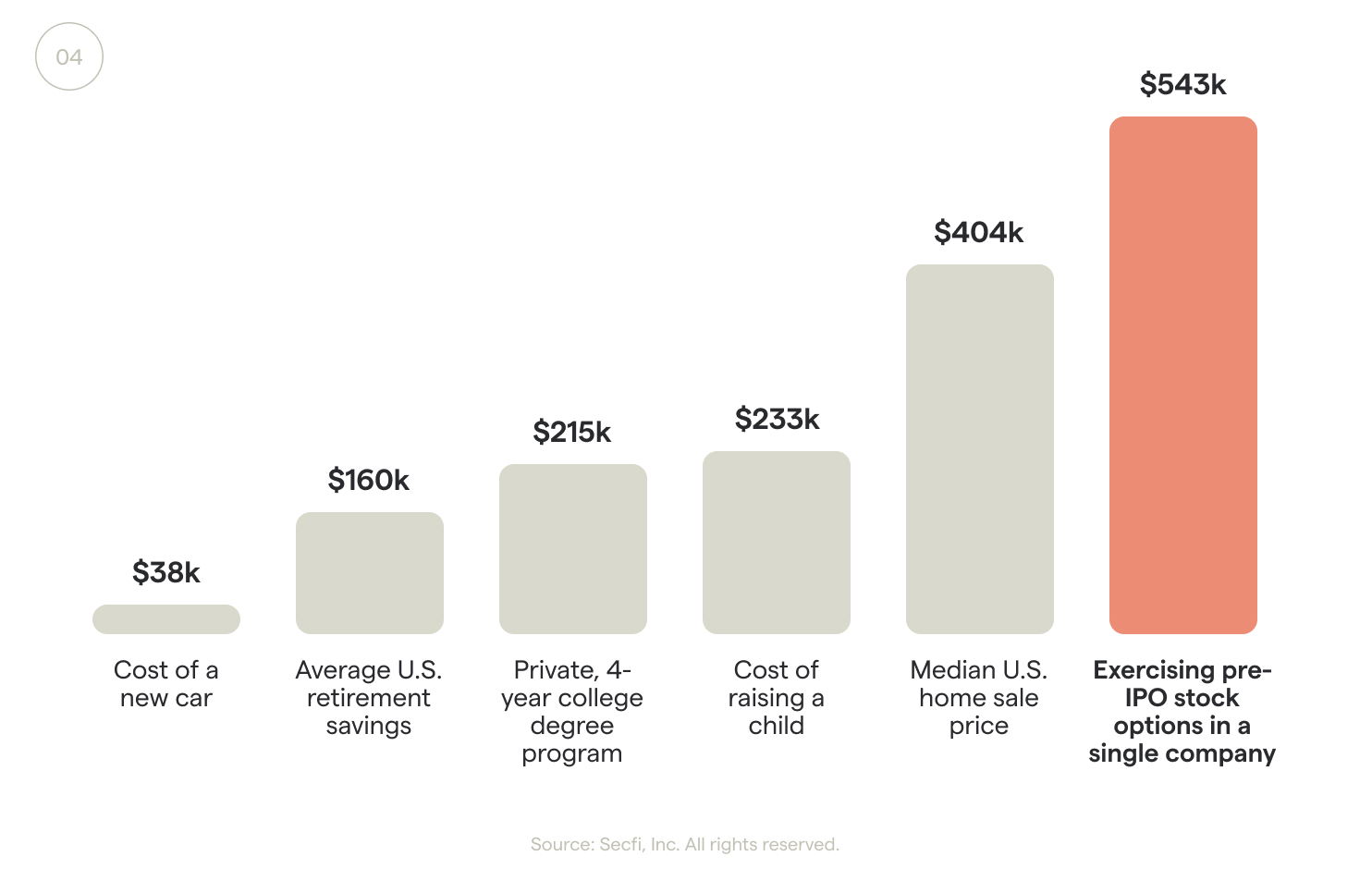

Stock options are one of life’s biggest financial decisions

For most people, exercising stock options can be one of the biggest financial decisions they ever make:

Americans typically finance major life expenses, such as buying a car, paying for college tuition and buying a house. Similar financing programs for startup stock options still don’t exist for the majority of American employees, who have to find other ways to pay for their stock options.

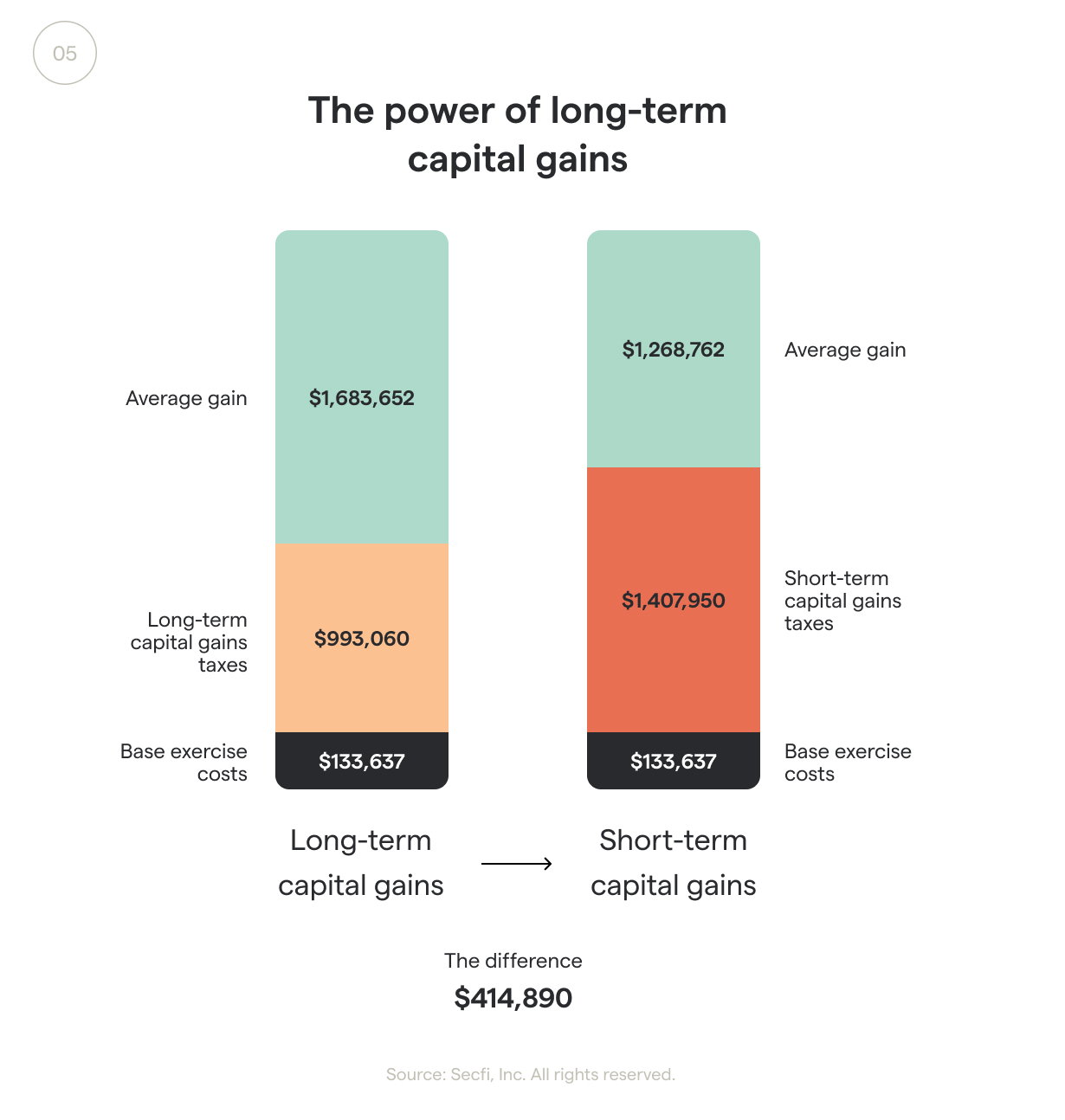

Average tax savings by exercising pre-exit: $414,890

In 2021, hundreds of startup employees used Secfi’s proprietary tools and calculators to better understand their equity.

Based on this group, which includes people who received financing from us as well as those who didn’t, people who were able to exercise pre-exit and take advantage of long-term capital gains were able to save an average of nearly $415,000 over people who performed cashless exercises post-exit, paying short-term capital gains.

Taking a look at the wider market, employees who exercised their stock options before an exit in 2021 managed to save an estimated $2.4 billion in taxes by taking advantage of long-term capital gains when selling, according to Secfi data.

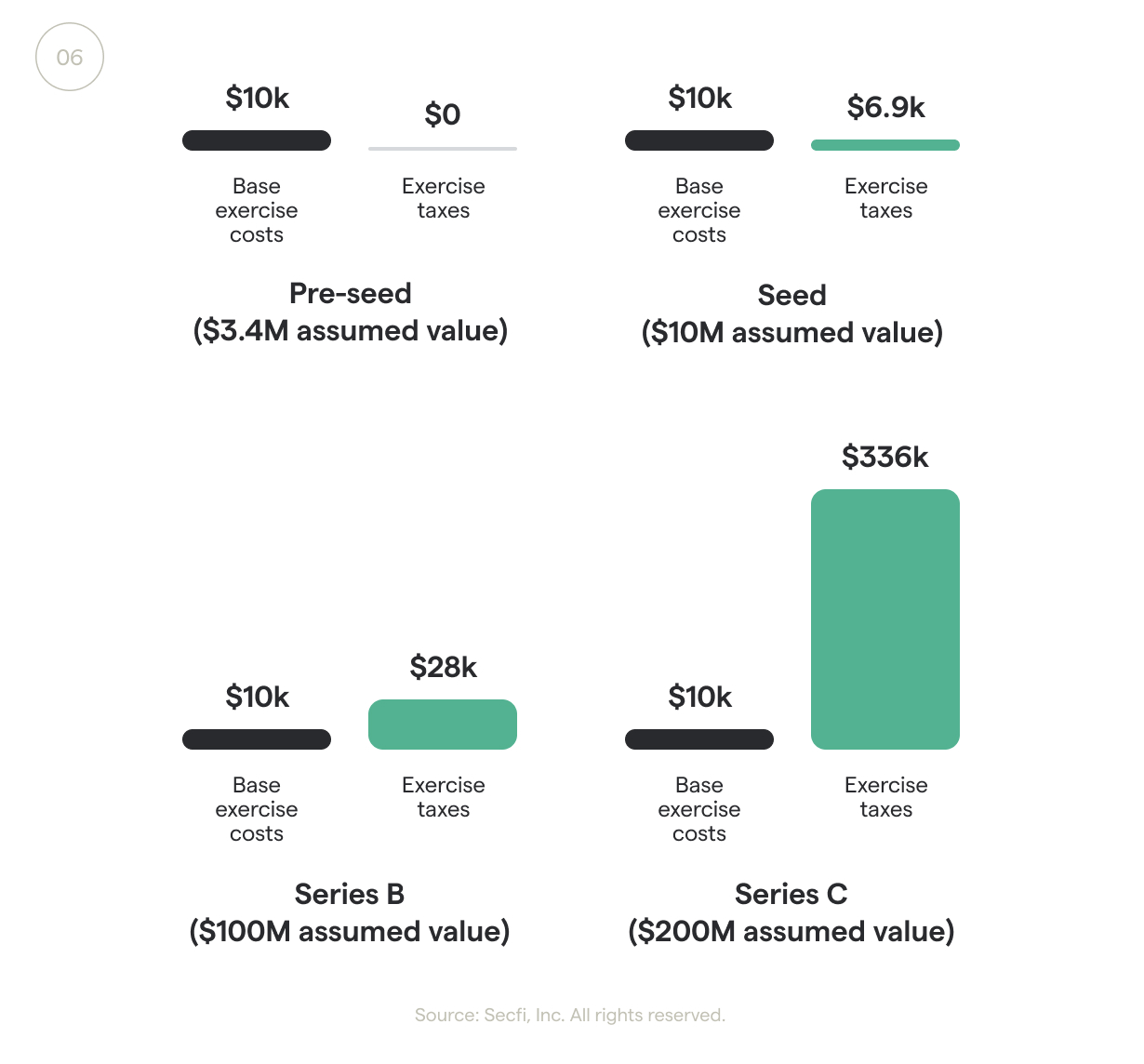

The cost to exercise can grow 3,360% between seed and Series C

On average, an employee’s cost to exercise stock options rises considerably as their startup raises new rounds of funding — assuming that each round increases the company’s valuation.

Here’s the hypothetical cost to exercise $10,000 worth of pre-seed stage incentive stock options over time, based on industry average valuation growth in 2021:

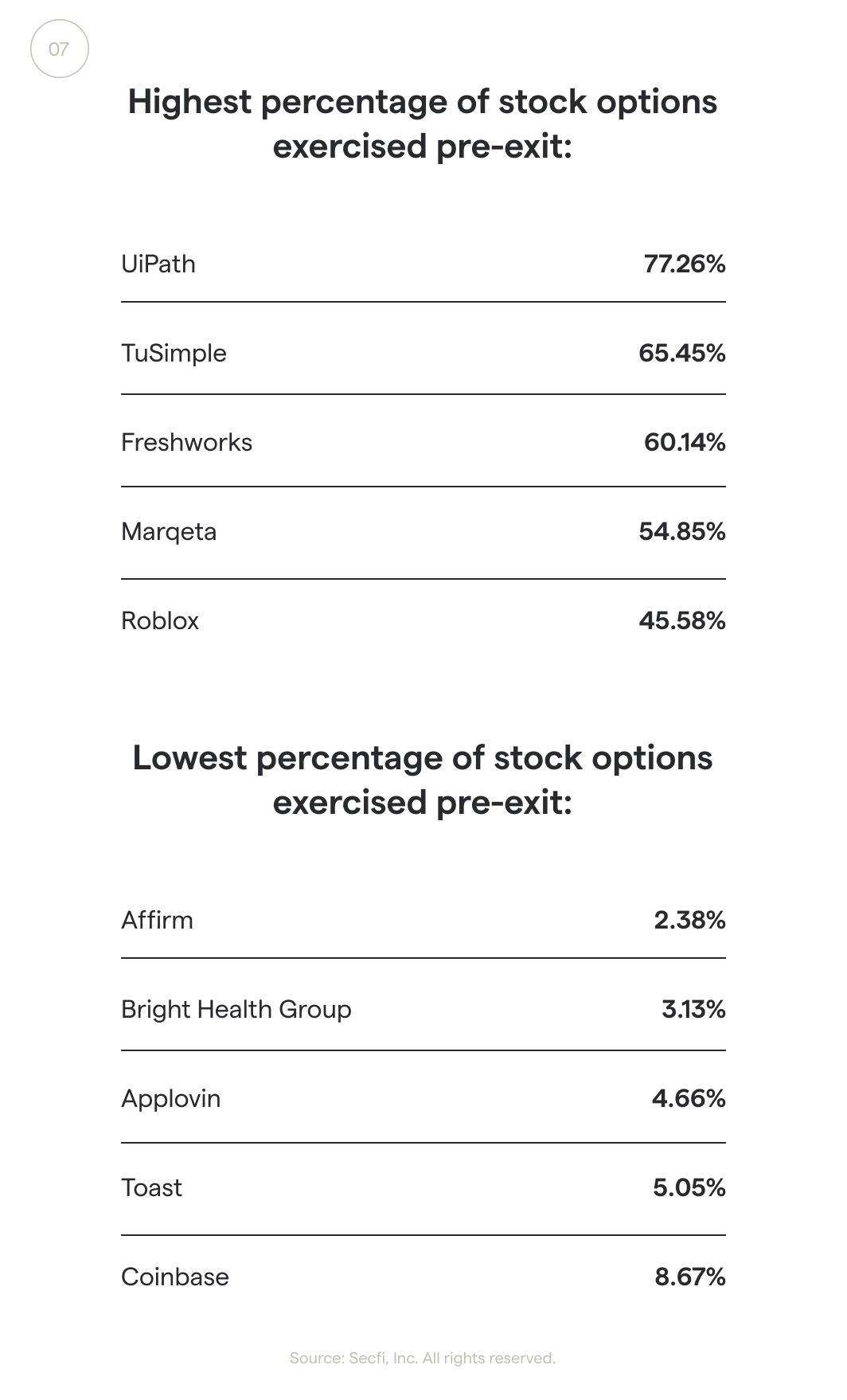

Pre-exit stock option exercise rates by company in 2021

Every stock option that’s exercised pre-exit represents an employee’s vote of confidence in their company. At some companies, employees exercised more than 75% of their vested stock options pre-exit. At others, as few as 2% exercised their stock options before their company exited publicly, according to S-1 data from 20 of the largest 2021 IPOs by market cap.

Employees take on personal financial risk when they decide to exercise their stock options — they could lose their money if their company never exits, or they could fail to experience a positive return following a flat exit. For employees hesitant about their company’s prospects, it can feel safer to wait to exercise their stock options until after the exit once retail investors have decided how to value their company’s shares.

In other cases, companies might fail to educate their employees on the value of exercising their stock options before an exit. Additionally, the current investment environment favors large pre-exit valuations, which can make exercising stock options cost-prohibitive for employees who join a unicorn that’s nearing a public exit.

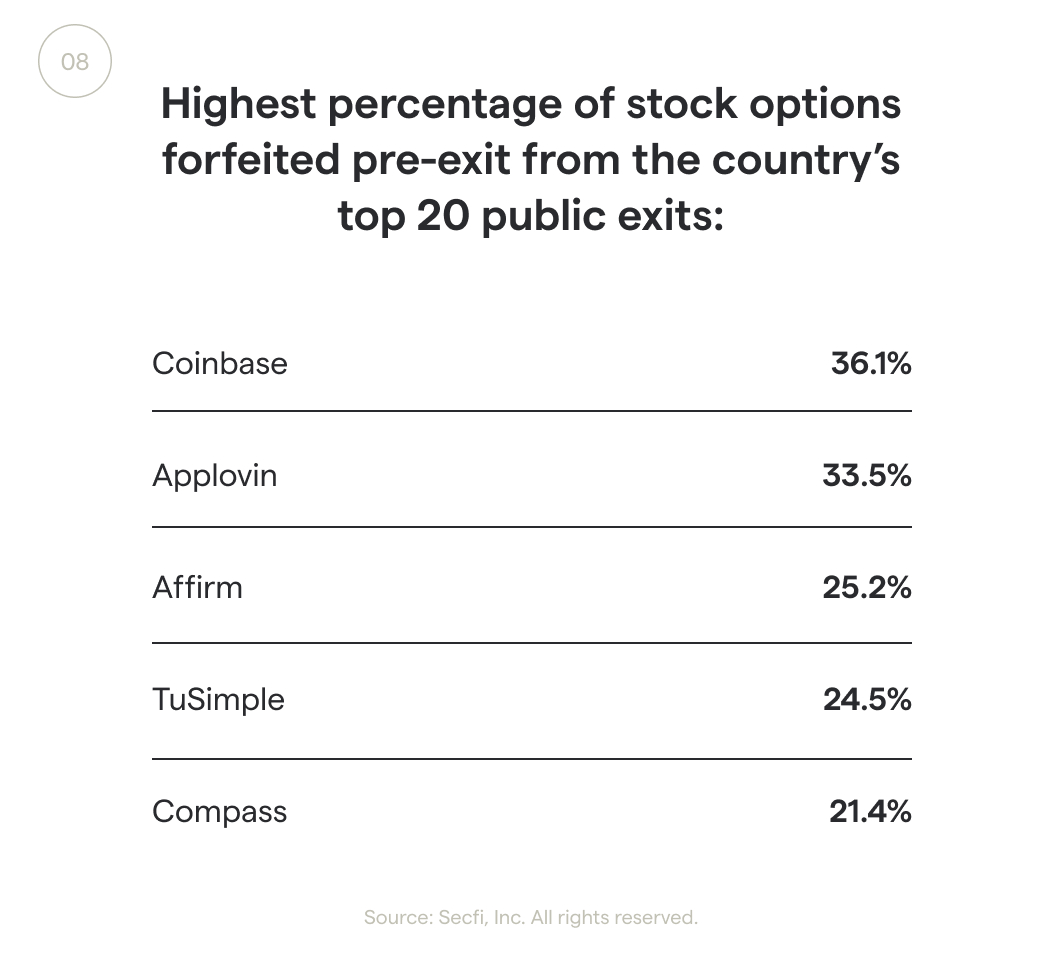

Pre-exit stock option forfeiture rates in 2021

As their companies stood on the cusp of going public, a number of startup employees at top companies decided to voluntarily abandon their stock options — by either leaving the company and forfeiting their unvested stock options or otherwise deciding not to exercise their vested stock options.

This is a different way of measuring votes of confidence in a company — employees may be more willing to walk away from their stock options if they believe they can earn better stock options elsewhere, according to an analysis of S-1 filings from Coinbase, Applovin, Affirm, TuSimple and Compass.

High forfeiture rates can also indicate a high employee turnover rate pre-exit or a lack of employer education about stock options.

In conclusion

There were a record number of U.S. public exits in 2021 that collectively generated tens of billions of dollars in wealth for startup employees who earned stock options through those companies.

But the relatively high cost of exercising stock options meant that most of the employees working at companies that experienced a public exit in 2021 weren’t able to exercise their stock options until after the exit, resulting in billions of dollars in avoidable taxes.

Looking ahead to 2022, it seems that the industry’s current trend toward mega-sized rounds of funding and longer exit timelines mean that for the average startup employee, their total cost to exercise stock options will continue to rise.

If true, taxes will again represent a major financial barrier to employees owning their stock options pre-exit. Early analysis suggests that pre-exit stock option exercise rates and forfeiture rates could be an overlooked indicator for the performance of a company’s share price upon public exit. This is an area worth further research.

Comment