The global startup fundraising boom has lifted nearly every sector you can name: Edtech took off during the pandemic, software in general got a lift, and even more risky and long-term wagers like space tech and biotech are seemingly doing well in today’s risk-on startup fundraising market.

But no single category or niche in startup land has done better than financial technology, or fintech.

Around the world, fintech startups have raised simply astounding amounts of capital, with geographies like Latin America, Africa, North America, and more seeing neobanks, payments companies, new consumer-facing lending services, cryptocurrency on-ramps from the traditional banking world, trading apps, and other sub-sectors raising tectonic rounds from investors hungry to get their own capital to work in the craze.

No surprises

Global venture funding reached a record $621 billion in 2021, according to the CB Insights 2021 State of Venture Report. That’s more than double 2020’s total of $294 billion.

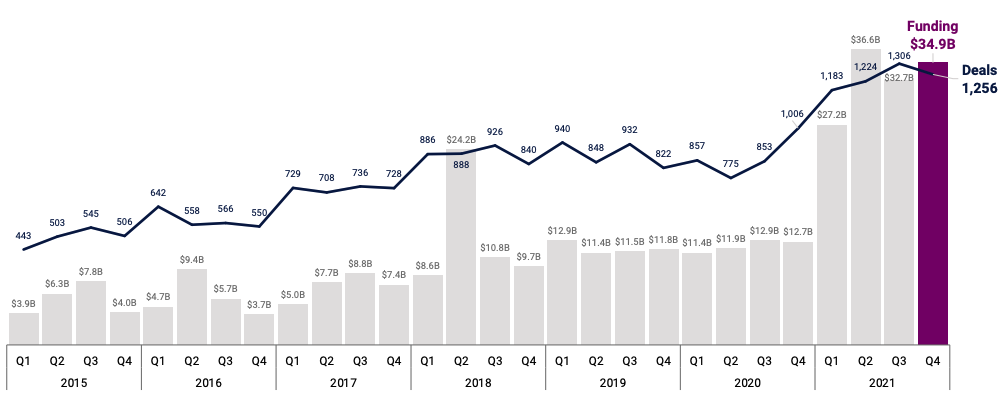

In 2021, global fintech funding jumped to a new record of $131.5 billion across 4,969 deals. That compares to $49 billion across 3,491 deals in 2020. As you can see, the pace at which capital was invested into fintech startups in 2021 grew much more rapidly than total deal count, leading to larger rounds on average. The CB Insights data that we’re citing here also helps put the pace of fintech investing into context compared to its peer startup groups, with financial technology companies raising one in every five venture capital dollars last year, or some 21%.

The fevered pace at which fintech startups attracted external capital continued: In the fourth quarter of 2021, fintech funding reached $34.9 billion – second only to Q2 2021, which saw funding total $36.6 billion. Deal flow was similar – 1,256 in Q4 compared to 1,224 in Q2.

To make those numbers a bit more understandable to our monkey brains, in the fourth quarter inclusive of weekends, holidays, and other non-working periods, some 14 fintech deals were announced every day, worth $387,777,777 every 24 hours. That’s pretty fucking rapid.

The fintech venture market is so big, in fact, that its outlines mirror those of the venture capital market itself. The United States, for example, led in fintech funding in Q4, as it did in total venture capital dollars in the year. The U.S. was followed by Asia and Europe in fintech investment – with $18.2 billion invested in U.S. fintechs, compared to $8.2 billion and $5.6 billion in Asia and Europe, respectively.

While still lagging globally, Latin America came in at an impressive fourth place with $1.9 billion in funding in fintech startups. (Note: In Q3, LatAm fintechs reaped $4.2 billion in funding; smaller numbers tend to be more variable quarter-to-quarter.)

But those are just the top-line figures. What happened on an individual round basis? Let’s talk about it.

Average deal size

Average and median fintech deal sizes reached new records last year. The average fintech startup round in 2021 was $32 million, up sharply – nearly double! – from $18 million in 2020. Meanwhile, the median deal size was $5 million, compared to $4 million in 2020, a more modest increase of 20%.

The difference between mean and median fintech deal size implies that there were a simply huge number of large rounds for startups in the sector last year. This is backed up by the fact that unicorn creation reached a record pace for fintech startups in 2021; generally speaking, unicorns are the companies raising mega-rounds, so more unicorn creation directly implies rising round size, which we anticipated given the above data.

In the fourth quarter alone, 34 fintech unicorns were born, bringing the total to 235. That was actually down from the simply bonkers Q2 and Q3 2021 unicorn creation rate in fintech, which saw 48 and 45 new horns apiece, or around one every other day during those periods.

But it’s not just the late-stage fintech companies that are enjoying time in the sun. Early-stage startups, in particular, saw a boom in funding, with their deal share ticking up to 64% in 2021 from 61% in 2020.

How goes the exit market?

Money is good fun and makes for spicy headlines and solid copy. But it’s exits that set the real level of venture return, not paper markups from their peers. So how did fintech exits fare in 2021 as funding volume took off?

In somewhat good news for your local VC, consolidation was rampant in the fintech space in 2021, with a record 906 M&A deals taking place during the year. That figure was up massively from 540 in 2020.

Still, venture capital returns are hardly built on the back of startup M&A. Public offerings are where the real money is usually made, so we need to examine that data as well. In even better news for the venture team, some 75 fintech startups went public via the traditional IPO route last year, while 16 more opted to hit the public markets via the increasingly less popular SPAC (special purpose acquisition company) route. That’s nearly three times as many fintech IPOs that we saw in 2020 (31).

It’s important to note that just because a bunch of fintechs went public, that doesn’t mean they were all stellar exits. Robinhood, the investing-focused consumer fintech, went public in July at $38 a share. At one point, its stock reached $85 a share. But as of today, Robinhood is trading at a mere $14.25 a share, less than half of its public debut.

There were other casualties to report, including the Brazilian neobank Nu Holdings, which is worth just $7.71 per share today, down from a post-IPO peak of $12.24. Given the sheer hype around that company when it was private, its debut was hardly the sort of chart that we anticipated.

And to add one more note of caution to the exit market, let’s talk about a SPAC deal. Dave.com was a fintech debut via a blank-check company that made some sense. It has a long history of revenue generation and was comparatively profitable contrasted with many other fintech debuts. And yet, even given those factors, it’s worth just $6.31 today, far below its pre-combination SPAC value of $10 per share.

In contrast, Coinbase’s huge growth from its final private valuation ($8 billion, late 2018) to its current market cap ($57.7 billion) is a pretty solid marker for some late-stage fintech companies working out when they want to cross over to the public markets.

The 2021 venture capital market for fintech startups was not merely superlative — it was batshit-crazy good. The exit market was softer. To some degree, then, it appears that what is true for the venture capital market is also true for the fintech market, but in a more exaggerated form. Fintech is like most venture, but simply more extreme.

Comment