Like you, I check NFT marketplace volume a few times each day to keep tabs on the burgeoning market for buying and selling digital signatures on various blockchains that point to images and the like. We’re very cool.

Mostly, the data is steady. OpenSea volumes tend to lead the space, with other, smaller NFT exchanges and some crypto games filling in the list. You can take a look at DappRadar’s NFT marketplace data set here, a related list of numbers from NonFungible here, and some great charted data from The Block here, if you want to dive in on your own.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

But recently the data changed, and an NFT marketplace called LooksRare shot up on the charts, quickly surpassing OpenSea’s results and taking the top slot among its competitors in volume terms.

Is OpenSea in trouble? Did LooksRare suddenly surge to the top of the charts thanks to a better model, price list or other business effort? Kinda, but it appears that there’s a lot of bullshit going down to make the numbers look better than they are. So let’s talk about incentives and governance tokens to parse out what’s up with LooksRare and the larger future of the financialization of everything.

Is OpenSea in trouble? Did LooksRare suddenly surge to the top of the charts thanks to a better model, price list or other business effort? Kinda, but it appears that there’s a lot of bullshit going down to make the numbers look better than they are. So let’s talk about incentives and governance tokens to parse out what’s up with LooksRare and the larger future of the financialization of everything.

Incentives

The data is pretty funny. In the last 24 hours, LooksRare has seen just under $290 million worth of NFT trades, per DappRadar data. OpenSea’s 24-hour tally is a more modest $131.6 million. Given how far ahead of OpenSea that single data point puts LooksRare, have we seen a new marketplace king crowned? No.

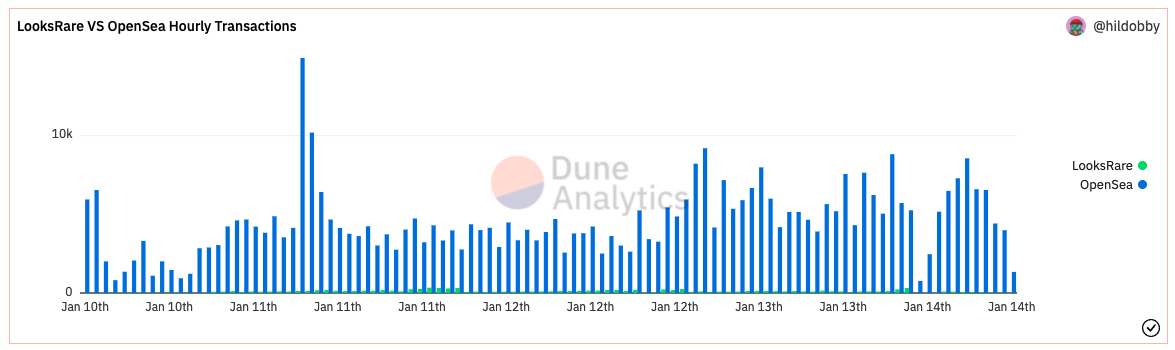

To better parse what’s up with OpenSea and LooksRare, we are best served by this data set from Dune Analytics that was compiled by @hildobby_.

What we need to first understand is that trading volume at OpenSea dwarfs what LooksRare has managed to build since the latter’s recent launch. The following chart makes it clear that in terms of transaction activity, OpenSea remains the absolute king when compared to LooksRare’s results:

OpenSea is therefore doing far more total transactions, while LooksRare is seeing greater volume in value-traded terms. What gives? Are LooksRare users simply buying and selling more expensive NFTs?

Yes, but with a twist. Since LooksRare began allowing users to earn its LOOKS token for trading activity, there’s been lots of it. But how much of the volume is actually folks buying and selling NFTs between different parties, and how much of the volume is folks simply passing their wealth between different accounts (wash trading), is less clear.

As LooksRare notes on its website, users “earn LOOKS every time you buy or sell an NFT from an eligible collection via LooksRare.” Later on, the company notes, LOOKS will “be the governance token in LooksRare’s future DAO,” adding that until that time users can “already benefit from LOOKS as an incentive for participating in the LooksRare ecosystem.”

The picture is starting to form. LooksRare has built a system that, if humans weren’t the greedy jerks that we are, would work well:

- LooksRare builds an NFT marketplace with slightly lower fees than OpenSea (based on a preliminary TechCrunch analysis of their pricing schemes and media coverage).

- LooksRare also creates a token, given to users for trading on its platform, providing a stake in its future governance in exchange for using its service.

- Human users do not abuse this system, and everyone earns LOOKS in keeping with their legitimate trading volume. The eventual DAO launches, and everything goes well.

In reality, this is what appears to have happened:

- LooksRare builds an NFT marketplace with slightly lower fees than OpenSea (based on a preliminary TechCrunch analysis of their pricing schemes and media coverage).

- LooksRare also creates a token, given to users for trading on its platform, providing a stake in its future governance in exchange for using its service.

- Users execute wash trades of expensive NFTs to accrete LOOKS tokens, artificially boosting LooksRare volumes and putting huge amounts of LOOKS tokens into the hands of the already crypto-wealthy, ensuring that the future LooksRare DAO will be heavily influenced by a handful of users.

Another option for No. 3 in our second list would be that users who earn early LOOKS tokens simply sell them as soon as it appears that their game is about to be called, crashing the token’s value and potentially undercutting the entire LooksRare project; we’ll have to wait and see.

On the wash trading point, I want to make it clear that it is a generally held view that not all the volume on LooksRare is normal. CoinTelegraph noted it. DappRadar has written about the issue. The same with Gadgets360. Ditto Nairametrics.

What we’re seeing is the result of mixing democracy (DAOs) with financial incentives (token drops) in which the wealthy or sophisticated can quickly scoop up ownership (votes) ahead of regular folks, thus keeping either the financial rewards (selling the activity-generated token) or influence (later DAO votes).

DAOs then, in this case, appear to be more oligopolies than democracies. A bummer, as I think that a more democratic corporate landscape would be great.

All this is water under the bridge to some degree. Yes, the NFT economy is new. Yes, DAOs are still being sorted out. Yes, it’s actually early for this particular sector of the larger crypto landscape. But that doesn’t mean that early indications are looking great for some of the key mechanics and systems that are being touted as not only key to web3, but also the future of the world more broadly.

Comment